Dear reader,

I last wrote about INOV in “Most Unloved” and I see that Woodford has sprung up again with his views. If he remains unloved, well 13 people don’t think so - giving the unloved once loved Fund Manager a thumbs up on his YouTube channel.

Even the Oak Bloke only occasionally gets more likes than Woodford!

Faint praise.

One of his ex-Trusts (the last remaining?) INOV has voted for a managed wind down. Schroders demanded its euthanisation. 98% of shareholders obliged. The OB was among the 2% dissenters.

Why’s that?

Schroders have done a good job but the legacy elements of the portfolio have dragged it’s true. The 2024 results were a fall in NAV of 21.2% and 97% of that fall was ex-Woodford picks. Some crashed to zero because they simply needed more cash (growth capital) and the environment is not conducive - Reaction Engines being a notable example - despite having valuable technology and IP. Reaction were working with Rolls Royce and BAe on a jet engine that can switch to being a ramjet. To the non-technical that is an engine that works with and without gaseoous oxygen. Such an engine would be useful for spacecraft launching like an aeroplane and then switching to ramjet at high altitute. This project goes back decades and was called HOTOL.

How much Woodford is left to crash and burn?

2025 is more chipper. 1Q25 (31st March 2025) NAV per share increased to 21.86p, an increase of 9.6% relative to the NAV per share as of 31 December 2024 (19.94p).

That’s an NAV of £176.8m

As we can see above the 31/3/25 valuation contains a number of holdings lower than prior 31/12/24 and 30/06/24 valuations - marked in red. Some exits by going bust marked “BUST” in the final column.

But some green too - marked in green. Among those some exits of Anthos and Kymab via Sale. More on those later.

The Balance Sheet per “Official”

The above holdings totalling £126.4m break out into Life Science, Venture and Growth. There’s £50.4m of “cash like” holdings worth about 6p a share and you are likely to get that or part of that in the near term. Potentially this month.

The discount to NAV once you strip out cash-like is

There are particular holdings I’d call out:

Statement 1 - Atom Bank is worth (at least) its NAV £23.1m.

INOV’s largest holding is Atom Bank. This is the UK’s first bank built exclusively for mobile. It aims to redefine what a bank should be, making things easier, more transparent, and better value. Atom Bank currently offers savings accounts, mortgages and business loans.

Atom Bank is on the cusp of releasing its 2025 report (which I’m anticipating to show strong results) but for now using its last 2024 annual report for the year ending 31 March 2024 the recap is:

32% growth in net interest income (from £76 million to £100 million)

Net interest margin remained stable at 2.8% despite pressure on spreads within the residential mortgage market

Deposits grew by 14% from £5.7 billion to £6.6 billion

Loan book grew by 39% from £3.0 billion to £4.1billion

Operating profit grew by 575% from £4 million to £27 million, primarily due to the loan book growth

More recently we can see a 93% customer satisfaction score:

The valuation of Atom Bank based on a £100m fund raise in November 2023 with ToscaFund and Spanish bank BBVA at a valuation reduced from £435m to £362m. INOV owned 7.28% following this and marked down its valuation by £8.6m. Eagle Eyed readers will spot that 7.28% of £362m is actually £26.4m.

So this is held at a £3.3m discount to its last valuation.

Or considering Atom Bank’s balance sheet (a nefarious thing to do for a bank I know) £402.4m Equity at 7.28% ownership equates to £29.3m, so INOV’s valuation is at a £6.2m discount to its NAV. Or excluding intangibles of £41.6m then £360.8m NTAV at 7.28% is £26.3m so the valuation is at a £3.2m discount to NTAV.

Intangibles are probably worth worth than £41.6m by the way - in my opinion. To evidence that statement what price should you put on a +88% NPS? The next best “big bank” is First Direct which has a +63% NPS? Look at their brand credentials - £41.6m is a bargain for that level of satisfaction and feedback.

Bain & Co have some ground breaking research that a bank with a high NPS means customers tend to buy more stuff, are less likely to defect and more likely to recommend. Well I never?!

Statement 2 - Revolut is worth (at least) £14.6m.

