Dear reader,

To those who read last year’s “BETR LINVing” you’ll see poor Uncle Derek is a year older but he refuses to relinquish Auntie Mabel’s hat. He’s decided to cut all ties.

If you’d chosen Uncle Sam and bought BETR then that’d have been worse. You’d have lost -33% of your money. Seems the OB got that one right.

What about LINV? I was pretty positive on that one. Ay caramba! You’d have gained 33%. Double bubble.

So what about LINV’s future prospects. Will this be a LINV-ord Christy in 2025?

Well the Stocko folks in their only commentary on this think LINV is colourless (not good or bad) but commented “Profitable in Sep. Cautiously optimistic re: achieving run-rate profitability during rest of the year”

Hmmm. Let’s try to add some colour to that.

I’m not going to look closely again at BETR but a couple of quick points:

If your name is Betsy I’ve got bad news for you. Your name has been trademarked. Trademarked by BETR.

12 months on there’s suddenly plenty of references to “AI”. Trademarked Betsy it turns out is an AI autodialer we are told that phones oodles of folks to “auto sell” them loans. Really? Bet that’s a really successful sales tool. Hopefully American households will employ an AI-powered voicemail to screen out such junk.

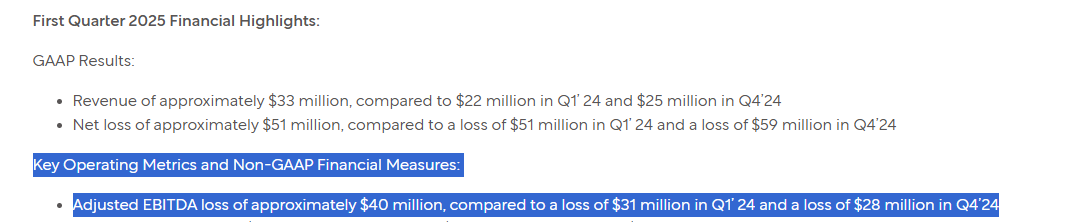

Meanwhile BETR is making large losses - in 1Q25 a net loss of -$51m. The “NAV” of +$44m back at 30/06/24 is now a net deficit value of -$102m as at 31/3/25. Ouch!

Yet incredibly it is today a Market Cap of $218m!! (so £161m)

LEND INVEST Plc (AIM: LINV)

As at 31/03/24 - Net Assets £59.3m; Market Cap last August was £39.5m

As at 30/09/24 - Net Assets £56.4m; today a market cap is around £54m.

LINV’s share price is “up a third” but at a market cap less than a 1/3rd of that of BETR! And a 1/3rd of its past valuation too.

(Hint: there might be some upside. Read on reader, read on).

LINV is a FinTech focused on property finance and BTL (buy to let) and bridge loans. You can see it has attracted a wide range of prestigious partners (and funders)

Key financials from 31/3/24 → 30/09/24 include:

Platform Assets under Management (AuM) grew again £2.8bn → £2.95bn

Funds under Management (FuM) increased from £4.1bn → £4.7bn (at 30/09/24)

Post Period FuM grew £4.7bn → £5.39bn

AuM are the assets earning income. Those can be on or off the balance sheet. “On Balance Sheet” has been renamed “Principal Investments” in 1H25 and this is where you borrow money (i.e. have a liability) and lend money (i.e. have an asset). You earn a net interest margin (NIM). Off balance sheet is renamed 3rd party funds and, well, you don’t borrow money (i.e. no liability), but you charge a fee to a 3rd party and use their money. Typically the 3rd party will be a well-known Bank.

FuM is the pool of money you can use to lend. It is your “dry powder” you might say. So £409.7m is LINV’s money and £1315.2m are funds belonging to 3rd parties.

While direct lending is more lucrative, the danger and risk is that LINV get caught short. This happened in 2024. So LINV have been running this down in favour of 3rd party funds. This is why we see only 5% growth in net interest (which is thanks to higher margins) while we see direct falls of the proportion of “on balance sheet” drop to 19% from 31% - i.e. to £539.1m while the corresponding liabilities fall to -£601.7m

We also see a return to profit in the 6 months to September, well at EBITDA level at least. LINV tell us that the month of September was profitable from a PAT perspective too.

