MAFL can baffle

The 4Q25 year end update

Dear reader

Today’s Audited Results in the final 3 months to its June 2025 year end gives us a further £0.5m gain moving the NAV from £13.2m at 31/3/25 to £13.7m at 30/06/25.

That’s a 26.6% CAGR consistently achieved since 2018.

That’s 33.5p → 34.5p per share fully diluted from 3Q25 to 4Q25, and up 18.5% yoy.

Net profit for the year ending 30/06/25 was £2.21m so worth +5.4p per share. On a constant currency basis, gains would have been a further +2.75p pre tax so post tax potentially nearly a 8p gain per share.

But at a 37p/40p bid ask are readers finding themselves invested at a premium to NAV all of a sudden?

Or is 30th June not even the whole story? Were eagle-eyed readers poised over their buy buttons on the 22nd Dec spotting an opportunity?

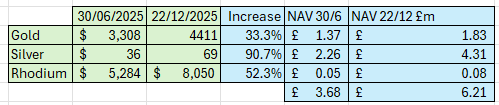

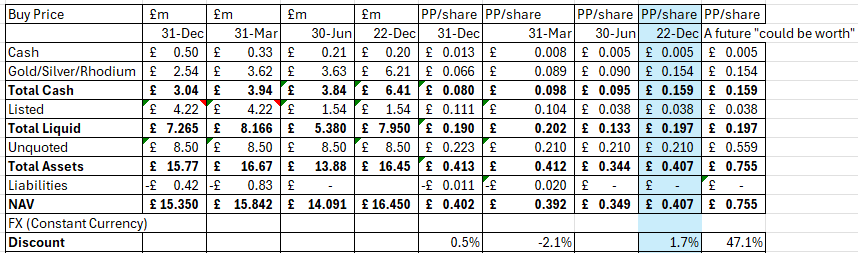

Eagle-eyed readers would no doubt be rolling their eagle eyes at these rhetorical questions. They would have spotted the over £2.5m post period gain to the bullion which was held at 30/06. That today’s gold, silver and Rhodium bullion alone adds 6.3p per share meaning you can buy MAFL at a discount even today. True NAV is 40.8p just considering the bullion.

Eagle-eyed readers would be cognisant, too, that any further deferred gold payments from Golden Sun post period in lieu of interest, or in lieu of any Toburn NSR accruals would also be at a $1,750 per ounce rate….. raking in a further $2,650 per ounce gain for MAFL at today’s $4,411 gold price.

Tactical

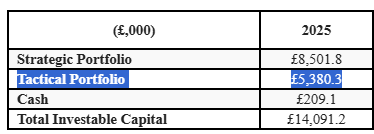

Tactical is £5.38m.

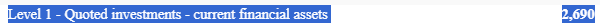

But then we are told Listed Investments are £2.69m.

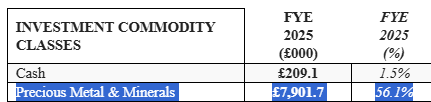

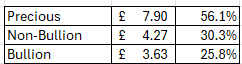

Bullion is also part of Tactical and we are told

“if deferred gold bullion and our physical silver investment are excluded from the Precious Metals classification and deemed as near Cash, the Precious Metals and Minerals category represents 30.3% of our IC”

And also told Precious is £7.9m

We can deduce therefore that Bullion is £3.63m:

Add the Rhodium and you get to £3.68m:

So if you deduct the Bullion from the £5.38m Tactical you only get £1.54m. How do we reconcile that back to the Level 1 amount of £2.69m?

The answer is £1.15m must be sitting under Strategic. But what?

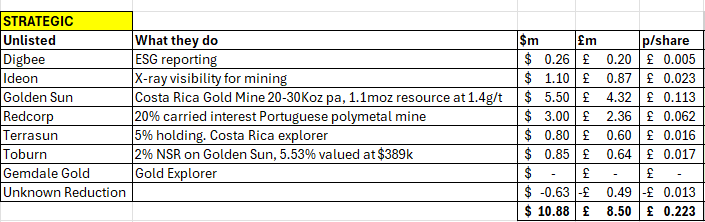

My best guess is Redcorp, which of course is now Cerrado. If it isn’t that, then what is Level 1 listed?

