Dear reader,

Famously, in the film Snatch, Tommy questioned “want to see if I’ve got the minerals?”. Tommy might have been describing KDNC which has not been an amusement for its shareholders, who mostly feel the arcade has been smashed to bits, and the overlooked value screams in a void. (and avoid, is what the market does)

But Tommy does indeed have the minerals. In Brazil at Amapa. Mineral Resources of 276 million tonnes (Mt) at 38.33% Iron (Fe) and Ore Reserves of 196 Mt at 39.34% Fe.

The optimisation increases the production rate of 5.5 million tonnes a year, after ramp up (Vs 5.28m previously). Over 80% is high-purity iron ore too - so worth $23.80/tonne more according to KDNC but Wood Mackenzie tell us the future is very bright for high grade Fe and see further 20% price rises too.

This is a picture of the Amapa mine. This isn’t pristine jungle. I see a plant. A railway line. It’s all already there, but needs renovation. A do-er upper.

History of the Amapa Iron Ore Project

What you are looking at is an open-pit iron ore mine, a processing and beneficiation plant, a railway line, and 100Km away, there’s an export port terminal (to the Atlantic). DEV and its subsidiaries own the Amapá Project. DEV is owned by PBA, a joint venture between Cadence Minerals Plc (“Cadence”) and Indo Sino Trade Pte Ltd (“Indo Sino”).

The Project ceased operations in 2014 after the port facility suffered a geotechnical failure, which limited the export of iron ore. Before the cessation of operations, the Project generated an annual profit of US$120 million in 2011 when Iron was $170/tonne. US$54 million in 2012 at $128/tonne. Production steadily increased, producing 4.8 Mt and 6.1 Mt of iron ore concentrate products in 2011 and 2012, respectively.

Today it’s $111/tonne and arguably at a low due to negative sentiment about China. Yet global demand for steel is rising by about 2% a year despite that.

DEV continued to operate the Project and rehabilitate the port up until 2014. However, due to the restricted iron ore exports, and cash flow constraints, in August 2015, DEV filed for judicial protection in Brazil, and operations at the Project ceased.

In 2019 Cadence and Indo Sino, alongside DEV, submitted a judicial restructuring plan (“JRP”) for approval by the unsecured creditors. As part of the JRP, DEV sought to redevelop the Amapá Project. This strategy includes a plan to resume operations after plant revitalisation and modifications, aimed at improving product quality and increasing recovery, along with recovery of the port, railway, and support areas.

Details of the Agreement with Indo Sino

As at 30/09/23 Cadence owned 30% of the Amapa Project, with Indo Sino, the remaining 70%. Cadence has a first right of refusal to increase its stake to 49%. Meanwhile as KDNC spend money on Amapa this increases its stake - last reported was 32.6% and further spends I’ve estimated brings it to 33.6% ownership.

What happened this week?

An optimisation study was released this week that identified 33% (US$63.2 million) of capital savings associated with the beneficiation plant at the Amapá Project.

· The Study has resulted in a forecast increase in production of approximately 4.8% to 5.5 Mtpa of iron ore concentrate, of which 4.51Mt will be a 65% product ($10/tonne more) (also an increase from January from 4.36Mt) and 0.99 Mtpa a 62% product. This puts Amapa on a par with world class BHP/Rio Tinto mines which are at 63% average grade (and receive an AISC margin 2.5x that of say Fortescue as a result).

· A redesign of the mine plan is also planned which will reduce mining costs.

· The (already released) PFS will be revised for its capex and mine plan

· Amapa will be developed as a 67% "Green Iron" Fe product flow sheet at a production rate of 5.5 Mtpa. (Remember 20% price rises, and a sweet spot)

· The capital requirement for the entire Project is now in the bottom quartile of comparables at US$58 per tonne of annual capacity.

(The RNS says per million tonnes, but that makes no sense as the Capex would be just $319!) I believe, reader, the RNS is also telling us the Capex is now $319m (i.e. $58 x 5.5mt). In January the Capex in the PFS was $399m.

Just to put this in context, a high profile current example is Rio Tinto Simandou mine which is costing Rio $6.2bn and delivering a share to Rio of 27Mt annually. So that’s $229.6 per tonne of capacity - 4x as expensive!!

Re-iterating the PFS

The optimisation study doesn’t give us a(n upwardly) revised NPV but in January we saw in the PFS (full detail here):

Post-tax Net Present Value (“NPV”) of US$949 million (“M”) at a discount rate of 10%, with profit after tax of US$2.96 billion (“B”) over Life of Mine (“LOM”) gross revenues of US$9.39b over LOM.

