Dear reader,

The top 10 holdings if you buy SILG, a silver producer ETF are these:

Let’s deep dive to see if this is an interesting way to profit from a possibly rising Silver Price.

#1 Holding 21.08% of Assets - Wheaton

2025 and Long-Term Production Outlook

Wheaton's estimated attributable production in 2025 is forecast to be 350,000 to 390,000 ounces of gold, 20.5 to 22.5 million ounces of silver, and 12,500 to 13,500 GEOs (Gold Equivalent Ounces) of other metals, resulting in annual production of approximately 600,000 to 670,000 GEOs, unchanged from previous guidance.

Annual production is forecast to increase by approximately 40% to 870,000 GEOs by 2029, with average annual production forecast to grow to over 950,000 GEOs in years 2030 to 2034, also unchanged from previous guidance.

#2 Pan American Silver

Pan American has been doubling down on Silver over 2023 and 2024. Its purchase of MAG Silver will improve its silver output.

MAG part owns Juanicipio so this will drive down the average AISC of the business.

Its mines span North and South America and 468 Moz Silver reserves is quite impressive.

#3 Coeur Mining

Coeur is also expanding its production of silver. This will generate boosted free cash flow.

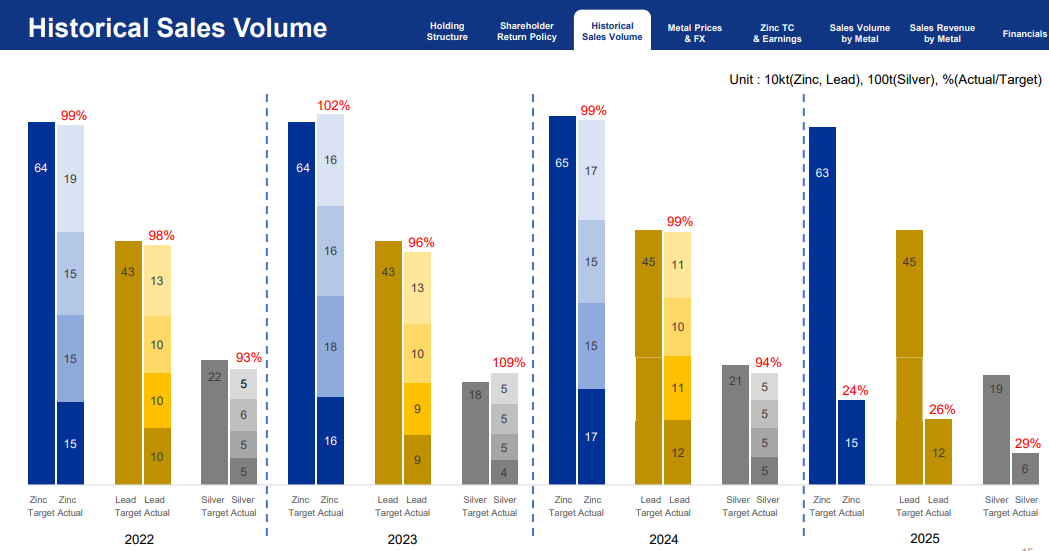

#Korea Zinc

As the name suggests this produces a lot of Zinc, and lead, with a little silver. Strange one to include in a Silver ETF.

#5 Or Royalties

Or has a wide range of royalties.

Per share it is growing its cash flow and NAV each year.

#9 Hecla

Hecla deserves a mention for its low AISC and high grade (which helps drive the low AISC!)

Reserves of 240Moz are substantial.

Bringing it all together

The Top 10 holdings account for 70% of the NAV of SILG.

The first item of note is that there’s not all that much Silver at SILG. 41% silver vs 59% gold (NB apart from Korea Zinc I’ve not considered by products and base metal credits). You are not getting as much Silver exposure as you might imagine.

Second is that two of the top 10 are Royalty Companies. These are going to give you a LINEAR upside to the price of silver going up. Silver producers will give you a LEVERAGED upside. Taking Pan American as the example -$19.53 per ounce AISC and a $32 Silver price is $12.47 profit right? At today’s $37 per ounce profits net of ASIC have increased to $17.47 per ounce. That’s 40% more profit, while a Royalty would be 15% more profit on a $5 higher price.

Third that these are point in time using 4Q24 or 1Q25 numbers. The P/E is as of the last accounts.

Fourth that if Silver were to go $50 per ounce then Silver Revenue would increase - in Pan American’s example from $740m to $1bn. In the column “$50 upside” that’s the increase of profit vs $37 taking the revenue per ounce minus the AISC.

Finally the “Vs P/E” is comparing the $50 upside and dividing by the price earnings to see which holding has the highest bang for the buck. Coeur and Industrias Penol come out the best value relative to their upside.

I recorded a video on my YouTube channel that talks through this chart.

