Dear reader,

If you don’t own ASX:SRT then bad luck you can’t buy this idea (even if you wanted to) since it is currently at a trading stop. It stopped at A$0.16 (7.75p) about 8 months ago. At what price might it start again? And why did it stop? Read on, reader, read on!

Strata Investment Holdings Plc (ASX:SRT), a natural resources-focused investment company, and since my prior article “peeling the layers” it has released its financial results for the year ended 31 December 2024, showcasing some measure of resilience in a volatile and somewhat depressed commodity market. Formerly Metal Tiger Plc, Strata continues to pursue long-term asset growth through equity and royalty investments in mineral exploration and development, with a portfolio spanning gold, copper, lithium, iron ore, and other critical minerals across Australia, the Americas, and beyond.

Financial Overview

The company reported a total portfolio value of just under £9m across listed equity investments and warrants with £0.83 million in private holdings, based on disclosures from its 2024 Annual Report.

But the bulk of its value is in its Royalties Receivable.

2024 Profit & Loss (£m)

A strong gain to the royalty was offset by losses on equity positions. Quite a lot of this was culling off lithium, rare earth, nickel and cobalt ideas. SRT geared itself up to ride the green wave only to see the prices plummet and equities follow suit. After all nickel is nearly -70% down its 2022 highs, Cobalt -60%, NdPr -67%, Lithium -87%!

So bad top down choices, even if the bottom up could’ve been great. Having said that, who forecast back then that the above metals would be smashed on the rocks of despair in 2025. Predictions were quite different! The problem has been oversupply from Indonesia, China and the DRC. Various problems mean those sources of supply look quite wobbly in 2025.

Two exceptions to the tale of commodity price woe: Gold and Copper. Both recently exceeded any 2021/2022 highs and Copper as I write has rebounded 4%, to $4.53/lb so Dr Copper is NOT diagnosing recession, even if every pundit except the Oak Bloke seems to be. Even in the past 24 hours the China tariffs have begun to crumble as Trump introduces exceptions (which by the way are categories #1 and #2 to US Imports from China - see my article on Friday)

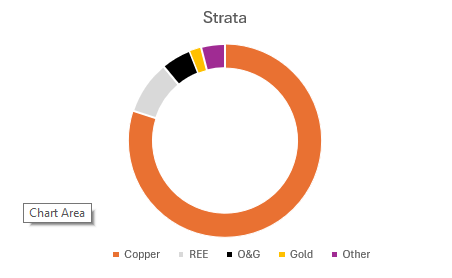

SRT separate out their largest holdings and call them “Active” and also their most promising and calls them “High Conviction”. As can be seen below these are focused on Copper, O&G and Rare Earths. So these account for about two thirds of the £9.8m equity portfolio.

Another insight is that £17.5m Royalty is mainly Copper while 25% of the above portfolio is Copper too. So about £20m of the £25.7m NAV (so 80% of NAV) is COPPER

(Copper-Silver technically)

#1 Cobre

a/ 2nd largest tenement holder in the Kalahari Copper Belt Botswana, Cobre is working with BHP agreeing a 25% earn-in JV at its Kitlanya project. BHP gets 75% in return for injecting A$40m of exploration expenditure. Work starts this month (April 2025).

b/ Separately Cobre is working towards defining a JORC-MRE at its Ngami project. This is where Cobre would use liquids to extract copper rather than dig and mine. I knew ISCR was used for Uranium and Lithium so it is news to hear it being potentially used for copper too. The recoveries of 90.7% seem really high.

c/ Actively drilling is going on at a 3rd project Okavango. So far it has intersected copper-silver (see the samples below) and follow up drilling is planned.

d/ Its Silicon Dioxide project in Australia is progressing also. It has potential of between 5 Mt and 28 Mt of 99.1%-99.6% purity PRE-BENEFICIATION.

If they can achieve beneficiation to 99 point 9 recurring the rewards are substantial as seen below. Assuming 100% recovery and the lower end 5Mt at $7k would be $35bn revenue while 28Mt at $41.2k is $1.15tn revenue. Less processing costs of course.

e/ SRT own a 2% NSR valued at £0 in the balance sheet over Kitlanya.

#2 Iondrive

Iondrive is an ASX listed (ASX.ION) company specialises in the development and commercialisation of innovative lithium-ion battery recycling technology.

It delivered a £1.2m gain in 2024.

So a little bit like the UK’s TM1. SRT hold 14.3% of the capital. During 2024 it successfully completed the PFS of its battery recycling technology “DES” (Deep Eutectic Solvent). A pilot plant construction, process optimisation and commercial expansion are next steps.

