Dear reader

Central Asia Metals previously covered in “I’d fly 10000” moves to a new contintent. Not only does this Kazakhstan miner (14 year remaining life) have a mine in Macedonia, Europe, with 9 years life it has acquired 7.1% of a third project in Arizona and launched a takeover bid. This is to acquire New World Resource, kind of a fitting name. An offer of A$0.062 values the takeover company at A$230m. (£109m or US$150m). It outbids a rival by $8.8m so isn’t yet a done deal but it is looking good.

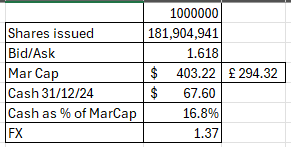

CAML had $67.6m at 31/12/24 so the remaining funds will be debt funded.

Once built, the mine called “Antler” would be highly cash generative. More so considering today’s prices. An NPV of over $700m based on a revised resource estimate and at today’s metals prices (based on a 0.8% Cu.Eqt cut off).

The resource was significantly upgraded in May from its prior estimate which was as below:

That’s based on a 12.2 year annual operation of 30,000 tonnes of Copper equivalent where 50% is copper with about 10% gold, 10% silver, Zinc 25%, Lead 5%. Where the Silver is sold for more than a peppercorn (contrasting their existing arrangement).

Antler is a high-grade volcanogenic massive sulphide (VMS) deposit located in a sparsely populated area of northern Arizona, approximately 200 km SE of Viva Las Vegas. The JORC-compliant MRE, updated in November 2022, forms the basis of the PFS. It includes:

14.2 million tonnes (Mt) at 2.1% copper (Cu), 5.0% zinc (Zn), 0.9% lead (Pb), 32.9 g/t silver (Ag), and 0.36 g/t gold (Au).

Equivalent to 14.2 Mt at 3.8% copper-equivalent (Cu-Eq).

Mining Method: The project will utilise underground sub-level open stoping with paste backfill (CAML already do this in Macedonia) to minimise environmental impact and surface footprint. Tailings from the processing plant will be mixed with a binder and used as pastefill in stoped areas.

Production and Mine Life:

The PFS outlines a 12.2-year mine life, processing 1.2 Mt of ore per year at an average grade of 1.6% copper.

Total production is expected to yield 341,000 tonnes of copper-equivalent, including 186,700 tonnes of copper, 387,600 tonnes of zinc, 41,100 tonnes of lead, 6.0 million ounces of silver, and 67,500 ounces of gold.

Once steady-state production is achieved (Years 2–11), annual payable production is projected at 16,400 tonnes of copper, 34,500 tonnes of zinc, 3,600 tonnes of lead, 533,300 ounces of silver, and 6,000 ounces of gold, equating to 30,100 tonnes of copper-equivalent annually.

Economic Metrics:

Capital Expenditure (CapEx): Estimated at just under US$300 million.

Revenue: Projected at US$3.16bn over the mine life, with net smelter return revenues averaging US$202.43 per tonne of ore milled.

Post-Tax Free Cash Flow: Estimated at US$978m.

Net Present Value (NPV): Post-tax NPV of nearly US$500m, based on a copper price of US$4.20/lb. (And based on the original resource estimate - since revised)

Infrastructure:

Water will be sourced from a well field on private land owned by the company, 12 km west of the deposit, and delivered via a 15.6 km pipeline.

A fully operational overhead mains power distribution line extends to the planned processing plant location, with studies underway to upgrade it to 69kV.

Permitting Progress:

Accepted as a FAST-41 Transparency Project by US Federal Government under the Bureau of Land Management as the Lead Agency

The Mine Plan of Operations (MPO) received a Determination of NEPA Adequacy from the Bureau of Land Management (BLM) in February 2025. This is the only federal permit required, with full federal approval expected by early 2026.

Arizona state permits, including the Aquifer Protection Permit, air quality permit, and Mined Land Reclamation Plan, are under review and expected to be issued progressively throughout 2025.

The project is on track for groundwork construction to begin in the second half of 2025, with full permits by early 2026 and concentrate shipping targeted for 2027.

Next Steps:

Antler is advancing to a Definitive Feasibility Study (DFS) by early 4Q25 to further de-risk technical and financial aspects. The DFS will include additional metallurgical testwork and exploration at the nearby Roadrunner Project area (over 6 km of strike northeast of the Antler Deposit) and other regional targets.

