Dear reader,

I know, I know, it’s Gran Tierra but Gran Turismo Energy sounds so much better. Especially with a ticker GTE. Old school Vauxhalls and all that. You know the score.

Remember i3 energy? 6 months ago I wrote an article called “i3e(xit)”. Here’s the three eyes and the exit. Another one of my article pictures which deserves to be the next Banksy of the investment world, or I can go on dreaming.

I didn’t like GTE. I thought shareholders should say no to the i3 exit. Hence the picture. But shareholders said yes, and I sold off the GTE shares that I inherited pocketing a nice gain, i3 disappeared as yet another loss to the LSE and i3e became part of GTE. So do I like GTE any better now? Especially now it’s less than half its 12 month highs of over $10/share….even if it was a good choice selling - at the time :). Does it merit a revisit?

GTE just reported its FY24 results. Its share is in the doldrums.

GTE is a US$170m market cap and has $413m shareholder’s equity including $103.4m cash, so reading that you can see where my mind is going here. Net of cash $66.6m (the number of a beast) for $346.4m of assets.

That would be an >80% discount on the share price! But it’s not that simple. As well as cash there is debt. Quite a bit of debt actually, so $1.13bn of assets (including cash) offset by -$0.72m of debt, netting to -$0.41bn of equity.

But then consider that that $413m s/equity (it was $460m in 3Q24 when the below chart was produced in 3Q24 I think) is only the PDP - producing, developed and proven. It completely ignores the upside of the undeveloped, the probable and even the possible.

A story not dissimilar to something like OB24 idea PTAL Petrotal. Years of growth and decades of production.

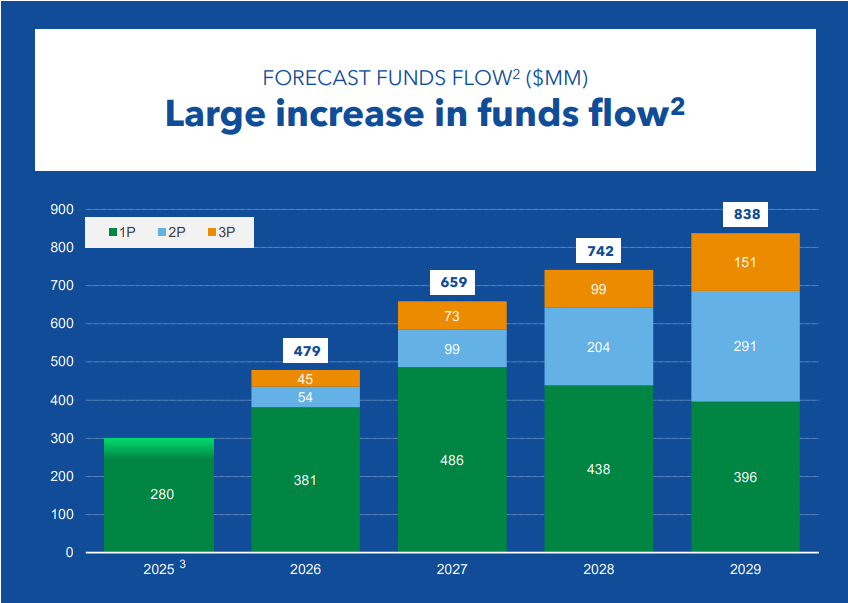

The 1P/2P/3P could add a cool $3.42bn (before tax) or $1.83bn (after tax) to the NAV.

Let’s go back a gear and consider who are GTE today?

Three territories, with 80% liquids and 20% gas, 47KBoepd production and $3.6 billion of reserves.

I spoke of cash and discounts to NAV but the plan and strategy is to pour the cash into the ground and grow production. If Oil and Gas prices are low by a smaller amount and if they’re higher by a larger quantum (plus enjoy some Free Cash Flow in 2025).

The same happened in 2024. -$162.6m paid for i3e, a whopping -$234.2m spent on PP&E while +$239.3 was generated as net cash from operations. Debt added +$221.5m cash flow.

So this is highly cash generative and 1 year of Op Cash Flow exceeds the market cap.

Shareholders were rewarded with 0.5m shares bought back in 2024 and 1.7m shares in 2023 (so 1% and 5% of outstanding shares). What might feel less rewarding is a tax rate of 106% dropping to 93% in 2024. I struggled with what looked like a lunacy in the original article but I believe I now understand this apparent suicidal tax rate.

The answer is that in US accounts you have a book depreciation and a separate tax depreciation. It can make sense to accelerate (i.e. increase) your tax depreciation to minimise your profits today thereby minimising tax payments in the early years in the hope that later you will be subject to lower rates of tax and also you are better able to afford to pay taxes on profits. Meanwhile if your asset has a 25 year life then you can depreciate it as normal over its 25 years (from a Profit and Loss point of view).

The key here is that GTE is paying tax today to carry forward tax offsets tomorrow. What’s less clear is the extent of future tax (although the above NPV calculation suggests a long term 33% rate which is highly encouraging).

The expectation is that investing into developing acreage pays off through growth in future operating cashflow.

Even though GTE operates in two separate South American countries this diagram explains the strategy. The darker section in the lower half of the map is Ecuador where 7bn BOE has already been produced. The top lighter colour is the Colombian side where only 0.6bn BOE has been produced, due to the civil war (with the FARC). That war is now at an end - has been for a while. Peace reigns. Essentially the two basins are contiguous and the same geology so it’s two countries but one very large project, really. There are high hopes over the yellow segments and GTE has been buying up lots of tenements to build out the opportunity.

For previous i3 energy folks this chart was very interesting. From zero to nearly 5 BCF exports per day via ship-borne LNG will come online over the next few years will transform the supply-demand dynamics of natural gas in Canada. Great news for GTE too via its acquired i3e assets. Although this price recovery isn’t yet in the price, a colder winter in 2024 has reduced the excess levels of storage and restored a better demand/supply balance.

Conclusion

To learn this has is a UK/US/Canadian listing, but i3 energy folks got given Canadian shares which is a bit bizarre. There is no dividend and the strategy is for growth, again this might not be attractive for all. This article is also speaking to those who held i3 energy and now hold a share called GTE and are pondering what to do next.

The investment going in to GTE holdings based on the reserves and undeveloped reserves, is consistent with the prior i3 energy strategy and over several years we can see success coming from the drill bit. The play on developing Colombian oil after decades of FARC civil war and the contiguous land yielding billions of barrels appears a sound strategy too. Add Canada to that, add recovering Canadian gas prices to that (which have been below US$10/BOE!) and there’s a stronger story ahead.

In fact the deep discount is astonishing and the future growth in that discount certainly puts this share falls under unloved.

There are risks. I’ve sought to make sense of the tax and feel a bit more comfortable knowing that there is accelerated tax payments as opposed to a status quo of tax but nothing is ever certain with tax, let alone wider political risk of Colombia and Ecuador, well and Canada I guess you could say (Trudeau hasn’t exactly been a friend to oil & gas has he?)

So the multi-jurisdiction is a blessing and a curse, but the numbers are deeply attractive and any kind of re-rate would reward shareholders, plus commitments to buybacks in time grows the value to shareholders too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

"This is a US/Canadian listing so the fact it isn’t UK listed might put some folks off."

Actually it has a UK GBP listing:

https://g.co/finance/GTE:LON?window=1Y