The Fun Run Final Result Part Three

Other runners cross the finish line

Dear reader

Bronze Medallist Mr Thompson 17.7%

The IC man Mr Thompson comes in with a 17.7% result and 6 wins 3 losses.

Agronomics delivers a top result and I cover ANIC in my 2024 review.

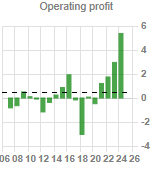

VLE invests in companies that require growth capital. Undervalued and distressed businesses and those with synergies to the existing group. Its business is organised into Food Manufacturing, Investing and management services. Food Manufacturing consists of the manufacturing of frozen pies, and other pastry products for retailers and food service customers and the company also provides investment and management services.

Definitely looks worth a deeper look.

Specialist recruiter Gattaca too, another one with strong profits growth citing success in the Water Sector in 2025, and sees growth in Defence and Energy in 2026.

Fourth Place Mr Arby up 16.4%

Feet up Mr Arby laughs at the Fun Run. Yes Mr Jon and Mr Bloke delivered 50%+ returns this year. Look how much work they put in to do it.

Mr Thompson with his 400k readers and Financial Times backing only achieved 1.3% outperformance and you’d have to have a large portfolio for 1.3% difference to pay for the accompanying IC subscription, Mr Arby probably says.

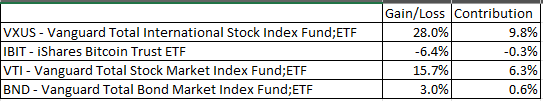

Instead of paying for a subscription Mr Arby drank beer and did not wake once at 7am to read an RNS. He put 35% on VXUS, 40% on VTI, 20% on BND and 5% on IBIT. Interestingly, if he’d chosen 50/50 VXUS/VTI his gains would be over 20% and Mr Thompson would be fourth place. Personally I’ve witnessed year after year of poor returns via Bonds but it is the idea of balance that we should keep a 60/40 portfolio. Perhaps BND will deliver one year and I will see the point of it. IBIT cost Mr Arby but not too much. A 5% weighting meant a -0.3% detraction.

VXUS non-US stockmarkets has consistently delivered year after year.

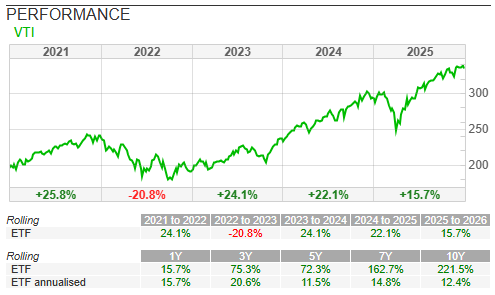

The VTI contains a big chunk of Mag 7 although the UnMag 493 feature too along with other US stocks. It’s also consistently delivered and +221.5% over 10 years so 12.4% per year on average. Those are great numbers, and you have to be brave to stay out of the US stock market.

Will BND deliver one day? It has lost money most years.

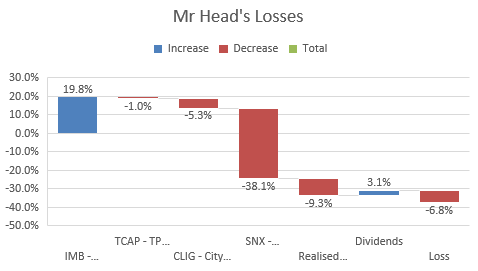

Firth Place Mr Head -6.8% return.

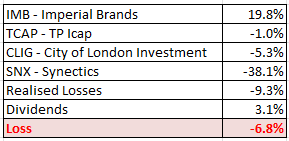

Puffing through next comes Mr Head. Top pick IMB was the best wheeze. It delivered nearly 20% plus divis. TCAP has delivered steady but unspectacular results in 2025. CLIG fell into a loss and Synectics is a further disaster. A falling order book appears to be to blame, although SNX up 138% in 2024 would have been a pricey choice on 1st Jan 2025. Are its prospects in 2026 any better? One to keep an eye on but nothing compelling.

Mr Head called time on many of his ideas throughout the year and looking at them some were wise to drop. Like Hilton Foods down -45%. While others like Coats have increased since being dropped.

Mr Head swapped ideas during 2025 but Fun Run rules state you can call time but can’t add ideas. That would be chaos so there will be an alternative narrative where new ideas did better or whatever but releasing a quarterly update to say you sold a share months before at such and such price and bought it on such and such date in some distant past date feels too much like marking your own homework. In a fair race using the ideas in the SIF portfolio at 1st Jan 2025 and calling time on those -6.8% is the empirical result.

