Dear reader,

You may recall in 1Q25 DEC covered in the article “DEC to March” there were some strange tax results. Did those iron out in 1H25?

Also a focus was on delivering a DECent EBITDA margin. 56% decent enough for you?

Land and Expand

DEC $106m land sales 2021-2024 averaging $13.25m per half year. Today an incredible $70m of land sales are announed far higher than the $40m forecast back in 1Q25. That’s worth $0.90 or 68p to each DEC-hand.

Shares in issue are now 77,935,467

LOE

Production averaged 192 Kboepd up from 144 Kboepd in 1Q25.

Lease Operating Expense was up 53% in 1H25 compared to 2024 and drove a higher Operating Cost per BOE to -$11.34 although that’s down on the -$12.01 per BOE in 1Q25. That’s due to a higher proportion of Oil (higher lifting expense) and also on the US bad weather in Jan and Feb. We are told that 50%+ operating margins can and will be achieved once things settle down. We see evidence to that today.

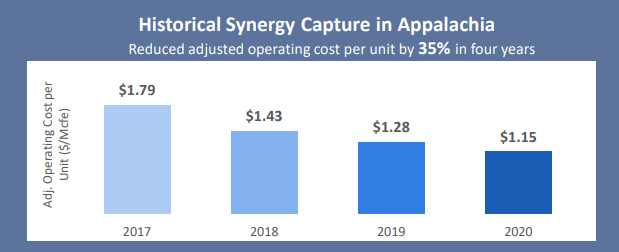

DEC’s track record is to achieve 35% reductions in Op.Ex over 4 years so they’ve achieved a nearly 6% reduction in 2Q25.

DD&A

On a BOE basis this rose 2%, while in absolute terms 38% and comes in at -$164m in 1H25 or -$5.40 per BOE

Acceleration of Decommissioning/Plugging

DEC paid out $13.6m in legal costs in 2024 and 1Q25 after it and EQT lost a class action brought against them by West Virginia landowners. DEC has an existing obligation to retire 200 wells per year. This obligation increases to 288 per year according to press coverage. NextLVL retired 215 DEC wells in 2024 so a 73 well increase on 2023. This additional cost equates to around an estimated additional expense of ~ -$1.8m per year, and this cost reduces the ARO liability. The outcome of this case is also that those landowners cannot bring any further action against DEC until after 2035.

In 1H25 DEC retired 170 DEC wells and 43 3rd party wells so is well ahead of is obligation.

NextLVL

DEC alter their disclosures and don’t tell us the Next LVL performance per Boe however we can deduce:

43 3rd party wells at $0.24 BOE is $6.2m so $145,200 revenue per well. This is a ~$20k drop per well compared with 1Q25.

210 total wells at -$8.6m so plugging cost -$41k per well on average. Some DEC well retirements were not retired by Next LVL which may expain a $3k/well uptick of cost here.

Cash Flow

Op Cash Flow is improved by over $100m in 1H25 although this is offset by higher Capex ($70m increase) and interest costs ($45m increase) included a one-off debt issuance costs of -$30m.

Op Cash Flow in 2Q25 was $132.5m so a $1m beat of 1Q25. Considering that 1Q25 is typically stronger winter pricing of gas that is a substantial improvement to the Spring cash flow in 2Q25. If you compare the 2Q24 vs 2Q25 numbers the improvement to operating cash flow is $78.1m or 140% higher.

Annualised $530m op cash flow fits perfectly to my forecast.

Although DEC’s guidance for 2025 was $420m adjusted FCF. Can it deliver $338m FCF in 2H25? Adjusted means adjusted for property sales so $82.6m becomes $152.6m adj.FCF due to $70m of non-core property sales in 1H25. So DEC has to find $268m FCF in 2H25 so the answer appears to be yes, if they can repeat the $70m land sales in 2H25.

