Dear reader

A martlet in English heraldry is a mythical bird without feet that never roosts from the moment of its drop-birth until its death fall; martlets are proposed to be continuously on the wing. The closest bird to this in real life is the Common Swift which rarely lands outside breeding season, and sleeps while airborne. Isn’t that incredible reader?

Curiosity led me to investigate Martlet Capital (well the first 20 of the 51 holdings) and what might we find there. Martlet manages holdings as assets under management and is managed by NSCI. It is important that NSCI investors should bear in mind the following. Losses and failure means reduced fees coming from Martlet, but otherwise losses are not your losses. Other folk are investing in Martlet’s portfolio. Why? Tax. Generally you get 30% income tax relief and 100% of capital gains relief. An EIS is high risk and high return, and is typically used by high net worth folk to speculate - to accumulate.

When those investors do get a high return, NSCI also gets a 10%-20% tickle of the gains (above a certain threshold). So it’s the future winners, and specifically those raising capital at a higher valuation i.e. an upround which count. More on that in a bit. Read on reader, read on!

1. AI Vivo

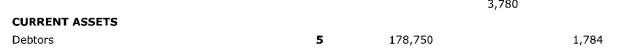

AI systems for building Organomaps. These link disease biology and treatments. There’s barely any info, and no sales data other than their debtors in their last accounts which have grown….. so they are selling something to someone.

31/3/23 accounts:

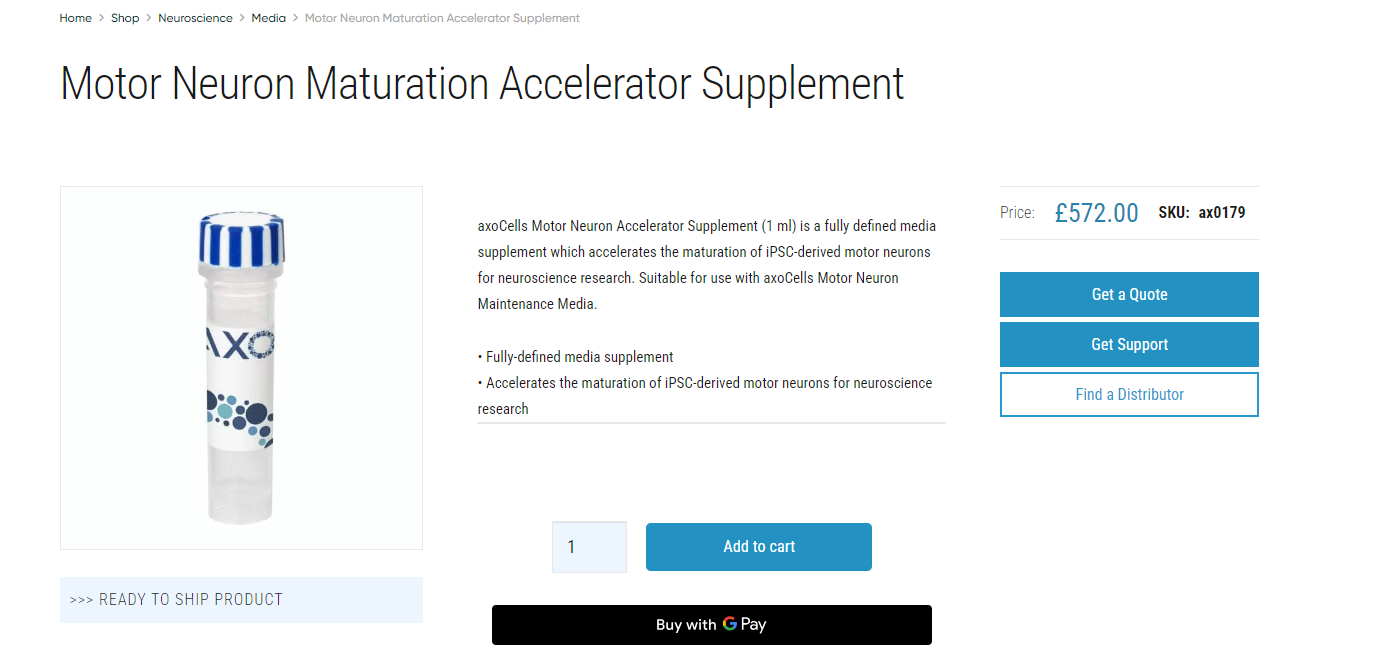

2. Axol - Censo BioTech

Human induced pluripotent stem cells are already giving researchers better models of human disease. These are reprogrammed animal or human cells. Axol sell these to biotech folk and researchers. For example this item sells for £572 for 1ml.