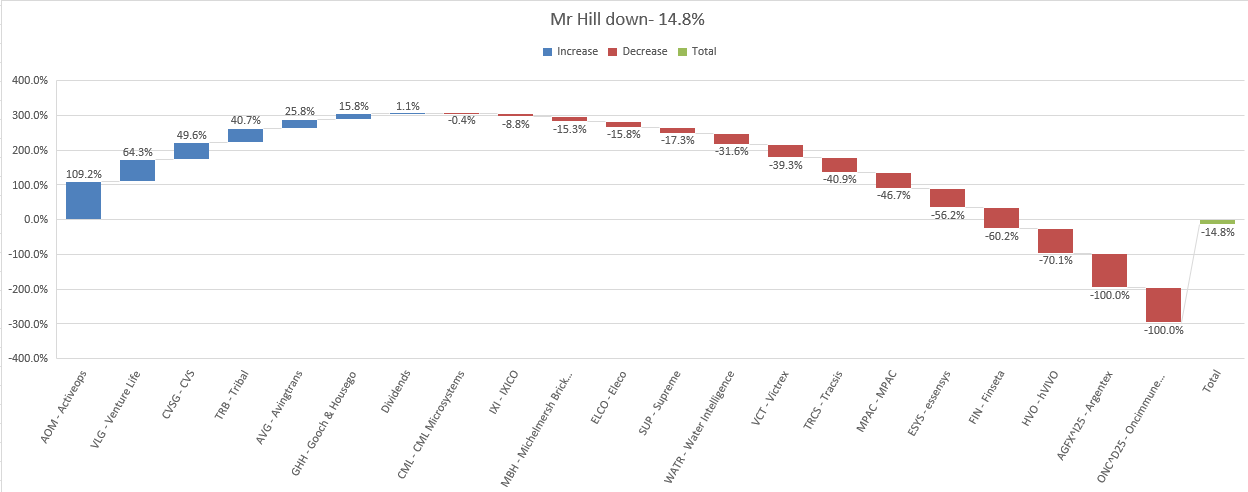

Sixth Place Mr Hill down -14.8%

A few winning ideas AOM the top one up 109%

AOM is a scheduling software SaaS platform to large enterprises with complex and often global back-offices helping them to adopt a data-driven, scientific approach to organising work and managing capacity. AOM hit profitability and growing revenue is magnifying profits. Great choice.

I was greedy in the article “Special Forces” and annoyed for not catching them at April’s lows (at which point Mr Hill had lost -25% from 1st Jan). I put them on a watchlist hoping for a fall and watched them rise. And rise. And rise. To nearly £2.60 a share in November. Today at £2.31 are they tempting again? I am tempted for sure.

I covered VLG quite a number of times over the past few years and a 64% result is a good result here. Personally I’ve sold out of VLG at 65p and while it has a large warchest not a lot has been done with it and the sale of its Dental brands for just £4.5m was disappointing too. I’m pretty sure the formula to Dentyl has been changed and the plaques it used to remove seem to no longer be present when I spit. Either that or my mouth is suddenly much less prone to plaque?! It could do okay in 2026 but it’s not presented any kind of strategy yet and I felt I could put the money to better use elsewhere.

Other ideas like Avintrans 25.8%, Supreme -17% and Eleco -15.8% all catch my eye and could warrant a deep dive. OB pick for 26 idea MPAC is back to 305p which is bargain territory too (in my opinion).

Other ideas like HVO -70% don’t surprise me and the dreadful WATR -31.6% too. I am looking forward to seeing WATR’s 4Q25 results and whether their modest 3Q25 results which were better than 3Q24 but much worse than 3Q23 as covered in “WATR turnaround” result in continued progress or not. Two months on and there’s still absolutely no evidence of a forced seller. Keep your eyes peeled perhaps they’ll emerge. Surely there was one. And they have to RNS at certain thresholds don’t they.

7th place Mr Madone down -72.4%

Single stock picker Mr Madone picked Touchstone and that has been a disasterous result. A combination of bad luck, bad geology with rapid declines, and a falling Oil price has led to this falling throughout the year.

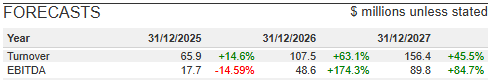

Beware of forecasts. The broker guess made me chuckle. All sunny uplands ahead for TXP apparently. It achieved $3m EBITDA in 3Q25 so to forecast $89.8m in 2027 would be a 700% performance improvement. Is that even remotely possible? Give me a break.

Heavy taxes for Trinidad is a further disincentive for TXP and I'm not optimistic for this for 2026 although drilling continues and the prospect and hope of better results and progress continues to be spoken about. If the company could achieve its “Drill to Fill” strategy then it would re-rate. But the risk of it failing to do so is substantial too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”.

Mr Arby's ETFs aren't UK listed and USD so I'd probably go for XMWX Xtrackers MSCI World ex USA or the iShares equivalent XUSE. Both trade in GBP. 0.15% fee on each.

I'd probably go for an S&P 500 tracker in GBP like CSP1 iShares Core S&P 500. An MSCI USA ETF like XDUS Xtrackers MSCI USA is another possibility.

To me, going for one ex-US ETF and one US ETF makes more sense to me than going for a World ETF because of the US concentration in the World ETFs.

PSRW Invesco FTSE RAFI All-World 3000 ETF is also interesting. It's about 48% US not 65% and the biggest position is Microsoft but only 1.13% of it. The percent of the portfolio in the top 10 holdings only 8.56%. It uses the Fundamental Index, a smart beta strategy that aims to generate excess returns using systematic contrarian rebalancing. Research Affiliates sell their indices to various fund managers. List here: http://researchaffiliates.com/how-to-invest/mutual-funds-etfs#f=family:rafi-fundamental-index&g=family They have one for the FTSE 100 for example which performs very like a normal FTSE 100 distributing ETF except higher fees! The World one though is fundamentally different to the MSCI or FTSE World indices so it has sparked my interest.