#4 GRG-ling shorts; sells become boughts

The T/U appears to validate the thesis

Dear reader,

OB pick for 26 Greggs Plc gave a t/u today.

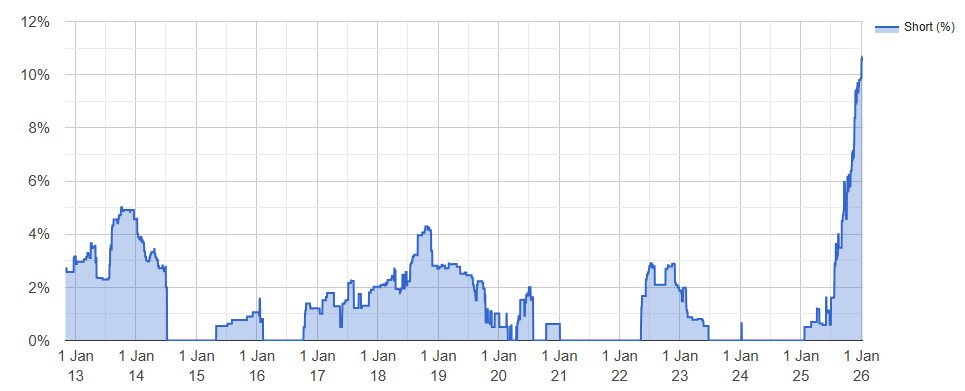

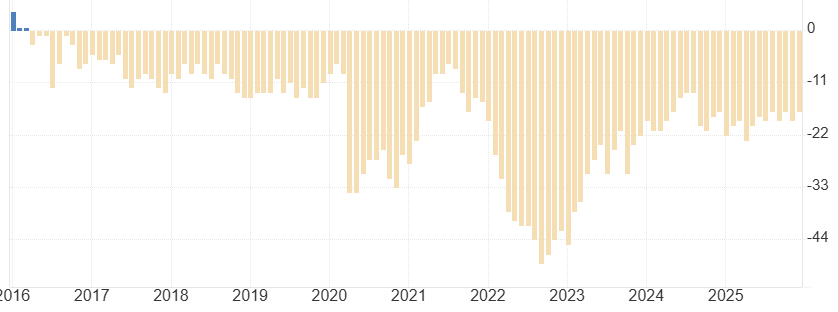

Disclosable shorts (i.e. not total shorts) shot up to reach over 10.5% of shares so that is £185m of GRG stock that has been borrowed and now has to be later bought back by the SS (sad shorters). What a marvellous position for long holders of GRG. At least £185m of future buys of GRG stock on top of any you or other investors make.

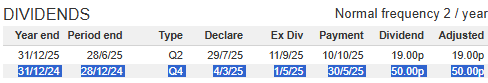

If £185m of shares aren’t bought (i.e. the short closed) in the next 4 months then the next dividend (if it’s 50p like last year) will cost over 3% to remain shorting beyond the usual 0.8% cost per month to short a stock or 10% a year. So in 4 months GRG must fall by -6.5% for shorts to profit at all.

