THS will turn around in 2025 OB Idea #13

PGMs have been in deficit since 2023; so Tharisa is #13 in the OB Ideas for 2025

Dear reader

Best I publish this ahead of this Friday. Idea #13 being published on Friday the 13th. What could possibly go wrong with that?!

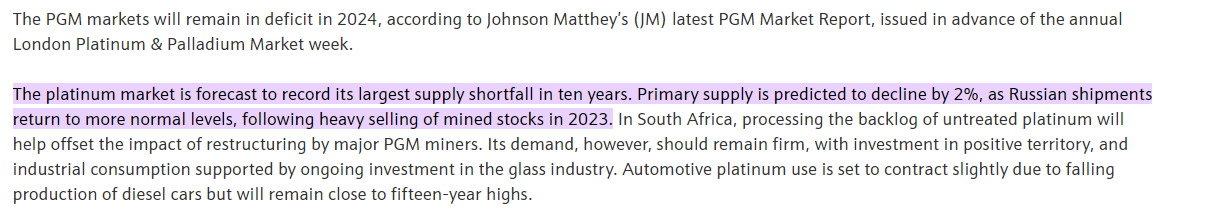

We were meant to all be abandoning ICE cars, going electric and PGM demand would plummet. Prices did plummet of course. Back in 2021, Rhodium was $14,000 an ounce (it touched a high of $23k/ounce I think) and holdings like Sylvania Platinum (SLP) was one of my largest holdings back then. SLP gave a magnificent 10% a year dividend. Simon Thompson basked in the glory of his successful tip. After seeing a wobble I exited. Glad I did. A crash ensued. So I was very surprised earlier this year to read Johnson Matthey’s 2024 PGM Market Report speak of “2024 - and the largest PGM supply shortfall in 10 years”.

Eh?! Come again?!

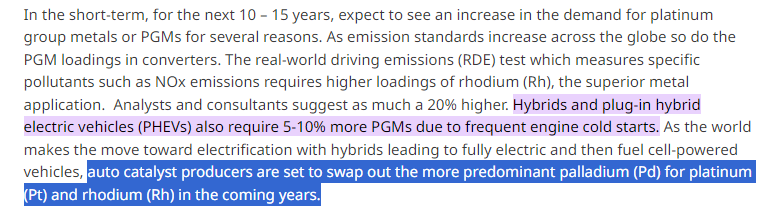

The theory behind PGMs seemed sound. Yes, ICE vehicles would decline, but hybrids need even more PGMs, Plug Ins more so. Meanwhile industrial demand would continue to grow and its use for pollution control a further growth area. Finally the Energy Transition requires PGMs. A 1 GW Wind Turbine uses about 10,000 tonnes of glass fibre and 1 GW Solar Farm 3,500 tonnes of Glass Fibre. In case you’re wondering what Glass fibre has to do with PGMs well production of glass making (including glass fibre) needs PGMs. PEM Electrolysers need them too, as part of the catalyser.

“PGMs” probably need some explanation. There are several PGMs or Platinum Group Metals and Platinum itself is probably the most well known. Followed by Palladium and both of these are used in catalytic convertors. You then have Rhodium, also for catalytic converters, and Ruthenium (Chemicals & Electronics), Iridium (Electrochemical) and Osmium (Fountain Pen Tips and a catalyst). A feature of PGMs is you can “thrift” which is to find ways to reduce their use as well as substitute one for another. For example devise ways to replace palladium and rhodium with platinum - as has happened - Palladium and Rhodium being particularly expensive were thrifted and susbstituted for cheaper Platinum. But also Chinese glass makers, particularly, found so many ways to replace Rhodium that they had excess and at record high prices they sold their rhodium and the volumes being dumped on the market, combined with an uptick in PGM production in South Africa crashed the price. Since then South African Rhodium production has fallen by 10%, rhodium recycling has fallen by 20%, while automative demand has fallen by around 7%.

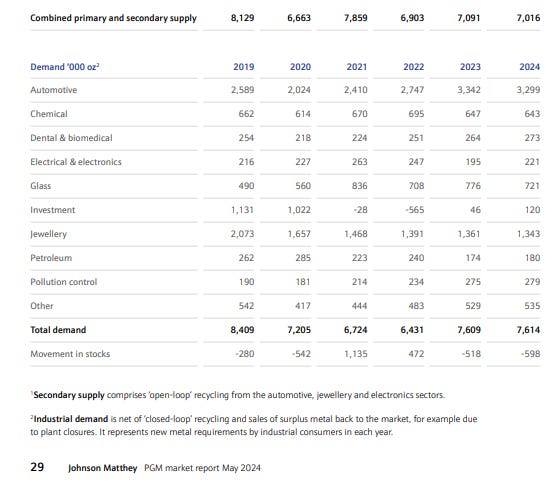

This chart from Johnson Matthey confirms Platinum has automotive and industrial growth forecast for 2024, and a 598Koz shortage - and that’s based on some aggressive EV growth. “Aggressive” translates from 11% of light vehicles in 2023 to 14% in 2024 according to the IEA.

