REA-dy Steady Go?

Revisiting OB2024 idea RE.B

Dear reader,

Looks like today’s picture features the Palm Bloke. It’s no family relation.

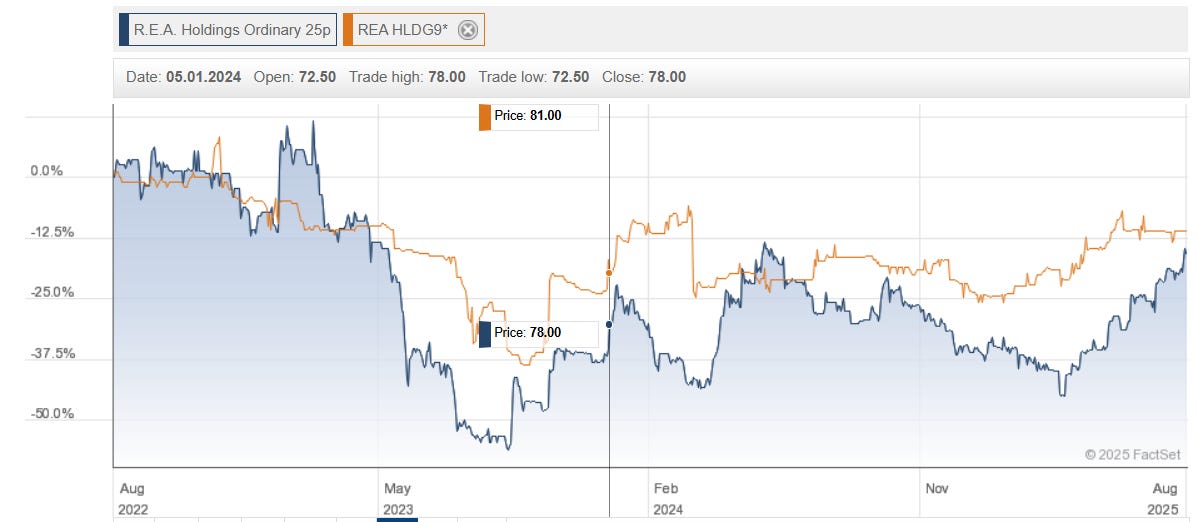

I last covered OB 2024 idea REA 9% prefs in “Reading the Palm” back in December 2024 and that was based on the 1H24 results. So is this Crude Palm Oil (CPO) and Crude Palm Kernel Oil (CPKO) producer one to consider?

Let’s dig in to the details:

Palm Oil Prices

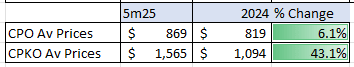

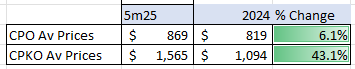

2024 selling prices were up vs 2023 and in the update to 31/5/25 up again. Some of this gain in price is due to a higher percentage of “certified” oil as in certified as sustainable.

Edible Oils are to some extent substitutes and we can see there is no clear price advantage by Sunflower or Rapeseed currently; in fact dry climate conditions and the ongoing Russo-Ukraine war has affected Sunflower Oil production pushing prices up nearly 50% in the past year. Steady prices for CPO and CPKO appear locked in for 2025. Moves by Indonesia to boost the amount of Palm Oil used in Gasoline to 50% in 2026 is highly supportive. The rate was 30% in 2023 and increased to 40% in 2024.

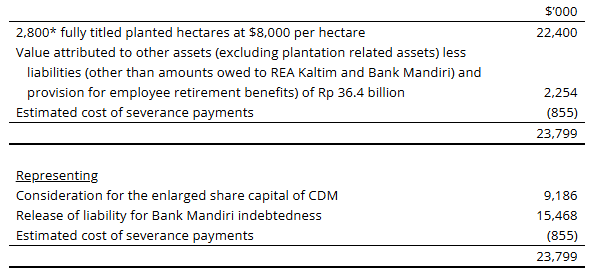

Disposal of loss-making CDM

CDM represented 10k of 63k of REA’s plantations. It lost around -$6m per year in 2022-2024 and there was a -$23m write down in 2023. The sale reverses some of that loss in 2025. $7.2m by my reckoning.

