DEC-iding to speak the unspeakable

Analysing the Q4 DEC results & arguments for/against a dividend cut?

Dear reader,

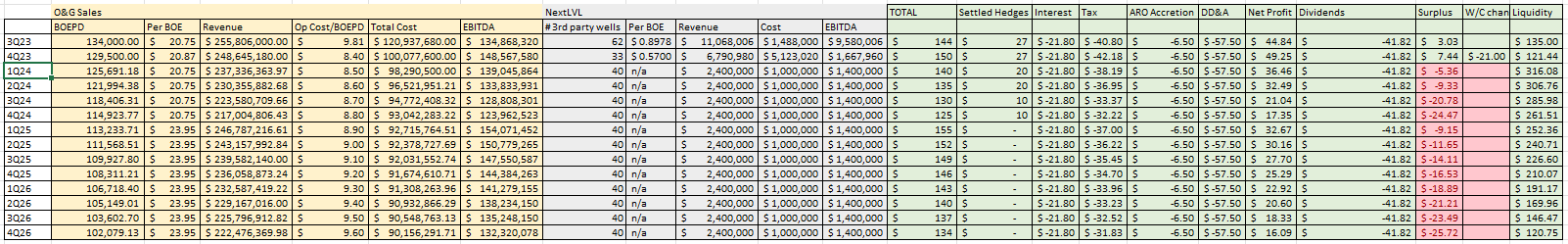

Below is my revised analysis based on today’s (pre-audit estimated) actuals and comparing to the profit model I released in DEC-ent future, recently.

My prior model was fairly close to the reported outcome. Closer than the shorter’s models that’s for sure ;)

Depletion - I previously used a 67/68 ratio to calculate quarterly declines in production. This is about 5% a year which mathematically is the DEPLETION. So while this is approximately correct, however production falls faster as you need to introduce workovers, shutins, and introducing capillary veins, compressors and other measures to eke out the PDP gas reserves. It would make no sense to spend a load of money on workovers in an environment of low gas prices - but do not let 10% drop alarm you - that isn’t 10% depletion. And it doesn’t mean you can’t press the accelerator in the future.

I’ve revised my model to the Q4 actual and have assumed a 66/68 (10% going forwards) even though that is DOUBLE the actual depletion according to the accounts.

It would make no sense to spend a load of money on workovers in an environment of low gas prices - but don’t let a 10% production drop alarm you - that isn’t 10% depletion.

We saw hedging boost the estimated per BOE price by 12c a Barrel. Nice.

Op Costs I’d assumed would increase. Nope, DEC achieved a superb performance here. This is a big, positive stand out for me because the US has tight labour markets and while inflation is slowing last year it was certainly not zero. To achieve and eke out further cost savings when I’d assumed a 20c a quarter cost increase is a great achievement in my opinion. Remaining conservative, my model still assumes a smaller 10c a quarter per BOE cost increases going forwards .

NextLVL I plug in (ha ha) the actuals reported today based on the per BOE metrics given. A notable stat is 210 wells retired in 2H23 and $5.1m + $1.5m of costs works out at a plugging cost of $31,481 per well. Much higher than the $20,770 in H1? Or is it?Fear not DEC hands, as the REVENUE in H2 suggests an average revenue per well of $17.8m so average revenue of $85k per well or $161.8k per 3rd party well. (17.8/210) & (17.8/110).

Theoretically a net cost of negative $54k per well?! The number of 3rd party wells is 184 for 2023, and H1 was 74 so H2 was 110 - a 48% increase in revenue-generating activity….. To be fair there could be non-Next LVL income included in this “other income” (the clue is in the name). We’ll need to wait for the Annual Report, but +$20k net cost seems not unreasonable as a conservative mid ground between +$31k and -$54k cost/negative cost! But it’s intriguing to wonder are we witnessing the NextLVL profit centre DEMOLISH the ARO myth? What happens if NextLVL grows at the same rate in 2024 and 2025?

