I offer nothing but Blood, Tears and Gore #6

OB Idea #6 for 2025 - the bombed out Gore Street Energy Storage (GSF) - 13.5% yield and 49.5% discount to NAV

Dear reader,

A finest hour is yet to come in 2025 - I believe - from Gore Street Energy Storage (ticker GSF). Today’s 51.5p bid/ 51.8p ask is priced at a level of a doomsday scenario which stalwart buyers can stare down. Even though a grisly gang of detractors point to faceless Power Experts who pontificate on prices which they’ve been predicting for years with limited success. I say there is a simple truth: There is an ongoing rapid build out of renewables in all the territories and grids where GSF operates (5 of).

All five grids are experiencing an accentuating Yo-Yo effect of pricing or “negative day-ahead pricing”. That number of negative days is growing. BESS or Battery Energy Storage Systems can buy energy while it’s cheap (or free or negatively priced) and then sell while it’s not. Additionally trading is only a part of the revenue. Ancillary services are a further revenue stream where BESS can help regulate and stabilise voltage levels, via the balancing mechanism and frequency response.

Meanwhile demand for power is growing rapidly. Demand for BESS assets themselves are growing rapidly. There are have and have nots. Those who have connections are ahead of those who don’t.

Forecast growth even over the next six years supports a build out for BESS.

BESS are becoming more attractive

There is a 2nd simple truth too.

Battery energy storage systems costs are plunging.

Meanwhile Energy price volatility shortens payback times for BESS. This shift, driven by a surge in intermittently generating renewables, and ongoing innovations in battery manufacturing, marks a pivotal moment for energy markets worldwide.

Image: S&P Global Commodity Insights

Energy storage installations generate returns through two primary streams: merchant revenue and contracted revenue. Contracted revenue often requires reform, market creation, and government backing to come to fruition, with key examples including capacity markets and large-scale tenders.

On the other hand, merchant revenue – which does not need an energy offtaker – is organic and can develop as more price volatility becomes present in existing market structures. Building a profitable business case for merchant storage, or any asset for that matter, relies on low capital expenditure (capex) costs and/or high revenue. These two things have changed across parts of the world, creating growth in energy storage installations.

Merchant revenues have been increasing in a number of key regions. The picture here is slightly muddy as wholesale price volatility hit record levels during the energy crisis of 2022, triggered by Russia’s invasion of Ukraine. At that time, building a merchant business case for energy storage could have been easy but it would have been based on shaky foundations as the drivers behind that energy market volatility were temporary.

Since then, volatility has fallen but not back to previous levels and, crucially, is now rising again. This time, wholesale price volatility is being driven by something much more permanent: renewable energy installations, and solar in particular.

Storage arbitrage

In many regions, installed solar generation capacity exceeds peak electricity demand. On sunny days, more energy is generated than is needed. This has a profound effect on prices, which can routinely tumble to zero or negative values. Meanwhile, in the evening when electricity demand is often highest, solar generation declines and power prices often rise.

This pattern creates the perfect environment for energy storage “arbitrage” – charging when prices are low and discharging when prices are high. This is an important moment for energy storage, as installations of solar and wind power projects are only rising. This will add to electricity generation and supply volatility in the coming years and drive an even more robust business case for storage as time goes on. Some countries have set bold targets for renewables. Spain’s latest National Plan for Climate and Energy aims to achieve an 81% share of renewables in electricity generation in 2030, up from around 50% in 2024.

Better technology

While that has been happening in wholesale markets, suppliers of energy storage systems have been rapidly scaling up and innovating. Recent breakthroughs in the design of battery cells have increased BESS energy density, meaning that the most recently launched systems can store more energy than previous versions for the same space. That has been achieved by the optimization of battery cell interiors with more area dedicated to electrodes, increasing capacity while keeping dimensions and voltage unchanged.

Rising BESS capacity and falling raw material prices for batteries have led to a significant decrease in energy storage system prices. This decline is also influenced by softer competition for battery cells due to a slowdown in electric vehicle market growth. We have seen prices for fully installed systems fall by about 40% since 2022.

Quick returns

With falling prices and rising revenues, the two key elements for building a profitable business case for energy storage are moving in the right direction at the same time. The return-on-investment (ROI) figure is a key indicator, showing how long it would take for capex to be paid back under current market conditions. ROI has seen some very significant declines in recent years. Not very long ago, it could take up to 80 or 90 years to make back an investment in storage by trading in day-ahead energy markets. Today, in many cases, the figure is less than 10 years. Add to that other revenue streams, such as real-time market trading, grid-backing ancillary services, and capacity market contracts, and the business case becomes very strong.

