Dear reader,

Back on the 3rd May and at a sell/buy price of 130p/135p I was pretty negative about AAZ. One reader spoke unequivocably:

You have this completely wrong.

They continued:

The last AGM was all about Demirli, a 20kTpa copper mine with $200m of plant in situ that AAZ has been given. For zero cost. It is likely to come into operation very soon, but the company is unlikely to announce anything until it is in production. It will have production costs of around $2k/t according to the last AGM. As for Gilar...average grade from the gold there is 1.6 g/T. Last quarter the company made a profit producing from the dregs at Gedabek at 0.2g/T. AAZ don't do investor relations. The board own over 40% of the shares. But there is a very clear path to Gilar being in full production, likely this month, and Demirli very soon after. But unless you went to the last AGM, you won't know about Demirli

Well I didn’t go to the AGM that’s for sure, but it’s good to get feedback from a reader who did. 19 days later the 2024 Annual Results were released. I’m never afraid to admit to a mistake. But nor am I afraid to quote John Maynard Keynes. Which one of those applies here?

My past AAZ articles were “Worth the AAZ-ard” and “Copper! Part Two”.

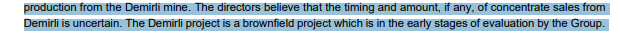

I will start with considering did I overlook and miss Dermirli. Let’s start with the 1H24 Interim Report. Did I simply miss vital clues?:

Sep 2024: Demirli had $0.1m unrecovered cost, and zero the period before.

Sep 24: “Demirli project is a brownfield project which is in the early stage of evaluation”

Oct 24: “We have obtained restricted access”…. “studies are underway”.

Nov 24 update “we are analysing… we will provide an update”

Jan 16th “investigations are underway”

Apr. 14th 1Q25 update. A single reference that says “encouraging progress”

So based on the facts presented by AAZ there seems no way to predetermine Demirli’s imminent future. Not unless you attended the AGM. Lucky people. But at what point does such a selective sharing of info become insider info?

Of course AAZ’s guidance was zero from Demirli in their 2025 forecast.

But the facts have since changed.

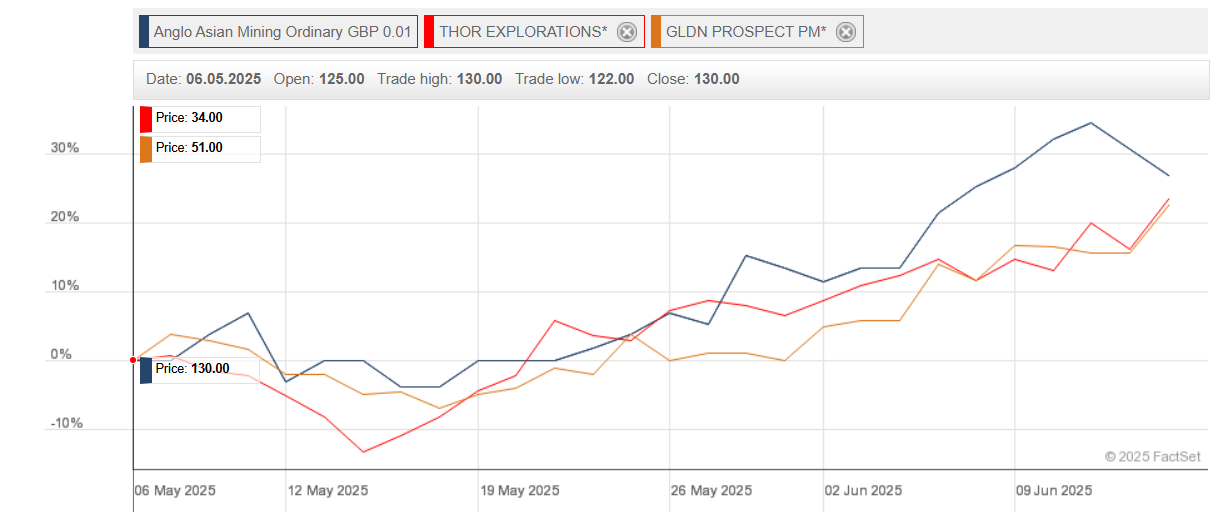

Let’s consider the 2024 Annual Report and the forward picture. It’s also true the share price has risen 25p to 155p/165p. So at a £194m market cap is it worth another look? Well to those who might say the OB “missed out”, well no not really, other ideas I felt positive about at the same time are up just as much as AAZ. GPM and THX are up by about 25%. Given that GPM and THX are gold while AAZ is part-copper with predominant future growth in copper production that’s a remarkable rise vs 100% gold miners.

So AAZ 2025 guidance was 47.5k - 53.4k GEO until the 22nd May.

In the full year report on 22nd May AAZ move targets upwards to 80koz - 85koz GEO for 2025, based on Demirli.