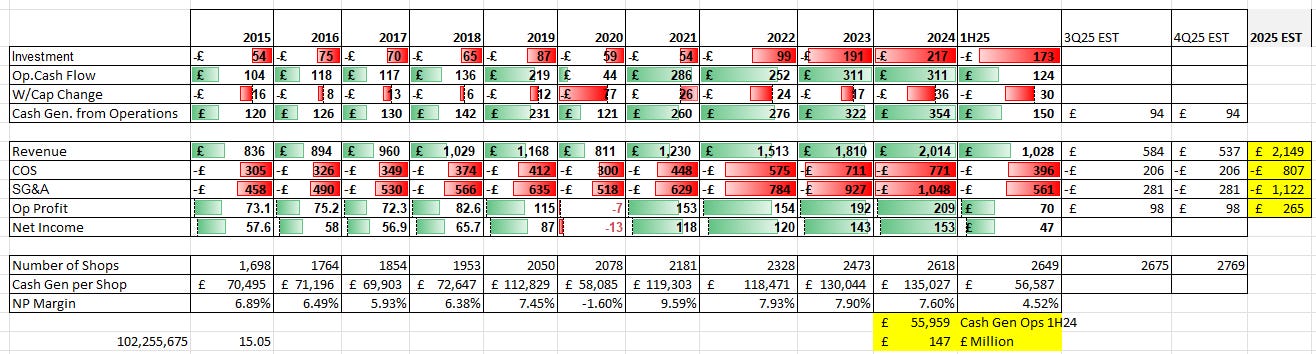

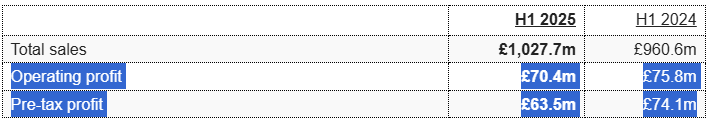

Revenue for 2025 was £2m higher than my own estimate for 2025 given in my prior article “Garrulous Views”. My estimate was based upon the 6.7% revenue growth reported in the 3Q25 results. COS I similarly forecasted to grow by that same 6.7% vs the COS margin in 1H25.

SG&A (Overheads) I took to be static vs 1H25. That was forecast to deliver an operating profit 20% ahead of 2024 and well ahead of previous years.

Static overheads. I didn’t factor in the £13m of efficiencies GRG disclosed this morning.

So has GRG delivered the below elevated operating profit of £265m in 2025? We don’t yet know. That op profit would be a huge leap from the 1H25 result. A >20% jump from 2023 and 2024.

Based on the share dropping -6.54% today the market is not convinced, and the shorters are having another go at driving the price down. By lunchtime the price was firmly heading back up.

What spooked the market?

Let’s consider today’s update and the facts that GRG has:

a/ Taken market share:

· Market conditions remain challenging but outperformance continues with year-on-year gains in market share

Of particular note INCLUDING IN THE EVENING. This is a key objective for GRG to grow its time parts (i.e. to the evening time part)

b/ Net Cash is up - despite heavy investment:

GRG ended 4Q25 with £15m more net cash than in 1H25 and GRG reiterates reduced capex in 2026 (signalling its investment plans into capacity is on budget)

Although they also speak of 2026 having a similar “underlying” performance even though there have not been exceptional costs for years. Could this now be the case where we see some temporary costs and the business argue its underlying numbers are stronger (for the future)?

We do see there’s a -£4.5m exceptional cost today.

Estimated investment was ~£130m in 2H25 so +£15m implies a £150m cash from operations post £4.5m exceptions, so equivalent to the 1H25 performance, but that’s just an indication and with growing numbers of shops and a likely working capital deficit that implies actual cash from operations could be £180m - £200m putting cash generation equivalent to 2024, and ~£350m Cash from Operations for 2025.

With lower investment levels in 2026 a “similar” outcome in 2026 would imply +£100m of distributable funds compared with 2025.

c/ An inline result vs expectations:

What expectations were those? That 2H25 would have an enhanced performance.

And what were the “stronger comparative trading performance” in 1H25 vs 1H24? £5.2m drop due to Rachel’s taxes and cost inflation.

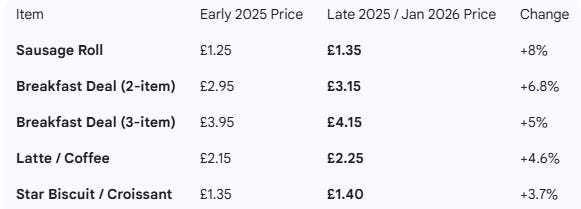

Rachel’s taxes. They shall continue. The effect came into effect 6th April of course so the operating profit was only affected for 50% of 1H25 so the run rate reduction of profit could be ~£10m per half or ~£20m per year, so a ~1% of revenue impact, although you must offset price rises against that. +3.7% to +8%.

But then deduct Cost inflation for 2025.

