Ocean Wilson Idea #10

A share where the 2025 cash receipts covers the purchase leaving the rest for free

Dear reader,

I zealously saved as a child. I remember the Post office books. A blue one was the ordinary account and the grey one was the investment account. I remember the investment account paid 11.5% interest and even today when I find a holding with double digit returns it reminds me of that little Grey Book.

The Grey book had one month notice. I only once withdrew from that Grey book. It was the day I closed that account. That’s a story for another day and today the story is instead Ocean Wilsons. Will I resist the Castaway references in this article? Not managed that over the previous three articles but I will do my best today.

We find ourselves in a bit of an odd situation.

OCN has sold an asset (a 57% holding in Wilson & Sons listed in Brazil) the 3Q24 update tells us for £12.53 per share after all costs and taxes. The sale price of Wilson & Sons is R$17.5 per share. This was below the speculated R$20 valuation the deal nevertheless repesents £16.95 per OCN share less costs. $198.5m or £4.42 per share or about 25% of the sale price is quite painful, but that’s what it is.

So at today’s market price for OCN you are paying £12.35 cash to receive future cash of £12.53. That’s 18p profit.

But the RNS tells us after all costs the proceeds are $16.77 per OCN share. The RNS states $16.77 is £12.53 cash per OCN share. That’s true if the exchange rate is 1.338 Dollars to the Pound next year. But today it’s 1.27 Dollars to the pound so $16.77 is £13.20. That’s 85p, not 18p. Is there more to this idea than a possible 85p?

Yes. This deal closes in 2H25 and OCN is entitled to all dividends between now and then. Dividends paid to OCN in 1H24 were $30m. Let’s assume dividends don’t increase (although they increased 25% in 1H24), that’s $60m of dividends.

We have not yet even spoken about OCN’s portfolio of investments. These were valued at £247m or £6.98 per share as at 3Q24.

Let’s set all the above out in a chart:

How it looks today pre-sale. A 48.7% discount to the numbers as at 30/09/24. That’s based on Wilson’s book value being £16.95 a share plus Investments of £7.30 (up from £6.98 at 30/06/24 but more on that later), plus Cash of £0.13 a share.

All of that gets you to £24.38 per share NAV. So you can buy OCN at near half price.

We of course need to minus costs and £16.95 of Wilson Sons is only £13.20 after costs.

But there’s more factors at play too.

The deal doesn’t complete until H2 next year, and Wilson will pay OCN dividends estimated at $30m per 6 months and based on 1H24 Wilson Sons net profit with no growth. That’s worth £1.34 per OCN share assuming 2 x 6 months.

There’s 13p of cash so we’ll assume that’s static. We should also assume 7.5% growth to the investment portfolio (more on that later). I’m assuming this purely to extrapolate 2024 performance (which was 5.7% in the 9 months to 30/09/24):

This is the result:

All of that that means and based on a £13.20 net proceeds plus Wilson dividends plus Cash plus the investment portfolio that you are buying today for a 41% future discount. Because 5.4% dividends have historically been paid then the discount could be lower.

But look at the cash element. £14.67 per share. If we strip that out we arrive to a 116.4% discount to NAV (less dividends paid).

So you are getting paid 133p to take on a portfolio worth £6.98 today of listed funds - and potentially £7.85 next year.

Now that statement “you are getting paid” assumes the cash gets returned to you. What if it doesn’t?

Well if you assume the whole lot gets recycled into investments then 7.5% capital growth of £22.52 generates a £1.69 per share return. Current dividends are 67p. Even deducting costs out and that 5.5% yield dividend looks pretty secure.

We’ll look at the investments later but here’s another thought.

Love Me Tender?

What if there’s a tender offer? What if OCN offer a buy back at say £16 per share. That’s a tempting £3.70 return for the market on a £12.30 share.

Let’s assume half of shareholders (the daft 50%) take the money. 17.68m shares at £16 each is £282.88m. Let’s assume the wise 50% of shareholders (and let’s assume you are among that wise 50% reader) don’t. The results are quite dramatic.

Shares remaining are 17.68m and the same investments are now worth £15.70 per share. Deducting £8 (£16/2) from the £14.67 cash leaves £6.67 per share…. but wait the share count has halved meaning the cash per share has doubled to £13.34 per share.

The result is a NAV of £29.04 and assuming some level of discount say 15% we arrive to a future market price of £24.69.

What a margin of safety!!!!

INVESTMENTS (and why the “Stodgy” description is not accurate)

These are the Top 30 disclosed:

I’ve spent some time examining the publicly available information.