Let’s not forget that that would mean a P/FCF of 3X even if it’s on an adjusted basis. Using a screen the only businesses generating that on Stocko are where they are banks (Arbuthnot and Secure Trust) and are counting Customer Deposits as part of that Cash Flow. Strip out that factor and the FCF is about 4X. So DEC is, as far as Stocko Screens can be trusted, the only company that generates 31 cents of cash per year per dollar invested. Even if Stocko thinks it doesn’t!

I see Mr Head commented today that he “disagrees with (DEC’s) calculation of FCF” and believes the true number is $115m although then fails to explain how he reaches that number. $37m of cash flow disallowed because…? Surely not the loss on derivatives! But that’s the only $37m value in the accounts. Oh dear.

The adjustment is to include disposals in with the operational FCF. The point is the disposals are of negiglible value on the balance sheet. It is not as though DEC is disposing of assets of any material value.

Dissecting Mr Head

In today’s Stocko at attempt was made to review DEC. It was not very successful.

Claim #1: ~$6.6m was generated from environmental credits. Nowhere in today’s 1H25 report was that disclosed. A broker note spoke of this erroneously today.

Claim #2: Equity in 1H25 is lower than 2019. Mr Head falls into the classic trap of ignoring the unsettled hedges. Those were only $77.5m in the 2019 accounts and had grown to $763.2m in 1H25.

$938.1m of sh/equity in 2019 would be $1,015.6m adj. sh/equity.

$727.7m of sh/equity at 1H25 would be $1,490.9m adj. sh/equity.

So adjusted sh/equity has actally grown $475.3m since 2019.

The reason Mr Head gets this wrong is he is including the potential loss of derivatives. Which is a cost that hasn’t ACTUALLY HAPPENED, yet. These derivatives relate to and are offset by a future 10 years of P&L income. They must be presented this way but it’s a nonsense, and the accounts only make sense if you adjust them out. (Or put another way if you keep them in then you must include the future income that offsets those future costs)

Claim 3: The share price is currently broadly unchanged from its 2017 IPO level:

Yes, and it’s a bargain at today’s price! Adj.equity is up 50% so there is at least 50% upside on that read across.

Besides Mr Head fails to consider that shareholders have received dividends since 2019 of: $15.61 per share. So about 100% of today’s share price and 140% of recent lows.

2025: 2 payments × $0.290 = $0.580

2024: 4 payments × $0.290 + 1 payment × $0.875 = $1.160 + $0.875 = $2.035

2023: 4 payments × $0.875 = $3.500

2022: 4 payments × $0.850 = $3.400

2021: 4 payments × $0.800 = $3.200

2020: 2 payments × $0.750 + 2 payments × $0.700 = $1.500 + $1.400 = $2.900

Total$0.580 + $2.035 + $3.500 + $3.400 + $3.200 + $2.900 = $15.615

The total dividends amount to $15.615 per share.

Claim #4 “it’s worth considering how this growth has been funded”

Yes - and it’s not in the way Mr Head claims it is.

Taking 2019 as the start point (to be consistent with Mr Head’s Claim #2) production more than doubles (509 → 1,202) i.e. 84.8KBOEPD → 200KBOEPD. A 136.2% increase. But with 10% annual depletion over 5.5 years a 136% net increase is a 262% GROSS increase in production.

$624.3m→ $1593.4m Total Debt less current assets. Is a 155% increase of debt.

Sh/Equity was £611.9m or $807.7m in 2019 so since 2019 $453.9m of “net issuance” occurred since (and including in 1H25). So that’s a 77.9% net increase in shareholder’s equity.

Does a 262% gross increase in production justify 155% more debt and 78% more equity?

Let’s not forget the $15.61 per share returns in that time.

Also let’s not forget today the mix is in 1H25: 76.8% Nat Gas, 12.9% NGL, 10.3% Oil. Over 10X the (more valuable per barrel) oil compared with 2019, and 33% more NGLs.

Let’s not forget the PV-10 today is $5.8bn, and reserves of 1bn BOE compared with 0.563bn back in 2019 and reserves of just $1.9bn. That’s an increase of $3.9bn since 2019.