We also see operating expense sharply down which has been achieved through a decrease in headcount.

According to the FCA the UK buy-to-let market is around £32bn per year so LINV have just £0.48bn of that market so LINV is capturing about 1.5% market share. But that number is growing. Data from the FCA show mortgage advances are 50% higher than a year ago but the buy-to-let segment remains flat. The UK B-2-L market is worth about £300bn and LINV have a £2.5bn share which is 0.83%. So winning just a 1.5% new share sounds pitifully small but that is a near doubling of its existing market share (so over time the existing grows to 1.5% as mortgages roll over).

LINV are continuing to target niches such as foreign national BTL mortgages and second-charge lending for residential mortgages as well as a seamless bridging loan to buy-to-let product. No one does such a thing. You take out a bridging loan, then separately you take a mortgage. Despite the negative headlines, the fact is if you are willing to “do it professionally” then being a Landlord is a highly lucrative affair.

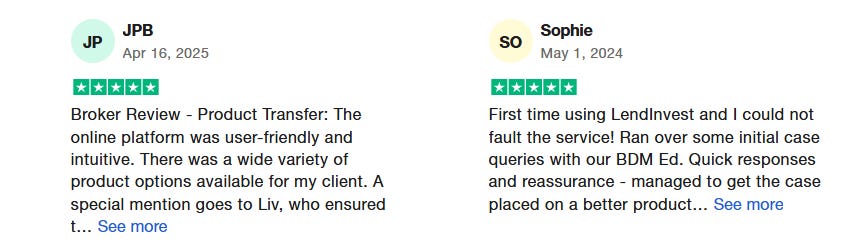

Wannabe Landlord? Another option that LINV offer is to make loans and be part of the FuM. It seems this is quite a popular option. It is interesting however. There are a number of 1 star TrustAdvisor reviews where those loans have had elements of capital loss - so the reviewer blames LINV that the borrower stiffed them. The equivalent of giving your ISA platform a bad review because you bought a share that lost you some money.

If you ignore those then everyone else is pretty delighted with LINV in the reviews.

The ONS tell us in the 12 months to March 2025 (latest data) that average rents increased to £1,390 (up 7.5%) in England, £795 (8.7%) in Wales, and £999 (5.1%) in Scotland, in the 12 months to April 2025. “Doing it professionally” means scaling the operation because scale makes it worthwhile. Scale also means taking on multiple BTL mortgages. Good news for LINV. Once you’ve used LINV to lend or to borrow you tend to re-use them. 850 times according to one reviewer!

The UK needs 227,000 more rental properties a year say USwitch. Landlords getting larger and more “professional” but also new entrants are joining. Judging by the ongoing popularity of books like Rich Dad, Poor Dad and enduring popularity of programmes like Home under the Hammer I’d say there’s still BTL Landlords joining. Landlords require BTL mortgages and Bridging Loans. The Labour government plan to increase housing stock by 300,000 homes per year.

So I do not see the demand for LINV’s products drying up or declining. Planning and land reform could grow development finance; along the commitment to build 1.5m new homes over 5 years. Let’s not forget either that today there are around 1.5m empty homes across the UK, plus plenty of empty Commercial Office space (about 102m square feet). At 75sq.m per dwelling those could be converted 0.15m more homes too. That’s 1.65m homes without building a single new house.

Of course LINV report a “Mortgages” segment, not just a B2L segment. So LINV have introduced a mainstream streamlined Residential Mortgage Proposition and further propositions will be launched in H2, to support further growth in the owner-occupied market.