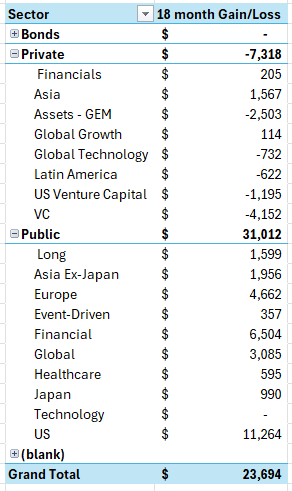

If we break down the data we see (of the Top 30 holdings) 77% are listed, 20% unlisted and 2% bonds.

In the broader portfolio (as of 31/12/23) $80m of the remaining ~$100m is Private Equity, $6m Bonds and the remainder are Hedge Funds.

Is the Fund Portfolio Stodgy?

I would question the assumption made by some commentators that the fund portfolio is doomed or stodgy. The top two publicly-listed funds show strong performance over time.

Private Equity

The largest private holding for example is Nexus Group - Peru who are focused on investment opportunities provided by the dynamic Peruvian macroeconomic landscape and the country’s emerging middle-class population. Economic growth over the past 10 years averaging about 3.5%.

NG makes control equity investments, focusing on creating significant value through strategic operational and financial improvements. NG appoints senior investment professionals to management positions in its portfolio companies:

Grupo SMI (packaging company), Innova Schools (K-12 schools), NG Education, Financiera Oh!, La Tinka and Inretail Peru.

Considering Performance 31/12/22 to 30/06/24 (NB I’ve used latest available numbers where a holding didn’t exist 31/12/22 which was true in 6 out of 30 of the top 30)

Given the post covid period, rapidly rising interest rates, the supply chain crisis, the inflation crisis it possibly shouldn’t come as a great surprise to learn that Latin America hasn’t done well. But Latin America is a fast-growing territory in 2024. Are its future prospects as bleak?

Nor has Venture Capital. Yet VC trusts with Molten have nearly double bagged in 2024 and HGT is a nearly 0% discount to NAV. Or consider HVPE - a fund of funds like OCN - announcing NAV growth and 29% premiums to carry this week.

So there’s potentially circa $10m tied up in overstated discount rates. Comparing with VC in Public markets and particularly the very rapid rise in interest rates (and discount rates) a de-rating of privately listed Venture Capital is no surprise is it? But as has been seen in the public markets the valuations are sharply discounted while the business performance of many PE/VC have actually been quite robust as I’ve proven time and time again in various articles such as GROW, CHRY, TMT and others.

The -$7.3m net loss in private holdings hides value I suspect. With interest rates falling leading to discount rates falling will we see a rebound in its VC/PE holdings?

Venture Capital is now in its 10th Quarter of downturn (2.5 years) - that’s now equal to the length of the downturn post 2008 and 1999. Will VC bounce in 2025? Statistically it is due.

Within VC there are already bright spots. Perhaps unsurprisingly we’ve seen a doubling of AI-related Venture Capital in 2024.

Meanwhile a $31m return on public holdings is actually pretty good. $31m gain on circa $200m of public holdings over 18 months is a 20% per annum return reader!

$31m on circa $200m of public holdings is a 20% per annum return reader.

Is that stodgy?!

Considering the Cash Proceeds

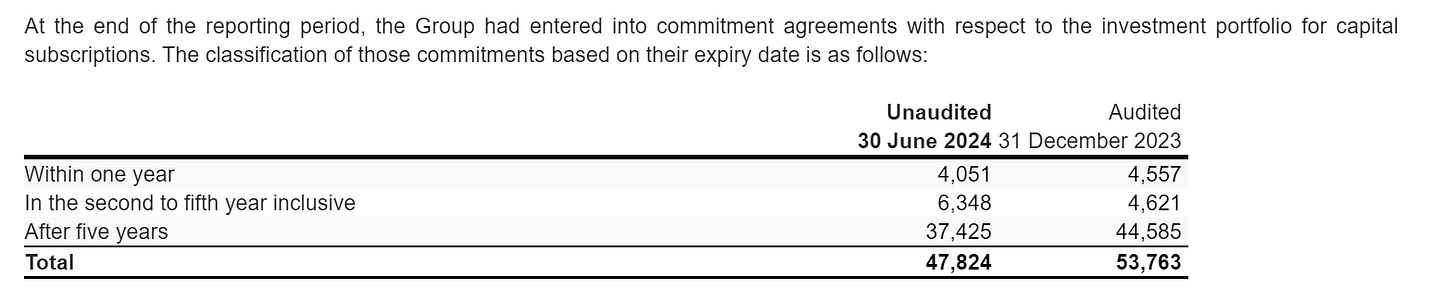

It’s true that there’s £48m of future commitments to funds but only £10m over the next 5 years.

