Tekcapital owns 5.2 million shares in Innovative Eyewear which is ~40% of the total issued share capital. At today’s market price of $0.42 that ownership is worth $2.2m/£1.8m or 1p/TEK share (TEK is £14.7m market cap total at today’s 8.5p ask). Because TEK has a controlling interest there’s a 15% mark up on the NAV so 1.15p/TEK share.

(A drop of a third since my article 2 months ago)

Ouch.

Q3 results out today.

Is it a Double Ouch?

So let’s do a quick recap then get into the results.

Then let’s get into how the future changes in 2024 and 2025.

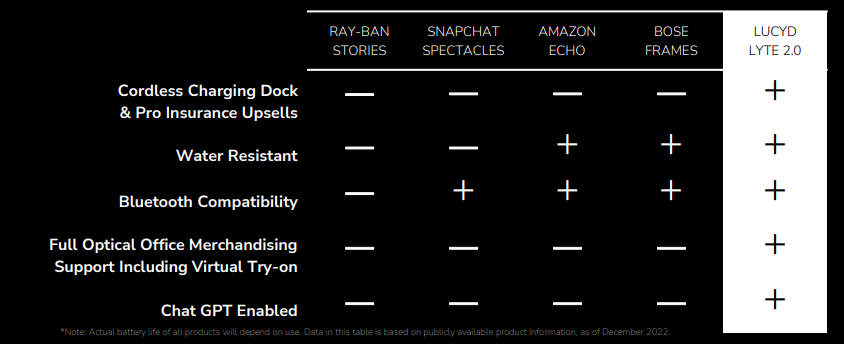

Lucyd have 64 (1 more than last time) patents pending/granted including a voice to query Chat GPT interface, the best battery life, lightest weight and an ability to add prescription lenses including Blueshift, and patent-pending hinges (patent #64).

They have what others don’t.

Product Progress in Q3:

Chat GPT 2.0 launch

Reader, have you considered what happens when Chat GPT can do more than it can today? GPT 4.5 or 5 is imminent. You can now bypass the “historic model” limitation and make access live internet queries.

Lucyd have launched XL glasses for larger and wider heads.

Hinge Springs for better comfort and fit.

Lucyd have launched its Blueshift lens - for people driving at night and feeling “blinded” by oncoming lights did you know as you get older you get sensitive to blue light so BlueShift can make night driving much safer?

Lucyd has “try on” facilities where you can try on the glasses from the comfort of your phone or laptop.

Commercial Progress in Q3

The share price tells another tale. That’s dropped from $7 at IPO to less than a tenth (over 94% destruction) at $0.42. A recent placing raised at $1.05/share raised $4.1m net.

The Good

$ Sales are up by a third QoQ

Price rises have been put through for the v2.0 without any loss in volume growth

Volume Sales are up 50% YTD

Gross margin is up from -15% to +33% (Oak Bloke previous estimates on margin were spot on!)

Distribution is up - 25% more stores QoQ.

Share of online sales now 37% - higher margin

Cash - we have enough for “at least 12 months”

Delisting - did you read about the reverse split planned? LUCY “should” be able to do a 10:1 and share price goes to $4.20 instead of $0.42.

I read in today’s results:

Optical retailer feedback at the Vision Expo West conference on the new Lyte XL frames and pre-production Nautica smart eyewear samples was extremely positive, indicating the strong potential of the optical channel for our products. Reception of the Nautica samples was some of the best feedback the Company had ever received. With the optical industry being a largely brand-driven marketplace, the introduction of the Powered by Lucyd lines bode well for the Company’s future prospects.

The Bad

Replacements in Q2 make comparison difficult

Small batch production is expensive

Nautica delayed to Q1 2024

Safety glasses delayed to Q2 2024

The Ugly

The share price is down

Cash flow looks ugly

The murmer on peoples lips - will Lucyd run out of cash?

So show me the money!

Sales Volume

I pieced together volumes by channel and by Quarter using the cumulative and the percentage split to work out the ratios. It makes interesting reading.

Before anyone says, ah hah, sales volumes are down 33% in Q3, compared to Q2 they’re not. Q2 has lots of replacement glasses (remember COS was larger than sales). Volume includes replacements. Lots of free replacements.

Best way in my mind to look at the figures is to halve the Q2 number, or ignore it and look at Q1 to Q3 (Year to Date). Up 50% YTD.

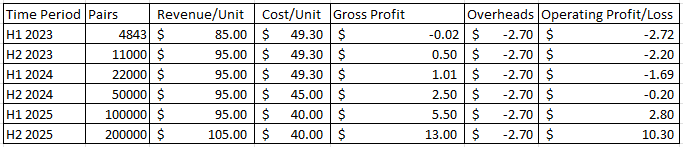

So let’s compare my prior predictions and now my new ones.

Sales P&L

PRIOR

NEW

Revised assumptions:

a/ 4732 Q3, assuming 16% growth in Q4 (50% YTD in Q3 remember) arrives to 11,000 for H2 2023.

b/ Reebok, Nautica and Eddie Bauer Partnerships launch Q1 2024 I’m working on a 2X ramp up in H1 followed by a H2 ramp up of 2.5X

Do you think that’s excessive reader? I sense the scoffing. So here’s my thinking. LUCY in Q3 2023 now has 350 retail stores and sold 1500 pairs. Authentic Brands Group sell into 380,000 points of sale and have 10,800 own shops. That’s 11000 times the number of current retail outlets or over 30 times just based on own shops, if we say points of sale are irrelevant (hint: they’re not). So is 2X and 2.5X that much of a stretch? (For glasses that were the best feedback ever received remember)

c/ Price rise in Q3. Assuming the $159 minimum price and circa 25% price rise translates to a mere 12% price rise ($85 to $95). That’s probably pessimistic but let’s go with it.

d/ Cost/Unit. The economics of contract manufacturing larger batches kicks in from H1 2024 rather than H2 2025. The opportunity to reduce cost of production going forwards was signalled in the Q3 results.

Cash Flow

I’m forecasting a slight improvement to cash generation so warrants are not required but am assuming will happen in 2024. In fact I suspect $1m of warrants is too low.

4.68m warrants exercisable at $1.05 would be $4.92m cash in. Potentially. Appreciate the SP would need to more than double to get above $1.05.

I’m still predicting cash positive in 15 months - and net profitable.

OLD

NEW

Notice I’m assuming $1m of warrants converting next year…. assuming this is at the $1.05 rate then that’s 0.95m shares so a 6% dilution (reducing TEK to 37.3% ownership). Or assuming all 4.68 warrants are converted then dilution for TEK takes ownership to about 30%.

Conclusion

Is there ugly? Yes. Were you expecting otherwise today? I wasn’t. Go back and read my prediction made in September 2023. Yes there’s ugly cash bleed in Q3…. as I predicted.

Is there good? Is LUCY heading in the right direction? Yes, there are both commercial and product progress.

Is there bad? Not so much. Delay isn’t welcome but let’s do it right, don’t do it fast.

The crucial times lie ahead. If cash burn (Operations and Investing) is above $3.3m in Q4 then there’s trouble ahead. I’m forecasting $2.7m for Q4, or better.

See you in 3 months! And we’ll see if LUCY will bring us luck in 2024.

My posts are written for my benefit, you see, to set out my investment rationale to myself. I hope you enjoy what I write and find it entertaining but also useful in forming your own rationale.

Good luck.