The CORD vs DGI9 smackdown

Comparing Investment Trusts

Dear reader,

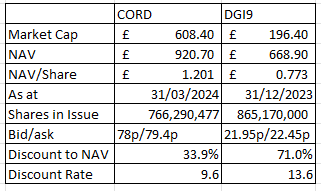

Until 2023 CORD and DGI9 ran like blood brothers. Ondulated up and down in unison. Then 2023 happened. DGI9 fell 65.6% while CORD fell 9.5%. DGI9 scrapped its dividend and CORD increased its by a third. Both faced interest rate rises, inflation. So how did one dodge bullets while the other took slug after slug? Which one offers the strongest prospects going forwards? Which one’s the better value?

So the erstwhile pair face off in a value comparison. Who will win reader? I am excited to find out. Read on reader, read on!

CORD mainly focuses on assets in Central and Eastern Europe. While DGI9 part owns part of UK’s Arqiva (99% of UK TV/radio/Satellite), CORD owns Emitel, Poland’s equivalent. But also Ceske Radiocumikace (CRA) Czechia’s equivalent. CORD owns data centres. DGI9 Snap. CORD own an Irish infrastructure business. DGI9 Snap. So not only can we do an IT vs IT smackdown but an asset to asset smackdown too!

Round 1

Arqiva vs Emitel/CRA

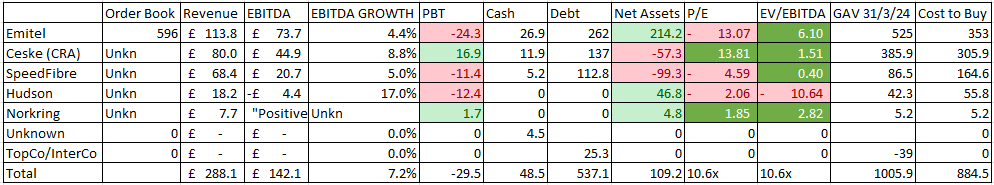

Arqiva’s has a £1bn NAV (£510m to DGI9) while Emitel/CRA are a £910.9m valuation.

Arqiva generated a PBT of £64m (£32.5m DGI9) while Emitel/CRA a PBT of -£7.4m

Arqiva generated an EBITDA of £290m (£148m) vs an EBITDA of £118.6m

But Debt is a problem. Arqiva has £1.53bn debt at holdco level vs £0.4bn. In the past 6 months, Arqiva generated £232m FCF in the year to June 2023, and paid down £60m of debt in 2H23, and rolled around £250m to 2028, but it is relatively heavily geared. Cost of debt is 7.1% (for Arqiva) vs 6.5% (average for Cordiant). The debt is manageable and will grow more manageable with time.

Round 1 to DGI9.

Round 2

Speedfibbbbbbbbre versus Eliooooooo. I’ll stop doing the Boxing Umpire theatrics. It’s more interesting for me to type it than for you to read it.

Cough.

Speedfibre vs Elio. Speedfibre is a Dublin-based FTTC networking operation, whereas Elio offer Dublin and Cork wireless internet.

Speedfibre cost £164.6m to buy, is now valued at £86.5m NAV and generated £20.7m EBITDA but lost £11.4m PBT. Elio grew from a £50.8m NAV to £55.4m in 2023. It generated £1m EBITDA and an unknown profit.

So while it’s difficult to make a direct comparison, on balance Elio appears the better buy with stronger growth.

Round 2 to DGI9

Round 3

Hudson vs SeaEdge. Hudson is a NY DataCentre, while SeaEdge is a data centre building lease operated by a DataCentre operator. Hudson cost £55.8m to buy, was negative -£4.4m EBITDA and -£12.4m PBT in the last year. SeaEdge generated £1m EBITDA and again an unknown PBT. The asset generates that income despite a NAV 75% lower than Hudson. Verne would have monstered Hudson - if DGI9 still had Verne, but that’s in the past now.

Round 3 to DGI9

Round 4

Norkring vs no one. CORD has a small £5.2m telecom towers asset with no comparable in DGI9.

Round 4 to CORD

Round 5

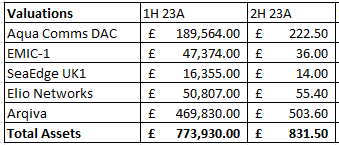

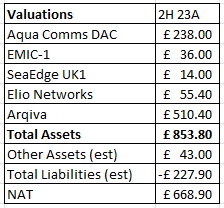

No one vs Aqua Comms. Transatlantic and Pan Europe to Asia undersea data cables grew 20% NAV in 2023. They only generated £9m EBITDA in 2023 but that should rapidly grow in 2024 and in 2025 when the EMIC-1 Asia connection goes live.

Round 5 to DGI9.

Round 6 The Corporate Battle

Having considered the assets where the only winner was an asset with no comparable, you probably know which way this is heading.

But there’s more to consider. Did one of these pair cheat their way to victory? Spike the chances of the other? Can you spot it reader?

