Cruzing for a bruising?

Considering Canadian SantaCruz ticker SCZ

Dear reader

A Silver Miner that you can buy at below 10X Price/Earnings? What? Shut up! Yep.

3.1p quarterly EPS in 2Q25 on a share costing £1.15 (CAD $2.16).

It was below 2X! The share price is up nearly 500% in the year to date but following a pullback earlier this week SCZ caught my eye, and I took a position. The latest quarterly earnings of 3.1p a share were at Silver prices far below those of today too.

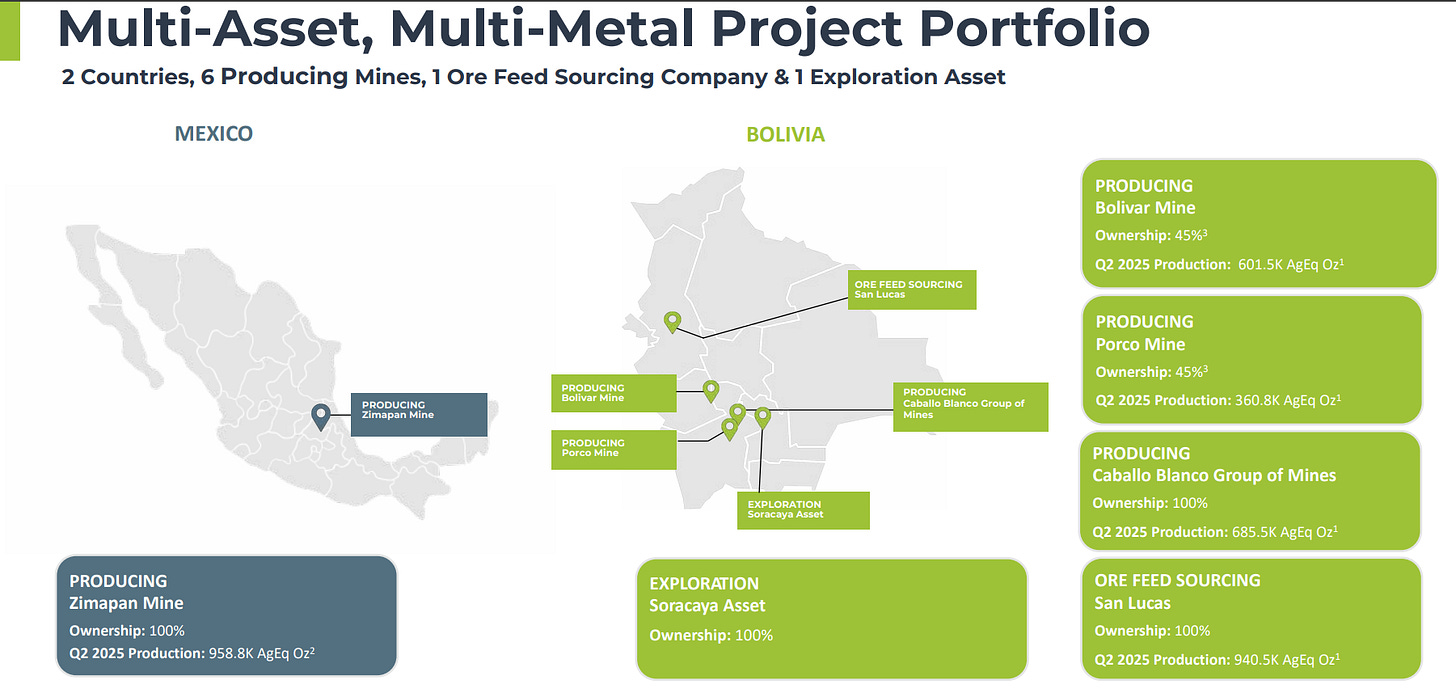

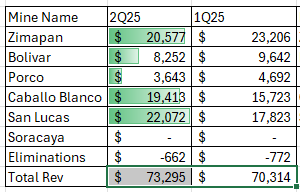

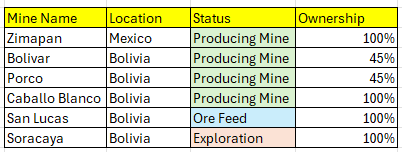

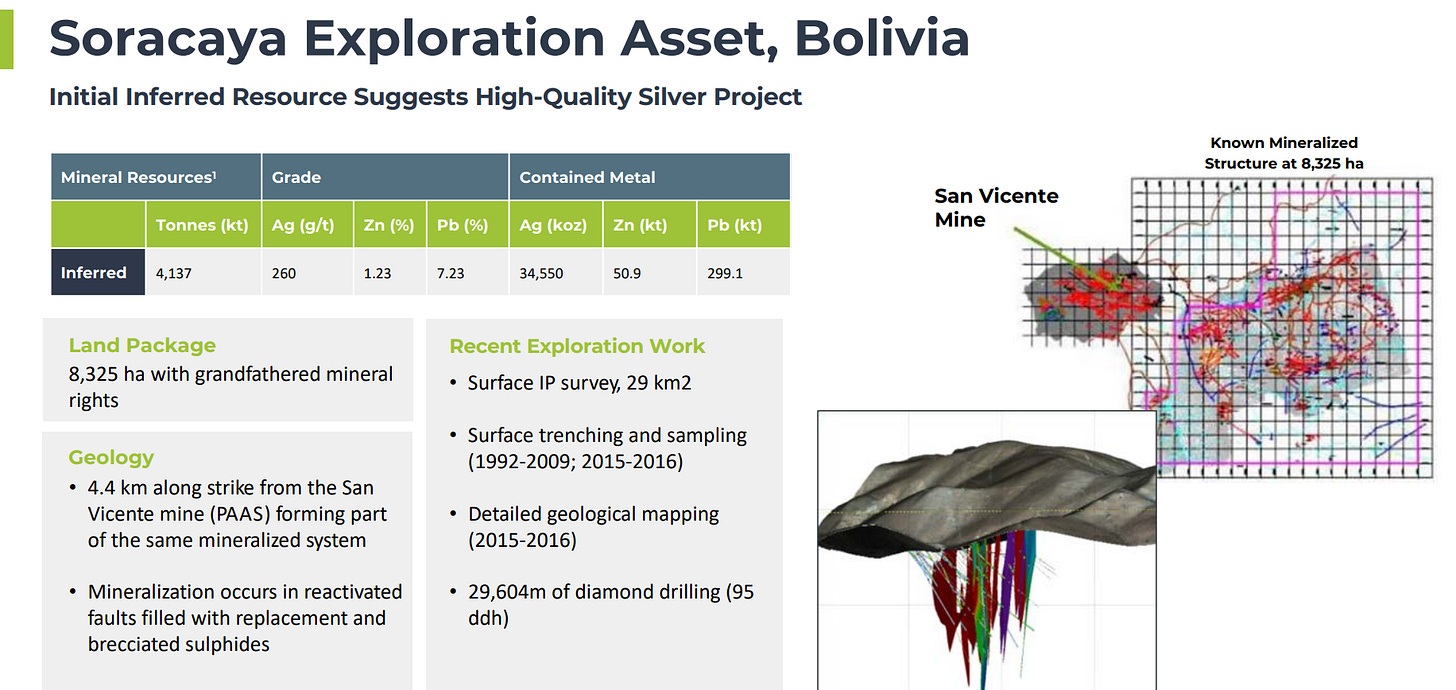

SCZ has four producing mines as well as an ore feed agreement, plus an exploration asset called Soracaya.

