Dear reader,

Dastardly shorters have been busy this week.

DEC-hands have had to brace against what feels like a 100 year storm. A turbulent time and those with weak hands have flung themselves off DEC abandoning all hope, and drove the price down yet further. Yet, here on early Friday evening as I write this the price once again is rising - each day the UK sells - and the US buys. Is that noticeable? And those who short, borrow shares from DEC-hands. A day must come when they settle their short. The longer they keep the short the more they will be squeezed. Ouch.

More importantly, readers have reached out this week - OB what do you think? The price, the price. Well, like yourself reader, I’ve been contemplating the situation deeply. Have I missed something? Have I misunderstood? Am I too optimistic? I spent a very long plane journey this week focused on this question. What have I missed? Did I miss something that Jeff, Ted’n’Kathy, Alex Smith had seen but failed to explain? Should I listen to Motley Fools? Speaking of which - just for a nanosecond - considered should I unfilter and read the drivel from GG? That madness quickly passed.

It was one of two possibilities.

I am wrong. There is a reason for this panic.

I am right. This is an exceptional opportunity.

Reasons I could be wrong:

ARO & Plugging costs dramatically more than $25,000 (net of MERP & 3rd party P&A profits)

There’s a huge Methane Fraud

Natural gas has no future - selling price drops away.

US Government shuts down DEC or whacks a fine so goes bust.

Hedge liability provokes a meltdown

The market “knows something”

DEC is running out of resources / 10% a year myth.

It’s not an audit

The dividend is unsustainable

How do I answer if I’m right?

ARO

Do you believe my OB back of a fag packet calculation on P&A?

Has any land-based O&G company actually got $80k+ per well costs? (and do they use a 3rd party who charges them that - or is it their actual costs?)

What profit does NextLVL produce to offset the P&A cost?

Is there actually any credible and up-to-date evidence about ARO (Ted’n’Kathy reprised)?

I just don’t think this is wrong or if it is, it’s not wrong enough to rationally justify the share price. 5X wrong just beggers belief.

2. Methane Fraud

How has DEC deceived regulators, auditing bodies over multiple years?

There’s clear evidence of improvement so isn’t it simply Honorable Pallone looking at some outdated AND ESTIMATED using 1990s methodologies data?

If it were “so easy” to cherry pick bad wells, why haven’t Bloomberg or Ted’n’Kathy done a follow up and shown how they were right and DEC are fraudsters?

Natural Gas has no future

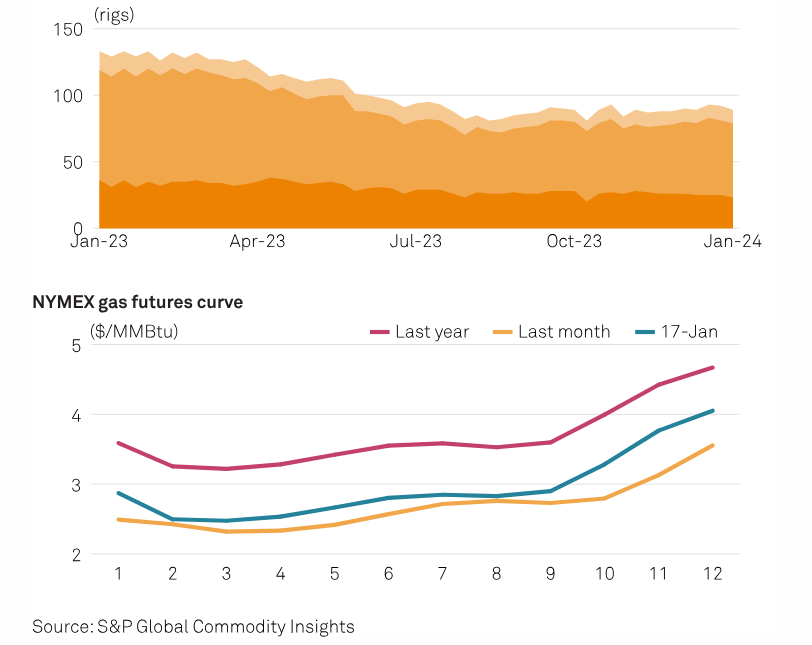

That’s almost impossible. Coal remains huge in the US and gas is replacing coal. LNG exports are growing. If anything the opposite is true. I pay the equivalent of $144 per BOE (plus standing charge) (which DEC sells for $20.75) and my boiler will be using gas for the foreseeable. Even if renewables continue to grow (and I hope they do) gas still is an important base fuel. Is sub $3/mmbtu sustainable - I struggle to see how. Oil is 4x the price at around $70-$75 a barrel. Gas in Asia is over $9/mmbtu and the UK $8.75/mmbtu. Nowhere other than America can you buy gas for such prices. Will US natural gas remain so cheap? Both the supply (US rigs) has dropped by a third in a year, and demand (futures market) is rising and doesn’t think so.