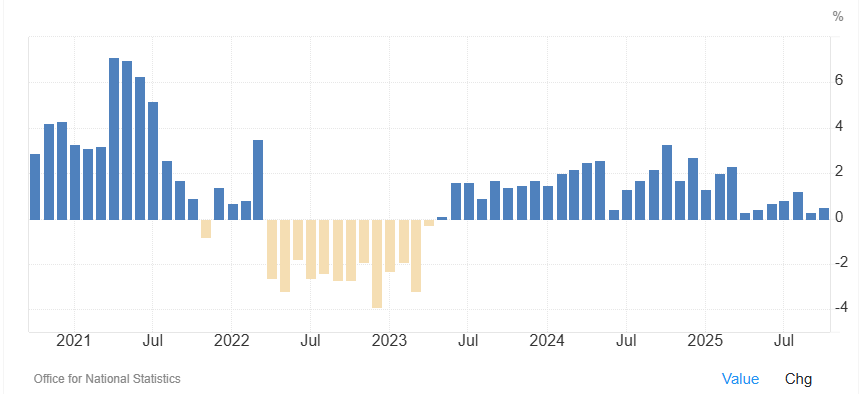

Deflation?

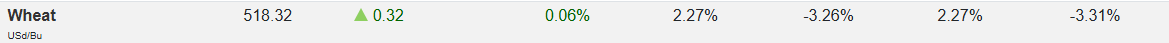

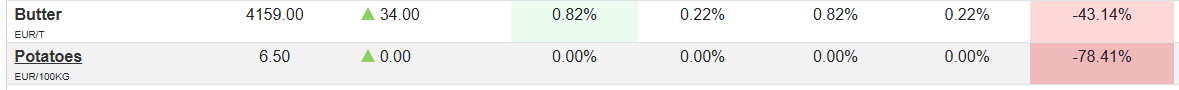

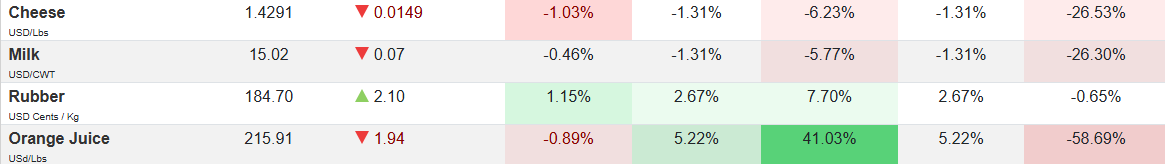

But who’s thinking about cost DEFLATION in 2026? Well it’s a fact YoY wheat down -3.3%, butter significantly down -43%, cheese too, milk too, ok coffee is up 17% but cocoa is -50% and orange juice too. Even Taters, precious, Taters, mash ‘em, fry ‘em put ‘em in a stew……

No wonder I was buying a bag of potatoes just before Christmas for 5p a bag. Buying several bags. I was fed up with Potatoes not Turkey this Christmas.

I’m not saying producer prices feed down immediately and that suddenly the world is all sunny uplands, but it seems to me we are stuck on an upwards cost fixation aka “The cost of living crisis” when there are signs that those pressures have abated - and a headwind possibly has become a tailwind.

We the British are good at having a moan.

d/ Successfully continued to grow its estate.

Why would you grow your estate by a net 121 shops if you were cannibalising your sales?

Answer: because you are not doing so.

And that point about saturation remains the central tenet of the shorters. Yet it continues to be demonstrably not the facts.

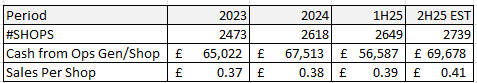

Revenue per shop keeps rising. Cash from operations per shop remains robust.

The shorters that have a huge £185m exposure to Greggs right now with 10.5% of all stock borrowed from long shareholders. Costing them at least -£1.6m per month with a -£5.5m kicker in April. A short based on growing and expanding sales and solid cash?!

e/ Hello Tescos?