Falling prices and rising revenues are strengthening the business case for merchant energy storage going forward. But that may not translate directly to growth, due to the inherent risk in merchant markets. Greater development of contracted revenues plays a key role in driving down risk for investors and broader availability would open up access to capital to drive the industry forward. So despite the tailwinds behind the rise of energy storage, there is more to be done to unlock maximum growth for this critical industry.

COP29 launches pledge to deploy 1.5 TW energy storage by 2030

The UN Climate Change Conference, or COP29, has launched a pledge to collectively deploy 1,500 GW of energy storage globally by 2030. Analysts at S&P Global Commodity Insights forecast 2030 energy storage capacity to reach 1,100 GW, including battery and longer duration technologies like hydro-pumped storage. Focusing on grid-connected utility-scale battery installations, some 650 GW were forecast for 2030 after battery costs have fallen sharply over recent years.

What's next? Annual additions for front-of-meter batteries are set to exceed 50 GW for the first time this year, up 34% from 2023, Commodity Insights analysts said in a September 2024 report. Annual additions would rise to 100 GW in 2027, with Chinese demand accounting for over 50% throughout the forecast.

GSF’s Portfolio

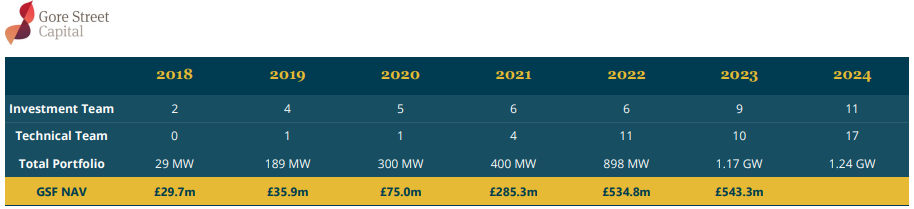

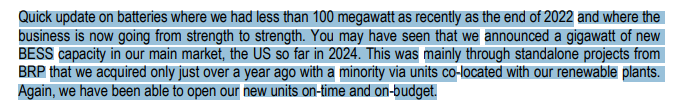

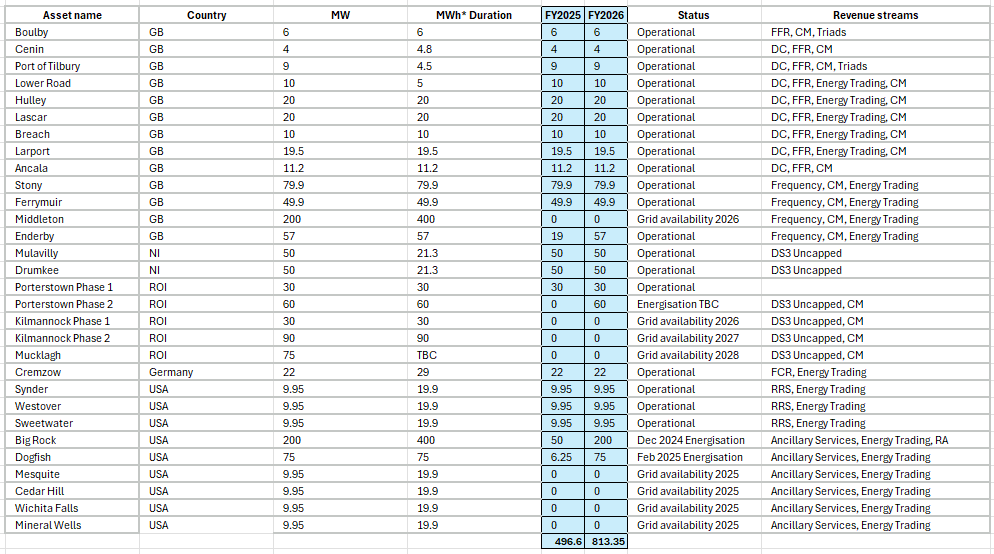

GSF has grown its portfolio from a lowly 29MW 6 years ago to 753MW by next February with a further 494.8MW in preconstruction. 0.75GW is enough energy to power 2m homes for a year.

Ignoring the spike due to the Ukraine war, UK retail electricity prices are about 50% higher than 2020 and forecast to be at £1,928 from January 2025. Ireland, Germany and California are no different. Only Texas offers inexpensive electricity at a retail level, yet even there a winter and a summer brown out was experienced in recent times. Prices were cheap until they suddenly weren’t.

A further simple truth is that power consumption is rapidly growing. Crypto is part of the reason for that. AI is another. Reshoring of manufacturing another. Population growth and migration another. General electric cannot build out gas-powered generation fast enough to meet demand according to their latest update and nuclear faces the same delays. Coal comes with its own issues and is being phased out in Germany and Ireland, is history in the UK and certainly California are not supporters of coal either. Texans? No comment.

