Dear reader,

I wanted to keep my non-nanopore thoughts separate.

First of all, here’s a current view of IP Group assets.

So we see a 58.3% discount to to NAV at year end due to a further price erosion in ONT, discussed in Part 1. Yet NAV is still at a 56.5% discount as at 15/03/24.

I have already discussed the portfolio of IP Group in introducing, and done a life-science deep dive in my article IP-cress, and the 10+ inflection events coming in 2024 and 2025, so my commentary here is more around the health of IPO itself rather than market opportunity.

Debt is fixed at 5.3% and repayments begin and are largely offset until 2027.

Quoted (publicly listed) amount to £203.8m and cash and receivables gross amount to £236.50. At today’s market cap of £449.50m stripping out assets and listed, the private portfolio is a remarkable 98% discount!

We see 3/4 of these private assets are either revaluing at their fair value of higher in 2023. There is an increase to down rounds year on year from 10% to 24% which comes at no surprise whatsoever, given the horrific UK market conditions, inflation, supply chain and war.

But the fact that majority are actually uprounds is very encouraging.

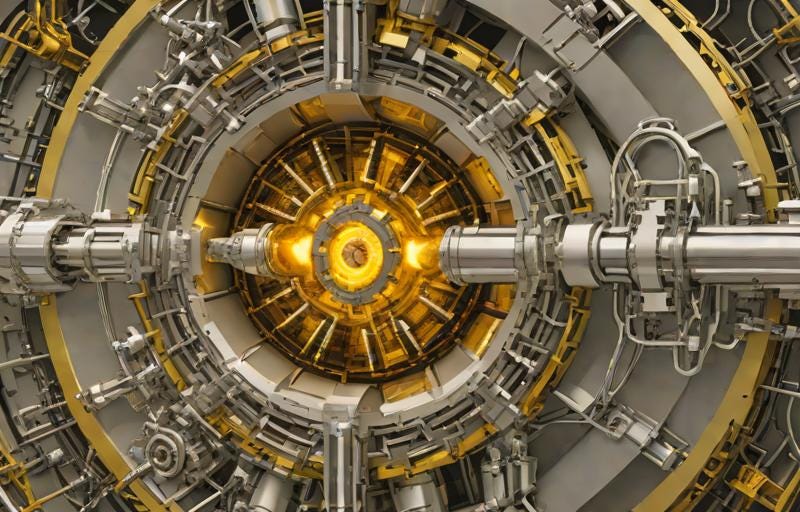

I would also draw your attention reader to First Light Fusion:

First Light Fusion, which had successfully achieved fusion in 2022, has not yet completed a planned funding round given market conditions and, as a result, we wrote down our investment by £49.6m, or 43%, essentially reversing much of the unrealised gain recognised in 2022 following their announcement of achieving a fusion result.

So the write down is not based on commercial progress nor on technical failure but simply reflects the poor investment environment. Harsh. But reader, did you know that investment into nuclear is forecast to triple?

So is that £49.6m write down emminently reversible? (Or arguably “not real”)

Remember reader, the market believes IPO’s 27.5% stake in First Light is worth 98% less than book. Which at the remaining £64.9m valuation is just £1.3m according to the market.

£1.3m to own over a quarter of a key company in what the Fusion Report thinks will be a $40 trillion market by 2040.

I’m not saying First Light will corner that $40 trillion market but we are talking about a 6 million bagger to that £1.3m if it did.

Fusion would displace nuclear fission since it is far safer and potentially limitless. I say potentially because it remains an aspiration technology. But FLF has made a number of breakthroughs including for the first time to produce more energy than you consume (in initiating fusion). You need to create incredible amounts of gravity to achieve fusion - and that requires energy.

Life Science revaluations

We, again, see write-downs resulted from independent valuation reappraisals informed by the more difficult funding and pricing environment

So no actual negative commercial or technical reason apart from Oxular. In fact focusing on Hinge Health, Business Insider reckon they will IPO in 2024 although they have $400m in the bank so “don’t need to” (to raise funds), Hinge will be cash generative in 2024 and is growing fast. Why? It is leaning in (pun intended) to a growing market of tackling illness.

Hinge Health is moving people beyond pain by transforming the way it is treated and prevented. Connecting people digitally and in-person with expert clinical care, we combine advanced technology, AI and a care team of experts to guide people through personalized care directly from their phone. Our approach is proven to reduce pain by 68%, prevent 42% of new opioid prescriptions, and avoid more than half of joint replacement surgeries. Available to 18M people (in the US), Hinge Health is trusted by leading health plans and employers. It regularly delivers 2X ROI to insurers and health plans so is approximately doubling turnover year on year (although there are no accounts to examine to prove this).

Their last funding round in 2021 valued them at $6.2bn and they are undisputedly far further forward in three years. Could it IPO at $10bn-$12bn? Or more?