Strategic Context:

The project benefits from existing infrastructure, a mining-friendly jurisdiction, and support from recent U.S. executive orders prioritising domestic critical mineral production.

Existing Ops

CAML’s principal operation is a highly cost-effective leaching operation that supports a 73% EBITDA. That’s a tough act to follow. In fact its SASA operation only delivers 35%.

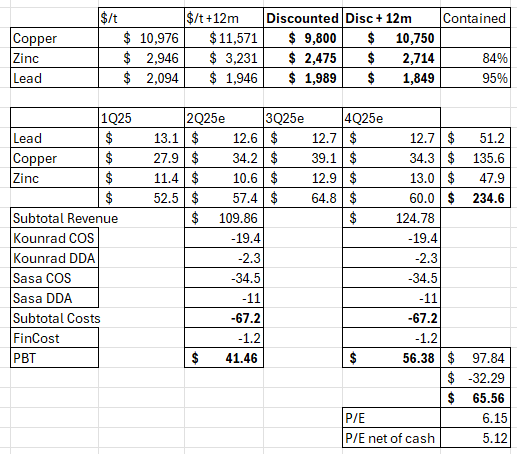

Based on 1Q25 actuals and the guidance for 2025 this remains very cheap in my view. Adding Antler seems a very reasonable move to me. The 18p dividend is a major attraction costing -$40.9m in 2024. A forecast $65.6m PAT would suggest that’s affordable in 2025 - except for the fact that it is based on FCF and that will drop in 2H25 as construction gets underway for Antler.

For CAML’s that can survive the thirst for a 2H25 and 2026 dividend the oasis after this shall be a near tripling of profits.

WAIT. WHAT?

With revenue at Antler likely to be well in excess of $300m and based on the PFS annual volumes based on a 1.2Mtpa operation. The PFS estimates an AISC -$120.15 per tonne cost which is -$144.2m per annum. So $180m pre tax or $120m post tax net profit.

Cash and Debt

Acquisition cost is -US$150m and Capex is -$298m (including -$31.4m contingency) so less $67m Cash at 31/12/24 plus FCF 2025 and 2026 of $133m leaves perhaps -$250m debt by 2027. Debt will of course be higher if dividends remain flowing.

With FCF approximately tripling too then CAML could be debt free by as soon as early 2028.

CAML say they can access competitively priced debt and has significant borrowing capacity.

Valuation Thoughts

With a strong balance sheet and net assets of $351m (assets $440m and liabilities -$89m) pre Antler this was priced at 5.1X earnings net of cash (or 6.1X).

So cheap-ish but not vast hidden value.

6.1X would of course be a 16.5% dividend yield but the actual dividend is 11%.

That’s with zero value assigned to its 28% Aberdeen holding which is described as having “encouraging results” and CAML X’s four early stage licences in Kazakhstan.

Antler moves the dial on profit and would move the P/E to 2X based on that tripling of profit…. to circa $200m per annum if CAML can pull it off.

The other aspect here is to consider upside from the metals. Zinc at $2,782 per tonne is not a demanding price. That could rise at least 10%. Copper is forecast to rise 10%-20% potentially far more. Gold? Silver? Yes they could rise. Many claim they shall.

Price rises would flow to the bottom line (with an assumed -33% tax) so +$40m is conceivable based on Copper +20%, Zinc +10% and Silver +50%.

So $240m on a $400m marcap is of course 1.66X price earnings.

Could prices collapse? Anything is possible but it seems unlikely Copper remains in demand due to electricifation although there is no actual deficit - yet - one is looming. Silver is certainly in deficit meanwhile. There is also the US location premium particularly in a “strategic” world.

A final risk is that of a harrumpher.

Some people buy stocks for a dividend. Hey I’m as human as the next guy - that’s what I do. So the question here is also how many income folks will sell and how many growth people will buy?

I say risk, the “risk” is actually also an opportunity if volatility leads to price drops. Where one harrumpher leaves an excited growth buyer enters. The numbers show that £1.62 is already very cheap for a prospective 1.6X earnings. That’s potentially 60p profit per year per £1 invested. We also know that management are always generous in their dividends so it’s likely that dividends won’t be zero in 2025-2027 and that therefore debt therefore also won’t be zero by 2028 either. I haven’t attempted to second guess but the principle of 30%-50% of free cash flow is what management guide.

So to summarise, with its prospective new mine CAML could be smoking.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks for the early morning Caml toe snigger! :D

I read a comment that substack is onlyfans equivalent for intellectuals but i've just regressed...