Dear reader

GROW’s merger with Forward Partners is complete.

Combining cash, the recent fundraise, primary bid gets us to £96.9m cash. The £60m RCF takes us to £156.9m of available funds available and shortly £24.1m more given today’s news on the sale of Perkbox (£181m total)

Molten invested £14m at a valuation of £75.4m so own(ed) 18.57%.

More cash to come?

Graphcore - eagle eyed readers will know I’ve been following the Graphcore story via CHRY. Since GROW own 1.1% of Graphcore and a price tag of $1.67bn has been mooted that would mean £14.5m cash (and a £6.5m write down on disposal).

However it would take cash to £195.5m

Meanwhile NAV moves to an estimated £1,277.50 (or £6.76/share)

Based on today’s share price once you strip out cash from Perkbox and Graphcore (if that happens) we are looking at a 72.7% discount to NAV ex cash.

A 72.7% discount is a discount on top of GROW’s self flagellation.

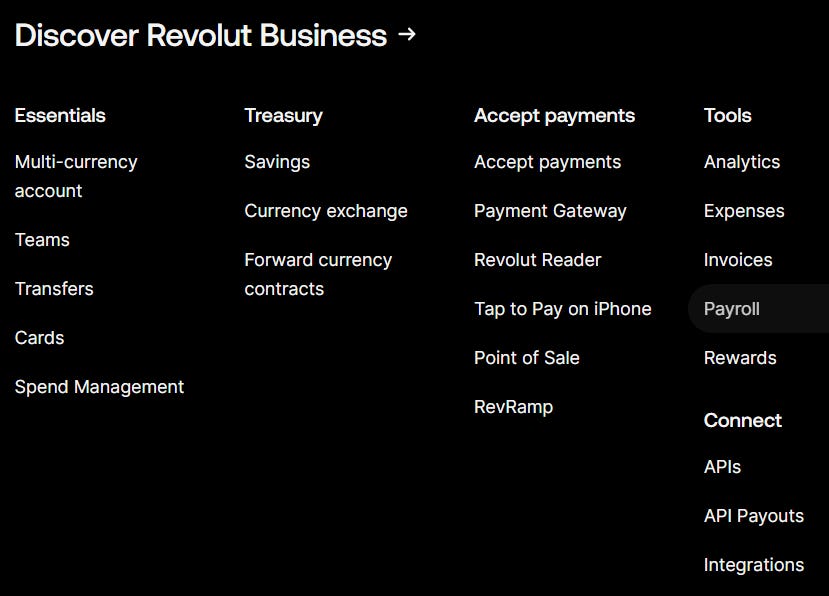

For example GROW values its 0.35% holding in Revolut at £54.5m. This means Revolut is worth £15.4bn ($19.5bn).

Other investors have flagellated far less. Triple Point for example think its worth $4bn more. ($23bn)

But Mr Market thinks a 72.7% discount is appropriate for assets like Revolut. So valuing GROW’s Revolut holding at £4.2bn ($5.3bn) instead…… $17.7bn less than Triple Point…. and $27.7bn less than the prior up round valuation (that other FinTechs are re-achieving - like Klarna for example)

This for a company which hit $1.1bn (£923m) in revenue in recently released Revolut’s 2022 accounts, a 45% increase from the £638m the year prior, and is profitable albeit net profits for the year were down 78% from £26.3m in 2021 to £5.8m.

The revenue boost in 2022 was in part credited to the onboarding of almost 10 million new customers over the year. The company says it currently serves more than 40 million users worldwide.

It doesn’t even seem fair to call them a challenger bank when their portfolio of services exceeds this and continues to grow.

Conclusion

There remains a huge disconnect between the market price and the value of the assets. Today’s news is yet another example where applying a 72.7% discount is far too harsh, and this level of discount is not occuring in reality.

This is not advice.

Oak