HOC-key to 2024

Is the new Mara Mine the key asset for HOC?

Dear reader,

I realised today that I hadn’t updated my HOC model since my article HOC on the Block and based on the recent Q4 production update. So this is a forecast based on actual production/sales which HOC call a “slight improvement” on H1. My numbers agree. Importantly Pallancata went into Care & Maintenance in Q4, it’s no good producing at a loss. It will resurface in around 2027 as Roropata and the new vein at a Pallancata mine should reset this to an AISC of $1,100 but that’s some way out and permitting is still required.

HOC’s presentation deck is here and worth a read.

I assume a steady AISC in 4Q23 in keeping with 1H23, and guidance is for $1,490-$1,580, so we know the FY23 results aren’t going to shoot the lights out. But it would be a blunder to extrapolate the past to forecast the future. With one mine now in C&M and a new mine opening, extrapolating the past you’d be wide of the mark for HOC’s future.

I’ve reduced my forecast production to the lower end of guidance (343,000 Gold Eq'. Ozs) and used HOC’s own guidance for the 2024 AISC, Mara Rosa reaches nameplate (100k per annum) in Q2. As can be seen San Jose’s bumper Q4 doesn’t repeat in 2024 and Inmaculada puts in a poor performance relative to 2023 with higher costs (which I reduce slightly in Q4 as the one-off MEIA cost drops away). I’ve reduced my assumption of 2024 gold prices to $2,100 Gold Eq.

I also updated my prior article to clarify that Volcan isn’t divested but it is up for divestment. HOC have spun it out into a standalone company for an investor to pick up and run with should they wish. It has an IRR of 20.5% and looks fairly decent so perhaps HOC will develop it themselves at some point. Or if you fancy investing then their presentation is here.

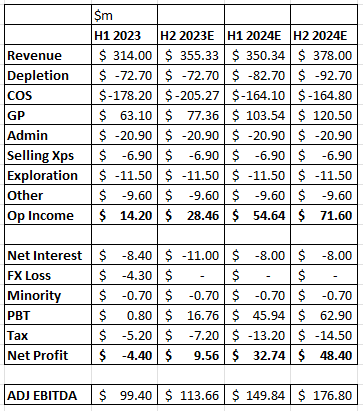

So back to my production estimates, let’s next see how those translate into the P&L. They show a pleasing improvement of some $15m QoQ, from Q3 to Q4. This should lead to an outturn of a small profit overall for 2023. Given that I’d previously anticipated a $8.5m loss for H2 an estimated $9.5m profit for H2 and $5.1m overall profit for the year is a better result, although to the casual onlooker it would seem poor (just a 0.8% net margin)

However what remains on track is Mara Rosa and the difference this makes to profits, particularly when you consider its effect on a full year basis i.e. from 2025. With approximately $800m revenue and $140m net profit takes HOC from a 0.8% net margin in FY23, jumping to a 13.3% net margin in 2H24 and beyond….a HOC-key stick effect!

Also worth noting is I’m modelling 343k gold eq. for 2024 onwards i.e. the minimum guidance but there’s 20k-30k per year of production upside. Moreover the AISC will improve throughout 2024 and beyond too. As they infill at San Jose and Inmaculada we can look forward to a future costs potentially being around 25% lower by 2026. Plus what about the price of gold and silver? About 15% or 50koz per year of HOC’s production is hedged for 2025-2027 at $2,200, and around 8% of 2024 production is hedged at $2,100. But for the remaining 85%-92% upside opportunity remains. For me gold mining is the leveraged bet on blood in the streets and uncertainty drives the price of gold up. Besides, silver is 42% of revenue (this article speaks of gold equivalent ounces but it’s nearly half silver by value), and “one day Rodney, one day” silver prices will shoot up. Silver is an industrial metal and a green tech metal - its demand is increasing and its primary supply is stagnating. It’s a by product even at HOC.

Even assuming zero benefit from higher gold/silver prices and/or lower AISC we still should see a large difference in 2024 based on targets. On a PE basis, today’s market cap is $577m, and forward forecast earning of around $97m puts this on a PE of 6 falling to 4-5. So even very conservatively £1.35-£1.50 a share isn’t unrealistic today, in terms of valuation, with a £2+ upside if it can produce above the minimum or achieve targetted reductions in cost or gold/silver prices move up from $2020/$23.

This is not advice

Oak

Need to do a side by side with the very best players in the market — ie the Newmonts and Barricks as increasingly the money flows to the very largest scale operators.

IMO PAF is a far superior PM mining play with lower aisc and a healthier balance sheet, also significantly undervalued