INOV’s holding is valued at Revolut being worth $42bn. The valuation was uplifted in 2024 from a (ridiculous) £8.7m valuation based on a $24.4bn valuation. The original £11.75m or $15.25m holding itself was based on a $33bn valuation which is a 0.046% holding so of course tiny.

But consider the recent secondary share sale which provided liquidity for Revolut employees to sell (successfully) at a $45 billion valuation.

At a $42bn valuation there is £1m hidden in INOV’s £14.6m valuation.

Why is Revolut worth $45bn or more?

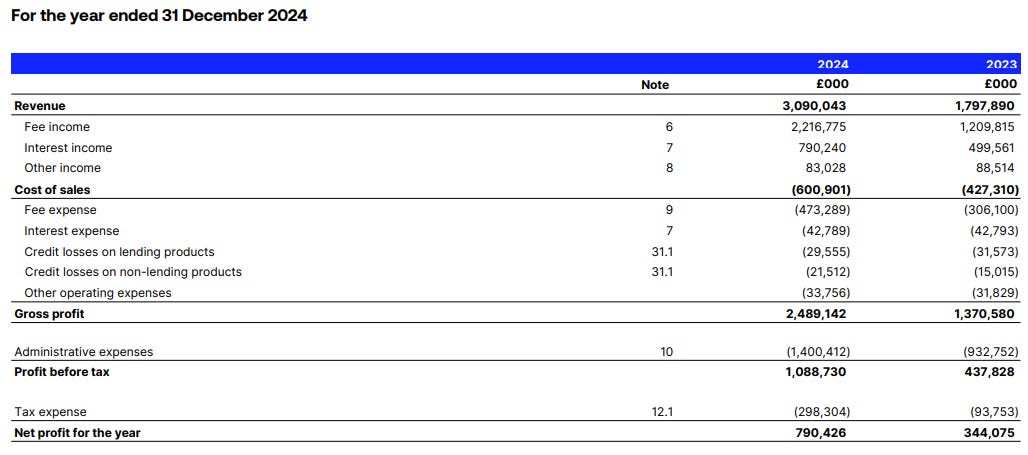

Revolut, according to its 2024 accounts grew its customers well beyond the 50m milestone that I covered in November 2024.

In late 2024 Revolut gained 2.5m more customers in what 7 weeks up to 31/12/24?!

Customer numbers were up 38% on 2023.

It’s not just volume of customers the depth of the base is growing even faster - up 52% to £1tn in 2024.

Revenue up 72%. Wait, what? Customers have parked £30.2bn of funds, transactions up 59% and net profit up 130% to £0.79bn.

Wait what? That’s a P/E of 43X. If it grows by another 130% in 2025 that P/E drops to 18.7X and another 130%? That would be 8.1X P/E in 2026. If that’s possible then that’s decidedly cheap.

“Surely such growth isn’t possible” the detractor blurts.

“So how do you explain 2024?”

“Erm”

Revolut say they are off to a great start. The Chair says this:

The CEO says this:

Consider that Revolut was the most downloaded Finance App in 2024 in many parts of Europe or #2 in some; it still has plenty of market to penetrate. Notice the USA and Asia remain unconquered targets for Revolut.

Consider that Revolut isn’t just “a bank” it’s a software subscription service and that element is 14% of revenue and growing fast.

Revolut fosters a culture of innovation with its people and through its dedicated “New Bets framework”. This internal program empowers employees to act as entrepreneurs, identifying and developing novel products, capabilities, and functionalities.

The framework operates on a VC-inspired model, where Revolut strategically explore multiple promising initiatives with limited upfront investment, allowing it to rapidly test, iterate, and scale the most promising opportunities.

As Revolut continues to expand its global footprint and product offerings, the risk of increased complexity and slower development cycles arises. The New Bets department ensures that promising initiatives are risk assessed whilst moving efficiently through development and launch, maintaining the high-velocity product development that has become its hallmark. This approach allows Revolut to maintain an agile and forward-looking product pipeline responsive to changing market conditions and customer preferences.

Examples of initiatives that have gone through our New Bets framework include RevPoints, Revolut X, eSIMs, Robo-Advisor, Flexible Cash Funds, among others

Revolut’s Accounts

The growth in gross margin is very encouraging; 76.2% grew to 80.5% in 2024.

