Dear reader,

My forecasts in spicy as a JLP-eno for Jubilee were seen as too optimistic. But today’s update shows my forecasts were not optimistic enough, at least for production.

Chrome at 1,548,205 tonnes is a 20% increase and 100kt more than my forecast. Copper at 3,422 tonnes is a 17.1% increase and 56 tonnes more than my forecast.

But PGMs at 36,411ozs is 5% less. To the 30th June PGMs remain at depressed prices, so this is something of a conscious decision by JLP to focus on chrome-rich run of mine.

Chrome after all is at $308/t so focus on chrome is good business. JLP produce a mix of own-sourced as well as 3rd party material (with a fixed margin) so $93 average assumes a greater mix of own-sourced selling at over $300/t, delivering a $96 average price for 2H24 which alongside a $90 1H24 average arrives at the $93 average.

-

Jubilee set new targets for FY25 and increases for Chrome and Copper. The go live for Roan and the copper modules processing previously mined and previously processed materials are a blueprint for other projects. Its design capacity is up to 13,000 tpa of copper units.

This blue print is directly relevant for the Waste Rock Project partnership with IRH.

Production guidance for FY2025

Chrome concentrate production guidance is 1.65 million tonnes (6.7% year-on-year production increase)

PGM 6E production guidance is 36 000oz (similar year-on-year).

Copper units production guidance of between 5 750 tonnes (68.0% year-on-year production increase) and 7 500 tonnes (119.2% year-on-year production increase).

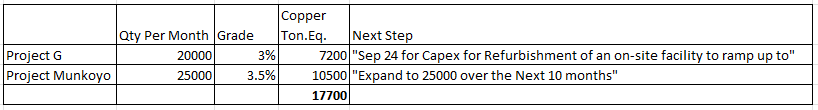

The copper guidance points to growth much lower than I had anticipated and new timelines are introduced by JLP. This is due to Munkoyo and Project G requiring capex and development which will take time.

Despite Sable being operational (albeit with expansion planned to 16Kt), and with Project Munkoyo brought into operation in July with a 3.5% feed, the increase of supply will target 25Kt of material per month and this alone should deliver 875 tonnes a month (10.5Kt per annum), however requires 10 months of development and expansion with $2.25m estimates of capex.

A 2nd Project, Project G is undergoing refurbishment and $2.7m initial capex (with total capex being announced next month) to target a ramp-up to 20Kt a month at 3%-4% grade copper.

As can be seen, once fully operational Sable’s 16Kt capacity will be fully utilised. Until then, concentrate will be sent from Roan to Sable to fill capacity.

But additionally the JV with IRH adds 6Kt for JLP (given 30% attributable) at a cost of circa $4k/tonne (i.e. circa $3.3k margin) potentially adds $20m profit, in the future.

It is helpful to think of production according to 3 stages. The first being the feed or mine, the second being the preproduction which can happen as part of either 1st or 3rd stage (i.e. modules can be located at the mine/feed site, or at the production site), then third the production itself. This is comprised of Copper Cathode produced from the Sable Refinery and Copper Concentrate (25% copper) produced from the Roan Sulphide Circuit. The Concentrate despite being 25% copper is worth less than a quarter of cathode, so refining is preferable.

Returning to FY24 the production outturn now looks like this:

Where a decent £35.4m EBITDA is achieved.

But where estimated below the line costs are likely to deliver a modest £3.1 FY24 net profit. A P/E of 55!

Hidden Value

Considering the business on an FY25 run rate basis the picture brightens. There have been a lot of delays, glitches and issues. There still are to some extent.

Even now, Jubilee speak of a ramp up process and “the next 10 months”.

But FY25 signals a definite improvement.

FY26 and beyond (i.e. 1st July 2025 which is just over 10 months away) shows much, much more.

What is not reflected in the forecast FY24 numbers, and in the broker coverage e.g. Zeus are a few things:

The assets. The very fact it has production capabilities of 25kt and greater is not reflected in the balance sheet. The “NAV” value of JLP is book value and book is the price of buying Sable/Roan with some capitalisation of costs, but in no way does the balance sheet reflect the replacement cost of building another Sable.

Know how. Jubilee have established and proven a “modular” process for Chrome. It is applying that and now ranks a Top 5 global producer. It aspires to become a Top 3 producer and shows all the signs of getting there. The only factor holding it back from doing so (quicker) is capital.

Polymetal Modules. The fact it has begun to prove that it can replicate its success in Chrome into a 2nd metal - Copper - is highly significant too. Copper discoveries and average grades are falling, and exploration is fairly low also by global historical averages. This foreshadows a car crash for copper some time in the future and to be able to scale the efficiency and recovery of copper through its modules could prove significant. Especially as the firm began with 15,000 tonnes/month modules and has worked up to 50,000 tonnes/month modules. Will we see 100Kt and 250Kt modules in time? The proof point around modularising this at Roan could mean Jubilee The Engineering Firm becomes as big if not bigger than Jubilee the waste processor. The market gives zero credit for this. Clearly there’s a great deal of engineering time and refinement required but if this can deliver costs which beat world class FTSE100 Copper producers then that know how has value.

I say polymetal rather than “Copper” because if you can do it for one and then for two metals, how about others? Cobalt is another future car crash (I mean energy transition) metal where supply is concentrated in the DRC and while battery technology has headed in a different direction (LFP for example) that’s not to say Cobalt does not have a future as a battery metal. Solid State batteries are one technology area where it will continue to be needed despite hopes that Sulphides could replace it but with very limited success so far. Its properties make it hard to replace.

Mining. The fact that (apart from the open pit at Munkoyo) JLP does not mine is significant. It typically processes on surface disgarded waste and has proven this approach, and there are vast volumes of waste or disgarded material available at very modest cost (it’s waste) and that require modest costs of production. We haven’t yet seen the full extent of this, but the Gross Margin of copper 1H23 to 1H24 rose by 27% despite the selling price dropping by 3.3%. Antafagasta by comparison has comparable costs per tonne of $5,289 vs $4,554. Just pause and think of all of the economies of scale a monster FTSE100 producer enjoys, compared lil’ol’ JLP. Yet it already outpaces the monster through smarter approach. Once JLP can benefit from further economies of scale, then profitability can ratchet upwards.

PGM rich materials. Stockpiling PGM rich material for the future means when PGM prices do recover JLP will be able to respond with PGM-rich material. This stockpile is nowhere in the price.

Conclusion

It’s the hidden value which I find most interesting. The Q4 production results give a positive out turn especially for Chrome. I remain positive that PGM pricing will begin to improve (and in July/August there’s already tentative signs of this) and also remain positive for Copper’s prospects too. $9,250/tonne is decent but could we see $11,000-$12,000 in the coming months?

So JLP may report profitable but weak FY24 results, and we may not even see a strong FY25 interim result, but the trajectory, growth and know how are what investors should look to. That’s where the hidden value lies. Full year FY25 and particularly FY26 will be transformative. The question will be when the market evaluates that jam tomorrow and realise it’s Jam from Harrods and not Jam always tomorrow.

What’s for sure is at 5.7p the jam is not in the price right now.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Are you confident about the management from an ethical standpoint and their ability to execute on the plans? What has caused the share dilution from 2.1 Bn to 3 Bn from 2020?