Dear reader

Very, very, interesting to note the PGM basket over at the Sylvania family (Ticker SLP) is up by quite a bit for the quarter ending June 30th at a 4E basket price of $1,383/oz and a 6E of ~$1,230/Oz and a Q3 6E of ~$1160.

Fellow PGM producer Tharisa (Ticker THS) reported their 6E basket price for June 30th as $1,391/oz ($1,343 in Q3).

What does that have to do with Jubilee? (Ticker JLP)

SLP have a 6E split of Pt 52%, Pd 18%, Rh 9%, Au 0%, Ru 16%, Ir 5%

JLP have a 6E split of Pt 60% Pd 18% Rh 8% Au 1% Ru 9% Ir 4%

THS have a 6E split of Pt 52%, Pd 16%, Rh 9%, Others (unkn) 23%

The Platinum rich content of JLP means a basket price above $1,300 (at least for and after Q4 ending June 30th) and well above the modelled price I’d assumed.

That’s not all. SLP also speak to Chrome prices now at $350/tonne. At 30% concentrate that’s around $105/tonne.

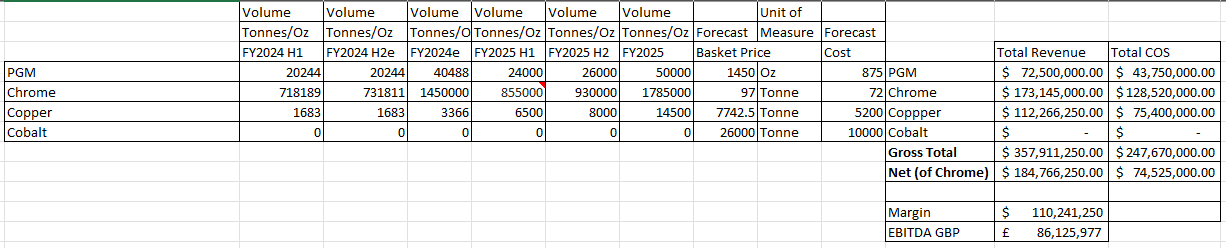

Therefore I move the model to a 2H24 price of $93/tonne ($83 in 1H24), and the PGM/Oz to 1H24 $1020 and 2H24 $1125 both of which I think are conservative. Also the Copper price to a 1H24 price of $6,600 and 2H24 price of $7,750/tonne.

I also note that H2 Chrome of 731kt gets to the 1.45mt “target” but 408kt were produced in Q3 so to hit target would mean Q4 chrome production has to fall by a third.

In other words my model of a £29.5m EBITDA outturn is actually quite conservative.

In other news today the commissioning of Roan completed today, and JLP are showing off what looks like a fairly impressive and glistening set up.

With an FY25 futures price of Copper at $9,500 and a production cost at or below $4,500, with the rapid expansion in Zambia now bearing fruit. Assuming a fairly muted 14,500 tonnes of copper in FY25 (10% below target). Even so, Copper delivers the same profit to JLP in FY25 as the entire JLP operation did in FY2024.

Meanwhile with a modelled $97/tonne average 30% Chrome concentrate price and just a 1.8MTPA output of chrome and a $1,450 PGM basket price, with 50koz of PGMs, profits looks to double over the coming year to June 2025. What’s more the “2 year target” announced last month is to get “well beyond 25,000 tpa” of copper. Could it take more than 2 years? That’s the challenge facing JLP.

The above includes no consideration for the upside from Project Munkoyo, the relationship with IRH, the Waste Rock Project and further expansion towards (and beyond) Chrome beyond 1.8mtpa (the medium term target being 2.1mtpa).

I am forecasting a $1,450 basket in FY2025 which requires PGM prices to continue moving upwards. Chrome at $97/tonne, Copper at a net $7742 (JLP appear to lose 18.5% of the market price) and I assume zero cobalt production. The key assumptions here is the Roan plant’s capability and reliability now it is fully commissioned, the continued copper price, the PGM basket rising in price from a post smelter $1,300/oz in H1 to $1,600/oz in H2, and Chrome remaining elevated too, with some very mild reduction in cost over FY2024.

With a market cap of £183m, I’m not sure the market has realised the sheer scale of change occuring at JLP.

And more to the point, how that translates into pounds and pence. The FY2025 P/E is easily below 3.

Those in the know - like Zambian mine owners at Project M and Project G are selling majority stakes in their operations in exchange for JLP shares. But they are not the only insiders who are seeing what the market hasn’t.

The Directors also are in an open period and recently purchased £66,560 of shares.

Ironically perhaps, Coetzer - unlike the market - is not a statue!

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks for the article. Copper has come off a little but the trajectory appears to be unchanged medium and longer term. I didn't see a video or statement regarding Roan being completed - Are you including Roan and Sable here for 14,500 tonnes copper at an average $5, 200 cost.

You mentioned the market doesn't seem to have realised the scale of the change and that seems to be the case however the broker forecast consensus figures (as per stockopedia) don't appear to be taking them into consideration either, sakes forecast at approx £200m - not sure if this nets out some chrome - and

net profit £17m and on a pe of 9. How do you reconcile these figures? Especially given we're already in FY25?

I'm not sure I'd call it directors filling their boots but it is or should be seen as a positive. Best, Mike