Don't clown with Crypto Treasury Management

The danger of the Saylor playbook - for investors

Dear reader

I see a new meme stock craze has landed.

Bitcoin Treasury Management. Give me strength.

So it involves first reading up on the Michael Saylor playbook, probably.

Bitcoin Treasury sounds grand and involves using big impressive words like “Capital Management Strategy”, “Vision” and perhaps even a mention or two of Michael Saylor of Strategy which I covered in a deep dive last October in my article “RBTX and Rockstars”.

The wheeze involves taking an unproven business, a modest business or perhaps even an unsuccessful business and building a panache around it. Get some social media presence where you appeal to people’s greed, FOMO, and speak about 100X returns and the Ferrari that you will not be able to buy if you miss out.

Sell some Merch and employ some folks to be your social media cheerleaders. Heck get an army of bots. Get the world talking about it.

Whip up a frenzy of excitement so you can point to the inadequacies of “real” business, you know like the Mag 7, and even show the fact that you’ve outpaced the very asset you keep borrowing to buy. The story becomes the logic. Critical thought is dismissed as de-ramping or as a lack of vision.

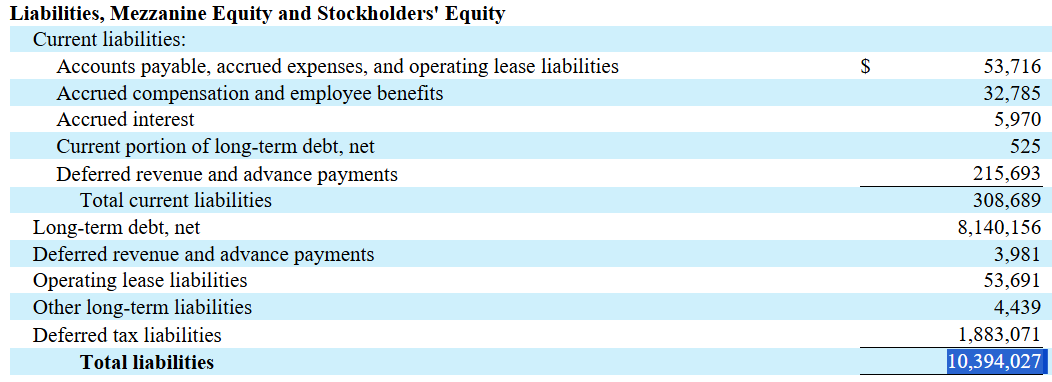

Meanwhile if you are a MSTR investor 99.15% of your total assets are Bitcoin. So you have no real business assets except BTC.

The Liabilities meanwhile are real. There are no bitcoin loans. Just USD convertible debt.

Aggressively raise equity, under the guise of opportunity. Maybe theme that token business to be on trend: A.I. is a good one. Give it an interesting brand name. Declining revenue? Rising Cost of Sale in 1Q25 vs 1Q24? It doesn’t matter. It doesn’t for MSTR.

Is a $5.9bn loss on digital assets in a single quarter a shock? Nah. Details. Bitcoin can only go up. “There will never again be a crypto winter” declared Saylor recently.

Consider too, that MSTR is doubling down on its bet. Last June when I last looked at MSTR it held BTC at $25.1k. Today the average buy price of those BTC is $68.55k each.

At today’s $105k per Bitcoin (and assuming selling 2.5% of the world’s BTC wouldn’t drop the price at all) there’s about $15bn of “hidden value” on the balance sheet, and net of liabilities those coins would sell for $48.5bn. On 256m shares that’s $189 per share.

So you’d get a bit over half your money back. Plus you’d have paid for a software business that generates $56m income. That’s $0.22 per share per year.

So that’s a net $188 per share cost for an annual income of $0.22. That’s a P/E of 854X…. assuming those declines we talked of don’t continue.

Of course if Bitcoin doubles to $210k then your $377 is worth $415 plus that $0.22 per year.

IF.

That’s a 10% upside. Great.

If it goes to a million then clearly the upside is greater - assuming MSTR don’t keep buying so the cost of sale has risen to let’s say $500k so your gain is less and think too on the dilution between now and then. To give a sense of dilution in 9 months shares have risen from 200m → 256m so about 20% dilution.

I covered Bitcoin last year in “Bitcoin Asset or Liability?”. You owe it to yourself to at least consider the counter view.

Meanwhile MSTR the pinup poster child of these Treasury Management Meme Stocks and is itself running a not very successful business that is also gambling on an asset going up. So what chance do you have with a UK start up, which is a much smaller version that has probably bought bitcoin at or around $105k fairly recently?

The parallels to the 1990s when people invested in dot com businesses determined to invest in getting as many clicks and web site hits and achieving “Internet Dominance” through their brand is terrifying. Truly terrifying. Clowns are cuddly and don’t jump out of drains by comparison.

It is noticeable that a flurry of UK companies are jumping on this band wagon and mark my words it will likely end in tears. Not for the companies - for the investors. There are some vested interests at play too. At the very least, as a strategy only invest in a company that has a credible plan to generate cash as a real business - and that have simple things like a track record. If they are buying and holding crypto currency remember the funds used to do that are being diverting from the real business of investment, generating profits and generating future cash flows.

Above all beware of words a prospective investment use that involve “missing out”. It doesn’t matter to miss out on something worth missing.

Regards

The Oak Bloke

Disclaimers:

This is not advice. Make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I wish every investor in the world could read this salutary assessment. Well done OAK. Your sole motive seems to be looking after your readers.

In the garden of Eden the fruit was very enticing, genuinely appealing. We've been discarding logic and common sense ever since. We're persuaded to make impulsive decisions, our senses are appealed to, our greed cultivated, our reasoning anaesthetised. In the last twenty years the internet has hightened this danger, playing into the hands of devious crooks wearing smart city clothes with bleached teeth and artificial smiles. We take the bate, a few clicks and lives are never the same. A future of regret. Of changed circumstances. Of embarresment. But it's all too late.

Jesus said 'What good is it if you gain the whole world and loose your soul'.

When BTC reaches 200k Sailor will dilute the shareholder to hell again. There is no winning, lol.