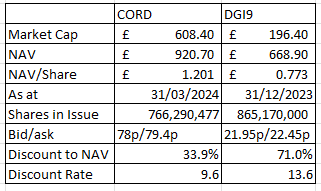

The obvious “value” is the simple fact that you can buy DGI9 for £196.4m and own £832m of net assets for a 71% discount. For over triple the cash, you can own 10% more assets. Are the holdings more attractive? Not really.

You could make the argument that Emitel and CRA are growing faster than Arqiva in 2023 but they have no water metering business (10 million premises and 50m data points) and no product development around Media Technology to speak of. Arqiva is global with has 80 satellite dishes accessing 30 satellites delivering TV to 5 continents. Arqiva speak of future growth and enjoyed 80% growth in operating profit in 2023 vs 2022, despite facing difficulties. It has a £3.3bn order book vs a £0.6bn Emitel order book.

It’s true Emitel/CRA have a lower debt than Arqiva, but profits are much, much lower too. Besides between a 100 year old UK “institution” and some Eastern European assets the less risky must surely be the UK.

The Hudson asset is growing fast(ish) but far, far slower than Verne did. Norkring seems a bit pointless, and Speedfibre compared to Elio or Aqua Comms is no comparison.

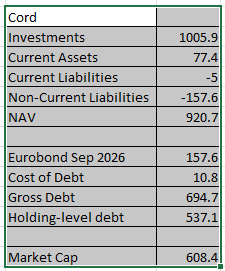

But DGI9 is laden with debt? Not really. CORD has £157.6m vs £227.9m at DGI9 - at topco. It’s true Arqiva is leveraged but it is also throwing off a lot of cash (circa £240m a year), and it is rapidly deleveraging.

Round 7 The Spiker

Did you spot it reader?

Based on everything you’ve ready about Polish and British TV/radio broadcasters, US and UK data centres, Irish connectivity providers, tell me do see any fundamental reason why the discount rate for CORD is 9.6% (for Discounted Cash Flow) versus 13.6% for DGI9?

I’m fascinated to hear from anyone who can provide a credible reason. 9.6% vs 13.6% is like a boxer fighting with smashed bottles versus an opponent with boxing gloves. It’s not a fair fight.

So in my opinion, either the assets of Cord valued at a future discount of 9.6% are too high or those of DGI9 are too low. I previously spoke of 13.6% being an unreasonably high discount based on for example, contracts in Arqiva’s case stretching out to the year 2050 - the year we no longer emit carbon dioxide or methane. Well there’s something smelly about discounting at 13.6% reader. National Grid has a discount cash flow rate applied of 5%!!

Pull the rip CORD?

Look, it’s true Cord pays a 5.2% dividend. It’s true CORD’s NAV grew in FY2024. It’s true the CORD annual report is clearer and better presented. The Oak Bloke spent 4x less time working out the relative numbers relative to the time it took deducing DGI9. I’m sure CORD-ficionados could claim the management is “better”. That CORD were better capitalised and didn’t overcommit, and got caught out. They are correct.

But the degree of punishment outweighs the crime.

On a valuation basis, DGI9 is like the Pikey Bareknuckle Boxer, easily overlooked but packs a mean punch and knocks out CORD pretty much immediately.

Between the pair, I know which one I’d put my money on - and for sure my choice will not be going down in the fourth round, no matter what Bricktop wants.

A Final Thought

The CORD FY24 year runs to 31/3/24 while DGI9 is to 31/12/23. So 3 months ahead and it’s not an exact like-for-like comparison.

So the newer CORD results are encouraging for DGI9 investors that NAV growth, and reduced discount rates lie ahead - as they did for CORD.

Some degree of difference will be the fact that DGI9 is being wound up whereas CORD is a going concern. But again the punishment outweighs the crime.

There’s also other factors like an admittedly seemingly shambolic sale of Verne and the associated £20.5m of costs, as well as the 75% discount on the earn out (equating to 9.25p of DGI’s NAV) “just in case” Verne doesn’t carry on growing. Other reductions seen in DGI9’s NAV are mainly due to applying a harsh 13.6% discount - and no reflection on the profitability and progress of the holdings.

AN UPDATE TO READERS

I am on leave from tomorrow until early July with no desktop access, and so I shall continue Oak Bloke articles after my return.

Thank you to the 4 additional readers who contributed to my Bowel Cancer Appeal. It is greatly appreciated. This is article 278. There is a wealth of free articles going back 10 months you can enjoy, but in return, if you’ve not contributed I would ask you consider doing so please.

-

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Sorry to nitpick...'Shares in issue' are in the wrong column! Otherwise very informative as ever, many thanks. Discounts are a very funny accounting treatment, given there seem to be so much wiggle room to massage asset values as desired, especially when projected streams of revenue are long dated and basis sensitive. Given both the blue chip nature of the majority of DGi9's companies' service buyers (other infrastructure providers or ex-public monopolies - e.g BBC, Anglian water, Thames water, Meta etc...who lets face it, aint going anywhere) a 'weighted average' discount of 13.6% seems excessive. You can lend to Arqiva at 7-8%.....

Oh no! Another kick in the teeth to shareholders in this company today. So NAV is only 45p at best. Seems that this company is jinxed. But also it does highlight that when small companies are suffering from bad news, that bad news seems to steamroller into a stream of more bad news, and that may be something to do with their disadvantages in raising finance.