So after making four erroneous claims that paint DEC in a wholly negative light, for no good reason and due to a lack of understanding the remainder of Mr Head’s analysis is just some waffle about DEC being “a more speculative situation” and “I’m going to mirror the algorithms”.

Revenue

This is a very useful way to understand the evolution of DEC. Consider in 1H24 it genrated $336.1m of revenue. That was by dollar revenue in 1H24 a split of 62% nat gas, while 21% was NGLs and 17% oil.

Volume increases (i.e. via acquisitions) added 18% gas, 27.6% NGLs and a 428% increase of oil. That added $258.2m to the $336.1m achieved in 1H24.

Price changes added 70% to nat gas, 2.7% to NGLs and minus -16% to oil. That delivered an overall $143.5m to the $336.1m achieved in 1H25.

That’s how we arrive to a 1H25 revenue of $737.8m

Net Profit

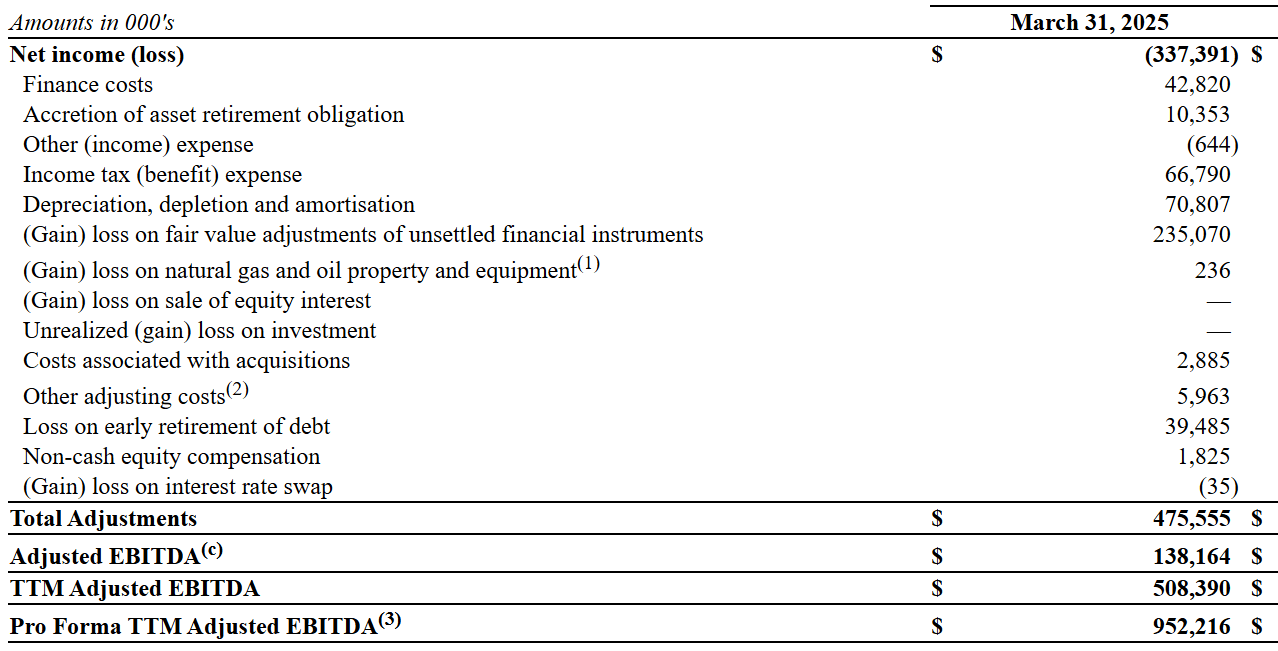

A -$34m statutory loss is a “slight” reduction from a -$337.4m loss in 1Q25 isn’t it?

1H25 unsettled hedges are -$77.6m so adj.profit is actually a true profit of $43.6m

Considering extraordinary costs of Maverick of $21m G&A and $30m debt. That gets you to an underlying ~$85m post tax.

As I speculated, the -$66m tax bill in 1Q25 nets to a -$6m tax bill in 1H25.