In the chart above is firm evidence that sentiment - not just fundamentals - can drain or flood the PGM market.

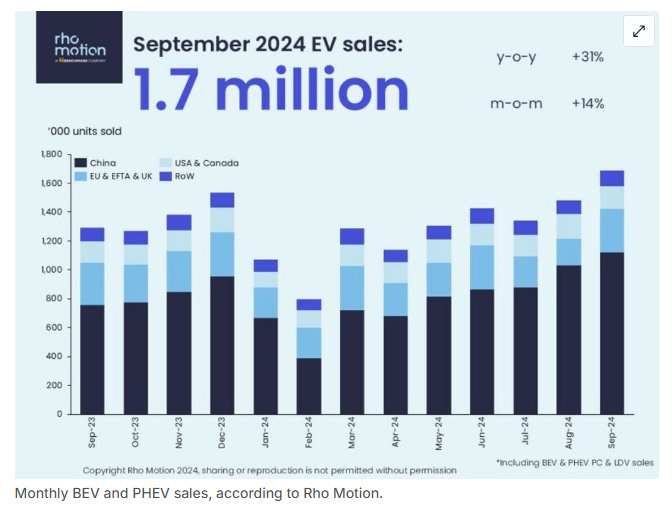

But what if that EV growth is being outpaced by the growth of ICE vehicles with a hybrid or plug in hybrid capability? Demand for PGMs (including Rhodium) would be higher than even Johnson Matthey expects. Potentially much higher. Latest numbers appear to confirm this where HEV and PHEVs are growing faster than BEVs - at least in the UK. 28k non BEVs vs 22.7k BEVs. And growth of non-BEVs is faster.

And up over 30% year on year?

US hybrid Sales continue to grow.

What if you knew that PHEVs require 5%-10% MORE PGMs (than non-hybrid ICE cars) not fewer?

The answer, reader, is you’d have the mother of all bull runs in what is a tight market where profits have smashed the balance sheets of the supply, and rhodium can only increase in price in response to shortages.

And that’s before you consider that Russia produces 23% of the world’s Palladium, 10% of Rhodium and 8% of Platinum. That might not sound like much but it’s enough to tip the balance if sanctions or restrictions are applied in the ongoing effort to throttle Putin’s ambitions and funding for war.

What if consumers are increasingly realising that PHEVs are able to deliver 2X-3X the electrical range compared to their earlier models from just a couple of years ago? That PHEVs can get around city pollution taxes. This is a link to the TopGear Top 10 PHEVs by Range.

93 miles + Petrol range would provide commuters with all the upside of an EV with none of the anxiety.

Or for those with a cast iron bladder or suffering unusual levels of range anxiety (yes you know who you are) how about a tri-fuel Niro to keep you on the road for 1,000 miles at a time?

Investment Flows for PGMs

Returning to Platinum and looking at Platinum demand and supply in the diagram above, it is noticeable that investment flows in 2019 and 2020 of 1moz created a large deficit but subsequent reversals in 2021 and 2022 reversed that. There is firm evidence that sentiment - not just fundamentals - can drain or flood the PGM market. A rising number of people are now talking commodities, particularly Copper, Gold and Silver. How long until PGMs - the forgotten precious metal becomes the next hot idea? Especially as they play a role in Energy Transition - same as copper - and are a precious metal - same as gold and silver. In fact a quick scan of YouTube and the number of PGM tout videos has shot up.

According to US Geological Survey data, over ~917m tonnes of silver and ~105m tonnes of gold were produced in 2023, which compares to just ~7.4m tonnes of palladium and ~6.3m tonnes of platinum. Trading economics tells us Palladium ETFs have surged recently.

In fact let’s compare Platinum and Gold. Over 50 years we see a large disconnect between Gold and Platinum. Yet both are a store of value. Platinum offers 60% discount compared with 10 years ago.

What to do with this shock news about PGMs?

I’ve compared Anglo, Sylvania, Jubilee and Tharisa. I’ve found I really like Tharisa.

Only 18% of Anglo American is PGMs and they are under bid takeover pressure due to their copper business so I’m excluding those. Too expensive. I’m excluding non-UK listed. This leaves Sylvania and Jubilee as options but more expensive on a P/E, P/B and FCF basis. Also on an absolute PGM ounces THS wins too. 131.4koz vs SLP’s 75.5koz vs JLP’s 43koz. THS recent Results show a P/E of just 3.2.

