POW-wow

One of the Oak Bloke Top 20

Revisiting Power Metals

Dear reader,

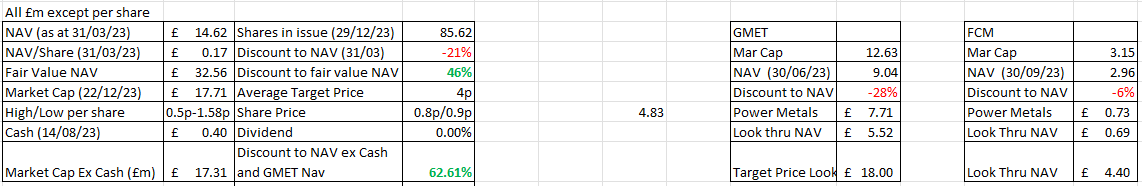

I first wrote about POW in my article Introducing POW! It was at a 67% discount to NAV. Today it’s remains at a 62.6% discount ex cash and listed holdings.

…. Or is it more?

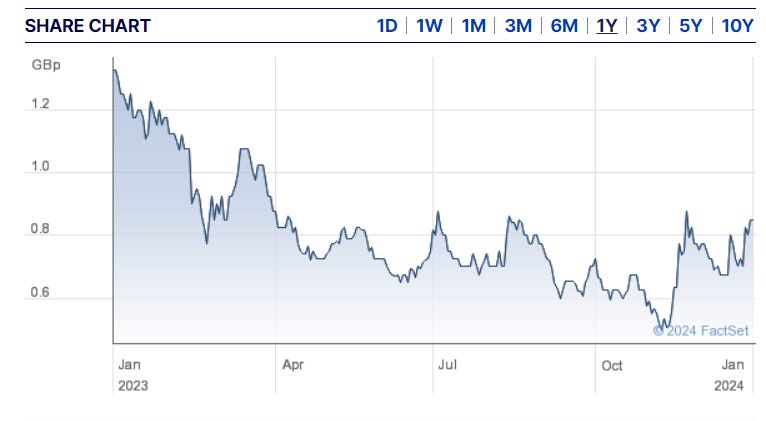

Since my article GMet has spiked. And FCM has spooked. These are POW’s 2 publicly listed holdings.

POW owns 61% of GMET and 23.24% of FCM. These are two of several forthcoming spin outs masterminded by ex-CEO Paul Johnson.

The increase has tipped POW into OB20 profit territory, just (remember I’m including spreads and costs reader and there’s a 12% spread here).

But the discount to NAV has barely moved - how come?

Spiking

GMET released wonderful news about a BONANZA. Doesn’t the very word fill you with joyful memories of Sunday TV as a kid? Exciting news from 1 of its 3 projects Garfield. GMET 100% owns Garfield which is in Nevada.

It has identified “high grade gold-silver-copper” in bedrock and re-examined geological mapping and sampling to identify a “Magnetic Bullseye anomaly”.

This type of formation is “often” an intrusive porphyry centre.

However have you heard that lightning never strikes twice? What about geological events? Do they strike twice? That’d be golden (metals).

GMET postulates (I love that word).

Sorry, reader, GMET postulates “that epithermal mineralisation overprints earlier porphyry mineralising event, increasing the overall prospectivity and most importantly the gold-silver potential” over 4 square kilometres.

POW…..WOW!

What next?

“The typical next stage when exploring for porphyry deposits … [involves a] … search for a geophysical anomaly which could represent a porphyry centre at depth. To our excitement, this was identified by a third party survey and is located within the High-Grade Zone, which happens to be broadly overlapping the uranium target identified during the same exploration programme”.

Golden AND Radiological Metals!! That’s polymetal combo you don’t see every day.

And of course where does most Uranium come from? Da, comrade, and does the West want to buy Russki uranium? I’m not even going to answer that.

I included POW in the OAK BLOKE TOP 20 because of its several Uranium assets/projects in Canada and Australia. This was when Uranium was $91/Lb. Today it’s reached $106/Lb! Will these prices continue? Nuclear is part of the net zero strategy.