In my article DEC-mand and supply I mused about a $350m adj.net income in 2025, so is that possible? Maverick only was added in March 2025 so we get the full pro forma in 2H25.

If we extrapolated $85m x 2 = $170m we’d be 70% above 2024 but only about halfway there. There are many further factors how 2H25 will be different. The Carlyle deal being one of those.

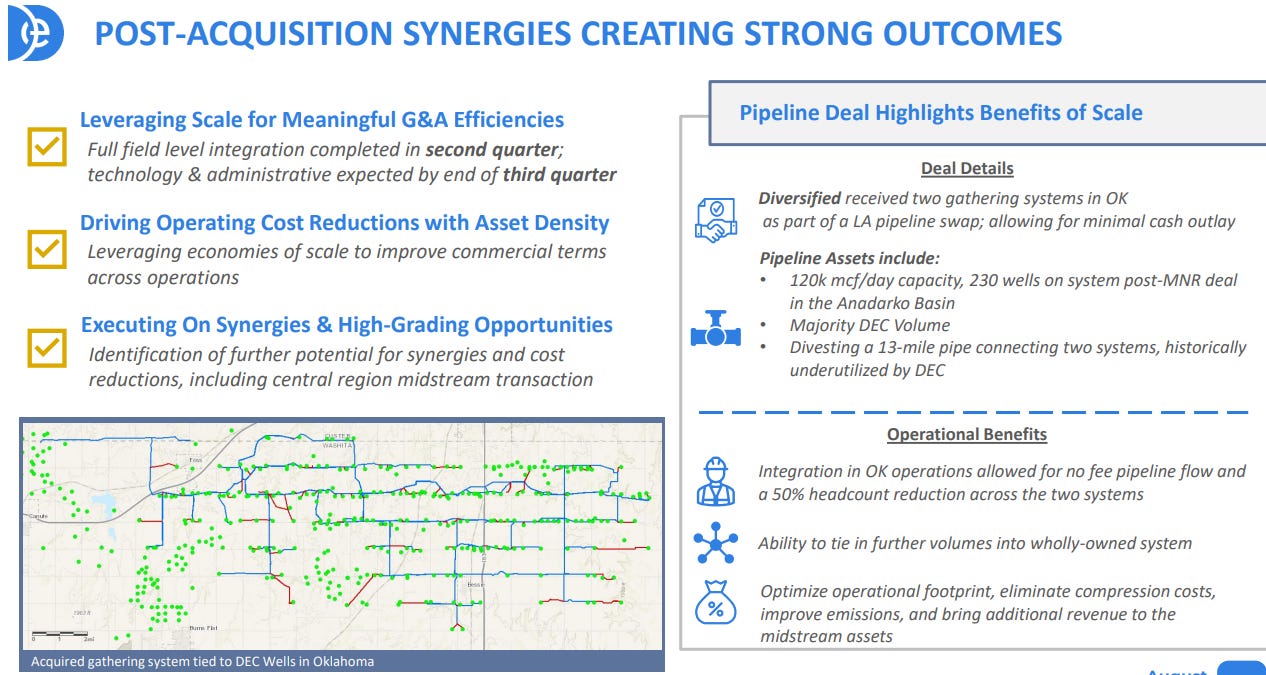

Synergies

We learn of over $55m of synergies shows DEC has EXCEEDED its target of OVER $50m. It says to except $60m of annualised synergies. More to come.

G&A reduced in 1H25 by $0.24 BOE due to synergy we are told.

Supply and Demand

Post hedges we see a $1.80 BOE to nat gas revenue. Excluding hedges it is far more stark. 1H24 $10.98 per BOE for Nat Gas grew to $18.66/BOE.

Since 2Q the price has barely fallen below $18/BOE augering strongly for the second half and beyond. There is a simple geological fact: Gas is rolling over.

VAST does not mean unlimited.

Haynesville - we see a bell curve and falling supply

Anadarko - we see an elongated bell curve and peaking supply.