Receipt of the cash consideration for the 100% sale of CDM, coupled with the release of the group from liability for the loan provided by Bank Mandiri to CDM meant a further reduction in group net indebtedness of $23.7m

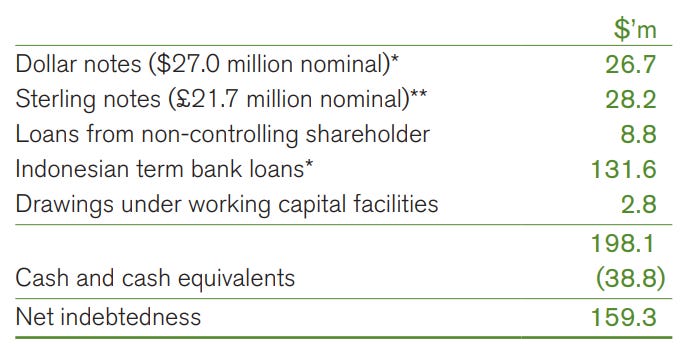

This implies net debt reduces from $159.3 - $23.7 = to $135.6m before considering cash generation in 2025. In 2024 net debt reduced by $19m.

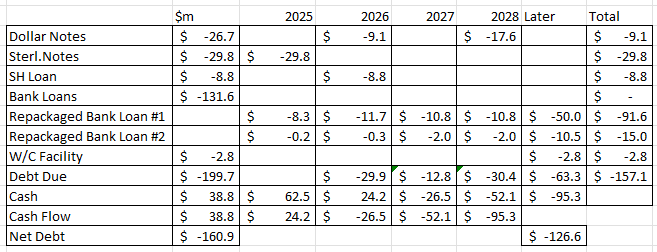

If you map these debt and due dates then ignoring operating cash flow gets you to 2026 before current cash is exhausted. Moves have been made to push back the Dollar Notes to 2028 and two repackaged loans have kicked the debt ball down the road too.

Of course zero operating cash flow would be quite ridiculous. Op Cash Flow was $58.6m in 2024 and net of w/c movements, tax and finance costs net cash from ops was $31.7m with a $7.3m FX gain gets you to $39m.

