TEK H1 2023 - is Cliff doing a Cliff Hanger?

H1 results 2023 - new AI investments planned - how (on earth) will TEK do that?

Examining TEK’s accounts for H1 2023 it’s first worth thinking about TEK’s longevity. How much cash runway does it still have?

My forecast per below, is another 15-18 months. That’s based on the same modest increases to its Invention Evaluator reports, and recruiting placements, and based on a steady state of expenses and working capital.

Interestingly, TEK increased its executive search assignments by 66% (from 6 to 10) and it recruited some key new experts in AI, as well as new academic clients such as MIT and industrial clients such as Vale in Brazil.

But what if TEK ramps up its activities further next year? Two new advisers recruited and with half of its portfolio now publicly held, Microsalt to be floated early in 2024 which leaves only Guident and ReVive Energy Solutions, it doesn’t seem an unreasonable thought.

The answer is a doubling of revenue from reports and recruits leads to a runway extension of about 4 months. So potentially TEK could drive this area and lengthen the runway into 2025 or even reach a cash generative state (a quadrupling of activity should do it… from 10 to 40 placements a year).

So with all 5 companies either floated, ready to float or ready to sell is that what’s going to happen? I don’t think so. The H1 results gave the first hint of life beyond the current portfolio.

What hints?

AI. It’s not a hint. It’s a declared intention. “In subsequent periods, Tekcapital intends to invest in Generative AI startups spun-out of universities that have the near-term potential to increase the productivity of existing specific businesses.”

My reaction is to form an orderly queue Clifford. Everyone is keen to invest in AI. But TEK do have some unique advantages. Its network, its proven capability to include AI in its products (except Microsalt but you go figure how AI and Salt can intertwine)

Now for the outliers…

Why did TEK sponsor 'Innovation for Sustainable Water USA-MEX'? Logically the reason would be a planned 6th portfolio company. What better way to help the world that to invent some new method for Sustainable Water - don’t you think? A new-fangled Solar condensor perhaps?

Follow the TEK patents…. One that catches my eye are the biomechanics patents held by TEK. If you’ve been watching Celebrity Race Around the World (like I have) Billy (pictured below) is a double amputee. To raise some cash they went squid fishing but Billy could only fish sat down on the rocking boat. TEK’s patents are essentially mechanisms to provide stability and support to various parts of the body through variable pressure. This would be of enormous help to amputees but more than just this (as if that isn’t enough) then imagine a technology that helps people with knee and hip replacements. Even wider than this, we are all familiar with shoes with gel support. Imagine a technology enabled pair of trainers or footwear that have “adaptive pressurisation” and helped you walk or run faster? Cushioned your poor knees and joints better? ReVive for people instead of vehicles! It ain’t that far fetched to think that’s the 6th portfolio company, don’t you think?

Where’s the money coming from Cliff? We don’t want to go off a cliff Cliff

Just where will the cash come from to fund a 6th portfolio company? (PS I’m working on the basis that SmartTek Food Technology valued at £38k is irrelevant and doesn’t count as a portfolio company)

Where do you think? Secondary placings aren’t all the rage right now so TEK will need to sell some of its holdings. Let’s examine that idea:

The 5 portfolio companies:

I recently wrote about 14 ways to feel positive about TEK’s portfolio in this article:

TEK flash update

TEK has risen from 9.5p to 11.5p in the past 2 months As of 9th Sep 2023 the NAV looks like this: LUCYD - TEK holds 5,189,086 shares @ $0.66 = £2.72m BELL - TEK holds 15,138,767 shares @ £0.47 = £7.12m Microsalt - TEK holds 97.2% = £13.37m Guident - TEK holds 100% = £14.65m

Let’s examine 3 of the 5 holdings today in light of the H1 update.

a/ BELLUSCURA

I’ve previously covered Belluscura comprehensively in 3 articles:

BELL-under? and in

In these, I’ve detailed the analysis of how BELL can reach 200p/share price by 2025 and how the current crisis of confidence will be a close run event but further funding is not inevitable - and its likelihood diminishes daily. Of course the market disagrees currently. Since 30th June, the fair value to TEK has dropped $577,337 as at 29/09/23 on a 30p/share bid price, so you might well disagree.

But, reader, we are back to the SAME share price as before announcements of a $55m 10 year royalty agreement (+ Profit Share) and $15m of (high margin) Discov-R orders. Distributors queueing up. How is that logical?

But if you follow my analysis and think that I’m right, TEK’s holding of BELL in 2025 is worth $38.45m or £31.5m. Selling off just 4% of that holding in 2025 would cover the $1.5m forecast cash shortfall in 2025. Selling more would fund a 6th portfolio company.

Or if it reaches “only” 100p/share then liquidating 8% of TEK’s holding achieves the same outcome.

b/ LUCY

In my cunningly named, Innovative Eyewear Lucyd part of TEK I gave similar arguments that poor LUCY would also prosper in 2024 going into 2025.

The turnaround is already beginning. Today LUCY posted the fact that Nautica has now launched. These glasses are on display at the Las Vegas Vision Expo but also arriving into Nautica shops across the US

Yet again TEK’s 5,189,085 shares in LUCY have droppped even further. By $1,738,343.40 to be precise at a $0.56 close price 29/09/23.