Permian we see increases but deceleration, and the tantalising view of the peak of a bell curve in the near future.

Appalachia - a peak and decline bell curve.

I’ve spoken before of the value of DEC being a “hypermiler” ekeing out production long term. That remains true and that strategy seems increasingly smart. It acquired plenty of assets to consolidate its position and now via Carlyle has an opportunity to scale it by 2X.

Competitors seeking to replace production through the drill bit are going to be increasingly disappointed as productivity falls. Discarding their “old wells” will prove to be a huge mistake in time - that’s what makes DEC special. One man’s trash is another’s treasure.

CAPEX

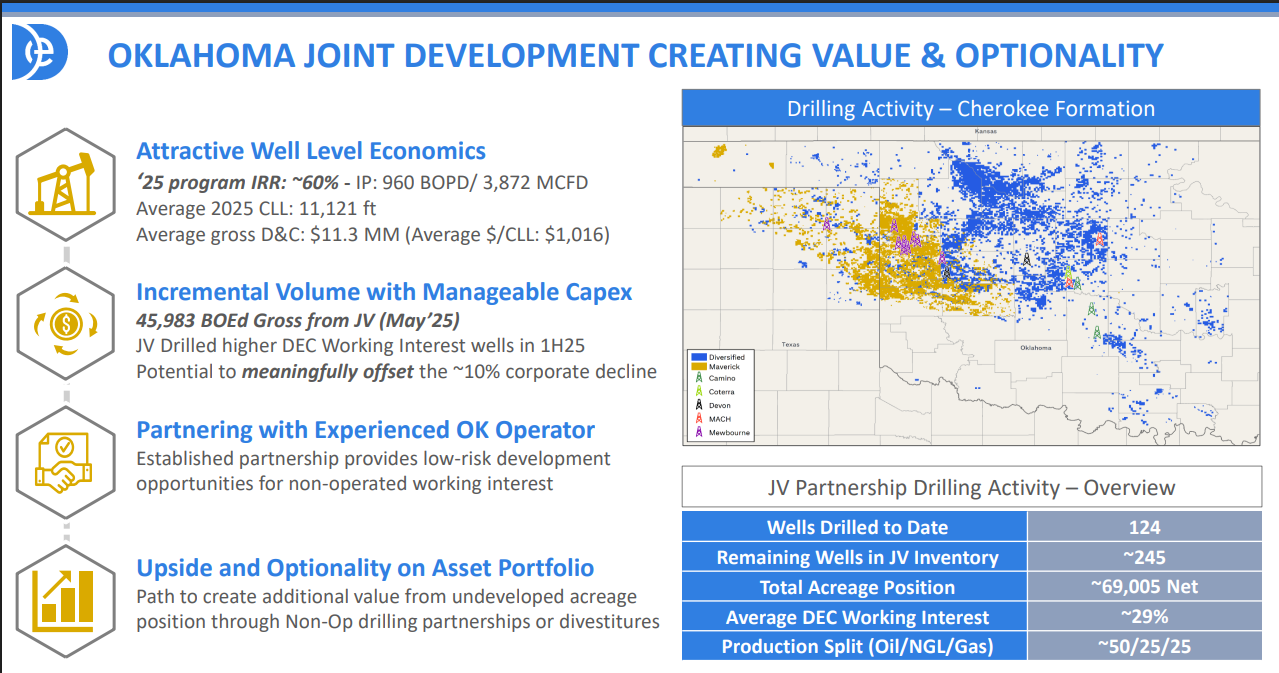

$89m of expenditure and a target of $165m-$185m, implies capex is on track.

That capex is delivering 13.33Kboepd at a 60% IRR, implying that declines at now at -3% per annum, net of development, i.e. -10% gross. Assuming that kind of run rate is achievable.

Buy Backs

Further buy backs are planned.

DEC repurchased ~3.5 million shares year-to-date in 2025, representing ~$43m of share buybacks. Current shares in issue as of 11/08/25 are 77,935,467.