US Govt shut down DEC

Why DEC and no one else? Why not Coal? No other O&G firm (or Coal miner) is similarly affected even though we know DEC has a better NGSI score (for example better than Exxon). So I can’t see how that’s true.

Hedge Liability

Again, it makes no sense (and not even any shorters have come up with this one) but what if someone messed up on a hedge and bet on something crazy?

The market knows something.

What does it know? No one knows. Yet lots are shorting. Why wouldn’t you reveal your basis for a short if you were that convinced? Why wouldn’t some Alternative Reality-Oak Bloke write short articles like the Oak Bloke does?

Running out of resources

I’ve been through this time and again - please read or re-read Captain on DEC. You need to look at proven reserves and you need to look depletion those are the key numbers. Just because production drops 10% a year it does NOT mean remaining resources do. Through shut ins, workovers, compression, capillary string improvements the actual depletion is lower - and that’s before any new drilling or sale of land for drilling of UNPROVEN resources. This article DEC-tecting fact and fiction explains why you have to consider DEC “resets” its production. The true level of net reduction (i.e. depletion) in 2023 is 5.8% per annum of proven reserves - and slowing.

An audit isn’t an audit

I saw someone argue that the interims only have a qualified audit (in relation to my reliance on the $20,770 per well for P&A). Yes there are limits to audit in an interim report but a/ there is a DEC internal audit committee which appear to have the blessing of DEC’s Chair and NEDs as well as b/ the interim numbers are reviewed as part of the end of year audit. So it can be argued both ways. Would someone cheat the numbers in the interim to be caught out 6 months later? Give me a break - you must have a Scrw(l) loose.

The dividend isn’t sustainable

Hmmm. Finally a good question. So what if we built a model to look at sustainability? (See below - my gift to you reader)

We know there are roughly 17 years worth of production (at today’s production volumes). Therefore that’s 68 quarters. I’ve used a 67/68 quarter-on-quarter ratio to forecast production for the next 3 years. (so no accretive purchases or development but I am assuming workovers and shut ins). I’m assuming Natural Gas moves to its future price in 2025 of around $4/mmbtu (which is $23.95 BOE). The revenue is these combined.

The Cost I’m assuming a $0.20 per quarter rise (despite it falling over the past few years). Total cost is again combining volume and unit cost. EBITDA is therefore revenue less op cost.

I then have used a $0.15 per MMBtu to arrive at $0.89 for Q3. Therefore that’s $11m of revenue. I used $24k plugging cost (going to $25k from Q1 2024). Again EBITDA for NextLVL is revenue less cost.

I arrive at a total. I assume $21.8m interest (despite this falling QoQ). I’m leaving tax blank - so $176m tax credits are NOT considered.

ARO I’m holding at $26m a year which is 10% above the minimum but let’s go with it. DD&A is a NON CASH COST reader but I’m working on the basis that there’s $57.5m of ABS debt paid down per quarter (on top of interest). That level of repayment clears the entire debt of ~$1.2bn over 5 years by the way.

Notice I don’t reduce DD&A or interest costs even though I probably should.

Net profit is a calculation. Dividends assumes the current 28% yield remains (to answer the can DEC afford to keep the dividend). Surplus is net profit less dividends, and liquidity is the “headroom” (i.e. cash plus the revolving credit facility)

As can be seen, I’m having difficulty running out of the money to pay the dividend… and not just in the next 12 months. In 36 months I don’t fall below $300m liquidity. Alex Smith please explain yourself.

I don’t think these are optimistic numbers. I believe these are quite conservative. I will be using this model and refining it to test various theories.

Some example upsides/theories:

a/ What if MERP means there’s $ billions of funds to support an expansion of P&A (either DEC own wells or 3rd party)?

b/ What if gas prices rise to $5/mmbtu or higher? ($5 is like $30 a barrel of oil equivalent…. what if Gas drew parity with oil? $12.5/mmbtu? That’s 5X today’s price.

c/ What if BOE costs reduce and not increase by 20c a quarter?

d/ What if NextLVL increase the number of 3rd party wells P&A’d?

e/ What if buy backs reduce the cost of dividends?

f/ What if further SPVs are spun out?

g/ What if the $500m undeveloped properties are developed?

h/ What about $176m of unused tax credits?