The OB preferred Silver Route

Frankly I think SILG is really expensive. Eyewateringly so. Would there be upside if Silver went to $50. Of course. But with the Top 10 at an average P/E of 66.6 and there not being all that much Silver I’m not keen. Could the P/E compress as newer results come through? Yes but from what I can see this is already in the price.

So my preferred route is to consider overlooked options. For example Cerrado ticker CERT.

Eh? Who? I covered it in the article “Certifiable”

On a fully-diluted basis CERT has 143.4m shares and a CAD$0.72 buy price is a 40p buy price so a £57.36m market cap.

Its Don Nicholas Mine is producing and currently has 6.6Moz of Silver (plus Gold), and its RedCorp or Lagoa Salgada Project has a further 9.8Moz of Silver. Prospectively more. Relative to Gold it’s over 50% of the resource at Lagoa Salgada.

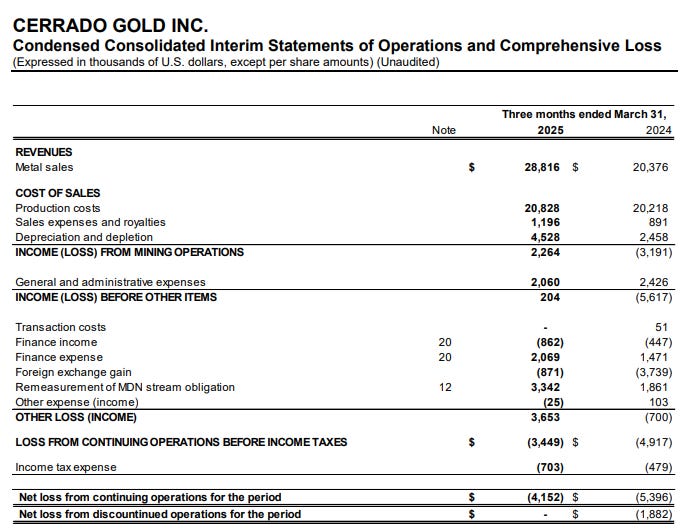

Judging by the latest accounts you might barge pole Cerrado. A loss of -US$4.15m

But look ahead. CERT made significant improvements to its working capital position and balance sheet in 1Q25. CERT now enjoys far strong gold prices (realised price in 1Q25 was only $2,520 per ounce equivalent, while production at the Las Calandrias Heap Leach is nearing expanded nameplate capacity and initial underground mining expected to commence in the second half of the year.

CERT expects to generate significant cashflow in the coming year to support the various growth projects currently underway. The cash on the balance sheet and expected cashflow generation from Argentina are expected to enable CERT to maintain its capital growth programs including developing the underground at MDN, ramping up exploration activities and progressing the development of its Mont Sorcier high purity iron project to feasibility and completion of an Optimised Feasibility Study at the Lagoa Salgada project in Portugal.

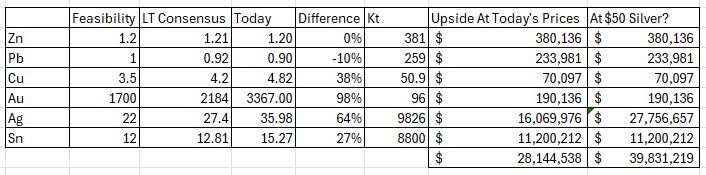

This feasibility study for the Lagoa Salgada project is 80% owned and was acquired via the buy out of Ascendant resources. It is expected that the “Kt” numbers below will grow. Note, reader, the 9.8Moz of silver. How much will that increase by?

But note too the current PFS is based on $22/ounce silver. If we consider the project at today’s $35.98/ounce then the economics are quite different. Potential for $28m (undiscounted) more than the $147m NPV.

Lagoa Salgada has a current 39% IRR and $147m NPV post tax.

The above assumes Silver at $22 an ounce. At $37 an ounce (and other current prices) then there’s $28.1m upside, or at $50 an ounce there’s a further $11.7m.

CERT achieved a run rate EBITDA in 1Q25 of $27m and EBIT of $9m per annum, so with the underground and CIL coming on stream the different to income should be at least $49.2m based on the feasibility study or $87.5m at today’s prices.

That should translate into a net profit of at least $15m assuming -$8m per annum interest costs, and assumed 33% tax.

So a P/E of 5.7X just based on Don Nicolas - and where there’s zero value assigned to Lagoa Salgada or Mont Sorcier.

Conclusion

For me CERT is a good way to profit from rising Silver prices.

It’s also the case you’re choosing a share that’s 12X less expensive than SILG based on the Top 10 in 1Q25, although of course you need to be happy that CERT’s prospective Price Earnings will arrive since it is not there in 1Q25…. but of course profits are being made at 9 of the Top 10 Global Silver producers and prospectively if those grow then the 25X number Global X appear to disclose could make CERT only 4X less expensive….

…..Before you consider its two other projects.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"