Dear reader,

It wasn’t an entirely comfortable sitting position in today’s picture. I’m sure you understand the gravity of the situation.

Thank you so much to the 73 supporters who have contributed to the Emmaus 2025 fund raise. We are getting really much closer to the target.

Please, please, please if you haven’t yet please consider helping too. Give a hand up, not a hand out. If you enjoy the content please click on the link below and do your part.

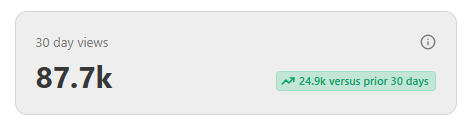

There are now over 1 million Oak Bloke pages being read per year and nearly 2,000 subscribers so readers have donated just 0.27p per page read. If we could get this to 1p per page which is £20 donated per article and considering each article takes at least 4 hours to write then that would mean my efforts would generate £5 per hour to Emmaus. Right now my efforts are generating a small fraction of that. Please help if you can.

Emmaus is supported by Terry Waite, President of Emmaus. Here’s a quote from Terry to warm your heart and loosen your purse strings

-

Reviewing Videos 1-6

Interestingly NBDG is proving the most popular video so far. 109.5 hours of viewing pleasure for interested readers (watchers).

Idea #7 Thor Explorations

Idea #8 EMV Capital

I walk through the holdings and my thinking.

Idea #9 Cadence Minerals

No, I walk through my model and thinking, especially the Project Financing and what the greediest Dragon investor looks like.

Idea #10 Ocean Wilsons

New content? Yes, I walk through my data model and consider the FX movement since I wrote it.

Idea #11 Avation

New content? Yes, I consider the AGM statement and tweak my article.

Idea #12 Water Intelligence

New content? No but I walk through my article and my data model.

Regards

The Oak Bloke.

Disclaimers:

This article is not advice. These videos are not advice. You make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

On WATR, I think there are 2 mistakes (1) PBT for 9M 2024 was 7.7M and thus 1.7M in Q3 and therefore no slowdown is expected by Dowgate in Q4 (ie 1.9M Q4 forecast vs 1.7M in Q3) (2) the Dallas franchise made PBT of 0.9M in the LTM period prior to acquisition and therefore not sure what the 29% margin refers to, but it is not the PBT margin of Dallas franchise. So the PBT growth for 2025 excluding Dallas assumed by Dowgate is 0.6M, which represents ~6% organic profit growth.