#3 Rapid (down 80% in 2024, flat 2025)

SRT hold 11.06% of capital and options too. This is a:

a/ A Hard rock lithium project in North Dakota, USA (will it get MAGA money?),

b/ A Gallium-Germanium Project in BC, Canada (both minerals now subject to China export restrictions)

c/ A Nickel-PGM project in Zimbabwe (samples include 2.46% Nickel and 2g-3g/tonne PGMs)

#4 Omega (double bagger 2024, down 25% 2025)

Omega Oil & Gas is well-positioned to capitalise on both the Australian east coast gas market (it’s located west of Brisbane).

Its Canyon Gas Field next-door to Shell, is strategically focused on addressing substantial gas shortages. The successful drilling of the Canyon-1H horizontal well to 4,616m confirmed strong gas shows and condensate potential, reinforcing the quality of the reservoir and possibly of multiple TCF recoverable reserves.

With a solid financial position and a clear path to proving the commerciality of Canyon-1H, Omega is well positioned for further progress in 2025.

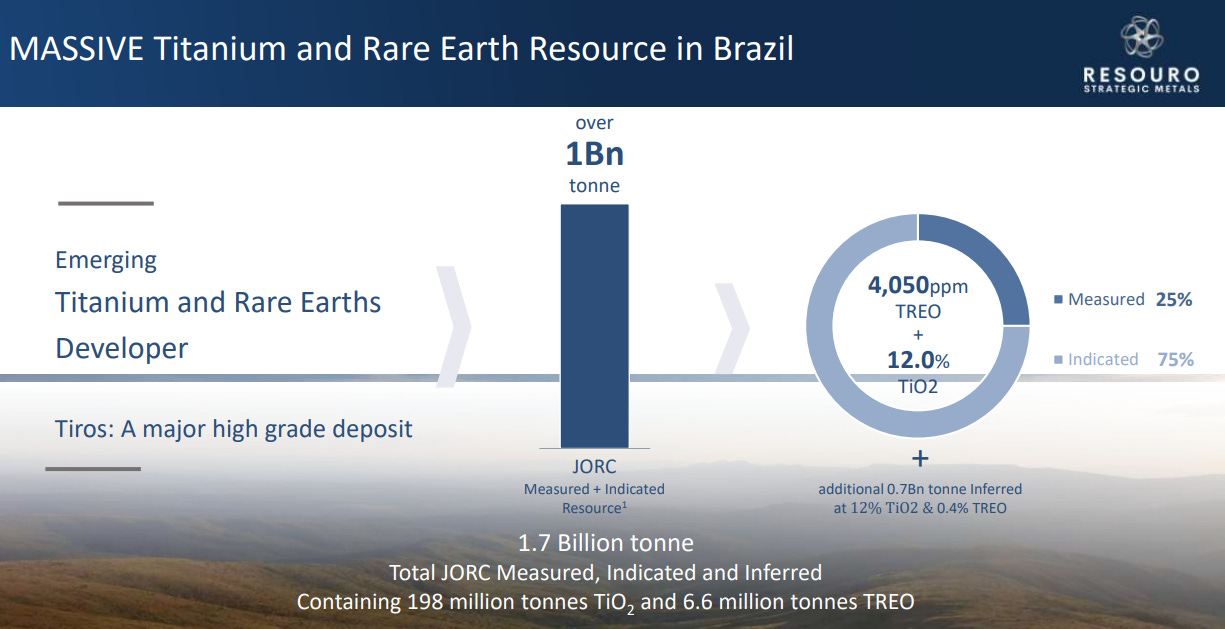

#5 Resouro Strategic Metals Inc. CDI - down 67% 2024 - flat 2025

RAU delivered a JORCE resource of 1.7 billion tonnes at 3,900ppm TREO and 12% TiO₂, including a high-grade zone of 120 million tonnes at 9,000ppm TREO and 2,400ppm MREO.

This positions Tiros as one of the world’s largest undeveloped rare earth and titanium projects, with significant upside given that only 7% of the project area has been drilled.

#6 Viridis down 85% 2024

Viridis is an ionic clay REE project moving from explorer to producer. It is working on the FEED/PFS

Of course anyone who followed the OB25 for 25 idea Mkango knows that REE is a hot topic right now. Why?

The China Ministry of Commerce under Article 12 of the Export Control Law, have tightened control over global rare earth supply by introduction of new export restrictions set to disrupt industries dependent on critical REEs.

Seven medium and heavy rare earths on an export control list:

Dysprosium (Dy), Terbium (Tb), Samarium (Sm), Gadolinium (Gd), Lutetium (Lu), Yttrium (Y), Scandium (Sc).

#7 The Rest of the Investment Portfolio

The above covers the first two columns, while the remainder cover 10% copper, 5% gold and then a variety of other metals making up about 18% remaining.

#8 Royalties

Strata’s royalty segment provides stable cash flow and gets amortised as the 2% rolls in. This is comprised of a 2% royalty over Sandfire’s A1 and A4 deposits (but not its T3), plus 2% over all of Cobre (earlier stage)

Given that Sandfire is increasing production and moving more towards A4 later in 2025 and more still in 2026 these payments will rise.