Valuation

77.9m shares at £10.40 puts DEC at a £810m market cap.

If I’m right in my calculations about the adj.Net Profit for 2025 that DEC is going to achieve £220m, so an adj.valuation P/E of 3.7X.

Looked at another way:

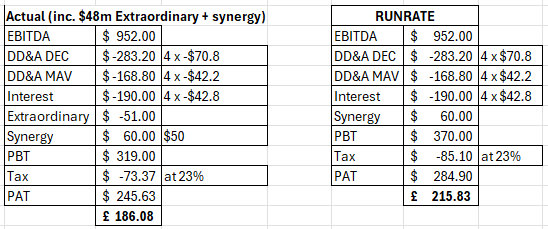

Factoring in the above numbers to the above pro forma EBITDA and including $60m synergy and known extraordinary costs of -$51m you arrive at a £186m 12 months outcome, or £215m on an ongoing basis…. close to my £220m forecast.

Valued at > ~4X prospective earnings with a positive backdrop of demand and supply there remains lots to like at this OB 2024 idea.

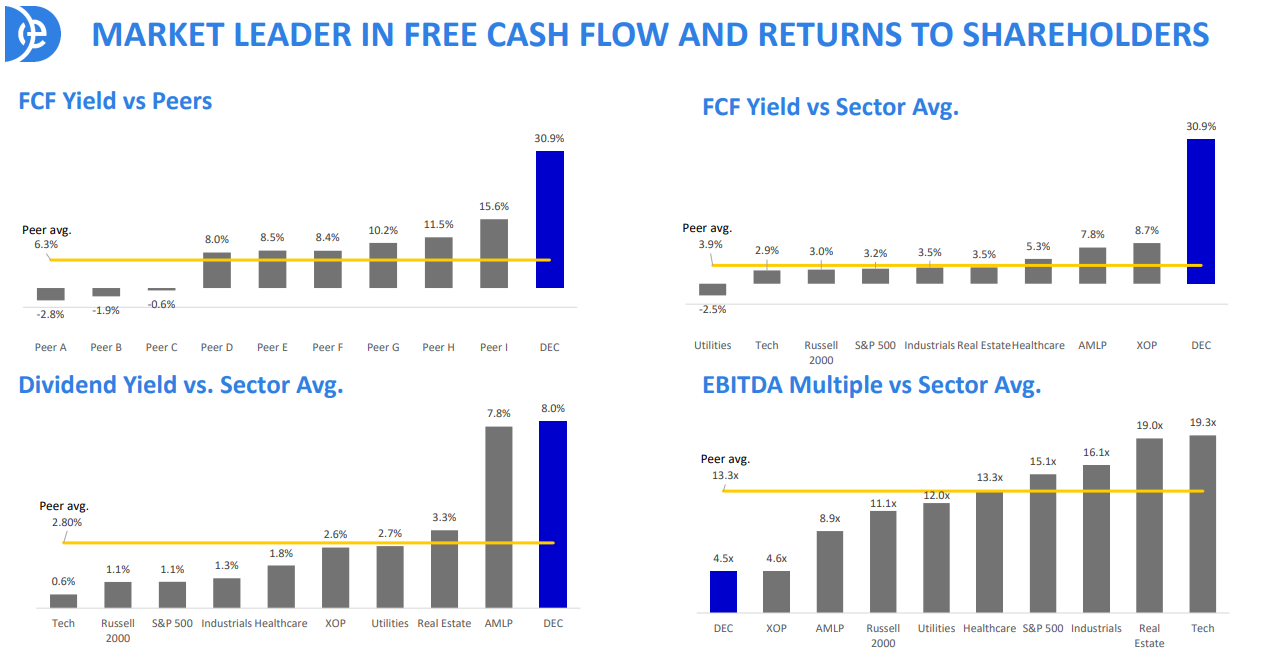

When you consider DEC vs other “contracted assets” then you do a HUH. 4X cheaper than real estate, nearly 3X cheaper than utilities. DEC’s ability to generate FCF is remarkable but it is not priced remarkably.