Revenue streams

#1 Interchange fees

Revolut earns a small percentage from card transactions whenever users make payments using their Revolut debit or prepaid cards. This fee is paid by the merchant, not the user. As transaction volumes rise so does revenue.

#2 Subscription plans

Revolut offers Plus, Premium, Metal, and Ultra plans, providing perks like higher withdrawal limits, travel insurance, cashback, and airport lounge access for a monthly or annual fee. Subscription revenue ensures predictable recurring income.

#3 Currency exchange

While Revolut offers free interbank exchange rates on weekdays, it charges a markup on weekends and for high-volume transactions, generating revenue from forex conversions.

#4 Crypto and stock trading

Users can buy and sell stocks, cryptocurrencies, and commodities through the app. Revolut earns commissions, but also benefits from spreads and charging withdrawal fees, making it a key revenue driver, especially as trading grows. A picks and shovels play on Crypto without taking the risk of Crypto.

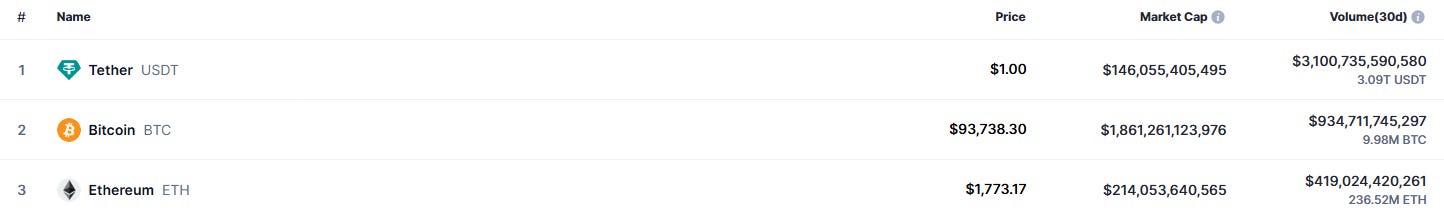

Using Data from https://coinmarketcap.com/ for 30 days of trading of the top 100 Cryptocurrencies is $5.1tn. The top 3 below account for $4.4tn. The market cap is $2.9tn so if those numbers are true 166% of Crypto is trading each month. That’s a shed lock of picks and shovels!

#5 Business accounts

Revolut Business offers accounts tailored for companies, freelancers, and entrepreneurs, providing features like multi-currency payments, corporate cards, and expense management. Revenue comes from monthly fees and payment processing charges.

#6 Lending services

Revolut generates income from lending products like personal loans, credit lines, overdrafts, and BNPL (buy now, pay later) services. It earns through interest charges and loan fees, similar to traditional banks.

Revolut’s Revenue by Geography

It has achieved a strong outcome in the UK but when you look at its footprint and growth it has plenty of runway in the rest of Europe and beyond.

Revolut Comparisons

Lloyds Bank is roughly a $45bn market cap too - same as what I believe Revolut is worth. Its net EPS is roughly static over 5 years, revenue static over 5 years. It’s true that it has achieved a ROE of ~10% over 5 years. It pays a decent dividend. But it cannot boast growth, and growing profit.

Revolut with 52.5m customers at 31/12/24 (compared to Lloyds 26m customers and that number is static over 5 years too). It’s not just customers which are growing at Revolut but transactions per customer too. 52% growth at Revolut. Lloyds has a much lower 13.6% ROTE, earnings growth drops Revolut’s FY26 P/E to about 12X (on a forecast 2026 revenue of $9.3bn according to the WSJ and $100bn by 20240) implying a potential 300%+ valuation upside by 2026 to its $45bn market cap.

Comparing it to a traditional bank fails to capture the difference with Revolut: $300m of revenue will be generated through advertising by 2026 for example. Also considering that Revolut is as much a software as a service (SaaS) company as a Bank then $45bn starts to look extremely reasonable even extremely cheap - if you believe the growth is sustainable.

In 2024 it was. And then some.

Wise Plc is another comparison to Revolut - and probably a better comparison than Lloyds. Wise has delivered similar revenue growth (at a lower profit than Revolut), and is valued in public markets currently at 31.2X earnings and its share price has approximately doubled in the past two years.