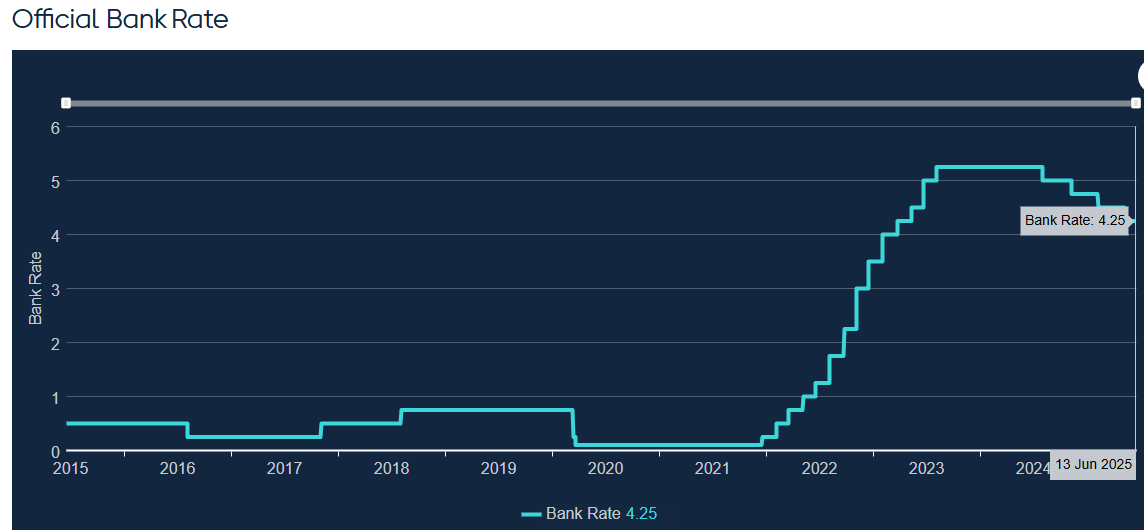

The UK 5 year swap rate is down well below 4%, and down below what it was at the last LINV results last September. This has led to LINV being able to drop its rates which will encourage more people to take out mortgages (since they’re cheaper!)

The UK base rate has fallen to 4.25%

So everything is heading the right direction, and LINV is winning awards as “Best” product and that’s based on feedback from 1,100 mortgage brokers representing 98% of the market.

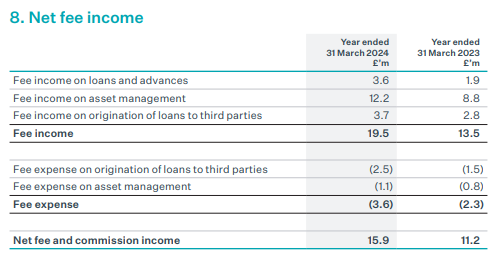

LINV reported growing income based on growing assets under management in March 2024 (year end) and in their interims.

LINV was a story of losses in 2024 but prior to this in 2023 and before it paid a high dividend and was profitable. So the question here is can it return to that?

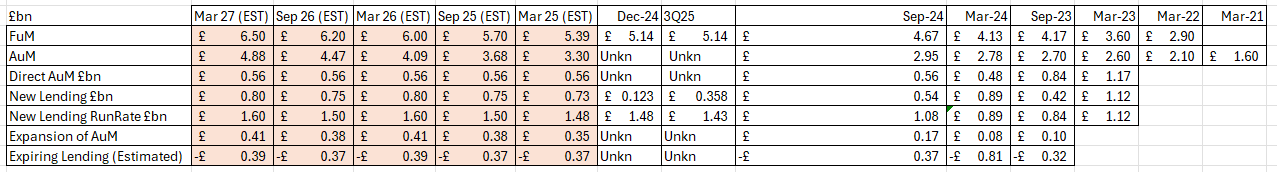

2025-2027 Forecast

Based on a AuM growing by similar amounts over each of the coming three years, and also that 1Q25 lending (to 30th June 2024) is 20% higher than the average for FY2024, along with the interest rate cut in August.

We know the FuM has grown to £5.39bn as at March 2025 but we don’t know the new lending to March 2025. In December it was at “record levels” of a run rate of £1.48bn. That’s nearly double its prior run rate.

That run rate will translate into higher net income. These are my estimates (based on the above growth in lending):

The increase in income assuming they can control cost growth (which appears to be possible even at higher levels of activity since so much of the operation is automated) and further assuming no impairments in the next year or so, then we see the price earnings at today’s £55m rapidly growing into low single digits, potentially.

LINV’s historic focus was BTL and bridge lending while in FY2024 it entered specialist residential mortgages for mortgages for people with multiple incomes, self employed, variable income etc

Technology

Developing the platform has been an investment of £60m over the years. That investment has been written down (impaired) by -£50m so you are paying £55m to get a business generating profits as well as (arguably) IP that is worth the share price at COST PRICE.