31/12/22 Accounts show Censo’s NAV is £10.6m, and it made a loss of £4m, debtors doubled to £0.67m in 2022.

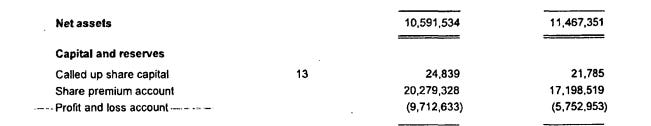

3. Cambridge Mask

Remember trying to find a decent mask in 2020? Be pandemic ready with a military grade mask effective against chemical, biological and virus attack (I’m just being dramatic). Are N95 masks past their sell by? I don’t know. Part of me thinks to buy one just in case. What do you think reader? Are you prepared?

4. Myrtle AI

What caught my eye is they list both Intel and AMD as customers of Seal, which is a way to achieve more efficient processing.

5.Cambridge Neutraceuticals

Is Niagen the secret to eternal youth?

NAD+ is an essential coenzyme that plays a vital role in cellular functions, including mitochondrial function, cellular energy production, and DNA repair. Research has shown that reversing NAD+ depletion has positive effects on inflammation, and many common age-related health conditions such as Parkinson’s disease, heart failure, chronic kidney disease, and autoimmune diseases, among others.

With £2.4m of current assets in the last accounts they are actively selling product to over 50 countries (according to their web site).

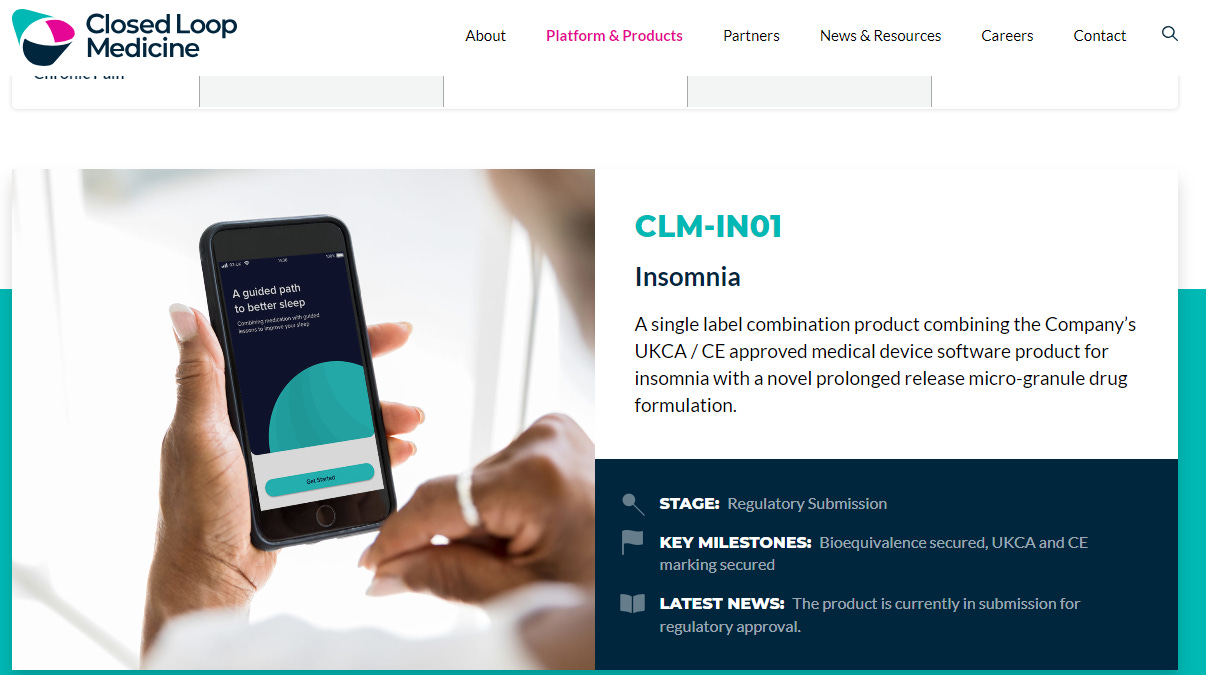

6.Closed Loop

This one caught my eye. Similar to Wanda Health and ProAxsis, seeking to offer wearables, a software App, but interestingly medicine too (presumably existing ones) to offer personalised dosing. Now I think that’s really interesting.