Are we witnessing the NextLVL profit centre DEMOLISH the ARO myth?

After the NextLVL columns in the profit model, I make no new assumptions other than I correct the liquidity based on the reported $135m, so I assume the $20m surplus post dividend is negated by a working capital change.

The $230m DD&A is a non-cash cost so from a P&L I’m accounting for this to show a “truer” profit than just EBITDA.

From a cash flow perspective there’s no outgoing cash (DD&A are non-cash) so I’m assuming a $230m annual pay down of DEBT according to the ABS schedule. (Which clears the debt by early 2029)

Cutting Dividends?

My model shows that dividends can fairly easily continue to be afforded in the next 4-5 years even with fairly conservative assumptions, and assuming zero activity, improvement while leaving plenty of cash to address future ARO and all the other priorities the business also has. The level of decline I’m building in to the numbers assumes zero workovers, zero replenishment, while my model shows a consistent war chest of liquidity over time this could be boosted via workovers (less the cost of those workovers of course), JVs to drill undeveloped land while still paying debt down.

Should a ~30% dividend continue? Or should capital allocation go to other measures?

Pay down debt faster?

An ARO sinking fund?

Faster retirement of fully depleted wells?

Buy Backs?

Acquisitions?

A lower dividend is a longer dividend

Something else?

Debt is virtually all fixed and scheduled in an ABS structure. The RCF is a slightly more expensive form of debt so there’s some modest benefit to paying this down faster.

What about a Sinking Fund?

Were DEC to set aside increasing amounts in an ARO sinking fund this would make DEC the ONLY company in the entire US O&G industry (to my knowledge) which does this. Some people feel strongly such a fund should exist….. for DEC. But why ask it of a single firm? Odd behaviour and one they themselves don’t appear able to answer beyond Bloomberg told me 3 years ago about DEC. Perhaps innocent people concerned about US taxpayer liabilities or the environment, yet aren’t interested in discussed either topics more broadly. One can’t help but feel suspicious as to their motives. My sense on this is the US government does not mandate a sinking fund of any firm, and if they intend for this then they should legislate for this - as a level playing field for all. (I dare say that would cause a sharp contraction in O&G investment - a major US industry and export - but if that’s what the US decide so be it). Would it just be O&G? What about Coal? What about Electric Vehicles? Who will pay for recovering all the lithium trapped in batteries in the future? Should car companies be forced into a sinking fund too?

Meanwhile, the assets of the business and the future profits of the business more than cover the retirement obligations and NextLVL’s growing capability and capacity means retirement is whole lot easier if you own the care home! If it weren’t mandatory would it make commercial sense having a sinking fund invested in something like T-Bills or Bonds generate a higher profit to cover future ARO? When DEC can generate IRR of above 20% why limit profits and limit returns to 5%? It would make no sense.

Similarly faster well retirement could be commercially catastrophic too. Much like the US economy if everyone retired at 50 years of age the country would be in trouble (unless you quickly invent AI and robots that can do all the jobs I suppose). You keep producing wells producing. Perhaps not 24/7/365 though. One reason people think wells should be retired is they produce low volumes. Some of DEC’s wells are switched off and pumped 1 hour in every 24, or even 1 hour in every 168. To me, to understand DEC is to understand hypermiling.

When people dismiss DEC’s business model and try to compare DEC to say a “traditional” O&G firm the thing they’re missing is that DEC isn’t competing in a Formula 1. It’s performing in a Hypermiling competition. A ride in the slow lane means you keep going with your resources until you can’t anymore. Like Bob the Salesman with his BMW vs the OB who bimbles along with ease and his BMW lasts far, far longer as a result. And like the Hare and the Tortoise who wins the O&G race might come down to the best steward of resources and not the hungry hare, drilling to keep running. If baffles me that people don’t get this business model. Perhaps they need to read the Oak Bloke. Because BMW analogies, nursery rhymes and random videos are what’s needed to explain DEC it seems.