The Royalty Receivable is a 2% NSR - or net smelter return of all of Sandfire Resource's ~8,000km² area, excluding T3 but inclusive of the A4 and A1 Projects.

Let’s consider how that £17.5m arrived to the balance sheet.

If we first consider the A4 royalty, 9.7M tonnes at an assumed $3k profit** at 92% recovery and 92% concentrate recovery converted to GBP returns is about £19m. But discounted by 6% reduces the income to about £12.5m of the valuation.

** the C1 cash cost is US$1.54/lb while copper is $4.5/lb so $3k per tonne is pretty conservative.

The A1 reserve contributes the other £5m. Eagle-eyed readers will spot that if it’s reasonable to consider that commodities are inflation linked then a discount rate is a form of hidden value. Since the future returns will be higher since inflation causes everything including copper to go up then arguably a discount rate is countered by naturally rising prices for commodities. Will Copper remain at $9,750 a tonne, for example.

The royalty has increased in August 2024 due to Sandfire’s results of the A1 deposit

Sandfire is continuing other drilling programs, and defining its A1 resource so more upside could be announced. The £17.5m royalty not only is flattered by a discount but is just what is known today. And once drilling results are known this can only go up further.

If you ignore T3 (not part of the NSR) the royalty only covers the Probable. Yet I&I at A4 is at least 100% upside. So potentially a further £12.5m or more - nearly another 100% of the market cap. And that’s just based on the known indicated and inferred. In 8000 Sq.Km2 more could be found too.

First ore at A4 occurred in September and first royalty received into SRT in early 2025.

#9 Silver Royalty By-Product

Let’s not forget either that Sandfire has 2.5Moz inferred and 6.2Moz of silver within A1/A4. If Silver goes to the races (i.e. $50/oz) then that equates to a £2.5m upside to SRT based on a revaluation of silver credits. (or 1.5p per SRT share)

#10 Not in the Balance Sheet - Cobre’s 2%

Hidden in the (free) price is the fact that Cobre also has a 2% NSR royalty with zero value on the balance sheet. If Cobre is the next Sandfire then the Royalty could be worth millions theoretically. (or 5p-15p per SRT share)

#11 Who is SCP (The reason for the trading halt)?

SCP is a leading broker dealer specialised in the global mining sector that provides research, distribution, financing and advisory to small and mid-cap resource companies. The team at SCP has worked together since 2017, previously under the Sprott Capital Partners banner, and has raised more than $5.3 billion of capital and advised on $1.9 billion in M&A transactions / strategic investments. Headquartered in Canada and with an office in London, SCP has one of the broadest mining investment teams globally.

SRT is buying SCP for US$21.25 million on a debt-free, cash-free basis. SCP, originally Sprott Capital Partners and rebranded is a leading broker-dealer specialising in the global mining sector.

This acquisition aligns with Strata’s ‘Buy and Build’ strategy, enhancing its portfolio of investments in the resource finance sector and adding substantial depth to its resources. The transaction includes a capital raising initiative to support the acquisition, with the goal of securing US$20 million in total available cash.

Upon completion, SCP’s seasoned management team will join Strata’s leadership, with Peter Grosskopf as Non-Executive Chairman and David Wargo as CEO, strengthening Strata’s position in the resource finance market.

SRT paused the acquisition pending a decision from the Ozzy ASX about its re-admission. In late March 2025 the ASX confirmed they could make the acquisition and rejoin the ASX. SRT now need to get Canadian regulatory approvals and finalise negotiations.

#12 Conclusion

In plain language SRT will evolve from just managing a measly £17m fund (of its shareholder’s equity) to earning fees for assets under management (AuM). If it manages £500m of funds then that adds perhaps £3m-£5m gross income from fees.

Beyond this SRT is now a much bigger and focused bet on Copper. Where much of that is a successful Tier 2 producer called Sandfire. Where that generates royalty income that keeps the lights on and more.

Meanwhile the rest of the portfolio is looking pretty interesting. The Australian Gas the Braziliand and Australian Rare Earth companies appear quite exciting. The portfolio feels like random and more focused.

Comparing it to my prior article where the broad mix in the interims contained some gems but lots of holdings. Since then SRT clearly have put a knife to much of its portfolio. The big stuff now is copper, an exciting gas play, some exciting rare earth holdings and a smattering of other stuff.

Its horrific past track record has settled to a much better performance in 2024. Now in 2025 it starts to look quite exciting. After all if you agree that Sandfire is a big beast which isn’t shutting up shop tomorrow (or ever) the market cap is more than covered.

You get about 1/6th of Sandfire Royalty in the price for free plus everything else for free. Where the Top 6 do appear to be on the cusp of some very exciting progress.

Plus the SCP deal adds value too. Not only to generate a new income stream but also to become far more focused on use of shareholder funds.

I’d be very surprised if you could pick this up at A$0.16 once it recommences trading. But sometimes the early bird catches the worm.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"