Dear reader,

Just back from a short break in Gibraltar and I was gobsmacked to learn that many Gibraltarians (children, women and the elderly) were evacuated to French Morocco in 1940, then expelled from there due to the British attack on the French fleet (to prevent it falling into Nazi hands) and subsequently the refugees were moved to St Lucia, Jamaica and the UK. But that some Gibraltarians weren’t returned to Gibraltar until 1951. I learned, too, that there are 35 miles of tunnels beneath Gibraltar rock.

Meanwhile back in the land of investments I see more good news from CHRY.

GRAPHCORE

In my article of the 29th January CHRY-pes I mused why had Graphcore been revalued by CHRY and was this the 5.5p per share potential sale CHRY have said may close in Q1. It seems the Telegraph and others (weeks after the Oak Bloke) are musing the same. Perhaps they are readers to your truly?

So the 5.5p would effectively be “in the price” to December’s NAV of £1.43/share. But that’s fine. £41.5m of proceeds would mean CHRY reaches the £50m of cash and would provide £5.1m for buy backs. This is because CHRY’s RNS 07/03/24 tells us cash is £13.6m.

At today’s prices of 89.5p buy backs would boost the NAV by 0.7p/share.

But, reader, Graphcore is only the beginning

KLARNA

Again, after musing in CHRY-pes about the fact Klarna’s peers are on much higher valuations, Klarna have since announced they are planning an IPO in Q3 24.

The mooted price is $20bn. CHRY owns 1.11% of Klarna so if that price is achieved the result for CHRY is a substantial £81.60m uplift and a £174.80m realisation. At its high point in 2021 Klarna was valued at $45bn (Or £393.3m to CHRY) and reading about Klarna’s progress it has achieved an astonishing 67% of customer service is carried out by AI avoiding the need for 700 employees. Also interesting in a nod to Amazon’s Prime, there are 37m US consumers, 7m of whom are now paying $8/month for Klarna Plus. So Klarna has grown beyond BNPL (Buy Now Pay Later) into a wider retailer offering, connecting consumers with brands but offering a compelling retail experience where you pay a subscription but get discounts, favourable payment terms and other benefits.

Worldwide there are over 150 million global active users and 2 million transactions per day, Klarna’s, sustainable and AI-powered payment and shopping solutions are revolutionising the way people shop and pay online and in-store, empowering consumers to shop smarter with greater confidence and convenience.

More than 500,000 global retailers integrate Klarna’s innovative technology and marketing solutions to drive growth and loyalty, including Apple, H&M, Saks, Sephora, Macy’s, Ikea, Expedia Group, Nike and Airbnb.

Assuming the IPO of $20bn on top of Graphcore so £174.8m of buy backs at 89.5p would boost the NAV by 36p/share.

Of course CHRY might decide to hold some or perhaps even all of its Klarna holding as it is clearly growing and an interesting play on the commercialisation of AI, on ecommerce growth and fintech payments.

Smart Pension

We also learn in the RNS that a £6m follow on investment has been made into Smart Pension (which tallies with remaining cash post 31/12/23), and that this has led to a 3.7p/share uplift. Well a 3.7p uplift is £22m so I have updated my holdings tracker based on the Smart Pension News (and Graphcore/Klarna).