Buy backs are another matter. I showed in DEC-laration on buy backs how the NAV can grow 7% through buy backs. And that was at £15 a DEC share! Today’s sub £10 would be even more strongly accretive (10%+). The challenge is that there are quite a number of rules including that your NOMAD must carry out the buy back at arms length subject to various rules and restrictions. It’s not as simple as saying Why Didn’t Rusty fill his boots via Buybacks today? Why doesn’t Rusty do BBs to get the shorters. Rusty doesn’t push the button. Personally I would support a reduction of dividend and have higher buy backs, but I appreciate different people have different views on this. I have to trust that Rusty to make the right choice around capital allocation.

Acquisitions are occurring in the industry regardless of DEC and MERP should send the tide out and we’ll see who’s swimming without trunks in 2024 and beyond. My analysis is that DEC is extremely close to if not below the 0.20% NGSI level where methane fines begin to occur. I’m sure other players, including and especially private companies (like Rusty used to be) have not been as forward thinking about methane. Therefore are acquisition targets. MERP and ultra low natural gas prices will probably send a number of such companies to the wall. So DEC may acquire some of those and has a warchest to do so, if it so choses.

Also the world is full of hungry hares who are happy to offload half eaten carrots. Tortoise-nibbled carrots can last 71 years.

A lower dividend is a longer dividend. It is fair to say that a 30% dividend costing $160m a year could not be afforded for 71 years. Or at least my model does not support that. The depletion and current PDP reserves do not support that. After 8-10 years so in 2032-2034, a dividend cut will be necessary ceteris paribus. I say that because DEC has constantly innovated and grown so with no further change or improvement it couldn’t be afforded eventually. It’s difficult to think there will be no innovation and growth. For example growing NextLVL could offer a great commercial opportunity to DEC that supports the dividend in the future.

Penultimate Thought:

There’s a great deal of inadequate, misinformed reporting around the topic. I see Rhodri Morgan of City AM is the latest to attempt to report the complex story of DEC. He believes “Concerns over well clean-up bill grow” and continues “a $200m asset sale, announced earlier this month, stands in as an attempt to avoid a dividend cut in the absence of revenue growth.”

Who has these growing concerns? Only Snowcap is mentioned. Honorable Pallone and the Democrats have been answered comprehensively. Is it accurate therefore to say concerns have grown? Isn’t shrunk more accurate? What’s changed to make Snowcap “more” concerned? (Were they ever?). More concerned about covering their short maybe? Most Financial writers would understand a shorter’s main “concern” is whether borrowing a stock to buy it back later is going work out in their favour? So I fail to understand why the word “grow” is used, and the accuracy of that.

On a second point does Rhodri not realise that “the absence of revenue growth” is totally irrelevant to afford a dividend? You pay a dividend out of liquid resources and ultimately out of profits. Revenue growth doesn’t provide for dividends, as Rhodri reports!

Not only is the logic poor, even the grammar is poor. Who writes an asset sale “stands in”?

Imagine. Today, we are conducting an asset sale. It will stand in to provide liquidity. Stand in what? A bucket?

To conclude:

Today’s results are a positive; rising profits, lower costs, progress via NextLVL…. there’s lots to like but also there’s nothing untoward based on what’s reported in the trading statement.

Keep the faith DEC-hands.

This is not advice.

Oak

Hey Oak, can you clarify how you came up with values in the "Net Profit" column in your model?

For the first line of your table (Q323) summing up columns starting with the "TOTAL" column

144 + 27 - 21.80 - 40.80 - 6.50 - 57.50 = 44.40 Net Profit (not 58.65)

Corporate decline less than 10%, Appalachia assets at 5% per trading statement. I would assume the new assets in the mid-continent have very high decline rates and the newest wells completed even higher decline rates. These declines should flatten out some in the next few years.

60% of production declining at 5% leaves the other 40% at a 17% +/- decline rate. If the 17% decline rate drops to a 14% average this year then company decline would likely drop by a full percentage to under 9% for 2024.