Meanwhile there’s a 10%-20% disposal of funds with an average 20%-30% gain on disposal based on the past 18 months. Will shareholders express a desire for higher levels of reinvestment (perhaps yes if they’ve read this Oak Bloke article) or will they actually clamour for buy backs? A tender offer? Or a higher dividend?

The RNS speaks to two key next steps:

1/ Consultation with shareholders

2/ A mix of special dividend, buy backs and reinvestment.

There are some existing follow on investment commitments of ~£50m, so it could be there is some money set aside for that. But £40m of the £50m is >5 years distant so the number could easily be less.

While the current discount to NAV has historically been far higher. It was 47% in February 2024 and 63% in September 2023 (on a look through basis). For that reason it's difficult to think the shareholder consultations will lead to 2/3rd of the proceeds being reinvested. Who will ask for this?

But even if they do I would argue it’s not necessarily a negative.

It's also the case that Wilson Sons whilst publicly listed in Brazil wasn't a tradeable asset in the same way that all of its other funds/assets are tradeable. Liquid assets usually trade on a 10%-15% discount, and ongoing buy backs can trim any outsize discount.

So assuming buy backs and/or a tender offer is the preferred route, as I believe is likely and assuming let’s say a £5.20 dividend, £0.30 reinvestment (i.e. £10m follow on investment), that leaves £8.50 for a tender offer.

Assuming a tender at a 5% discount to NAV a £300m tender results in an elevated NAV of £17.60 so a £22.80 per share return. Less any discount to NAV of course. So a target of £20.00 seems reasonable.

But forgetting OCN 5%-6% dividend yield is a further return, plus scope for future capital returns too.

A final intriguing thought: Will we see a counter offer for Wilson Sons? SAS weren’t the only interested party and R$17.50 is a very small premium to the market price, for an attractive asset with growing profits and opportunity located close not only to Southern Brazil but also is the primary port for Uruguay and Argentina too, I covered this in some detail in my article “The Complicated Story”.

Progress in H2 post period:

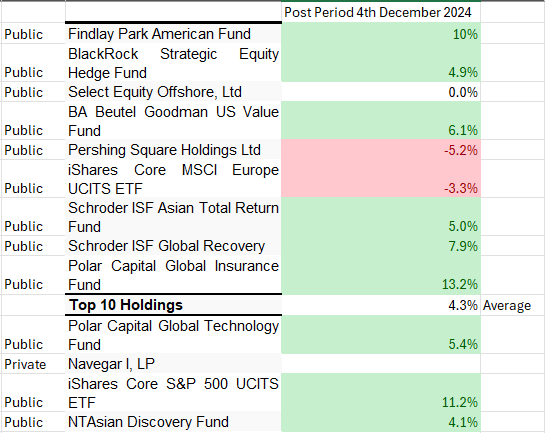

Comparing publicly listed holdings and their market prices from 30/06/24 to today is interesting too.

It reveals that average gains are 4.3% across the Top 10 and 5% based on the Top 20. That suggests my 7.5% per annum growth is actually quite conservative.

Now this relates to publicly listed holdings since of course there is no way to check privately listed.

But OCN’s own data shows Private Equity is AT LEAST as good if not startlingly better! 106.7% in 5 years is great! 33.2% overall is - guess what - not far off 7.5% per year! :)

The OCN investments have delivered 33.8% over 5 years, but interestingly new private equity is the strongest performer (106.7% return) and thematic the 2nd highest component. It’s designed as a 60:40 fund.

Interestingly it outperformed (by about 1% a year) a 60:40 composite of 60% ACWI+FM which is basically an Equity world index (as below) plus 40% of Bloomberg Global Treasury (Bonds)

Also of interest is the 24% North America quality and growth, but where this is being focused across towards Japan but also towards Bonds and thematic funds particularly Insurance where Reinsurance is a growing category.

By working towards greater balance and diversification OCN offers a balanced portfolio with interesting tilts and plenty of downside protection.

Conclusion

So to conclude, this offers a similar(ish) profile to PSH (PSH is one of OCN’s holdings actually) where there is upside potential along with downside protection.

If 2025 goes horribly wrong OCN offers some ballast through its hedge funds, bonds, uncorrelated assets and long/short strategies.

If 2025 is a storming year OCN offers some strongly performing funds which will continue to perform.

The Private Equity component looks completely overlooked and may offer a pleasant surprise - the numbers suggest it could.

Either way in my view it’s totally mispriced and during 2025 cash to the equivalent of 116% of today’s buy price works it way through and drives a “value event” too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Also worth noting that there is a $ 80m break clause if the sale of the Wilson and Sons stake does not go through

Regulatory Approval given to Wilson Holdings for the SAS sale to go ahead did you see Oak?

As much as c. $16 special divi less costs now on the horizon for OCN shareholders. Land ahoy.