Dear reader,

We were told yesterday of a £53m disposal at VLG. I was delighted. The market cap today post news is £63m. Pre news it was £49m.

When is a £24.1m gain - in cash mind you - only worth £14m? When the market disbelieves the value, and/or people quickly sell off short term gains leaving the share at a £63m market cap - £14m up on its market cap prior to the news.

But I also have to eat humble pie. I thought the CDMO could never fetch any decent money. How wrong was I! It fetched nearly double the broker’s estimate, and £53m more than what I thought it could :)

This is what I wrote previously:

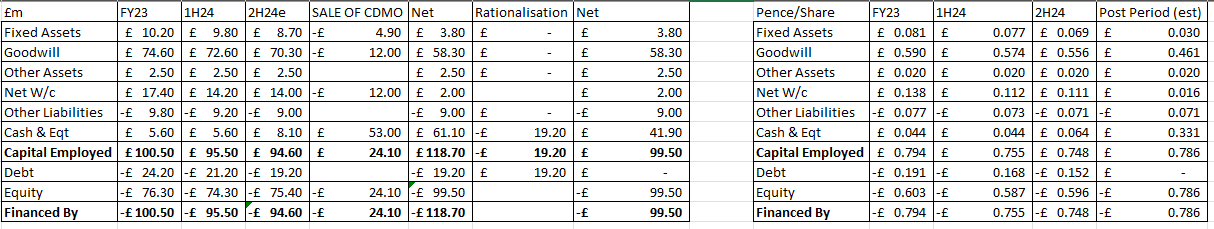

After that humble pie was consumed, I was confused. Or someone was. A broker note appeared almost immediately following yesterday’s RNS. We learn that shareholders equity will rise by a mere £2.7m in 2025 as a result of this sale. Oh dear. This was the balance sheet they presented.

I read the RNS again. A gain of £24.1m. Perhaps the broker believes VLG will lose lots of money in 2025 a loss of -£21.4m in 2025 would offset yesterday’s £24.1m gain, or perhaps there’s a typo.

Shareholder’s equity increases by £24.1m through an extraordinary gain.

The broker wasn’t the only one who was confused. Fellow fun runner Mr Head looked at VLG and gave it an amber claiming “near-term earnings could fall by a third”. If you exclude those £24.1m extraordinary gains, they could, I suppose. Of course Mr Head says he is following that same broker note for guidance.

This is what I believe the balance sheet actually looks like. We don’t yet know the FY24 results only the 1H24 results hence the “??” in the 2H24 column but the news is a £24.1m gain. The notes to the accounts tell us Fixed Assets relating to Biokosmes total £4.9m, we also know that raw materials are around £6m and the Customer Brands debtors are around £6m so w/c nets to around £2m. The balance must then be Goodwill of £12m.

In pence per share today’s news “should” have driven a 19p increase to the share price. It nearly did (and I’ll admit to a cheeky top slice) but then it fell back yesterday, I decided to swoop picking up more than I started with at 49p, reasoning that I was getting 10p per share ADDITIONAL to the news, and that I am buying at 35.7% DISCOUNT TO NAV (50p vs 77.8p NAV) and where 66% of that 50p is cash.

Let me show you how.

This is the balance sheet on a Pence Per Share basis.

Remaining Debtors are those for VLG brands and Stock is only finished goods and VLG’s main creditor going forwards (Biokosmes) where we know there is contractual agreements on terms and pricing until 31st December 2026 are existing transfer prices (i.e prices are “locked in”).

VLG tell us they plan to pay off debt (the RCF) but to keep the facility in place (for optionality on future acquisitions). So the balance sheet moves to something like this.

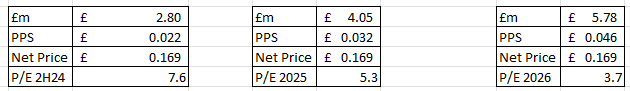

Now if I plug in my 2H24e estimates then I get to a net 33.1p per share of cash on a business you can buy for 50p. A net price of 16.9p.

So the business you get for 16.9p net is forecast to generate £66.28m revenue in 2025, although £10.8m of that revenue transfers to Biokosmes, I’m assuming as at 1st July, so an underlying revenue for 2024 of £45m at a 45% gross margin so a £20.2m gross profit. OpEx of -£12m and Amortisation of -£4.5m gets you to £3.7m PBT and £2.8m PAT, that’s 2.2p a share so a P/E of 7.6X (estimated).

That’s looking backwards. What if we look forwards? Double-digit growth and a focus on growth combined with cash to invest into marketing and into new market entry should speed up double-digit growth further still.