Oh yes Cerrado. Valued at $0.67 per share on 30/06/25 and now priced at $1.73 today.

That means the £1.15m holding is today worth £2.96m (+£1.82m).

If RedCorp is revalued that way relative to the price of Cerrado then that would be 4.8p MORE per share.

If it’s not then we can still use the liability price Cerrado has in its accounts for the acquisition of MAFL share of Redcorp and its Lagoa Salgada project, which is more than double too. And that’s based on an NPV at Lagoa Salgada that is about to increase once the optimised PFS is released. Bear in mind that the NPV will increase BOTH for optimisation AND for higher metals prices potentially.

Lagoa Salgada

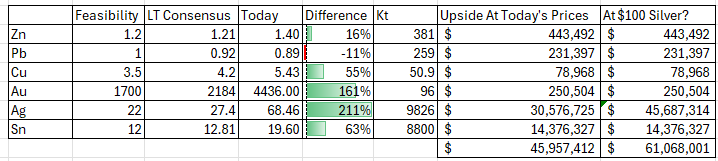

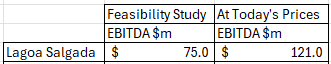

Regardless of what optimisation and recovery improvements they come up, higher metals prices adds about 60% to the EBITDA profit value of Lagoa Salgada.

5% of $121m EBITDA is ~$6m EBITDA so the current $3m valuation is 0.5X EBITDA earnings and if you agree it should be at least double due to Cerrado increasing in price then you then realise that you are valuing MAFL’s Redcorp holding at just 1 times EBITDA earnings….. and at higher metals prices you could find yourself at 0.5X earnings……

Jacques in an interview mentions a 10 bagger Santacruz and “we have 100,000 shares of that”. 100,000 SCZ shares alone is worth US$0.88m (which I deep dived in September in Cruzing) but it does not appear to be the case that MAFL holds as many listed shares any longer. They’ve been sold down it seems.

It’s not clear from the year end report. In an interview Jacques speaks to a pivot to Copper and speaks of Rio Tinto and BHP. A touchstone in 1970 is Copper was $0.70 and Gold was $35 so 500:1.

Today the Copper to Gold ratio is 12,800:1

Strategic Additions

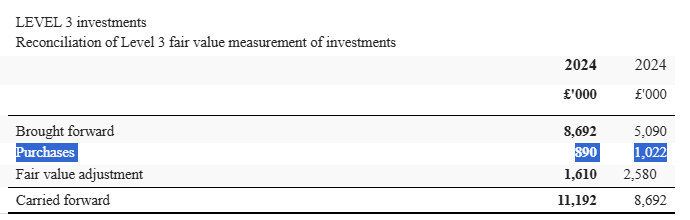

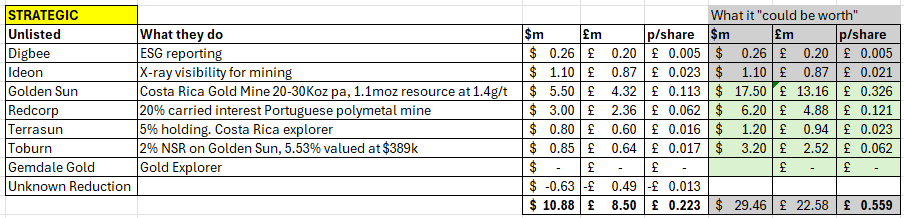

There is a typo in the report in that the 1st column should be titled 2025 but the £0.89m of purchases can only be Gemdale Gold and the Digbee secondary round. The Digbee funding in Jan 2025 was $0.43m (£0.32m) and we don’t know whether MAFL was the only funder. If we assume it were, then that means £0.57m relates to MAFL’s position in Gemdale Gold, a gold explorer.