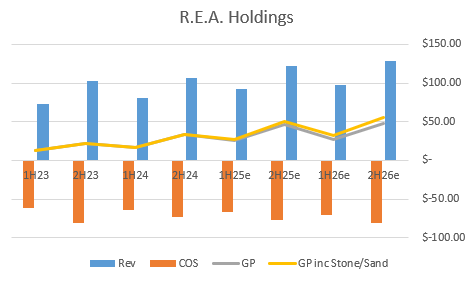

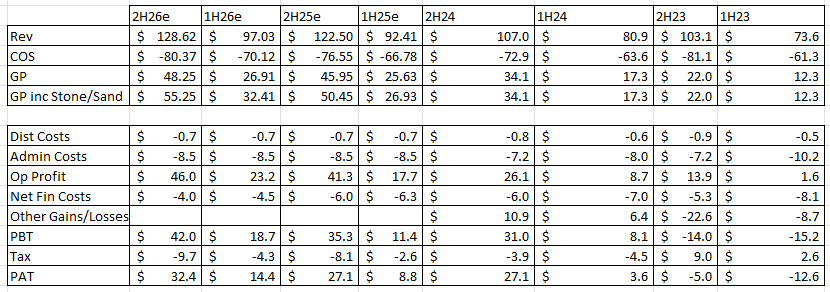

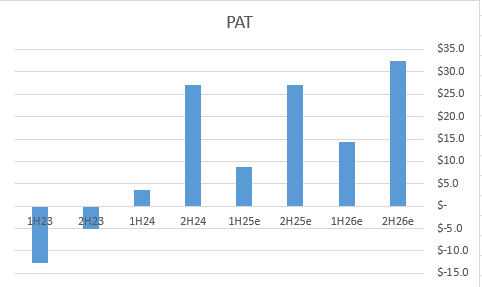

Rising Profitability

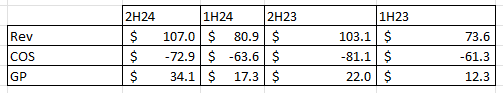

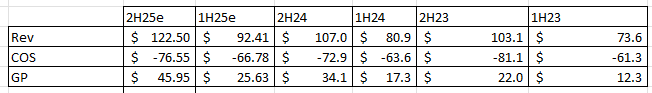

2024 reveals gross profits in 2H24 accelerated beyond what the business achieved in 1H24. There is a 2H weighting due to seasonality, so a $34.1m 2H24 gross profit is a $51.4m overall result with a 43%/57% H1/H2 split.

So what about 2025?

What about those rising prices we discussed earlier?

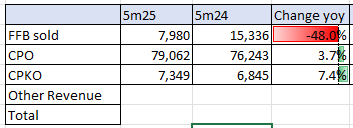

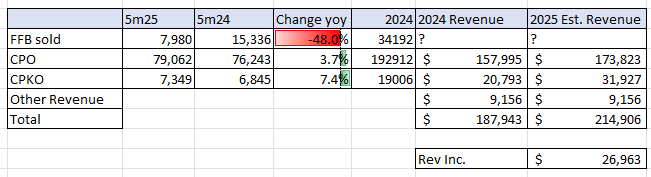

Combine those with rising volumes in 2025 that are 3.7% higher for CPO and 7.4% growth for the more valuable CPKO. The drop in FFB reflects more Fresh Fruit Bunches are being processed and sold a oil. FFB fetches a negligble amount of money by comparison.

If we extrapolate those percentage growth over 12 months and apply the current CPO and CPKO average prices as indicative for 2025 then we arrive to pleasing $27m growth in revenue.

Compared with 2024 profits have risen by 40%.

Sand and Stone

“Stone is not yet in full production but indications are that it will provide a significant increase to profit”

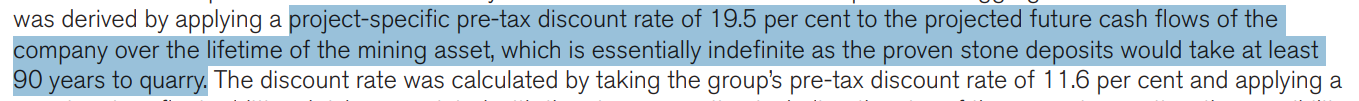

These businesses are held at a $65.3m valuation based on a DCF of 19.5% over 90 years.

A broker guess is that those businesses will deliver:

Stone Concession EBITDA of $5m in 2025 and $10m in2026

Sand Concession EBITDA $0.8m and $2.5m in 2026

Based on the DCF of 19.5%, those numbers are close to the $12.7m combined EBITDA I arrive at too.

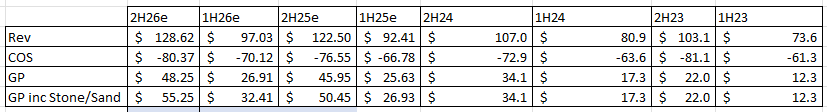

Using $12.5m number that suggests EBITDA profits are not 40% but 50% higher at $77.4m vs $51m

If we apply a 5% increase to CPO/CPKO in 2026 then we see an $87.6m GP forecast for 2026 up from $34.3m in 2023.

2.5X the forecast profits would mean more than double the share price wouldn’t it? But no. The Pref Shares languish but 12.8% higher than when I included them in late 2023. At a 87.99p ask that’s a 10% yield too. Of course that’s a great yield but it’s lower in 2025 because they were playing “catch up” in 2024 and overdue accrued dividends meant the yield was 22% that year!

But the capital gain is not in the price. And of course that ignores the SUBSTANTIAL reduction in indebtedness.