Review of 2024 Accounts

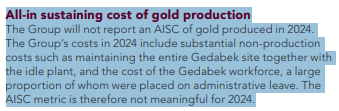

AAZ tell us the AISC was not meaningful. Oh I can assure you it is.

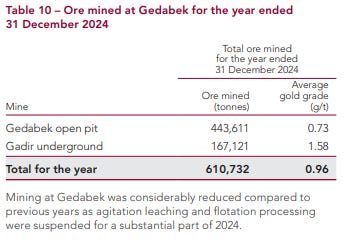

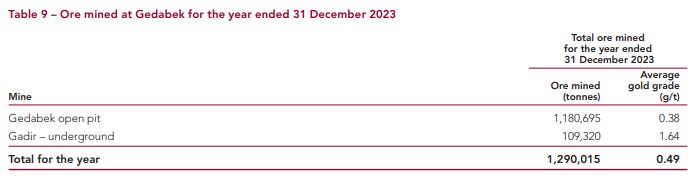

I see excuses are given that production was offline. But compared to 2023 Ore Mined was half and grade was about double - so the outcome “should” be approximately the same as 2023, shouldn’t it?

Something like $1,510 right?

15,200 GEO compared to $49.6m+$6.6m+$1.7m 2024 operating costs as below is an AISC of $3,809. That is a terrifying number. It gets worse. Those costs don’t include the cost of giving a cut to the Azerbaijan government either.

-$3,809 per ounce equivalent are solely operating costs, not sustaining capex. Note 15 of the accounts tell us those costs in 2024 were minimal (and unspecified).

1Q 2025

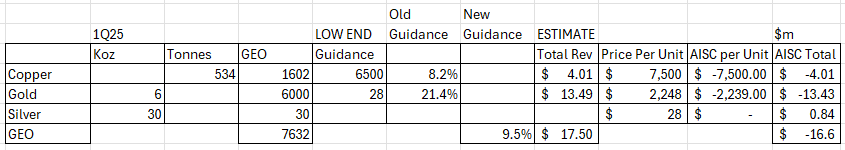

Their 1Q25 results preceded the 2024 annual report but gave me further reason to shrug: One quarter through the year and only 8.2% of their old guidance on Copper has been achieved. They said there was no guidance for silver because it’s immaterial. But 30Koz of Silver per quarter would be $4m a year so nearly 10% of last year’s revenue.

Under the new target of GEO (Gold Equivalent Ounces) they achieved 6,208 of 80,000. That’s 7.8% of targeted production.

We know AAZ made $17.5m revenue in 1Q25 and incurred -$16.6m Opex and (Sustaining?) Capex. So made a $0.9m cash operating profit. I play “Mastermind” to work out price per unit of gold, copper and silver and am shocked. Copper is sold for the equivalent of $7,500/tonne, Gold just $2,110/ounce and Silver $28/ounce. The mix of revenue might be slightly different but this mix agrees back to the $17.5m revenue.

Why is the revenue per unit so low?

The answer is a series of royalties and kickbacks to the government. On top of this in 2022 $7.5m PBT was taxed at >50% to net at $3.66m

DRAWING A LINE

Ok here we are on 14th June how does this transform? Can it?

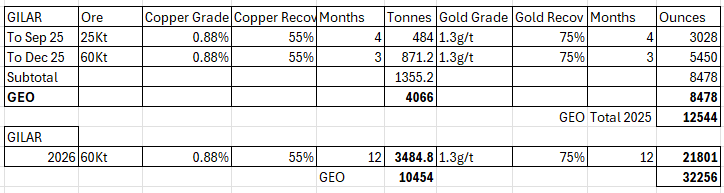

More news two weeks after my article on the 19th May is that Gilar has commenced production. Being optimistic and assuming a 4 months “steady ramp up” let’s add the numbers.

Based on the grades and I’m adding some recovery levels then we get to 8,930 GEO in 2025. That’s impressive!

My Gilar Estimates:

So Gilar add 12.5K GEO and Gedabek could deliver 30K GEO gets you to 42.5K. That’s not that far off lower end guidance to be fair.

Broker Guess

Let’s not let the Feb 2025 Broker Report off the hook. Reading the chattersphere many people were quoting those numbers. They claim (guess) an AISC of -$1,332 is possible for 2025 and that AAZ will produce 6.7Kt of Copper. So I estimate Gilar could produce 1.3Kt, Gedabek perhaps 1Kt. So 4.4Kt must be produced by Demirli in 2025 to reach that guess. An AISC of -$1,332 in GEO equates to -$4,000 operating cost for Copper of course. With both Demirli and Gilar being at a ramp up stage it is fanciful in extreme to think they are going to be operating optimally in 2025. I remain deeply, deeply sceptical that that level of cost can be achieved in 2025. Where the first quarter is an AISC (estimated) of -$3,809.

If you weigh 1Q25 by the fact it is 9.5% of the target the remaining average is $1,268 AISC where the 2Q25 results are going to almost certainly be nowhere near to that number.