Toburn

MAFL include the Net Smelter Royalty in Golden Sun’s BellaVista Mine called Toburn.

Since the year end the NSR has begun to generate income for M&F.

Several royalty companies have expressed interest in acquiring this NSR.

MAFL have a 5.54% interest partial ownership of Toburn. Its valuation is based on a DCF10 of 92%, 500TPD, at 6g/t, at an unspecified gold price generating 35.2 Koz of Gold.

Toburn is on the books at a £0.31m valuation which implies a £0.031m annual income discounted at 10%. 35.2 Koz on a 5.54% share is 1.95 Koz and £0.031m/1.95 implies just a valuation of £15.89 per ounce for a 2% NSR. But £15.89 for 2% of revenue equates to selling that gold at £795 or $1,060!

So its potential value is about 4X so up to a £0.93m upside, or 4.5p per share.

Golden Sun

The 5.54% ownership of Golden Sun meanwhile is valued at $5.5m

Assuming an AISC of -$1,900 per ounce then it is generating pre tax profits of $88m per year. That is $4.88m per year pre tax or say $3.5m post tax. At a P/E of even 5X that implies a $17.5m valuation.

That would be an uplift of 21.3p per share.

That is where Digbee and Ideon have no revaluation. Where Redcorp is only valued at 2X despite Cerrado more than doubling since June (and in any case the Redcorp asset is due an optimised PFS in early 2026 so I’ve not factored any upside to that in this article), and where Terrasun has a lowly 50% added…..hardly a stretch for a gold explorer: A 0.7p per share potential gain.

Bullion - Take the Cash or Take the Conversion for Golden Sun?

There is an option to convert the 1070 ounces of deferred Gold bullion into further Golden Sun shares. Those options would convert at a fixed $2,706/oz. So the 1070 ozs “owed” are worth: (1070x2706/oz =$2,895,420/$1.75) = 1.655m shares.

Golden Sun has 18m shares total and MAFL have 1m (5.54%) already. So it would equate to a ~14% holding.

At $4,400 per ounce 1070 ounces is worth $4.7m (and were valued at 30/06 at $3.6m) so if I’m right about 5.54% being worth $17.5m (i.e. if it’s the case that Golden Sun can get taken out at ~$350m i.e. $35 per ounce in the ground) then that implies $49m of gross proceeds (less -$3.6m of gold bullion foregone, and less the current -$5.5m valuation implies $39.9m upside to my numbers). Which converts to £30m or 74.2p per share FURTHER UPSIDE.

Is selling Golden Sun for $35 per ounce in the ground a realistic number? For a producer. Hmm. Centamin was taken out at above $225 per ounce in the ground last year. Is Costa Rica 6X more risky than Egypt? The Egyptian government took something like 50% of profits from Centamin as a royalty, do the Costa Ricans do that to Golden Sun? Nope.

Totting up the Strategic Gains

Totting Up the Overall Best Guess True Current NAV

Bringing together the numbers post period (in blue) you easily get to 40.7p, and getting beyond to 75.5p isn’t really a stretch since the current price of gold backs up the value for GOLD PRODUCING and near term production assets.

Conclusion

Eagle-eyed readers were snapping up shares at 37p-39p today at this OB 25 for 25 idea while the market wailed at the apparent premium to NAV.

That’s the problem with apparitions… they make folk nervous but usually there’s little substance. Just some weird noise that sounds like this: Woooooooooooooooooooooo.

While MAFL does baffle, for the eagle-eyed it continues to deliver double digit compounded annual growth. Jacques speaks to backing copper for 2026. Ok Jacques. And MAFL continues to be a horse I want to back.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Nice update, I bought in January 2025 and am currently up 115%. Looking foward to a great 2026 as well. Thanks for the tip.

Pretty sure you can move markets on this one OB 😂