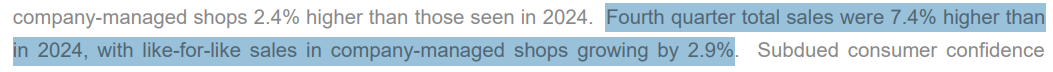

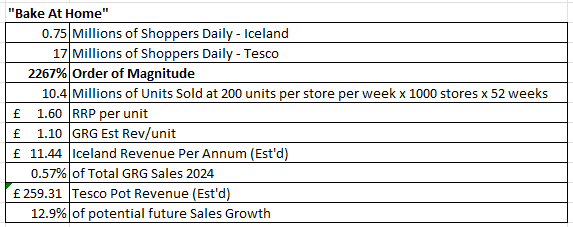

If 4Q25 sales were 7.4% higher than 2024 but company-managed shops were 2.9% higher then that tells me either the franchise shops were somehow performing radically better (unlikely) or there was a leap in B2B sales i.e. frozen goods via Tesco. That >4% differential implies something like a £20m revenue bump from Tescos in a single quarter, which annualised would be getting on for £100m per year. That’s just under 5% of revenue.

It’s not yet at £259.3m levels (12.9% of revenue) I’d previously forecast as a medium-term target and as an approximated read across from Iceland and the larger scale of Tescos but it appears to be heading in the right direction - and it’s still early days. Iceland has been selling GRG products for 13 years remember.

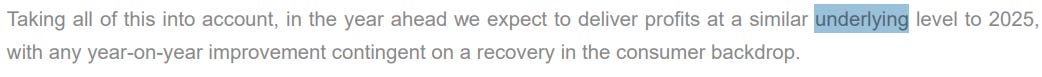

f/ Underlying

Sometimes single words niggle me in an RNS. Underlying. Why use that word?

Underlying would/should be excluding exceptions. But both in 2023 and 2024 GRG only had exceptional income while at least for the past 2.5 years (since 2023) there’s been no exceptional costs. None.

So the word “underlying” seems a bit redundant unless there are exceptions they’ve not disclosed yet in 2H25 - “new supply chain capacity will put some temporary pressure of margins” sounds like code for an exceptional cost to be fair.

The “similar underlying level” for 2026 could also be based on future temporary factors (i.e. future exceptional costs) where they are demonstrably taking market share - particularly for the evening “time part” (as they put it) - combined with strong sales growth. All of that where underlying profits are demonstrably growing, well that would be an ideal outcome where the market anticipates upside for 2027 and the share reprices ahead of that. In fact the t/u feels like that’s the code they are communicating to investors through their words.... with the further upside that if the consumer backdrop is stronger then the outcome is even better too.

g/ Is the UK consumer tapped out?

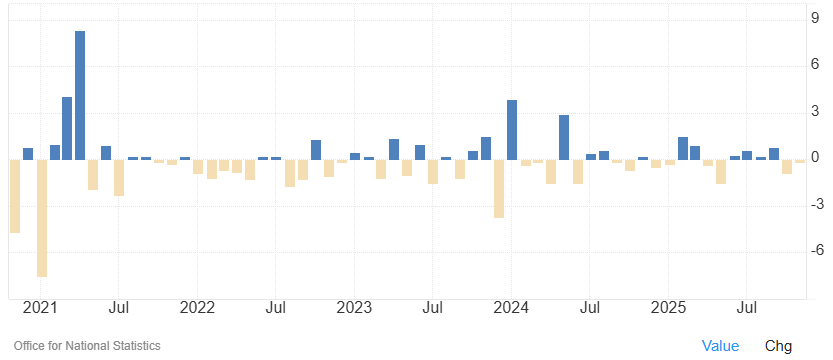

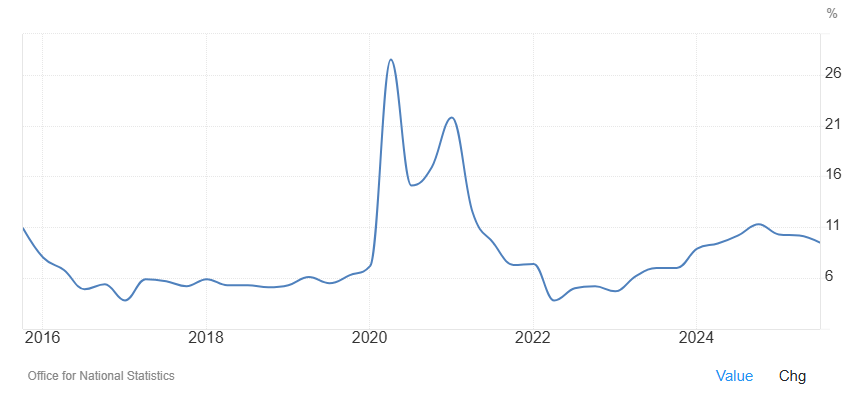

Confidence is overall steadily negative but not at any kind of extreme. Nor is net confidence declining.