If you take medicine, reader, how do you actually know your dose is what your body needs? This closed loop serves an enormous gap in the NHS - in my opinion.

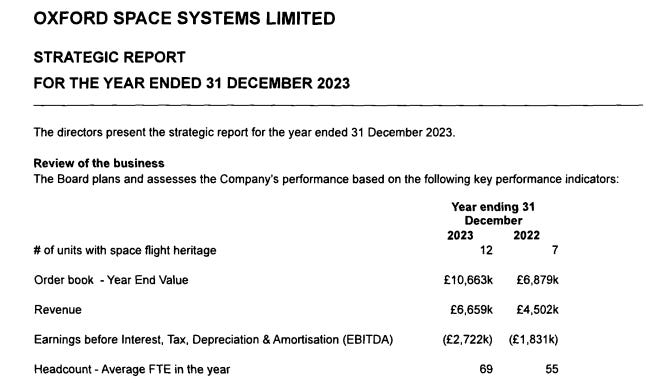

7.Oxford Space

Growing 50% in 2023 and selling space antennae, this could be an exciting holding.

8.NoBacz

NoBacz make liquid bandages for animals. I’m no vet but I suspect vets would appreciate this technology. If you ever spot a cow covered in green splotches, in the future reader, fear not - just stop oil might not have not sprayed that cow. It might just be bandaged instead.

9.Nu Quantum

Pre Series A funded (£7m) are building entanglement fabric essential to scale quantum computers. Rather than binary 0 and 1 Quantum computers use Qubits which contain many more values and therefore are faster. They are working on a Quantum Networking Unit (QNU) and a Quantum Processing Unit (QPU) to create building blocks for larger future Quantum Computers.

This is the CEO’s story - I found it quite inspiring - click on the picture to read.

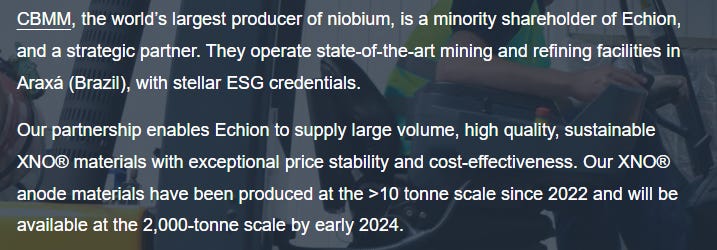

10. Echion

Applications powered by XNO® include battery electric and hybrid trains, mining haul trucks, opportunity-charging e-buses, heavy-duty industrial transport and delivery vehicles. Echion XNO® materials are based on proprietary mixed niobium oxide compositions and microparticle designs.

The world’s largest producer of Niobium, CBMM, is a shareholder in Echion. Echion reckon their XNO® materials improve lithium batteries - a lot.

They have 13 patents and have raised £29m 9 days ago in Series B round.