$65bn Valuation

The FT announced on July 10th that London-based challenger bank Revolut is in talks to raise around $1 billion in primary and secondary funding in a deal that could value it at $65 billion.

US investor Greenoaks is said to be in discussions to lead the round. Abu Dhabi’s Mubadala is among other investors likely to participate. It was reported that the sovereign wealth fund is looking to acquire a $100 million stake in Revolut through a secondary share sale. This would be the second time in less than a year that Revolut has pursued such a deal. In August, the company was valued at $45 billion following a secondary share sale led by Coatue, D1 Capital Partners and Tiger Global.

If that upround goes ahead then that equates to an £8m upside for INOV and values its £14.6m holding at £22.6m. That equates to 1p per share pre Tender offer and 1.26p per share post Tender offer.

STATEMENT #3 - ANTHOS milestone

The NAV does NOT include all the potential milestone payments agreed with Novartis.

After the year end, two disposals were announced; Anthos Therapeutics has agreed to be acquired by Novartis for an upfront purchase price of $925 million and a potential additional $2.2 billion of regulatory and sales milestone payments; and Araris Biotech by Taiho Pharmaceutical for an upfront purchase price of $400 million, with the potential for additional milestone payments of up to $740 million. The Company's share of the upfront payments is approximately $2.8 million and potential for $24.3 million, respectively.

STATEMENT #4 - ARARIS milestone

The NAV does NOT include all the potential milestone payments agreed with Taiho.

Schroders Capital was among the first investors in Araris as part of its CHF 2.5m seed round in 2019. In October 2022, the Company made a CHF 3.0m (£2.6m) investment into Araris, to support the further development and advancement of Araris' ADC candidates, created using its proprietary linker technology. The upfront will generate a distribution of approximately $24.3m (£18.7m) at closing (7.2x upfront gross multiple of invested capital ("MoIC")), and potential additional distributions of up to $43.6m (£33.7m) subject to near and long-term milestones (20.2x total gross MoIC).

Based on the valuation implied by the up-front purchase consideration, near-term milestone potential and accounting for specific closing adjustments according to the Company's valuation policy, the estimated value of its holding would approximately be £19.5m. This represents a positive valuation revision of £16.7m compared to its last published carrying value of £2.8m as of 30 September 2024. The overall impact on the Company's net asset value will be evaluated as part of the Company's 31 March 2025 net asset value publication.

The full upfront proceeds from the sale are expected to be added to the previously disclosed intended initial return of capital, increasing the total from approximately £10 million to £28.7 million, and hence the initial return of capital will take place shortly following the receipt of initial proceeds from this transaction.

Statement 5: Carmot was a 3.2x MoIC Return

Adding the 5 Statements to the Balance Sheet

The potential distributions represent a potential 8.3p lift to the balance sheet. The sheer scale of what was achieved given the depressed state of the Biotech sector makes INOV actually a stand out performer (go and check BIOG, WWH, RTW to see what I mean). NOWHERE is that recognised in this vastly depressed share.

If we strip out cash then you actually get to a 72.9% discount assuming you agree that contracted milestone payments (which of course are based on performance milestones) will occur. I’ve not attempted to factor in a DCF since I don’t know the timescale - however the milestones are not inflation adjusted either so as the value of money falls then the ease by which milestones are reached increases.

NB: The above Revolut $45bn is potentially superceded by news that a $65bn upround is “in talks”. The discount to NAV rises to 59% and discount ex cash rises to 73.9% if that goes ahead and if the upside is £8m not £1m. (Based on a $65bn holding).

Otherwise this revised balance sheet is merely taking the last March 2025 NAV plus the 5 statements.

I’m ASSUMING ZERO GROWTH to NAV.

There is no assumption being made that the 3 AI companies growing in valuation by circa 100% a year shall continue.

No assumption that either Revolut or Atom could be worth more than their read across historic valuation.

RISK

If you strip out the holdings where you have recent (June 2024 onwards) positive proof points of growth, success and upward valuation then the remaining holdings total £51.1m. I’m not saying these are 100% bad, in fact they probably aren’t. (The wobbly ones can only go bust once)

But you could write off a further proportion just to be safe.