This is a moving feast too where there are up to 12 changes are made (on average) per day.

About -£3m per year is amortised meaning the £10.5m carried forward balance today will be fully written down to zero by 2029. It’s unlikely to actually get to zero in that further development will be capitalised but the fact that a large slice of “cost” is really a hidden asset.

Value of Technology

There have been several Strategic Achievements at LINV over the past year:

1. Launch of the LendInvest Mortgages Portal: A significant operational leap forward, providing seamless access to our entire product range and facilitating easier transitions for brokers and clients.

2. New Product Transfer Process: Introduced a streamlined process allowing brokers to easily switch products at maturity, enhancing customer retention and satisfaction. This is a big win and as far as I can see unique in the market. Every Landlord I know is a “wheeler dealer” so I know first hand they would be keen to use a platform where this kind of transfer is possible.

3. Expansion of Funding Partnerships: Societe Generale and BNP Paribas were added to the financing syndicate.

The current market cap considers a small value to the IP. When you contrast LINV with for example Cushon which sold to Natwest on a £169m valuation for what arguably is a far simpler platform. Or BETR over in the US. Would the likes of Santander, Lloyds or another snap up LendInvest at some point? Banks and BS’s differ on how long it takes to do a mortgage application. The co-op says 30 mins, Natwest reckon 10, Lloyds 20, some saying 30 minutes, Barclays 15 but David Wilson Homes suggests you need 3-6 hours to complete a mortage application. LINV’s application takes 5 minutes.

The productivity of the platform for brokers, enabling them to process 100 applications per month per underwriter must surely be an attraction. There are 5,593 UK mortgage brokers so LINV’s network of 4,400 brokers is nearly 80% coverage of the UK. Of course a broker might work with multiple platforms and also it also depends on customers choosing LINV however, very often a digital marketplace is an ecosystem where more brokers attracts more buyers in a virtuous (or vicious) circle.

Combining this productivity with the ability to transfer and manage multiple products and evolving products give a smoother customer journey.

Conclusion

To conclude, I can’t see that the market has understood or appreciates LINV.

Not the growing run rate - driven further and faster by repeat business from growing BTL landlords and property developers who like the LINV platform - but also by falling interest rates and falling SONIA swaps down 0.14% in a year.

Also the tight cost control they’ve introduced and productivity initiatives that enable scale without further cost.

All of these factor mathematically translate to higher earnings. And that’s before you consider the hidden value of the IP and platform itself - and its attractiveness for a buy out.

The new lending run rate will translate into higher income, and that higher income is at a lower risk than historically due to the 3rd party funds approach. The platform continues to be the leading option for anyone who needs a non-standard mortgage and wins awards and plaudits from the industry. I come back to the simple truth that if you can handle the most complex permutations, then the easy ones should be a walk in the park too. Because, of course, life’s never simple is it?

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Great update today!

Very good article. I would disagree on the points that being a Buy to Let landlord is lucrative. There are now so many expensive certificates that are required on top of the maintenance and mortgage costs that a large number of private BTL landlords are selling out. Those buying tend to be large corporate landlords that have teams of in-house lawyers, surveyors, letting agents, Inventory clerks, gas engineers, credit checkers, EPC clerks and electricians. So they can employ such a team full time to manage a large portfolio and the unit cost is lower than for a guy with 1 or 2 flats.

The Tenancy Deposit Scheme has made it virtually impossible to ever hold back some of the deposit to cover damage or cleaning when a tenant leaves. Their adjudicators require the landlord to upload so many documents/photos and write extensive arguments that it often isn't worth the time to do so, and then they still judge in the tenant's favour.

It takes 12-18 months to evict a tenant that just refuses to pay his/her rent under the UK legal system, so with legal and bailiff fees, and then the council tax and repairs etc that need to be paid during the void periods, those kind of tenants are likely to make the landlord bankrupt.

Just read OpenRent's landlords' forum to see the nightmares that so many landlords are going through and therefore trying to escape the business as soon as they can.

The UK property market has also begun to slow significantly so there's no hope of capital gains on property this year, and next year is the 18th year of the land Economist, Fred Harrison's 18 year cycle which is usually the year when we get a property crash.