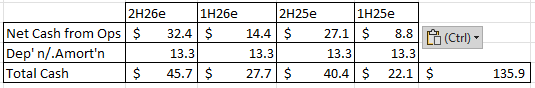

To arrive at approximate cash flows I calculate forecast profits and add back depreciation.

Assuming no cash needs to be recirculated into the business, maintenance capex, no working capital, etc then the -$160m debt meets around $136m of cash netting off debt to a much lower $24m by the end of next year, just over 16 months from now.

So a heavily indebted and loss making business that traded at a discount to its NAV?

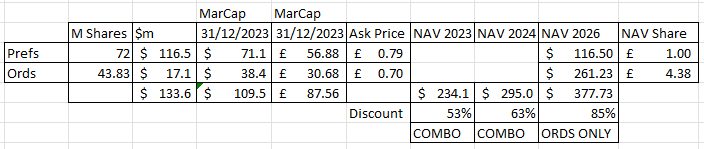

A NAV of $234.1m at the end of 2023 when I wrote the far less pun laden “Introducing REA” and $295m at 31/12/24. In that I said this “could be debt free” by early 2025. Hmm, not so fast! The Stone and Sand concessions have taken 18 months longer to get going and disposals taken longer too. There was also a period of lower Palm Oil prices to contend with too.

But I think I can see REA potentially being debt free by 2027, and this time I really mean it!

Understanding the two ways to buy REA

Prefs are a “share” but these offer a fixed return of 9p per year and are a hybrid form of debt. If REA retired the prefs they’d need to do so at their £1 face value. So that would be a £0.21 upside per share. If REA got bought out at 3X today’s value then it would be the Ords who’d get that upside.

Ordinary Shares or Ords have waited patiently behind the Prefs who have been getting their dividends, while Ords get none. Will the Ords get their day in the sun?

Assuming you agree with my mathematics that during 2025 and 2026 around $85m of net profit shall be generated then that gets you to a NAV of ~$380m.

If you deduct the face value of Prefs from that future NAV you arrive to a $377m NAV. If you deduct the $116.5m face value of the pref shares then the Ords have a NAV of $261.23m. Between 43.83m shares that’s an incredble £4.38 per share vs today’s £0.70 buy price. That’s an 85% discount to NAV.

That implies a 6X upside based on a prospective 2026 valuation being bought out SOLELY at NAV. What if it were valued at 1.75X book like MP Evans is today?

Of course the Pref folks buying today stand to earn 11p + 9p + 9p = 29p on a 79p buy price by the end of 2026, if the prefs got redeemed at 31/12/2026. (Of course there is no guarantee of that, and this article is simply postulating the value). And who knows in the event of a sale perhaps the company might throw the Pref holders an extra bone, and give them an extra tickle too.

But the real upside now in 2025 and beyond is in the Ords not the Prefs, if you believe this share is ripe for acquisition or sale, and with attractive assets why shouldn’t it be?

Conclusion

So can I read your palm? Hardly, but is there space for some CPO and CPKO in your investment life? This OB2024 idea continues to fatten and deliver delicious divvies.

Profits over at fellow Palm Oil producer MP Evans increased in 2024 to 11.1X, and it trades on 1.75X Price/NAV. MP Evans 2026 forecast earnings are static.

RE. (ords) and RE.B (prefs) are a combined $145.6m market cap today. That means REA trades on a prospective 4X P/E and 0.5X Price NAV. So a 3X upside compared with MPE.

The disposal of CDM leaves a stronger business which at today’s share price could be a strong candidate for a rival to snap up. Its proximity to Indonesia’s new capital city is attractive and its Sand and Stone businesses are not yet in the price either.

But RE.B (the prefs) has that fixed upside described earlier, while the RE.A (the ords) has a vast potential upside despite being the less glamourous version of this OB idea. Both stand to gain, but the Ords more so.

Regards

The Oak Bloke.

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

OB - Have you seen Mr Rebel's play on palm oil? I know he's not even into commodities so this must be worth a look, Anglo Eastern Plantations, AEP.

Nice write up Oak. Another share that's been overlooked by the market and frankly a doozy as things stand.

Excellent analysis