You might take the approach to apply an -80% to Woodford (appreciating that these have been severely marked down already) that’s a -£15.9m provision against 5 companies (Cequr, Federated Wireless, Econic, Genomics Plc and Industrial Heat)

Don’t forget that Woodford winners offer potential. Nexeon is up in 2025. It is shortly commencing its deliveries of silicon anode material fulfilling a binding supply agreement with Panasonic. That event is likely to generate an uplift to NAV.

Federated Wireless offers Wireless As A Service to US government agencies and businesses providing secure and high speed access. It is continuing to commercialise its offering and has military customers (US Marines). Defence stocks have been re-rating upwards and protecting comms against unfriendly ears is a high priority.

Genomics is commercialising a data service for the NHS and other overstretched health services to profile patients according to risk scores (aka a stitch in time saves nine). Genetic medicine while out of fashion promises a new era of personalised, but cheaper healthcare. This could come back into fashion.

So while you could pessimistically and arbitrarily write off a further -£15.9m worth of ex-Woodfords because it says “Woodford” is a baby and bathwater throwing moment.

What about Schroders £31.5m of holdings that didn’t rerate upwards? Deduct -10%? That’s -£3.1m. So a -£19m assumed discount total.

That gives a 15p per share upside even after you’ve had the 12.95p ask price paid to you (27.95p total)

Or 30.25p per share if you consider the -£19m deduction unfair.

Of course fair value is more than 30.25p per share if you believe ANYTHING can uplift further - y’know like a challenger bank with knockout customer satisfaction, 3 AI companies growing in valuation at 100% per year, a $45bn fintech growing at 53% per year.

Thoughts on Life Science

This chart from 2024 draws my eye. Compared to back then Carmot, Anthos, Araris and Kymab have all since scored a six.

That’s during a time when Biotech holdings were in a very depressed biotech market (albeit where for a while I’ve maintained that the majors must replenish their pipeline).

iOnctura, Memo, A2, Epsiliogen and Cequr are 5 holdings worth £11.4m that could also still score sixes too. It’s true ex-Woodford’s AMO Pharma was bowled out for a duck. But that’s a strong batting average.

Interesting to see Cathie Wood reporting on a high-profile FDA roundtable led by Secretary Robert F. Kennedy, Jr., in which regulators outlined plans to establish a new conditional approval pathway for rare disease therapies. Ark expect the shift to shorten traditional development timelines, lower the barrier to market entry for high-impact therapies, and accelerate patient access to potentially curative treatments.

Artificial Intelligence

£18m across three AI investments so secret that two of the three are only known by their Roman Numerals.

a/ Securiti – the pioneer of a centralised platform that enables the safe use of data with generative AI covering security, privacy, governance and compliance.

b/ “AI Company I” (MMC SPV3) - an early leader in an emerging segment of AI software.

c/ “AI Company II” – a privately held company that provides high-quality data curation services for generative AI models and application developers.

Given the buoyant environment for AI it’s hard to think we will see no upside on the realisation of these.

Conclusion

Credit where credit is due.

Schroders have picked some corking stocks so no wonder I voted against euthanisation. I shall follow wherever the managers go after INOV and probably buy into whatever they do next. Presumably a Schroders Trust or Fund.

If you want to own holdings that have the proven capability to deliver a knockout performance but that are so unloved that even 98% of their owners hated them so much to vote for their termination and meanwhile most commentators are blind to their potential - well the opportunity for outperformance in my opinion is extremely high.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Tender offer announced of up to £31m at about 21p.

https://www.londonstockexchange.com/news-article/INOV/circ-re-tender-offer/17093496

Just listened to the 2024 Annual Results presentation at https://www.schroders.com/en-gb/uk/individual/funds-and-strategies/investment-trusts/schroders-capital-global-innovation-trust/ and it seems they chose to wind-down the Trust because buy backs failed to reduce the stubborn discount. Not quite sure what they were expecting, given the vast majority of private equity trusts are on 35% plus discounts. Added to their woes I suppose is that the market cap of £102m makes it sub scale.

The question is I suppose how long will it take to wind it down and what's the lost opportunity cost of waiting?