***This might be NSCI’s first tickle?***

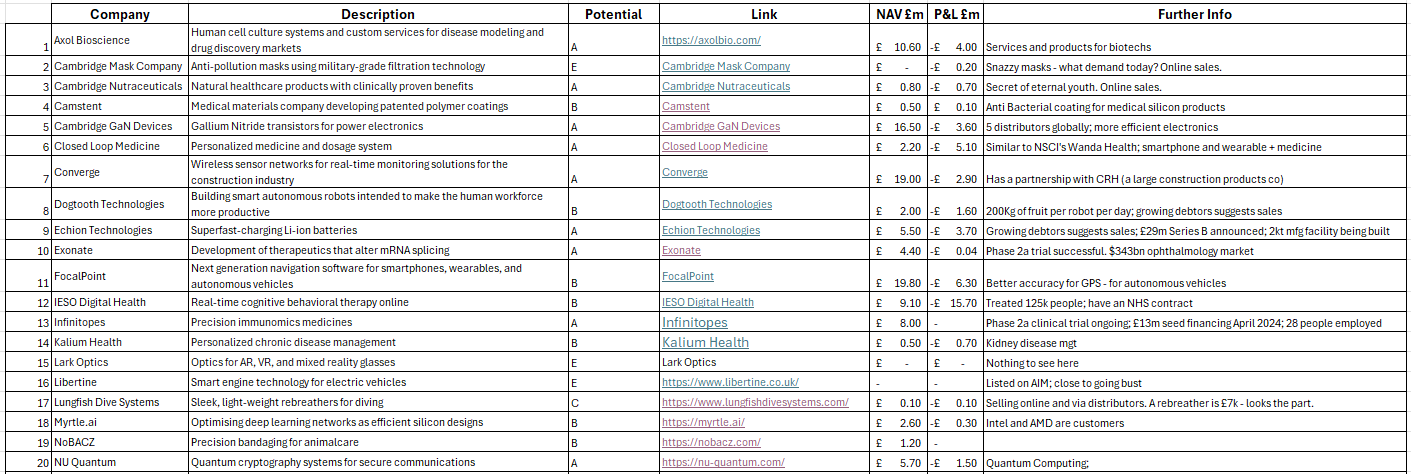

Summing up the first 20 (of 51)

Here I’ve given a synopsis of each companies last reported NAV and loss for the year (or profit). I’ve noted the potential of the technology or idea - just in terms of the market potential and whether it appears it “has legs”.

Bear in mind too the numbers in many instances relate to 31/12/2022 since private companies do not have to submit accounts as promptly as public listed ones.

A-E potential is just my gut feel - A being potentially lucrative, E being poor prospects (just based on what I’ve been able to uncover)

Summing up continued

What has become apparent looking at these first 20 is that there’s possibility of a future billion pound company among these - a Unicorn. Potentially more than one.

Echion - who raised cash 9 days ago - might actually be the first pay out for NSCI. Dealroom reckons the company now has an enterprise valuation of £120m-£190m.

Quantum Computing, Cancer Vaccines, Diving Equipment, personalised medicine dosing, more efficient electronics parts, health tech - these are generally addressing real world problems.

What impressed me is that Martlet are typically one of several investors and the Wellcome Trust, and various other Venture Capitalists are co-investors in a number of these. Some have had recent funding, and most are loss making at this stage. But I’ve counted £108.5m of NAV across those first 20 companies so most of these are not just a dude working in their garage with a few thou from Martlet.

Instead some of these companies are already employing several dozen people and are building factories, some have contracts with the NHS, or AMD/Intel. Some are backed by really large organisations, or have JVs or partnerships like with ex-FTSE100 CRH.

Most are commercialising what they are doing and have growing sales and debtors (even if they aren’t disclosing those fully at this stage because their accounts are full exemption).

The £23.2m of Martlet capital provides an income in terms of fees. But the 10%-20% of profitshare returns above a threshold and I could see how one or more of these could reward NSCI shareholders in the future. Perhaps one already has?

Meanwhile the losses are the losses of Martlet investors. Some of that loss is borne by taxpayers via the VCT/EIS scheme, which I suppose makes it your loss as a fellow tax payer, reader.

Conclusion

Considering this deal on the 13th May with Martlet didn’t cost NSCI shareholders a penny, and in fact generates income has not been appreciated by the market.

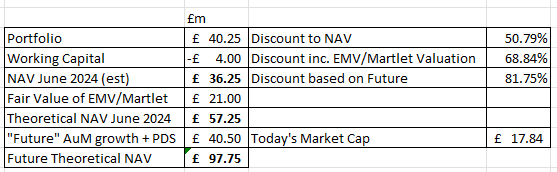

NSCI is up £1.1m since this news but remains substantially below NAV let alone the implied value of both EMV and Martlet. 50.8% discount if you assume these are worth zero, and 68%-81% discount if you place a fair value on them (refer to my NSCI-year-end-2023 article) for what I mean by that.

I’m very proud of the incredible invention our country produces and reading these twenty stories, it is my hope that the innovation and commercialisation remains in the UK too. Given our next leader says he wants economic growth, it is to be hoped the new government don’t disturb the ascent of Martlet, and more generally the VCT/EIS schemes.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".