Dear reader

Today’s trading update came in lower than I expected. The broker said “it’s in line”. Stocko repeated that conclusion. But zero growth didn’t feel in line at all, to me.

Equally, the market harrumphed and sold VLG, and it’s down 5.2% today so now a £57m market cap at a 44p/46p bid/ask

But it is as bad as all that?

£3m free cash flow in H1 during a period of investment is not a terrible result. Moreover the FCF in the first half of the year has always been much lower so FCF over time has a ripple effect from H1 to H2.

Moreover there are some important clues that the market did not properly comprehend.

First of all VLG Brands have an average 45% margin while Customer Brands offer just a 32% margin. So the £1m growth in VLG brands year on year is very welcome. That is not zero growth, but rather growth in what matters and a slow down in non-core activity.

Second that there are clues in trading update on progress in certain products.

Lift

Available in Tesco, Sainsbury, Asda, Morrisons, Amazon, Superdrug, Well Pharmacy, and appears to be the leading brand in the space. A packet of Lift RRP is about £1.20

We see an acceleration in Lift, up an estimated £0.7m y-o-y. We see this now accounts for 21.7% of revenue, up from around 17% of revenue last year. Diabetes UK tells us that 5.6m have diabetes in the UK and that’s up 0.2m year on year. Back in 2021 a researcher said we could hit 5.5m by 2030 if we do nothing. It seems we’ve exceeded that level already in 2024. Assuming a 50p wholesale selling price that’s 6m packets sold so just over 1 packet per diabetic per year.

In other words there’s plenty of runway to grow sales. Lift is useful if you are having a “hypo” moment and blood glucose monitors are becoming much more common place so that people know when they should be popping a Lift in their mouth.

Balance Activ

On Amazon 88% of 7,309 women gave this a 4 or 5 star review.

BV affects 23%-29% of women globally, and is most common in women aged 30-40. In the UK there’s around 4.5m women in that age range and 23% would be around 1m women who suffer from BV, with perhaps a further 0.4m outside that range of ages. A single course of treatment (7 days) is RRP £13.50 so wholesale perhaps £6.50, and recurrence of BV is about 70%. So based on the revenue numbers around 1m treatments were sold last year so even just for the UK there 300%-400% growth possible.

That’s before considering any sales outside the UK of course.

Earol

Earol is also growing and going after the market leader fizzy Otex. After doing some research despite my ears being wax free of late I was taken aback by how many “advice” web sites recommend Earol and warn against Otex. Otex uses hydrogen peroxide, an irritant, and this can dry and irritate the skin while Earol is medicinal Olive Oil and audiologist after audigologist say that’s the right product to use, including ya’should’a’gone’ta’specsavers.

The RNID tell us that 2.3m people in the UK require professional ear wax removal every year. If you’ve suffered ear wax then you’ll know paying for a tube of oil is small beer compared to the pain of a blocked ear. RRP of around £5 and wholesale of £2.25, that is 2.3m bottles so 1 for each of the 2.3m people with removal. Assuming it’s not the same 2.3m people you can imagine 1 bottle per person per year again is pretty low. There’s a 300%-400% runway of growth there too. Much more growth considering Earol outside the UK.

And so we see the growth trends if we map out the numbers - this year in H1, last year and growth period to period.

The bits that concerned me today were as follows:

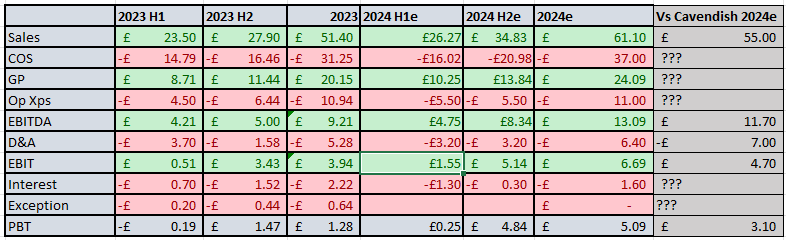

I have deduced £13.8m of VLG brands and £23m total revenue. Using the 1H23 revenue numbers and the growth percentages disclosed I can account for £10.2m of the £13.8m. But the split of the remainder is unknown (until the end of September). These are shown as ?? in the chart above.

Of particular concern would be having some comfort around Gelclair, the (previously) fast-growing Oncology product. We know 2H23 sales were circa £2.3m and that 2023 revenue was 25.4% up from 2022. Will we see continued growth? No word of it in today’s update.

What about Dentyl? Ultradex was mentioned and 23% growth mentioned, but nothing around Dentyl. A search using Google reveals Dentyl is available in almost every major supermarket so VLG have broken (back) into distribution points that it previously appeared to have lost. So why not report on sales (good or bad)?

It’s quite frustrating to only know that everything other than the categories mentioned are down 20% year to year from H1 2023.

Private Labels

In the 2023 annual report we were told Private Labels would be reported separately. Yet there is no mention of these today. Again, frustrating.

Profit Estimates

The trading update tells us that that GP margin was up 1% year on year. It was 37% in 1H23 so on the basis it is 38% then a GP of £9m and I calculate this as revenue of £13.86m of VLG brands at a 43% gross margin and £9.64m of customer brand sales at an average 31% margin (i.e. margins are down to have only made 38% overall, with the published mix).

I keep my prior estimates of operating Xps, Depreciation, Amortisation, and interest, and now see a lower outturn than Cavendish.

If I apply the usual 45%/55% logic to the H2 numbers I arrive at £52m for the year so Cavendish believe there will be £2.8m growth on top of the customary 55 vs 45 split for H2 (or 12.7% growth year-on-year, so I’ve decided to follow this also.

In my upside scenario FCF in H2 could be as high as £8m so debt might be as low as £2m by the start of 2025 (from a debt level of £10m at 30/06/24). Although the trading update speaks to a much more modest progress of just £2.2m FCF and a net debt level of £8.5m by the end of 2024. Cavendish believe just £1.5m FCF is possible in H2.

Conclusion

The three winning products for treating ear wax, diabetes and Bacterial Vaginosis are all doing well. The above £3m revenue growth could be achieved by any one of these three in 2H24. What if it were achieved at all three?

The concern today is why is there no mention of Oral Mucositis (Oncology) progress? Why is there no mention of the distribution agreement reached with Jaguar in the US which I covered in “VLG-reatness”?

A concern too is what of the private label update?

Also why is Dentyl not mentioned either?

Could my prior estimate of a £5.1m PBT and £61.1m turnover come true for 2024? The H1 numbers make £61m a hard number to hit. But not impossible. The Interim accounts at the end of September should provide a greater visibility as to the potential for this. The potential for some Oomph.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

In general, Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".