Hochschild (not to be confused with the Hothschilds) is a Silver and Gold miner with operations in Peru, Argentina and Brazil.

It’s been through a tough time - down 2/3 from its highs… up 2/3 from its lows. Sounds like the Grand ol’ Duke of York, right?

Where did it go horribly wrong?

Well the short version was Peru went through a bit of turmoil. A left-wing El Presidente decided he would kill off the golden geese (down with the capitalists), and after this the next challenge HOC endured was to get an environmental approval for its flagship mine (which only arrived 4 months ago - and the share has risen 2/3 since). The largest shareholder (Senor Hochschild) sold off a load of shares which didn’t help, and its rare earth venture has been a disaster (now written off to zero). It failed mainly down to Peru’s refusal to give permits. More salt in the wound was Pallancata whose grade diminished and is now in care & maintenance - but perhaps should have been put into maintenance a year previously.

Finally, buying Mara Rosa in Brazil meant cash rich HOC went from debt free to debt burdened.

Wow, are you getting a warm fuzzy feeling about this share?!

Looking at the map beneath:

4 - is the Inmaculada mine (and the C&M Pallancata)

2 - is the Mara Rosa mine

Red Cross - is the San Jose Mine

Blue Cross - is Volcan and this has been put into a divestiture entity called Tiernan, so has an IRR of 20.5% (at NPV5 and $1800 gold) but isn’t an active HOC project.

So why would I write about HOC? To sneer at it? To recommend a short? Not my style.

What caught my eye in their H1 presentation was this.

Cheaper than its peers, more profitable than its peers and almost the most generative of its peers…. lots to like if it’s true. So read on, reader, as I explore whether it’s true?

How will HOC turn the corner?

The short answer is Mara Rosa.

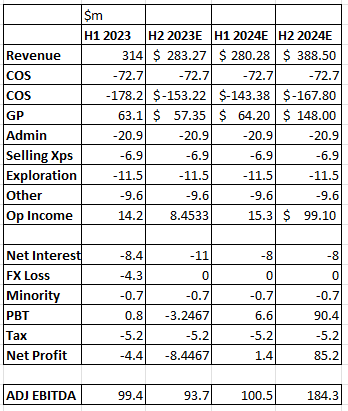

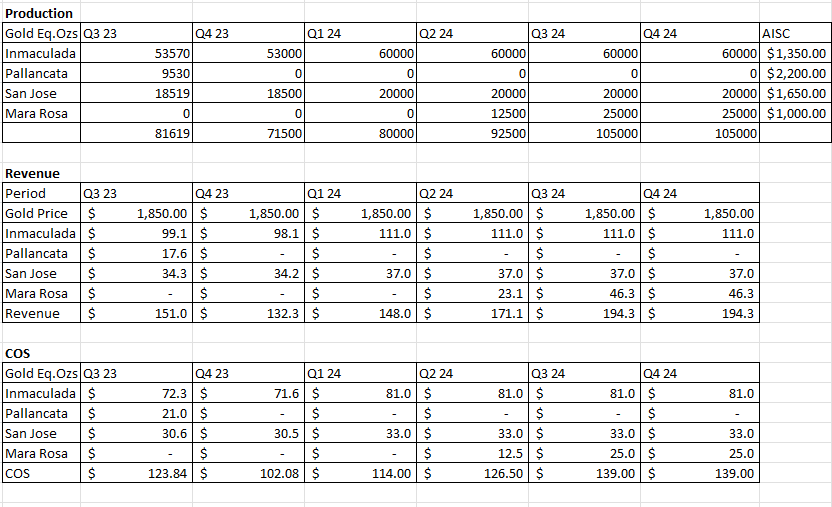

But before I speak of that let’s run the numbers. We know the H1 2023 numbers. We know the Q3 production. We can therefore extrapolate a forecast for 2024.

This is based on a mild production improvement at Inmaculada. There has been 10,000 metres of drilling during 2023 following the EIA permit so this seems reasonable compared to the past. A slight uptick at San Jose too. Mara Rose comes on board midway through Q2 even though it is 98% ready as of Q3 and 1st production H1 2024 - I’m assuming this is toward the back end. I’ve used a similar and undemanding AISC to that of H1 2023, which may be pessimistic since exploration has historically driven down the cost per oz at HOC.

I’m assuming an $1850 per ounce gold price (I’m using “Gold equivalent Ounces”) so a Silver Oz is 1/86 = $21.51. Again pretty pessimistic assumptions.

Result? We see a big uptick in profitability in 7-8 months time.

Does HOC pass the 3 tests?

EV/EBITDA - EV is made up of $697m of equity and $668m of debt so assuming a steady state of EV then EBITDA in 2023 H1, and $285m of adjusted EBITDA then we see a 4.8X ratio. Not 2.4X but I did say I was making some pessimistic assumptions.

P/NAV - my own reading of this is that its P is £520m and NAV is $697.4m which is £571.6m so a P/NAV of 0.9X - a bit higher than 0.7X but of course the share is up by a third isn’t it?

My own calculation of FCF yield is $388.5 rev -$326.9 Op Costs +$75m (Depreciation)-$5.2 (Tax) is 25.5% which is 1/3 higher than HOC’s own forecast.

What if the gold price goes up?

$1850 isn’t exactly high. What if HOC’s true value is as a hedge for the proverbial hitting the fan in 2024?

Not nice to think about but will the doomsters suddenly become bullish in 2024? New year new doom narrative. Gold is a hedge. And Silver. One day Silver has to have its shiny day in the sun. If Silver went from $21.50 to $29.00 then that’s the equivalent of $2500 gold. It was at $50 once.

So assuming a move to $2500 Gold Equivalent Ounces, the effect is dramatic.

We arrive at a EV/EVITDA of sub 3X and moving into 2025 something like a $450m annualised net profit on a PE of say 8 puts this share at £5.67 so 5.67x its price today.

P&L at $2500 gold eq oz.

There seems a lot to like about HOC. Has the market recognised the value of Mara Rosa?

What are the risks?

More trouble in Peru

Mara Rosa ramp up runs into issues

Gold and or silver price collapse

What are the upsides?

Pallancata will re-open as Royropata in 2027. 50MOz - drilling May 24

Inmaculada, San Jose, Mara Rosa all have upside potential to extend mine life and drive down the AISC

This is not advice. My advice is get advice is you need advice.