These are my growth estimates for 2025, more or less extrapolating existing growth patterns seen in 2024 and based on known newsflow.

The forecast translates to a £4.05m net trading profit (plus a £24.1m exceptional gain) = £28.15m.

That result is certainly not down by a third as others believe!!!

Where a run rate profit based on the 2H25 numbers of around £7.7m annualised (and growing) per year from 2026 appears eminently achievable…. assuming zero further growth from 2H25 mind you :)

If you’re happy with that then you’re buying a business able to generate an adj. P/E of 3.7X.

Oh Hoh it’s 50p not 16.9p

Look you have to be happy with the idea that about £41.9m cash on a £63m market cap is 66% of the value of the share, and I’m stripping out that amount to value the company. What’s known as the “EV value” (Enterprise Value). If that £41.9m cash sits earning interest then it earns 5% a year in money markets and generates £2.1m profit (on top).

If the company decides to return that cash to shareholders then we do get to 3.7X. They don’t plan to.

The intention is that VLG uses that cash and acquires further brands and invests into growing the existing ones. Its track record of doing that is good. The only acquisition that hasn’t lived up to expectations (in my opinion) is Dentyl. That has been because it has faced global giant competitors and China’s extended lockdown messed it up too. Sales went from 33% growth to -100% contraction. Mouthwash at a category can be too generic and lacks a clear USP (even if I’m a big fan of Dentyl in my personal life and it uses Oil Pulling - least I think it does to remove plaque).

Going into niche products like ear wax, hormones, mouth gel for chemotherapy sufferers and feminine products seems a smarter move - and has paid off handsomely. The theme of self-care and the fact that the NHS has been cutting back on various aspects of “Universal Care” - ear wax being a good example. Doctors and Hospitals will tell you to go away and seek private care. VLG can help with both olive and almond oil.

Another growth strategy which was disasterous was growing China, at least disasterous after 2020 (until then highly successful). The various third parties tasked with reviving that growth in 2021-2023 failed. China’s extended lock down is partly to blame but also Trump’s lib day reflects the reality that countries like China have pursued aggressive beggar-thy-neighbour strategies and made it hard for exporters into China succeed. VLG’s decision in 2025 to focus on UK/EU/US makes sense - plenty to go after.

The Covid 2020 hand gel episode was a time of super-normal profit for VLG except the world and his wife got into the action back in 2020 (it’s not hard to produce hand gel) and VLG didn’t pivot away quickly enough (alongside many others) and famine quickly pivoted to surplus and created losses on redundant stock.

In other words poring over past results will not provide you with the forward prospects for VLG, in my opinion. The above may sound like excuses but it’s a detailed rationale of a journey. Out the other end of that journey is a hungry big cat, ready to grow profits.

In other words if you believe and agree that VLG can repeat its more recent multiple successes and identify other medical-type products and grow those and profitably put its £41.9m cash warchest to work then the P/E valuation of 3.7X stands too. See my analysis later on that strongly backs up their track record to do so.

If you instead think, cobblers, Oak Bloke then move the dial to a forward P/E of 11X and compared to most peers like Alliance Pharma then VLG is nearly fairly valued or has around 10p-15p upside, and that’s on the basis the £41.9m cash pile gets squandered to zero gain.

There are significant differences to comparing with Alliance Boots. AB had lots of debt and no cash pile so it’s not a fair comparison really. At least not on an EV basis. I’d further point out that Alliance in the 3 years prior to sale achieved virtually no net sales growth. If you consider the VLG brands then in 2019 they delivered £13.5m revenue and in 2024 £34m. That’s 250% growth (in 5 years). Of course some of that is M&A and some is organic, so let’s split those apart.

Can it grow brands as well as profitably acquire them?

Final thoughts

Mr Head concludes “the success of this deal (for shareholders) will depend on whether Venture Life can now transform itself into a more profitable business.”

I agree.

He adds “Can this leopard really change its spots?”

I don’t want it to. Why?

It just needs to keep doing what it’s already doing. The 45% sales growth in 2H24 vs 1H24 in my prior article “Full Year Review” is TREMENDOUS!

That growth was on products with a 48% average gross margin while the decline in 2H24 was stuff with a ~30% average gross margin - now offloaded in the sale.

If we profile the remaining VLG Brands part of the business the four year track record of organic growth is solid too, and the 2025 outlook is attractive. Especially as it also now has a warchest of cash to deploy.

Just look at its acquisitions (each row shows the year of acquisition) and then subsequent columns shows the organic growth track record.

Do I see a leapord? Well I reckon I’ve spotted a fast cat that’s for sure.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

It says Euro not Pounds though Right?