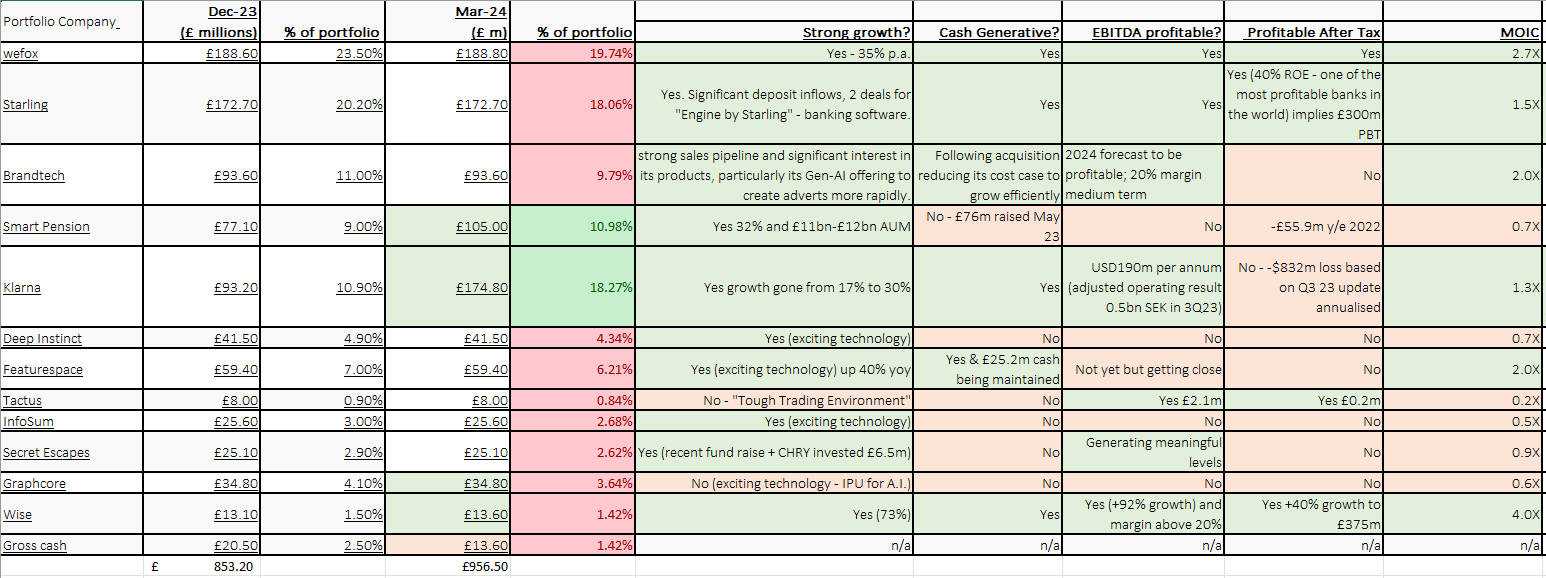

Notice the % of portfolio drops due to Klarna potential rerating.

Eagle eyed readers will see I believe there’s over £100m of upside in the newsflow. This equates to an estimated NAV £1.60 a share.

Whether CHRY will recognise this in March 24 ahead of the IPO is another matter - but that doesn’t mean it isn’t real and coming.

In fact I first spoke about CHRY in October 23 when it was 54.6p! Now it is 89.5p. But I believe the discount based on current news flow is 44% to book…. where book is proving again and again to be below the market value of CHRY’s holdings.

Penultimate Thought - Buy Backs

If I am right and if Graphcore then Klarna are sold in 2024 the stated policy of CHRY is to buy back shares due to the unwarranted discounted.

Assuming this could be done at today’s share price of 89.5p the effect on NAV is dramatic. The policy states that £50m must be kept as a liquid holding and assuming we are excluding Wise (which is publicly listed and could be sold), then only £5.1m would be used following Graphcore’s sale buying ~5.7m shares. This would boost the NAV by 0.7p.

But Klarna following this (assuming a $20bn IPO) would be substantial. £174.8m at 89.5p would equate to 195.3m shares and boost the NAV/share to over £1.97.*

*- the current agreement is to buy back 100m shares and then to use further realisations for a mixture of reinvestments and shareholder returns so these calculations are to illustrate the potential of buy backs - were they to be used this way.

If memory serves, CHRY’s NAV was something like £1.97/share back in 2021 when Klarna was valued at $45bn. That CHRY potentially returns to this NAV/share in 2024 while selling Klarna at less than “half price” to its prior valuation reflects the strong progress in other parts of the portfolio like Starling and WeFox - further IPO candidates with exciting stories too. But also the sheer overlooked value in its portfolio.

Conclusion

It’s hard to understand how this could be at a 38%-44% discount to book when it is making so much good progress.

One explanation is that in 2022 CHRY’s share price fell 73.3% yet the investment manager’s performance fees gave them an egregious £112m pay out. That scandal has been resolved with a more equitable agreement in October 2023 to prevent any kind of undeserved reward. When will the market wake up to how CHRY is CHRY-stallising value?

This is not advice

Oak

OB I think you are right that the episode where the managers paid themselves £112m when the share price collapsed left a bad taste. Technically it was due to them. Morally they shafted the shareholders, and that speaks volumes. Given the chance they would do it again. CHRY may deliver some gains in the immediate future, but I for one have zero trust in the managers to look after my interests. With a bargepole I would not touch.

Any managers reward should be shares, with an appropriate 1/3/5 years to vest. If the share price / performance drops below a threshold before vesting, the shares are released back to the company.