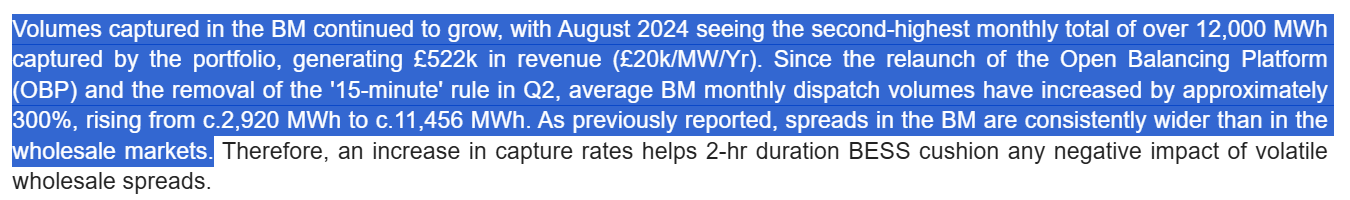

GSF is not the only BESS firm listed in the UK. Another operator (which I covered in “you cannot HEIT me”) Harmony reported last week that it had earned 300% more via ancillary services in the UK via the Balancing Mechanism. The read across for GSF should be obvious.

But also HEIT’s trading revenues were up 38% in the quarter to October vs the prior Qtr.

But finally HEIT which also traded on a 50%+ discount but now doesn’t since it announced it is looking to offload some or all of its assets - and have a number of offers. More to follow and HEIT is up Friday and today on the update.

-

Considering BESS in Texas

There’s not just a positive read across other UK listed companies but look at asset build out levels too. If you consider GSF’s fellow operators in Texas too. There is a rapid roll out of BESS. It’s not just GSF installing BESS just to be weird and lose 50% of their net asset value on some fool’s errand.

France’s Engie is a global energy player and a big part of the growth of Texas BESS. Two thirds of Engie’s profit growth came from its Renewables division in 3Q24 which includes BESS and Engie has seen it worthwhile to add the equivalent of 133% of GSF’s entire portfolio since the start of 2024.

Engie tell us in their latest investor’s update how BESS is a key capability and how that part of their business is going from strength to strength.

Or should be consider GSF’s fellow operator Plus Power who successfully raised $1.8bn one year back to build 2.7GWh of BESS supported by Goldman, Deutsche Bank, Siemens, Bank of America. That is 1.87GWh per £1bn worth of investment.

Consider that GSF by comparison has 0.75GWh capacity for £0.265 bn - that’s 2.73GWh per £1bn worth of investment at today’s market price - implying a 50% upside to GSF compared to the investment made into Plus Power - by some leading global investors…. and that’s leaving aside that GSF offers assets across 5 countries and a mixture of assets compared to a focus on Texas and Arizona with Plus Power. Oh and you get 0.5GWh preconstruction in the price for free too with GSF.

-

Or Hunt Energy who received $225m back in August 2024 to deliver 350MW. That’s 1.95GWh per £1bn of investment. Again, GSF is much cheaper by comparison, at today’s market cap.

-

Bloomberg reckons (based on ERCOT data) that despite a build out of storage that Texas will see brown outs in the next few years. That doesn’t appear negative for prices despite others joining GSF at the party.

Much of the power build out is Solar and the need (as opposed to option) for storage grows from virtually zero to a daily necessity by 2030 as the salmon blobs show.

GSF speak to this also where it shows its EV/EBITDA and P/E lies much below its peers. On other words cheap.

GSF Progress:

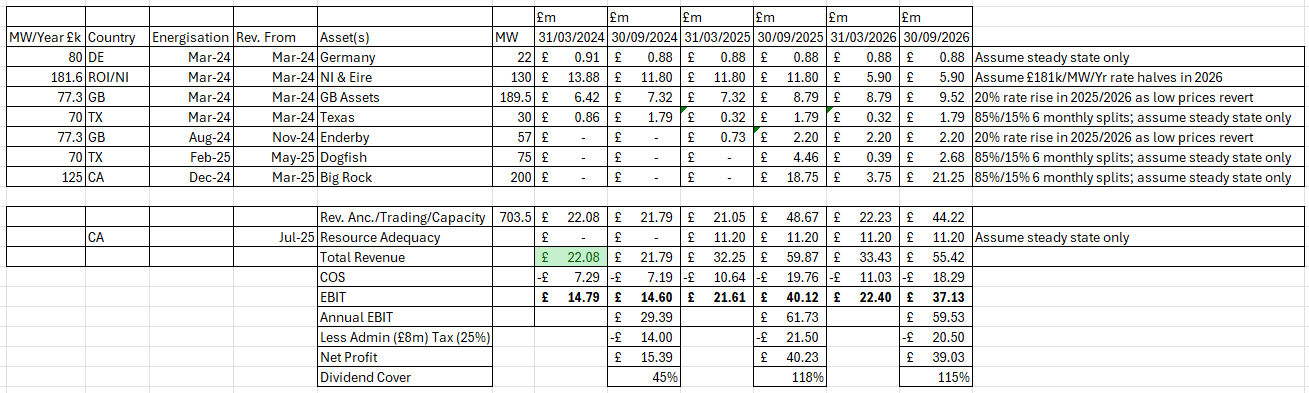

Enderby was energised and was granted a go ahead from Ofgem 1st November but let’s assume 3 months to 1st revenue (February 2025). Its Dogfish and BigRock assets come online shortly too - Big Rock this month and Dogfish in February so let’s assume March 25 and May 25 to be conservative.

I have revised down my profit model since Texas rates in 2024 have been much lower than 2023. £70k/MW/Year is now assumed (from £200k/MW/Year previously).

We see a circa £40m profit within the current financial year and a fully covered dividend* with some fairly conservative assumptions applied and an opportunity for upside. For example the above assumes zero money from the IRA in tax credits ($60m-$80m).

The IRA tax credits offer 30% subsidy to “front of meter” capex. The credits would apply to upgrades made to US sites from 1 hour to 2 hour also but also to any pre-construction assets - assuming Trump does not succeed in over turning the IRA. I have set out detailed reasons why I believe this will not be the case and noticeably nothing has been spoken about since his win towards doing this. In fact the WSJ tells us that Republicans say not so fast.

With 220 votes vs 215 Democrats the Repubicans admit change will be “super challenging” and dissenting Republicans will “get their priorities”. Sounds like tax breaks via the IRA are safe to me.

Valuation

At 20X earnings of £40m GSF would sell for £800m. That would be at a £273m premium to its NAV. Could the likes of Engie or similar acquire? Clearly HEIT’s prospective experience is yes, that’s a possibility. Could a large energy user acquire even just to acquire the strategic storage? Again yes, possibly. If Texas really is heading towards shortages as Bloomberg NEF suggest then GSF’s assets are going to be sought after.

The NAV, meanwhile, is £527m so putting GSF at a 49.5% discount to its NAV. If you agree the £40m net profit then it is at a miserly 6.5X its 2025 earnings - too cheap.

Too cheap and then you need to consider upside potential.

*Downside Potential

It’s worth including in this the fear some have that some of the 7p dividend will not be paid. That GSF will renege. Nothing is certain it’s true but there is a large amount of headroom in its available cash and it recently reaffirmed its commitment to pay this year’s dividend in full. Make of that what you will.

GSF have a good track record of paying up and keeping their word on dividends.

Upside Potential:

a/ Further resource adequacy contracts, such as for Texas.

b/ Upgrades of capacity from 1 hour to 2 hours driving lower capex and higher revenue through longer duration. Build out of new 2-hour capacity is £600k/MW suggesting my numbers of £250k/MW to upgrade is more than generous.

c/ Future better participation in the UK market’s grid services

d/ participation in the recent UK Long Duration Energy Storage (LDES) scheme and incentives (details still being worked out)

e/ New opportunities in other countries

f/ Either continuing IRA incentives or if its total demise is coming then the timing could still deliver benefits to GSF plus act as a disincentive to build out capacity (since incentives are reduced).

g/ Strong political support in all its other geographies (Germany/Ireland/N.Ireland/UK)

h/ Existing IRA incentives of $60m - $80m. Future IRA incentives (if they remain)

i/ What of the 500MW of preconstruction assets? What value do those have?

-

So as my 6th idea for 2025 I’m fairly excited about where this one can go in 2025. I mean it’s not a speculative zillion-bagger, it’s a GARP stock which should offer a good dividend nad capital return component too.

Churchill said “The farther back you can look, the farther forward you are likely to see.” That quote can apply equally to past and future Energy Trends as well as today’s blood and tears in Gore Street, contrasting against a brighter past and - I believe - future.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

I am substantially overweight GSF (vs. my usual allocation to individual ITs). Far too cheap based on installed capacity and the % of revenues that are fixed. Too much pearl-clutching from the market about historically uncovered dividends, when much of the portfolio was still under construction. (but with GSF in a net cash position, what would be better? Leaving it in the bank?) Once 750MW is fully operational and the US tax credit is in the bank, investors will look back and wonder how it ever traded at 50p.

"Battery energy storage systems costs are plunging."

That seems like a negative to me. The batteries that we're investing in now may be undercut by competition from cheaper ones in the future. This is what has put me off owning battery funds in the past, though I do now own some GSF. (It's also why I own a lot more wind than solar, as wind turbines are not likely to fall in price as fast as solar panels.)