Retail sales growth is broadly flat but not directionally negative.

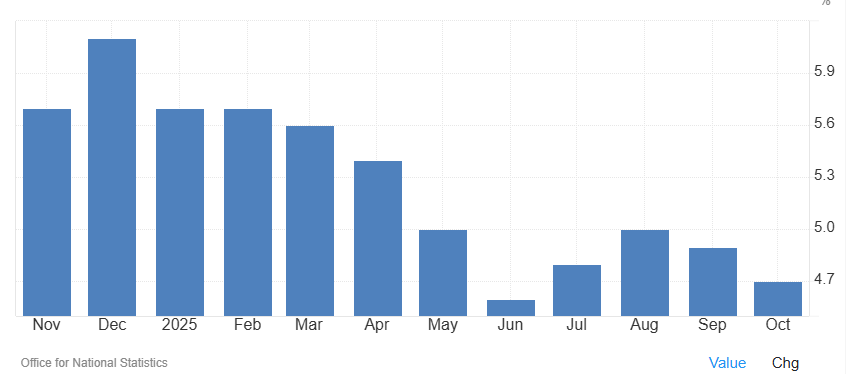

Wages are growing by over 4% on average (helped along by the minimum wage)

Where earnings are net positive post inflation, and also consider that interest rates are falling too (reducing mortgage costs).

Where the savings rate is reducing not rising.

The Autumn 2025 Budget changes means 560,000 families will see an increased income from the two-child benefit cap worth £3,514 per 3rd or more child (£5,200 on average). This has a strong correlation to areas of the UK with higher GRG store density and consumers benefitting from this change. The North East, North West and the Midlands are areas which will particularly benefit.

None of this macro evidence points towards 2026 being worse than 2025, actually.

The most damning chart is the confidence level. The actual pounds and pence, and savings levels actually gives far more confidence than people themselves appear to feel.

h/ Shorting is also betting against the power of Technology

GRG is six months away from its new logistics and manufacturing facility delivering to six of its distribution centres and replacing manual picking for each shop with automation. The benefit of that automation could drive a 2% margin increase or more. That’s a £42m+ bottom line gain.

GRG report it’s on track.

£42m gain would just be the beginning. Why invest £547.60m net of depreciation over 5 years? Capacity, yes, and that shall be 20% higher but what else is 20%? Oh yes GRG’s historical ROCE.

So my thesis is these investments will support delivery of cost savings and ROI equivalent to that 20%. I anticipate that in 2027 and beyond we shall see a £110m productivity gain based on the application of automation and the basis of a 20.3% ROCE.

2027 for Kettering’s opening but Derby comes sooner and improves productivity of the entire logistics chain.

Conclusion

Bearing in mind we don’t yet know what the FY25 result is (i.e. it could be very good). I was right or at least very close on the revenue out turn so if I’m nearly right on operating profit being £265m then that’s over 20% ahead of 2023/2024 and if it’s “only” £265m again in 2026 I think I can live with that, even if we see some temporary exceptional costs.

And today’s fall back to the low £16s is very much the opportunity I believe it is.

But this is not advice or a recommendation and you make your own investment decisions.

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Great update, enjoyed reading this. I have high hopes for Greggs, it will eventually mature into a dividend machine imo.

Thanks OB for your timely update. I had sold out yesterday just in case, and bought back today ( small amount) following your review confirming my thoughts on the TU. It's a lonely world trading, and your reviews are so much appreciated. Have you come across Coral Products - CRU, interesting news today, especially as they have a exposure to Jaguar Land Rover