What’s caused that drop?

Well, post period the first US analyst has ventured to give a target price (of $1.75/share). 3x upside. The upgraded ChatGPT 2.0 App was released, and Blue Light Lens were introduced. So no actual bad news to justify a near 40% fall in price.

The underlying challenge here is cash and cash burn. But I address that in my analysis, and I believe the company has the capability to turn cash generative in 2024. I laid out the evidence from the Q2 2023 report. I also set out that there are risks, and only with relentless management focus on cash generation will they achieve this. With the licencing and distribution agreements its put in place, together with cost control I believe LUCY will turn around.

My investment thesis is that I see a medium term path where LUCY’s future valuation equates to 38p per TEK share.

c/ ReVive

The Shock Absorber business is further along than perhaps we realise.

It’s generated revenue from a potential JV partner:

“secured a paid proof of concept agreement with a tier-1 tyre manufacturer for their regenerative shock absorber.”

It proved itself:

“This collaboration resulted in successful tests and detailed reports regarding the performance of the regenerative shock absorber.“

It’s commercialising for domination of a fast growing category.

“incorporated a new subsidiary… to commercialise its regenerative shock absorber technology. Guident believes that in the next few years all electric vehicles will have both regenerative braking and regenerative shock absorbers to enhance range and comfort.”

Notice the word vehicles.

According to various sources including Statista Battery electric Car sales grew 35% in the past year (14m), e-Bikes by 20% (10m), Light Commercial Vehicles by 90% (0.3m)

Taken together, assuming this technology is licenced to Tier 1 manufacturers and working from a $50/unit royalty, and conservatively a 25m annual units then that equates to $1.25bn/year. On a PE of just 10 that’s a $12.5bn take out price. Or £75.52 per TEK share.

Let’s assume sales to only 1% of that market (even though TEK believes all electric vehicles not 1%) and only a $25 royalty. That’s still 37.76p per TEK share.

Once a royalty is agreed, the royalty itself could be sold off. Valuable automotive IP - can you think of anyone who might want to own that? Tesla? BYD? The Chinese? GM? Ford? Even a Tier 1 supplier.

d/ Guident

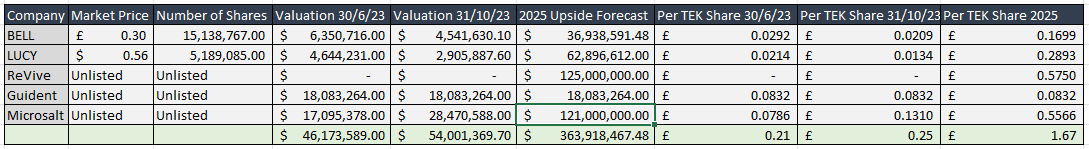

I will explore these in more detail in future articles but for now I’m going to assume steady state NAVs for the June 2023 valuation, September 2023 valuation and the 2025 valuation.

Guident remains at $18,321,027 for the next 2 years.

Microsalt Limited remains at $17,095,378 for the next 2 years despite an imminent IPO. (!)

I appreciate, reader, you may vehemently disagree with my treatment of these two, as in fact do I, but they are analyses for another day.

e/ Microsalt

See my “worth joining the IPO article here”

I discuss how an unlisted NAV of £0.0786/TEK share will go to £0.0986 or £0.131 or at worst remain at £0.0786 (listed) as the outcome of the IPO.

And why I think it could grow to a lot more.

My post IPO upside is $28.47m based on a £20m IPO.

My 2025 upside for Microsalt is based on a £100m buy out by a multi-national food co.

CONCLUSION

This draws together my forecasts for 4 out of 5 of TEK’s portfolio.

Under this scenario, and assuming all 5 holdings are still held as is by TEK in 2025 liquidating just 1% brings 2025 cash to a steady state.

As can be seen, and hopefully amply demonstrated, a 12.5p per share is simply too cheap given TEK’s prospects. Even with current depressed valuations, TEK remains at over 50% discount to (a growing) NAV. Forward pricing TEK to a forecast 2025 NAV then this is a potential 92.5% discount to NAV…. before we consider future values for Guident.

Funding a 6th portfolio company in time then a 7th etc, seems eminently possible if NAV grows anything like I’m forecasting….. just not today.

A final thought

Beyond the obvious financial upside I love that this company helps:

a/ People to see and protect their eyes and provide situational awareness through their ears

b/ People to move about autonomously but with human back up if/when needed

c/ People to breathe and live (more) normal lives even with a lung condition

d/ People to tackle the blood pressure and health epidemic caused by sodium heavy modern foods

And that in the future it will help new people too - maybe people with prosthetics who need to fish for some squid, that helps win a race around the world.

Enjoy your weekend readers.

My posts are written for my benefit, to set out my investment rationale. They are not Investment Advice. I state facts and source them where possible. I also use words like “infer” and “think” which means it’s a (reasoned) opinion based on a fact. Investment requires filling in the gaps with inferences and thinking about the facts to form forecasts. I hope you enjoy what I write and find it useful in forming your own rationale.