Dear reader

I’ve been contemplating the economics of agronomics (ticker ANIC).

I’ve also been contemplating the seven portfolio companies who convincing investors as to the current or future economics of a new investment. What did those investors see which investors in Agronomics don’t see?

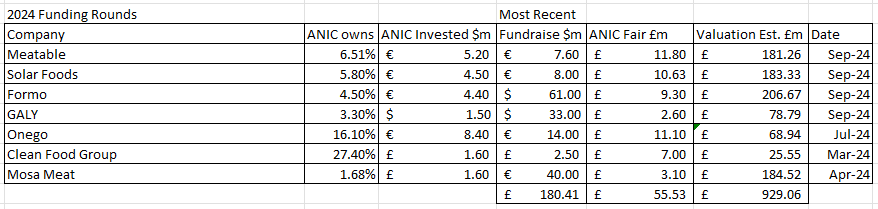

Seven new investments which on each occasion in the past 6 months are being made without any reduction to ANIC’s Net Asset Value…. no down rounds. The follow on fundraises are all where ANIC hasn’t also participated (so ANIC is being diluted somewhat).

But the positive is to consider Investors who have invested over £180m across companies which are worth nearly £1bn. These are not small businesses.

It’s interesting to see large players also sniffing around. Large companies like Unilever taking steps into Precision Fermentation.

Unilever is by no means the only large food business doing some sniffing. In fact Pepsico, Nestle, Kraft, Danone, CocaCola but also “meat companies” who you might imagine have a vested interest in seeing cultivated meat fail are getting in on the act. Hedging their bets perhaps, but doesn’t that create an opportunity for buy outs?

Some ANIC holdings are for expensive meat/fish products like Blue Fin Tuna and Wagyu Beef. Or those commodities affected by drought and climate change like Arabica Coffee and Cocoa. Considering the economics of muscling into a product like Blue Fin Tuna which sells for eyewateringly high prices would be too easy.

Let’s instead understand the economics of muscling in on meat and eggs. Let’s start there.

Did you know that Hilton Foods is a major UK producer of meat that according to their last annual report produces 0.52mt of meat at an average £6.26 per Kg of Meat?

So to compete with the likes of Hilton a production cost of £6.26 per KG is required.

That doesn’t feel like an altogether impossible aspiration. This is backed by academic research such as by Tony Seba in “The Collapse of Industrial Livestock” where cellular agriculture delivers a 5X cost advantage by 2030 and 10X by 2035.

How?

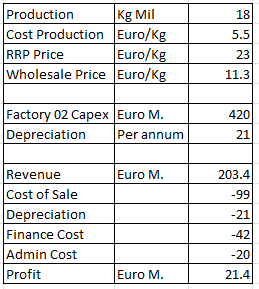

Larger Scale. Solar Foods (listed on Nasdaq North under SFOOD) has built factory #1 and is planning factory #2. The economics of factory #2 are far stronger than #2 due to scale.

By my estimates and based on Solar Foods records I calculated the following profitability to an expansion at Solar Foods to Factory #2:

I was pleased therefore to stumble across this corroborative piece of work regarding Solar Foods which puts the long term economics of Solar Foods cost of production from factory #02 (18Ktpa capacity) at around €5.20 to €5.90/Kg (which is over 20% cheaper per Kg than Hilton Foods, you notice?) and with scope to drive down costs to €2.80/Kg in the future. Even at circa €5.50/Kg the product is amply profitable assuming that electricity is inexpensive (€40/MWH or lower).

The above further assumes that cultivated meat and alternative protein is a commodity with no brand or form of differentation. But what if it does? Consider Solein vs every other plant-based protein for example.

Solar Foods victory in NASA’s deep space food challenge sets it apart and it is now in talks with various space agencies. Perhaps SpaceX and Elon Musk too? After all, to fly 4-6 astronauts to Mars requires 2.5-3.5 years of time and a launch mass of 4 Tonnes. Preserving food is a further challenge so being able to produce food in space is pretty key. While growing potatoes on mars was made to look easy in Hollywood the reality is a bit more difficult.

Additionally in 2023, Solar Foods launched the HYDROCOW consortium project, which aims to produce milk protein without cows. The European Innovation Council is funding the project as part of the Pathfinder Challenge funding program, which aims to identify groundbreaking research projects in areas such as food and nutrition. Solar Foods is the project coordinator, and the other partners are the University of Groningen in the Netherlands, RWTH Aachen University in Germany, and the Swiss biotechnology company FgenAG. The total budget of the four-year project is €3.9m The consortium aims to genetically engineer Solein into a novel technological platform that would enable new applications in food, materials, pharmaceuticals and chemicals. The project aims to produce intracellular machinery for the Solein microbe that enables protein secretion outside the microbial cell. Solein does not inherently have such a machinery, but the consortium members believe it is feasible. If successful, this would enable precision fermentation with Solein, which has a higher cost structure. Initially, the consortium aims to produce betalactoglobulin, one of the most important proteins in cow's milk, outside the Solein microbe cell. If successful, this solution would also allow the production of other milk and egg proteins as part of Solein production with relatively minor modifications. The success of the project could open up the possibility of extending the use of the hydrogen fermentation platform from animal proteins to various materials, chemicals and even pharmaceuticals or parts thereof.