I’m not surprised it has increased in price this morning in response to the results.

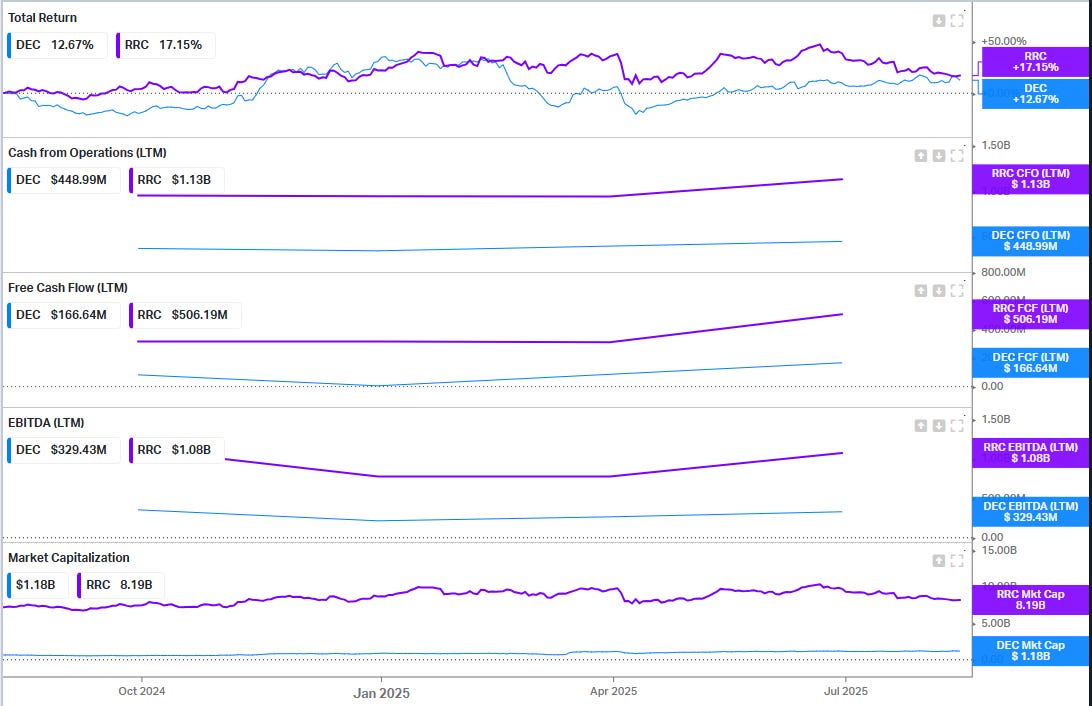

Consider that DEC is generating around just under half of the cash from ops and around a third of the EBITDA and FCF of Range Resources, a comparative US-listed company. Yet trades at about 1/8th of RRC!

DEC is an idea from the OB 2024 ideas which has delivered a 5% capital return and £2.20 of dividends (20% dividend return). I’m vey happy with 25% in 20 months. Overall the OB24 ideas have delivered 12.6% in 20 months, even after some that went south, DEC is one heading north, in my view.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

After two years of hard slog and a wall of criticism Rusty's strategy is showing the first signs of fruit. Congratulations Oak for staying the course and your confidence and patience. At some point the penny will drop with investors that new drilling at these O&G prices is uneconomical and that tier 1 targets are exhausted. Great times ahead for DEC which has set up shop for these times. More importantly they now have scale...very hard (impossible?)for other trad O&G companies to replicate....

Thanks OB - this has done 40% since the start of year. I was lucky and hit a low. As always didn't go big enough with only 3% Of portfolio.

Prognosis looks good and the gas powered data centre story seems strong.

Did you see BP have reopened a closed North sea field due to improved recovery technology.

Tech improvements could be a boon to Serica and Harbour.

I'm reading Economics in One Lesson which would recommend. The lessons about technology, productivity, allocation of labour / capital and government intervention is as apt today as 50 years ago. Some important lessons to be learnt for investors (and politicians).