Dear reader

I recently covered the opportunity at i3e in my article “i3e i3e baby”

Shortly afterwards Gran Tierra riffed STOP, COLLABORATE AND LISTEN. It’s offered to buy i3e and i3e appear to have accepted, at least the management have backed the offer.

The deal for i3e folk is 10.43p cash + 0.2565p dividend for 3Q24 + 1 Gran Tierra share for every 207 i3e shares which at today’s 630p share price is worth 3.04p.

That sums to a 13.73p offer at today’s prices.

For 1,202,447,663 shares in issue that values i3e at £165m or $218m

The question is now will a counter offer appear?

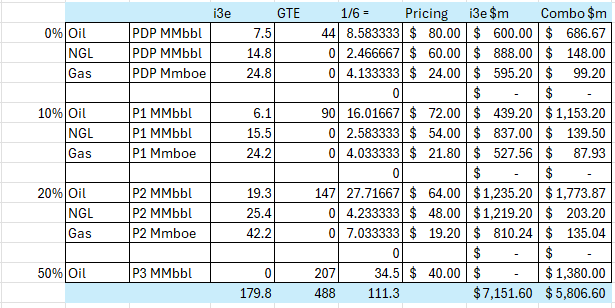

This offer at current prices values i3e at £3m above its last reported NAV. It values i3e at 54% of its PDP which itself is at a reasonably depressed NPV10 (if you believe North American prices will normalise with the rest of the world through progressively large LNG export which gives strong arbitrage on NA vs World pricing of gas)

It values i3e at zero for its 1P resource. Zero for its 2P resource.

It is my belief, there is plenty of room for a competitive bid. And that it won’t get the necessary 75% of shareholder support.

After all let’s consider who they are, apart from you, reader.

Polus Capital Mgt 19.7%, JP Morgan 8.9%, Slater 8.8%, Premier Miton 5.1% and Janus 3.2%. These would be swapping out shares to obtain 1/6 of their percentage holding in the larger entity, and little more than NAV. I just don’t see why any would apart from Premier Miton who appear to be selling down their stake and appear keen to liquify holdings to meet outflows possibly? (last month these outflows had slowed to “just” £139m for Q2)

GTE have received irrevocable undertakings from 32.32% of existing i3e shareholders. Not enough. So 57% or more of the remaining 67.68% must vote in favour to see the deal through.

Why Vote Yes?

GTE has a £319m NAV (a 43% discount to NAV which could be said to be decent), and has enjoyed some periods of profitability, including £27.6m 2Q24 profit but profit seems to vary widely and wildly with some weird tax deductions and credits. The tax rate varies from 40% to -300%

The combination of reserves means you are getting 1/6 of the broader company (assuming you opt for zero cash and 100% GTE shares), or 1/207 if you opt for cash.

The combined entity means you stand give up 179.8 mmboe for 111.3 mmboe. But that assumes all forms are equal. At a miserly C$2.64 price gas is worth far less than Oil (GTE is 100% oil). You stand to gain $0.6bn by voting yes for the take over.

But this is nuanced by 2 factors. First that in this analysis I’m assuming 3P is worth the same as PDP but of course that’s nonsense. If we even apply a 25% discount or more to the 3P then the deal is worse for i3. And if we also consider Canadian gas at a miserly US$12/BOE is not realistic in the long term and higher gas prices will prevail in the not too distant future.

The deal quickly looks poor value as soon as you apply any kind of discount to the less certain 1P, 2P and 3P resources. I’ve applied 10%, 20% and 50% and “lose” $1.3bn in the process by backing a GTE buy out.

However GTE do speak to “exploration upside” which could increase the numbers (but arguably i3e could point to the same potential upside on their acreage).

….GTE claims to be “firing on all cylinders”.

Yet their annual report shows they made a loss in 2023 despite a $400m EBITDA. Tax appears to be to blame but trying to decipher what’s going on with tax requires some serious amounts of focus. 106% tax rate in 2023! What? Why?

A 45% tax rate compounded by being a Colombian and US entity (with a double dose of tax from the US) with a healthy dose of adverse FX compounding the tax liability.

GTE speak to an improvement to tax in 2024.

In 1H24 the PBT is $44.6m tax is -$8.3 leaving PAT of $36.3m.

If we annualise that net profit and turn it into GBP that’s £55m which is a P/E of 3.3 which is very respectable.

But eagle-eyed readers who’ve read my I3e-i3e-baby article will know that:

Brokers forecasting a US$90 Brent oil price, and average near doubling of gas to C$/mcf of C$4 so also see a rebound in revenue and while Opex grows by around $10m, a near doubling of revenue against relatively fixed costs boosts net profit for i3e from $3.2m to $50.9m in FY25. This puts i3e on a P/E of 2.7.

I’ve managed to avoid making any negative reference to Colombia and political risk (compared to Canada), but that should factor in somewhere too. Mind you perhaps GTE have heard of the Bacon Sandwich quaffing environmental minister of the TinPot Monarchy of Britain and consider the North Sea a high risk area, with unattractive tax rates, and unfriendly government, compared to their Colombia.

Whichever way you splice, slice and dice the deal my conclusion to an i3 energy shareholder is a clear VOTE NO.

If GTE up their offer? Sure, but given the metrics I’ve set out above you’d want 20% more for this to be actually attractive.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Good write up.

Take a look at i3 Energy CEO Majid Shafiq' compensation package, especially the section where he stands to make several million pound and a full vest of his millions of options that were awarded to him for free, in the event of a full sale of the company. This is the main driver of this terrible deal IMO i.e. to reward management and insiders.

I3E was trading at 14p as recently as last September. I agree that it seems to be worth more than the offer. I’m curious as to why the board are in favour.