Solar Foods has an extensive patent portfolio that includes 12 patent families and more than 160 patent applications, of which 28 have been granted. Each patent family consists primarily of EPO and PCT applications, plus 9-13 applications in various countries worldwide. Patents typically run for 20-25 years and are expected to expand geographically in the future. According to Solar Foods, the patent on Solein's production organism is its most important, and the organism will not be publicly available to competitors until the patent expires. The patent was filed at the end of October 2019 and will expire no later than October 29, 2039. The company's other patent families cover its bioreactor technology, post treatment and food technology.

Next Let’s Consider Onego and Eggs

Did you know that Noble Foods is Britain’s largest egg producer? Their accounts and an article from the NFU tells us their cost of production is 17p an egg (in 2023).

It takes 30 eggs to produce 1Kg of Egg White so excluding production costs it requires £5.10 worth of eggs. Assuming the yolks are 50% of that cost, it’s £2.55 worth of raw material to producce egg whites. Including production costs increases costs by an assumed £0.65 to get to £3.20/litre cost. It sells for £6.60/litre retail.

Two chicks which appears to be a popular Egg Whites brand stocked by many supermarkets made a very modest £7k profit in the year to 30/11/23 (last accounts). Given they have less than £20k of tangible assets I’d venture to say they are subcontracting the manufacturing, but the growth of debtors suggests this product is growing in popularity.

So let’s consider the economics of Onego by comparison. Assuming six million hens lay six million eggs a day, then a 2m litre facility would generate 6m/30 = 0.2m litres of Onego egg white (per day).

The lovely Nigella tells us those 3 little words….. egg white weighs 40g.

So a 2 million litre facility at 120 g/l = 240 tonnes which equates to 6m litres of egg whites! Therefore a batch of product must take one month to produce. A process which we have seen has been reduced to just 4 days at other ANIC holdings such as at Meatable.

Body Builders love egg whites

I was particularly interested to consider that scaling to 250,000L fermentation vessels provides a means to achieve “competitive price points”. So compared to egg producers Onego would be cost competitive i.e. able to produce at or below the equivalent of 17p an egg.

Assuming of course that all egg protein is the same and there is no form of differentiation.

But what if Onego is superior? Consider Onego with over 90% protein.

And then consider “traditional” egg white with 10.9% protein. Which would a body builder choose do you think?

With its superior functional properties which would a food manufacturer choose do you think?

Forget about cost and supply - what about demand?

Supply without any demand would be pointless. But there’s good news there too. A large proportion of the population are keen to try cultivated meat.

Conclusion

It has been interesting diving into the economics of some of ANIC’s holdings. The accelerating wall of money (£180m in the past 6 months according to my estimates just for holdings held by ANIC) contrasts favourably with $3.1bn of investment worldwide into this sector since 2013 and $2.5bn in the period 2021-2023.

Are these investors running the same slide rule to determine that scale and Wright’s law style improvements to process will lead to burgeoning profits?

Meanwhile the 70% discount to NAV (£50.5m vs £166m NAV) at ANIC is also disconnected from the economics of its holdings growing production and supplying into a nascent but robust demand of Gen Z’s and Millennials, eager to give up the avocado on toast for greener, leaner proteins.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Hey Oak, I always enjoy your posts and hope you get lots of support for the fighting cancer fundraising

I’m glad many just seem to be watching ANIC. I’m down 50% on it.

The potential for this industry seems incredible. Even if you think cultivated meat might never reach cost parity, like some do, there are so many options left in their portfolio.

The fundraisings you mentioned should not be underestimated imho. What I read into it is, that this management team is really able to identify start ups with great potential, including management and everything. Yes, they did have write downs too.

What I don’t get, if Jim Mellon is a billionaire (!) why not mob up a lot more shares at 70% discount to NAV?

The ultimate trigger imo for ANIC will be profitability of the portfolio companies. Anthony C. has repeatedly said in interviews, that they know it will take long time for the industry as a whole and therefore tried to focus on pics that might be earlier than others. Then usually mentions Liberation Labs.

Like with all projects they lack their timelines a little bit. Latest interview he mentioned completion in mid 2025.

I wish they would announce “fully funded“ for this one soon and also provide more details on the estimated revenue/income.

Cheers Oak and everyone else

Another great article. I have been watching this for ages. The one thing that is holding me back is the slightly strange fee arrangements there appear to be between ANIC and Jim Mellon. It could be worth checking these to ensure they are shareholder friendly.