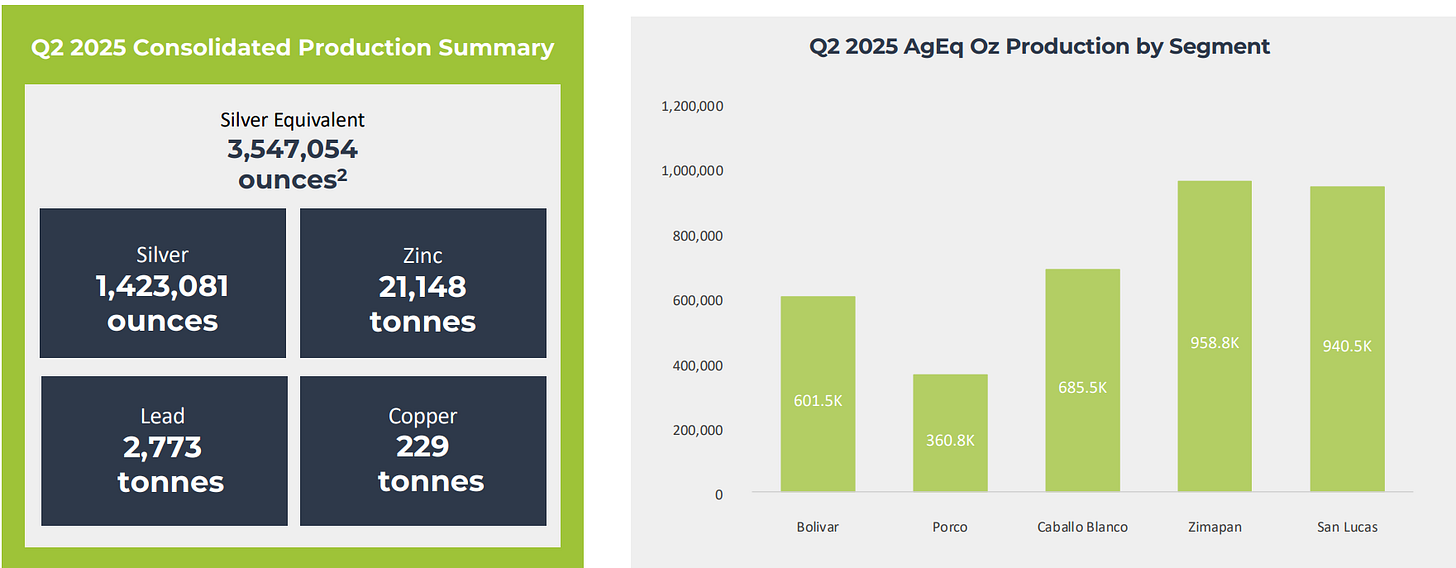

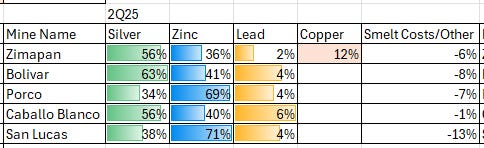

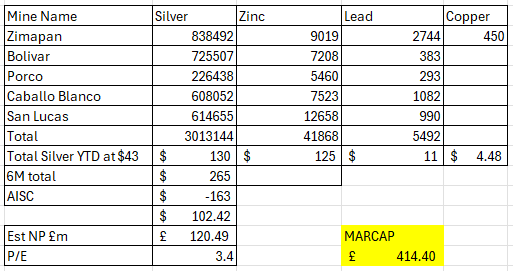

These were the 2Q25 results. 3.5moz eqt where 40% was Silver. But this fairly low percentage masks a couple of facts.

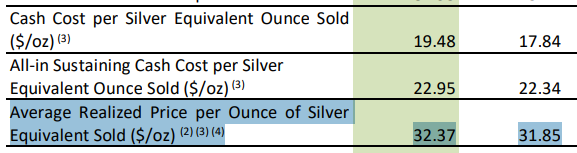

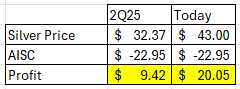

First of all that 2Q25 Silver Equivalence was based on $32.37 per ounce silver. At this evening’s $43 silver, profits are now double, while Zinc remains static to its price in 2Q25. Silver is today over 60% of the silver equivalent ounces.

Profit per ounce of silver today vs the average for 1H25:

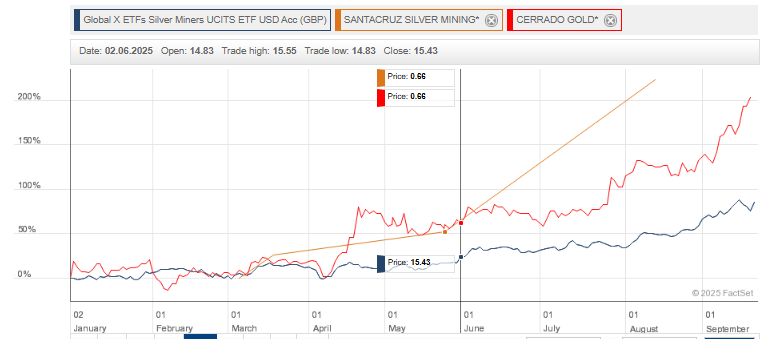

Will Silver top out at $43 per ounce? Don’t think so. Silver is at a 87:1 ratio to Gold and there are reasons to think Silver will accelerate past gold. Could we see $100+ Silver? I already hold a number of Gold Miners and while I hold both MAFL (which holds Cerrado and Silver Bullion) as well as I hold Cerrado directly which I last covered in “SILG - a silver lining”. Seems three months on that decision was the right one where both SCZ and CERT have left SILG the “hardly-any” silver ETF for dust.

SCZ is increasing its output too, up a modest 2% from 1Q25 to 2Q25. The underlying performance is stronger averaging 10% except for the Bolivar mine which suffered flooding in 2Q25. A one-off factor.

Most operations are in Bolivia and a weakening Boliviano means rising costs are offset by forex gains. But more than this cash generation has paid down deferred consideration owed to Glencore and completed this in September 2025.