It’s my view that the reduced capex, and the increases of the higher purity Amapa product which is worth over $23.80/tonne more makes the NPV calculation too low. I believe the NPV of $949m moves up towards $1.2bn. Based on the increased (estimated) 35% holding this equates to a £77m uplift from the prior £253 NPV valuation to £330m.

Post-tax Internal Rate of Return of 34%, with an average annual LOM EBITDA of US$235 M per annum.

It’s my view the 34% IRR revises up for the above reasons too.

Free on Board (“FOB”) C1 Cash Costs of US$35.53/dmt at the port of Santana. Cost and Freight (“CFR”) C1 Cash Costs US$64.23/dmt in China.

Comparing to the AISC margin graph above, these costs get you to world class

After applying tax rebates, a pre-production capital cost estimate of US$399 M, including the improvement and rehabilitation of the processing facility and the restoration of the railway and the wholly owned port export facility, cost estimations have a PFS level of accuracy at +/- 25%.

The optimisation study has shown a minus of 20%. There are more studies to complete too!

Further optimisation studies for the 1/ processing plant availability and 2/ efficiency and 3/ the port loading and 4/ developing the adjacent exploration targets* to increase the mine life, after which work on the Definitive Feasibility Study and after the Final Investment Decision can begin.

The adjacent Tucano Mine has just begun gold mining - a deal could be done to process tailings which are probably Fe rich. Nearby "Great Panther" areas could contain further orebodies similar to Amapa. A doubling of ore is not impossible. Another 195Mt would more than double the NPV.

Key assumptions: Long-term average price for 62% iron ore concentrate of US$95/dmt and US$23.8/dmt premium for 65.4% iron ore concentrate, both quoted on a Cost and Freight (“CFR”) basis.

$95 is well below today’s $111 trading economics spot price. The NPV calculation on this basis is fairly conservative. $23.8 for premium is in keeping with my own analysis.

What else do I need to know about KDNC?

I recently wrote about KDNC is bringing Cadence to Cadence so there’s other content there I don’t want to repeat here.

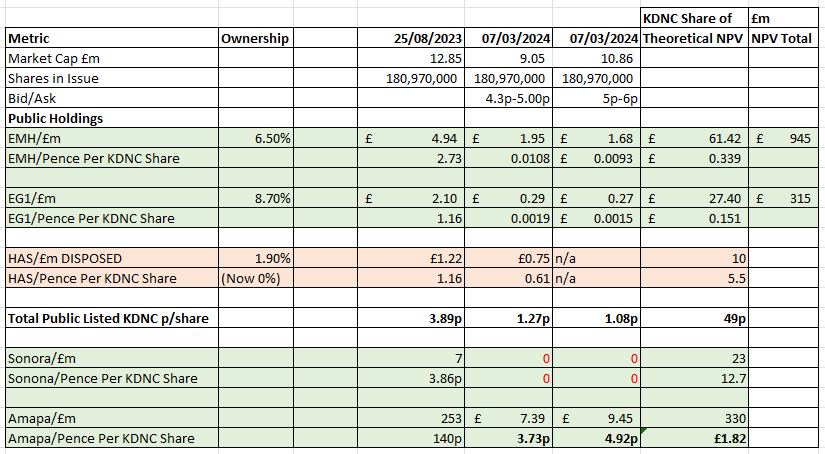

Valuation

This week’s news of a £77m upside has led to a £2m increase in Amapa’s residual valuation although I suspect much of that £2m is market makers manoevring the price of KDNC up from 5p to 6p rather than any kind of demand-based uplift.

At 6p the discount stripping out EMH and EG1 (publicly listed shares), leaves an estimated 97.1% discount to NAV, or a 97.8% discount at 5p.

In other words Tommy could get very lucky here. On paper he has a diamond at Amapa. In fact, EMH, EG1, Sonora at their NPV’s are each worth much more than KDNC’s market cap too - on paper. Four diamonds and one monster diamond.

The question is can KDNC pull out the diamonds, connect with a Doug the Head and get an Avi? All before “zee” Germans get there, presumably.

To this I believe the answer is yes. TCIDR is Doug the Head. RNS 30/10/23

Time will tell. It was an annoying ticking noise that unlocked massive value in the film; the same ticking noise should yield a result for (very) patient KDNC investors too.

This is not advice

Oak

The latest DFS proves again that you were correct that the NPV was too low! Mr Market still does not "get it"...