Yet IP Group values its 1.8% holding of Hinge at £34m (reduced from £51.4m due to those “difficult funding” conditions. £34m for an $111.6m (£87.8m) holding. Or £175.6m at a $12bn valuation.

But remembering the market thinks a 98% discount is appropriate for IP Group’s private investments like Hinge you can buy its 1.8% holding for £680,000 and potentially be sat on a holding worth £175.6m.

Compared to FLF this only represents a 258 bagger.

Hysata

Of course it’s not all pseudo-bad news. Hysata for example, tripled in value to £70m (which you can buy for £1.4m as this is a private asset too)

Hysata are making astonishing progress in electrolysis. Electrolysers convert electricity into hydrogen. Hydrogen is a fuel which can be used for pretty much anything, steel making, flight, fuel cells and has some useful characteristics which can replace metallurgical coal, naptha and other fossil fuels.

Trading Energy: Spain is a typical country which is investing in renewable energy generation. 19GW in 2022 and 76GW by 2030. And 28GW of wind.

What becomes apparent looking at Spain’s spot electricity is that there are times when power is almost free. While interconnectors and export via cable is one way to deal with that power, an electrolyser is another.

There are lots of countries where the success of renewables pioneered by countries like Spain (and the UK) can be replicated. South America, SE Asia, Africa and the Indian subcontinent are ripe opportunities.

Not forgetting the USA of course.

Specifically its Inflation Reduction Act expanded tax credits for renewable electricity and clean hydrogen. From 2023 can receive a production tax credit of 2.6 cents per kWh and up to $3 per kg of clean hydrogen, respectively, for the first 10 years of operation.

If you can produce renewasble energy at 3.5c essentially the net cost is 0.9c after subsidy so $0.37 of renewable electricity makes 1Kg of Hydrogen where the competitive fossil fuel price is $1.50-$2.00/Kg.

Meanwhile growth projections according to Precedence are exciting too.

Growth is exciting and owning 36.8% of a company uniquely positioned could be quite exciting! Hysata has a current £190m valuation, and IPO own 36.8% of that.

But if we saw Hysata at a £0.5bn valuation on the basis of 2% market share of the FY27 market size would be $2.22bn. Hysata would have a £171m turnover and at a 15% margin £25m using a PE of 20X gets me to £500m. 36.8% of that is £184m.

£1.4m to £184m is only a 131 bagger this time.

Buy Backs

I was delighted to read the focus will be on buying back stock at current discount levels rather than paying dividends. Last year there were £13m of dividend. This as a buy back would rebuy 2.7% of shares and increase NAV/share by 6.6p. If more than £13m can be directed at buy backs then the effect will be even more pronounced.

Conclusion

98% discount excluding cash and listed makes no sense and offers a great opportunity in the three areas of life science, deep tech and clean tech.

The upsides here appear numerous and exciting.

This is not advice.

Oak

I would guess the market values these private companies so low is because, generally, they are high risk and despite maybe having ground breaking technology they often fail. Commercial fusion is still way off in the distance (I’d say even 20 years is optimistic). Out of all of them Hinge looks like a decent prospect, especially as they are in the US health market which is huge and awash with money!

Hi OB, hope you are well. Thanks for your details on IPO; I have been a long term fan of their thesis, to commercialise scientific research, and truly believe they are an astute bunch; but I've turned cold on them, not because of an ignorance that what they do requires patience for fruition, inherent concern of their investments, because I fundamentally disagree on one of the strands you purport to illustrate focus - buybacks. IPO answers to questions in their presentation, showed an aloofness and disconnect. In explaining their decision of buybacks over dividends, they highlighted this reflected investor feedback, name checking RPS (their major shareholder) and PHNX (a major cash I hector investor). Despite, have a various and respected shareholder register, this spoke to me of a complacency. Yes, to other (small) investors, but that because their major shareholder, and their current major financial inputter where happy, they didn't need to focus with ANY urgency on fiscal return of their commercialisation. Whilst at such a NAV discount, buybacks are obviously accretive, frankly when you are at an 80% discount gaining 5 base points on that, pushed forever down the line to realisation, deflated investors like me, that are happy to be patient, happy to ignore short / medium SP drops, but want some crumbs to feed our patience/believe, that IPO's purpose is to make money whilst making life enhancing investments. Without those crumbs, the tunnel vision of only considering your major shareholder/funders, at this point in time, shows a disregard to those who have been, invested, believed, for a long time. It says to me that this is a mgmt that's pandering to such, not for profit of all the shareholders but to propagate the pet projects, careers, of scientists. And I haven't checked the renumeration of mgmt, but doubtlessly that to.

At a very base level, the dividend (,at the previous level), instilled a focus to commercialise and profitise, the buybacks don't because it has a maximum but no minimum, hence discretionary.

Couple of positives - net cash increased. And I think not only will Hinge return profits imminently, but handsomely, and growingly into the future.