2026 Outlook

Looking ahead to 2026 Gilar production at 60Kt ore/month would be 32.2Kt GEO in a full year. That’s based on 0.88% copper in Ore at a 55% recovery rate and 60Kt of Ore mined and processed. That’s 3.5Kt of Copper.

But AAZ in the below chart in the 2024 results tell us the forecast production number for Gillar - just for copper - and not expressed in GEO mind you - is 10,000 per year. That’s 7X more than the 1,355 for 2025 I estimated. And 3X more than my 2026 estimat. How will they achieve that?

What’s more the 2025 and 2026 copper production for Gilar will be equal they say. Despite not starting until May 2025 and there being a “Steady Ramp up”.

So yet again their own numbers are contradictory and make no sense whatsoever. If you are an investor in this doesn’t this make you not feel uneasy? Sorry to be calling your baby ugly and all that.

Let’s carry on. Let’s overlook the contradiction and hope for the best.

The above pictorial chart equates to the below GEO for Copper (and Tonnes).

So we get no Gold Production chart, nor any clarification whether they intend to offset gold (and other byproducts as an offset).

We get told there’s a switch in reporting in the FY24 accounts that GEO will no longer be used.

We also know that guidance has been raised to 80,000 due to Demirli. That’s a 31,000 target production at Demirli for FY2025, and about 80,000 for FY2026.

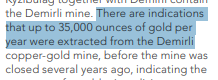

This little comment suggests that half that number could come from gold credits.

Yet the JORC for Demirli has no gold. So is their production guidance based on the JORC or based on and including “the indications of 35 Koz”. There is a colossal difference to the prospects, don’t you think?

We know that the plant is 6.5m capacity. Let’s be generous and assume the same 4 months ramp up and then full 6.5m production. It’s now mid June and there’s no news but let’s say August 2024 commence operations at 1Mt rate (83Kt/month) reaching 3Mt by 1st Oct (250Kt/month). Then the full 6.5Mt rate by Jan 1st 2026.

So on those terms which I don’t think are unfair, and in fact think generous you get 7.3K GEOs. Then 2026 is 44K GEOS.

7.3k vs 31k target for FY2025, and 44k vs 80k for FY2026 is WELL SHORT of guidance.

So what have I missed about Demirli? Will the recovery be much higher? Will the grade be much better? Will they be able to produce at 6.5 million tonne rate on the 16th June when markets reopen? If so they could theoretically produce the circa 6Kt of Copper they say they can at Demirli in 2025.

From 2026 the only way I can see they get to their own guidance is via the GOLD at Demirli. Guidance of growth of 80,000 GEOs fits nicely if you include Gold from Demirli, but seems impossible otherwise.

So then you are beholden to a resource based on “indications” of “up to”.

Taking the production forecasts completely at face value and along the lines described in the article and based on what AAZ tell shareholders are their forecasts then you can map out a world where AAZ is well worth its current valuation of £195m.

*IF* it can get there.

Even if it has a dramatically large AISC at current gold and copper prices it wouldn’t matter because a 6X P/E valuation would rely upon an AISC of $2500 or less, which should be achievable - although perhaps not in 2025.

The above doesn’t factor in development capital (which presumably would be needed to develop XarXar and Garadag) and “AISC” would need to cover every cost up to “comprehensive income” Net Profit includes taxes, shares, royalties, share-based compensation, rehabilitation costs …. everything.

It doesn’t factor in shareholder returns either, nor does it factor in repayment of debt (Liabilities were -$79.2m in 2024 accounts)

Conclusion

I don’t find as some have suggested that I’ve been “wrong” about AAZ. The guidance remains full of holes and contradictions, and hopes and perhaps dreams.

The 2024 results hide a dreadful AISC number that is supposed to transform to a much lower one.

Perhaps it shall. In fact let me say … it could.

There are certainly some positives compared to my last look. Certainly the addition of Demirli, and particularly if it can produce 35Koz of gold alongside 15Kt of Copper per annum that could be transformative. It certainly explains the production growth “out of thin air” which bothered me before.

I previously concluded I would wait on the sidelines at this one and I remain of that view. On the basis of a P/E of 6X and the fact the government take 51% of profits then you need £66m profit less the government share to justify today’s valuation.

If it can get to 100K GEOs by 2028 at a $2000 per unit margin (so Copper at say $10k and cost of production -$4k or Gold $3500 with an AISC of -$1,500) then the valuation would be higher than today’s £195m. About 120% higher at a TP of £3.60.

But I conclude I’m not gambling on that possible future when there are more certain options out there, and where - at least for now - I am reliant on wobbly and contradictory forecasts.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

OB i'd put this in the Buffett "too hard pile!"

I recently came across the letters from Nick Sleep's nomad fund and found them fascinating.

https://igyfoundation.org.uk/wp-content/uploads/2021/03/Full_Collection_Nomad_Letters_.pdf

His analysis especially on Costco is next level - pages 46-53.

Maybe some weekend reading!