POS-itivity!

Another contract (£1m) but what's the bigger picture for Plexus?

I set out the original thesis for Plexus in this 1st article.

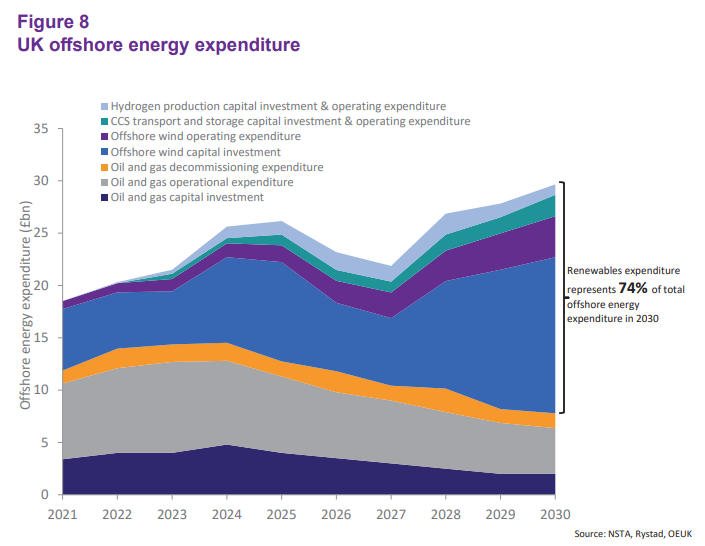

According to the NSTA, north sea expenditure just for decommissioning will average £2bn from 2024 - 2028. OEUK concur. If (when) Starmer wins this year’s election perhaps that number will grow much, much higher since stated policy is to knee cap any new O&G projects in the north sea. Sadly, without new projects the rationale to continue existing ones can dwindle and decommissioning inevitably grows. The current NSTA projections of Op.Costs/BOE are relatively high (compared to alternatives), and these numbers DO assume and rely upon new projects and investment flow.

But further good news for minnow Plexus, winning a £1m contract. If POS can capture just 1% of UK decommissioning expenditure that’s £20m revenue a year (so an EV:Sales of 1), which at a 65% gross margin is good business just for that type of rental & services, and just for the UK north sea. Consider other countries operate in the north sea too. Plus the north sea is a relatively small part of world oil, less than 1% of current production.

A £1m contract may not sound much, but the point is contracts tend to grow, plus this is the third win in five months following its re-entry into the Jack-up rental wellhead market. SLB and Plexus have done a lot of work improving the product range and investing capital in building an initial rental wellhead inventory. Plexus is re-establishing itself with this third win (helped by SLBs reputation and by its inventory build up following the recent $5.2m non-core IP licensing sale) in the rental exploration wellhead equipment sector prior to selling the previous division to TFMC in 2018. See the Chairman’s Statement.

Due to June year end, even though it begins Q2, this may or may not fall in to FY24 but will fall into FY25, but nice to have order book! This third win is further evidence that the one off contract last year wasn’t a one off but part of a building momentum.

This is the rate of growth for FY24 (y/e June):

Why else is that Oak Bloke dancing?

This chart of expenditure sets out how the opportunity for north sea decommissioning is £2bn but new projects prospectively £2bn-£4bn (although less if Starmer can stop projects already approved), plus CCS and Hydrogen are emerging opportunities. I don’t think I’ve seen anyone understands this yet (except Ben Van Bilderbeek who clearly says in a recent interview that POS’ technology and know how can be applied to new technology markets) but Hydrogen is a much trickier gas than methane. CH4 has a molar mass of 16, while hydrogen has a molar mass of 1. The first 10MW electrolyser is being built in the north sea as we speak. A USP of guaranteed leak seals is going to be extremely important. Environmentalists are (rightly) concerned about methane leaks and how these are many times worse for climate change. But hydrogen contributes to climate change too, if leaked. This study explains this. Plexus’ know how is fairly key enabler for the vast investment that’s going into hydrogen.

Carbon Capture the same (this time the molar mass is 44) but the clue is in the name. Not much point investing into carbon capture if it doesn’t stay captured. Sounds like a job for Plexus and its array of IP. 2024 is a pivotal year for CCU according to Wood Mackenzie.

White Hydrogen

The opportunity for Plexus is not just CCU, electrolysers and green hydrogen generated from renewables. There’s yellow hydrogen from nuclear, grey hydrogen, blue hydrogen and white hydrogen too.

White hydrogen? Yes, there are vast reserves of hydrogen in the earth’s crust and perhaps one day we will drill wells and extract it. We don’t now. What sort of technology would be needed for such a custom endeavour? A standard SLB well head? Or a custom, specialist one from Plexus?

Conclusion

Another small win but the technology to effectively and efficiently control leaks has a wider applicability and the potential for POS is quite exciting.

At its current £18m market cap, while this has increased from its £2m market cap busted status, in my opinion there’s much more to come.

This is not advice.

Oak

Excellent. Especially when read with the earlier piece.

Nice work 👍