Next GMET is “quickly moving towards determining optimal next exploration steps” to maintain the project’s momentum.

YES PLEASE!

BB chatter claim GMET will double from here. Is that realistic? First Equity believe that. So does that mean the discount to NAV could be much higher than 62%? Read on, reader, read on!

So does that mean the discount to NAV could be much higher than 62%?

Well besides Garfield there are 5 other projects - the presentation deck describes these. Pilot appears the most attractive of these.

Pilot has indicated and inferred 12.53Mt at 0.27% W03 with significant Cu -Ag -Zn Credits, or 34.29kt of metal. At $40k/tonne that’s $1.37bn of tungsten less the AISC net of “significant” credits. Tungsten is a focus metal for the West given its critical use within the defense industries (e.g. armour piercing ammunitions) as well as its usage within nuclear fusion technology.

The U.S. DOD has banned tungsten imports from China for DOD procurement as of Jan 1, 2026 – domestic sources of mined tungsten are needed to fill supply gap

Spooking

FCM First Class Meteals has spooked investors. How? A couple of TR1 notifications. CEO Marc Sale explains this is a transfer of one large shareholder from one account to another (i.e. they’ve not sold actually).

Another who Mr Sale said needed the cash but will buy back. Here’s the bing bong bing bong bing bong Stock Box interview:

So have shareholders been needlessly spooked?

Results pending in Q1

Zigzag - lithium results from core drilling - top marks for plain English FCM!

Esa - results from Soil Sampling - Gold 0.7PPM (which in GoldRush parlance would 1.9 ounces per 100 yards). Significant results widely found over a 20.6 square kilometre zone.

Sunbeam - Stripping at Sunbeam. Historically this had 12.2g/t (which is 32 ounces per 100 yards - another WOW). The stripping will guide the drilling programme.

Q2

In April drilling will continue

Our focus for 2024 will entail a two-pronged approach. Firstly, we aim to enhance our geological understanding and the mineralisation of these properties to further increase their value. Simultaneously, we will explore opportunities to secure third-party investment through 'earn-ins,' joint ventures, or potentially even corporate transactions.

As we approach the end of 2023, we are pleased to share that we have received expressions of interest from various sources across our portfolio. These range from junior exploration companies with comparable standing to significant players in the industry. This interest validates the potential and attractiveness of our properties and bodes well for the opportunities that may arise in the coming year.

In addition to the 'core four' portfolio, we are strategically preparing a pipeline of projects from within our existing portfolio of assets, to further advance our exploration efforts.

The cornucopia of POW

Valuation Thoughts

Comparing the above 2 charts you’ll notice that the sum of POW’s holdings comes in at £34.88m or at £14.62m. £34.88m is where I am using market price where available and analyst estimates where it’s not. And using zero where there is no analyst estimate. The NAV of course is BOOK VALUE in the latest accounts.

First Equity Target Price upside

Analyst First Equity puts FCM at a target price of 24p/share which would give it a marcap of £19m - so that’s worth £4.4m to POW.

They put GMET at a target price of 35p/share which would give it a marcap of £29.47 - so £18m to POW.

POW’s discount to NAV excluding publicly listed holdings and cash is above 100%.

For every £1000 you get £1,127 back in cash (theoretically if POW could liquidate at target price) plus you still hold a substantial Uranium holding at Athabasca Canada, gold and copper projects in Botswana, further Uranium, Gold and Silver projects in Australia, plus others. Many with newsflow and results pending too.

It really is astonishing.

For clarity I’m not saying selling listed holdings is the strategy or should be strategy but I’m merely illustrating the deep value here.

POW is wow, it’s as simple as that. Have a good weekend.

This is not advice.

Oak

Pow! GMET announcement of garnet resource at pilot mountain!!!....

Today’s news on FCM’s Sunbeam and up to 18.8g/t assays will turn a spook to a spike I believe