I think creating this model has helped reassure me that the dividend is safe. But even if I’m wildly out and the dividend is cut in half to say $21m per quarter (a meagre 14% per annum), it’s still a heck of a dividend. Something pretty spectacularly bad in addition would also need to explain the extent of the recent fall in share price.

Even Alex Smith who at first thought DEC couldn’t pay its Tinpot-Republic 100%+ RCF interest rate (the 100%+ interest rate was the only explanation to Alex Smith’s sums, reader - not reality) has now changed his mind, it seems. Investors Chronicle now claims Alex Smith DEC CAN afford interest payments, but can’t pay its dividend (make up your mind Alex Smith or else you lose credibility, oops). Even Alex Smith’s employer seems to have DEC at a £16.00 target price a share (putting DEC at a 60%+ upside from today and assuming a worst case 50% reduced dividend that’s a decent 9% yield at that target price). That’s the downside view from the analysts, reader, it seems.

Meanwhile everyone else - Stifel, Cavendish and others still think DEC is a triple bag £30+ a share from here.

So who is right? Don’t ask me - I’m just an optimist - allegedly. An optimist who uses a realist’s maths and listens carefully to a pessimist’s mutterings. Topping up today at a shade sub £9 felt good. Very good. I would thoroughly recommend the experience to you, but I fear you may never have the opportunity again reader if you didn’t experience it today.

Time will tell. And this article is not advice.

My advice is to enjoy the weekend.

The Oak Bloke

Hi OB. I have a few comments and questions about your post.

1. "The true level of net reduction (i.e. depletion) in 2023 is 5.8% per annum of proven reserves - and slowing." Could you please tell us where this figure comes from?

2. "Just because production drops 10% a year it does NOT mean remaining resources do." I assume the 10% figure (which you've also mentioned in previous posts) comes from this statement in DEC's last trading update: "Maintained industry-leading consolidated corporate decline rate of ~10%". It's not clear to me what DEC means by this, but let's accept that they're talking about a production decline, not a reserves decline. Then I take your point. Nevertheless, it's production that pays the bills in the short term, not remaining reserves. So I don't understand why your 3-year projection uses a production decline rate of 5.8% rather than something nearer 10%.

3. I would also note that DEC's 50-year ARO projection says that it assumes a "4.5% long term production decline rate". If their current production decline rate is 10%, this suggests that they expect production to fall faster than 4.5% in the near term but slower later, giving some sort of 4.5% overall average. I don't know how they calculated this average, but I hope they've allowed for the fact that early declines have a bigger effect on total production than later declines. In any case, early production is more valuable than later production (because of the time value of money), and I don't think the projection takes that into account, since it uses undiscounted values. I don't know what the overall effect of these factors is, and perhaps DEC has allowed for them, but to me it's another source of uncertainty.

4. Continuing on the subject of the value of time-distant production... Let's assume you're right that the price of gas will rise over the medium term for the reasons you've given. That seems reasonable, though not certain. What about the very long term? DEC's 50-year projection assumes a gas price of $4.91/MMbtu from years 10 to 50. Since the projection was published in late 2022, let's take year 50 to be 2072. If we remain on target to achieve net zero in 2050, it seems likely that gas demand will fall off well before 2072. Won't that result in lower prices? It seems like DEC's projection is probably based on an assumption that carbon capture will allow us to keep burning gas at the current rate indefinitely. Maybe, but that's very speculative, and not what the IPCC and other experts are assuming. Even if you and DEC are prepared to take that risk, US legislators may not be, as it's US taxpayers who will be stuck with the ARO costs if the assumption doesn't play out.

I'm still holding onto my DEC shares, as it doesn't seem worth selling at such a low price. But I feel far less optimistic than you.

Even though there have been no RNS about IIs selling, the way the share price is behaving does suggest there has been a big seller in the background for some time, and I think we all know there are many ways for IIs to obfuscate their selling or keep it below notifiable thresholds. I read recently somewhere that there is a new ESG regulation which will make it very hard for UK/EU income funds to hold DEC which could explain this (and also motivated the US listing), but frustratingly can't find it now, was mentioned on twitter