Removing this debt saves around $15m per year in finance costs. SCZ’ only debt is a Bolivian Bond where the FX rate means it is effectively free money to the company. SCZ is highly cash generative generating £24m of operating cash flow in 2Q25, so over £100m annualised at today’s silver prices.

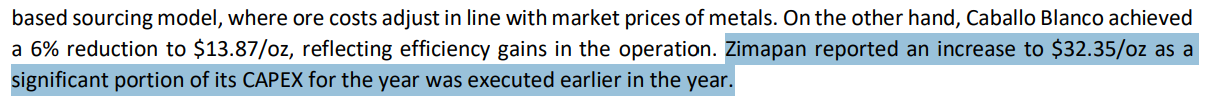

The average AISC was $22.74 per ounce. You’ll notice that Zimapan stands out as a peculiarly more expensive mine. Much of this is just a timing issue, and the investments being made to drive operational efficiency are paying off in the numbers despite some past inflationary cost pressures. Some mines are half of their AISC from 12 months ago.

At SCZ’ exploration asset 34.5Moz of Silver implies a 70% weighting to silver, with 6% Zinc and 24% Lead. The contained metal has a $2.5bn (£1.85bn) prospective price tag at $50/ounce silver plus today’s Zinc/Lead prices (less costs).

Comparatively SCZ’ other mines at historic ~$32 per ounce Silver Prices are around 30%-60% Silver by value.

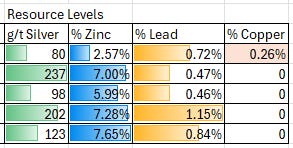

Generally 200g of silver per tonne or above is considered exceptional. So both Bolivar and Caballo Blanco are exceptional by that definition. Soracaya will probably be a third exceptional mine too.

COMPARING TO HOCHSCHILD MINING

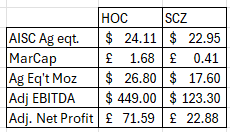

HOC has delivered a number of let downs to investors of late. The Oak Bloke called time on HOC in “cooking up the HOC” at 217p, but HOC is up 40% since then. Did I miss out? How does SCZ compare? Fairly favourably actually. At a quarter of the market cap, SCZ is about 20% more profitable than HOC, and produces at a cheaper cost per Ag Ounce Equivalent, and has reserves nearly equal to those of HOC.

SCZ wins on most measures, and has a more reliable track record too.

Valuation

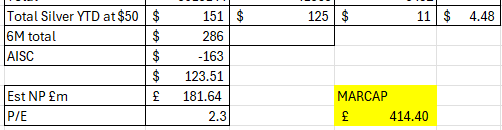

If I take the current $22.95 AISC per ounce, and deduct 25% for tax, plus take the production from 1H25 and double that to get an annualised estimate. I take today’s Silver price leaving Zinc/Lead/Copper at current prices then I arrive to a £120m net profit for the next year based on steady production with no efficiency improvement.

If Silver Prices advance to over $50 an ounce this alone boosts profits by 50%.

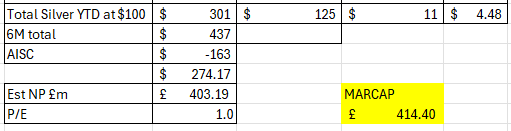

If Silver prices reached $100 an ounce, estimated earnings would equal today’s market cap. For every pound you invest there is a pound of net earnings each year.

Conclusion

Is SCZ a stand out performer? There are a number of approaches you could make if you want exposure to Silver or indeed other minerals. SILG is an easy option to pick, FRES and HOC too. But you will pay a pretty penny to join the Silver journey by buying UK names. For the sake of paying a circa £10 trading charge and probably another 0.5% - 1.5% loss on FX, Canada and Australia both offer intriguing options. I’ve only “matured” to venture directly into overseas markets in 2025 and choosing an ISA or SIPP provider that minimises those costs might be a consideration.

You could opt for Golden Prospect which has a small Silver exposure, or MAFL too. You could opt to buy a Silver ETF but your upside would be far smaller than the leveraged upside at a miner.

Of course Silver’s upward trajectory is not certain and those with long memories will remember the spectacular fall of Silver in 2011 to 2013 of -60%.

Those with longer memories and more years than mine will speak of Silver prices that skyrocketed from $6 per ounce in early 1979 to $50 per ounce in January 1980—a surge of over 700%

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

You say “of course you cannot do so via an ISA “ but I hold many US and Canadian silver stocks in my ISA.

What a way to start the day. Only wish I had as many pounds as you have brilliant write ups. Thank you Mr Oak.