Dear reader

An inspiring interview with Leon Coetzer today but listen carefully to the words:

Interviewer “Your revenue will be significantly higher than your market price”

Coetzer replies “Yes absolutely”

True/False - True.

The revenue according to my model would be £196m and the market cap is £163m. So we could quibble whether 20% more is “significantly” higher? We could quibble also whether the ratio of Price to Sales is a relevant ratio to be using to value a miner? I’m struggling to think so. But a forecast of £196m revenue is factually higher than the market price.

But the Interviewer then says: “Within a few months you’re going to be on an earnings ratio of less than 1”

Coetzer replies “What the numbers show exactly that fact”

True/False - False.

If it were true JLP would be a screaming bargain! £163m of post tax earnings would afford a huge dividend, would generate vast piles of cash, and JLP would easily have a valuation above a billion pounds.

According to my model and based on the FY2025 guidance from JLP earnings are estimated by the OB to be $29.5m. So either the share price would need to drop by over 82% from Friday’s 5.2p a share to be at a P/E below 1 (let’s hope not, eh?) or the price of Copper, PGMs and Chrome would need to substantially rise for JLP to be on a P/E of below 1, based on the FY25 guidance.

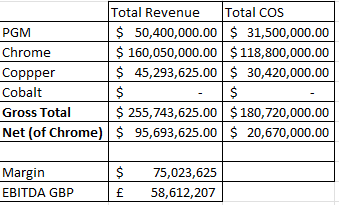

Here’s my model based on the guidance numbers. Arguably the PGM basket could move above a $1400 an ounce average during FY25 (currently they are at circa $1450/oz)

But what my model does show is a £22.3m net profit and a P/E of 7.3 for FY25. That’s at the lowest band of copper guidance. Not being cynical but I’m going with the lower number.

Ok, ok, let’s consider the higher guidance number. At the higher 7,500 tonnes guidance the P/E drops to circa 6.2 on an estimated £26m net profit. That’s based on a $7,700 average copper price. Whether a higher copper price than about 20% below the “normal” world price (currently $9,500 a tonne) could be possible isn’t entirely clear either.

Do I believe the JLP share price will drop 82%? No, I think it was a bit of high spirits and/or a mistake by the interviewer to both propose the earnings could be that, but also for Coetzer to agree with the interviewer. They might need to edit that bit out once the NOMAD realises what was said.

So what do I think?

Copper Production

Whilst the delay in increasing copper production is a little frustrating, it is now growing closer.

The bit which impressed me was this:

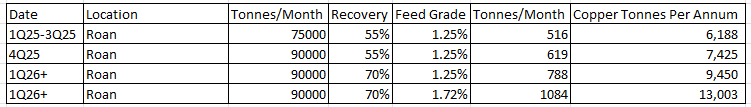

"The integrated Roan facility targets an initial stable feed rate of 75 000 tpm of material over the first three quarters of operation, with the potential to increase to a feed rate of 90 000 tpm thereafter. An initial copper recovery of 55% copper in feed is targeted before the introduction of leaching at Roan which is expected to increase copper recoveries to in excess of 70%. This translates to an initial copper unit production from Roan, prior to leaching, of approximately 520 tpm of copper with the potential to increase to 670 tpm assuming the lower feed rate of 75 000 tpm is maintained."

Hidden in the numbers it what I think is significant news around the measures being taken to improve the recovery of the ore. Assuming “in excess of 70%” only means 70% then we are talking about a >20% improvement through scale up at Roan and another >20% improvement through improved recovery via Leaching.

Roan - here’s how that translates:

This translates to a 9.5kt-13kt production at Roan from July 2025 depending on grade. The piece which made me sit up and listen was Coetzer speaking on Chingola. The same principle (and technological approach) at Roan would apply to Chingola.

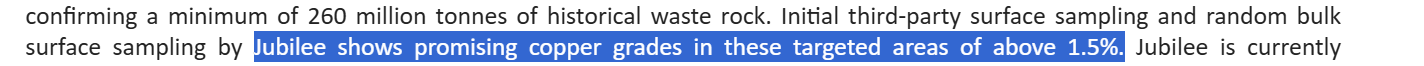

Chingola - the Waste Rock project

Assuming all parties reach agreement IRH would be fronting the capital cost for the JV (estimated at $50m), but applying the same method and assuming “above 1.5%” is 1.54% and assuming 24kt from a Roan v2 plant, at a $4,000 cost per tonne equates to a $3,750 per tonne margin. That equals $27m per annum net to JLP.

Sable

None of the above includes the expanded Sable at 16 000tpa (from 1Q26 - July 2026).

We don’t precisely know the cost of production at Munkoyo and Project G although I suspect with 3%-4% grades there must be some level of cost economies compared to the FY24 (current) $5,200 per tonne cost of production.

How does it all set up for FY26?

Assuming Sable “in the next 12 months” comes to pass

Assuming Roan is operating at 4.5Kt per half year. (9Kt a year)

Assuming an $11,000 per tonne copper price

Assuming cost of production drops by around 10% through higher grade processing and higher recovery

Assuming the 30% share of Chingola Waste Rock begins 2H26 so 24Kt for 6 months at 30% share is 3,600 tonnes equivalent.

Assuming PGM prices have recovered to a $1,700 basket price.

Assuming Chrome prices have fallen but remain at an elevated $90 tonne (for 40% concentrate)

Assuming Chrome is now 2.2Mt; PGM production is back to 40Kozs.

Obviously quite a lot of assumptions! But all are conceivable and perhaps some could be exceeded as much as undershot so it’s not an altogether unrealistic scenario.

We do see an Price to EBITDA of just over 1 in that scenario!

The P/E meanwhile is 1.8. This would imply a 3X upside minimum to today’s share price.

So for the patient, JLP may well get its days in the sun. I’m actually quite optimistic to that potential future.

Longer term the expansion and scale of handling the vast waste rock of Zambia and beyond almost guarantees a long-term growing trade.

But the piece which excites me and which is nowhere in the price is what value can JLP derive from their know how. What know how? JLP have achieved a couple of things no one else appears to have done:

First, a successful extraction of metal from waste disregarded as “impossible”.

Second, a modularisation to scale and concentrate that ore/waste. Success across more than one metal.

Third, the build out of a cash-generative operation which appears on the cusp of moving from investment to harvest, and where the future growth lies in scaling in partnership with the likes of IRH having proved the concept of - and profitably proved - “the Jubilee Way”.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Yup I went heavily in on thx a couple of months ago and have been adding on the bowls, so average price c. 15p.

Oak Bloke

I think your revenue and cost of sale presentation is different between FY25 and FY26

FY26 looks right but FY25 looks to have some netting down in it. Expectations for revenue are north of 200m usd and you have revenue of around half of that. Bottom line looks sensible. Just FYI