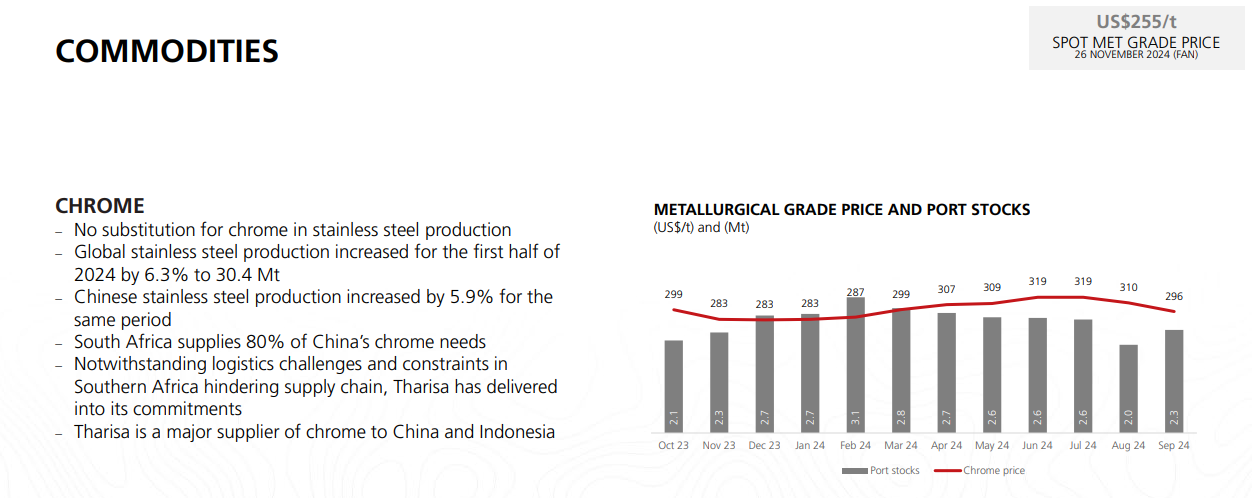

Also JLP and THS are major Chrome miners while SLP doesn’t appear to be. Chrome is at elevated prices and South Africa supplies 44% of the world’s Chrome, and 80% of the Chrome to China (which has ramped up its imports).

Also THS is building a 2nd mine, Karo, slated for 2026 but is being built on a “go slow” as THS preserves cash during current low prices. Debt finance is being discussed, but it presumably hasn’t made sense to fast track this.

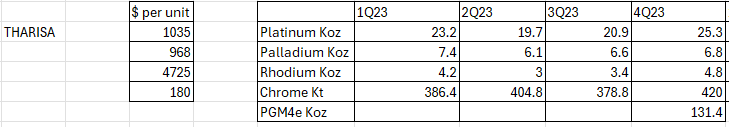

I next took Tharisa’s 2023 production and applied today’s prices so to get an idea of the product mix. THS appears to have a relatively high amount of Platinum and Rhodium.

This means even with fairly conservative reversion on prices (Rhodium returns to $10k and Platinum to $1.5k) an additional $122m would drop to the bottom line (PBT). That’s before we consider the future profit impact of Karo. That would equate on a share you can buy for 71p today to 41.9p per THS share extra profit.

Karo is a Tier 1 low-cost, open-pit PGM and Chrome asset located on the Great Dyke in Zimbabwe capable of 174 koz/year for 11 years LoM and NPV10 of $494m. Given the 131.4Koz it would more than double Tharisa’s PGMs and likely take Tharisa above $1bn revenue a year. The capital cost is $391m and $110.5m has so far been spent with spending slowed while debt capital is considered since cash flows are diminished with lower PGM prices.

The combined resource size for Tharisa Mine and Karo comes to 1Bt containing 52 Moz of 6E PGMs. Tharisa Mine has potential a 40yr life, of which the next 18 will be open pit, with a 20 year underground option. The I&I of Karo is 10Moz of 6E PGMs. This is based on 100m depth even though the resource goes to 1000m. In fact previous estimates of Karo by Zimplats, were 96Moz of 4E PGMs (so more inc. 6E) or c.10x the resource being currently measured in the Stage 1 production plan. Other benefits to Karo is a supportive tax regime of 15% for 10 years and ability to export (rather than sell to a government monopsony), and no BEE (black empowerment) legislation where you effectively give away a share of ownership for nothing. There are other miners in the area like Zimplats and Anglo so an educated and (mining) experienced workforce too.

Further Hidden Value

THS operates a “Mine-to-Megawatt” philosophy of vertical integration. So incredibly THS not only owns two Tier 1 mines (1 active, 1 under construction) but also downstream facilities too:

ARXO Metals produces specialised higher margin chemical and foundry grade chrome concentrates, operates Sibanye-Stillwater’s K3 UG2 chrome plant in Rustenburg and is the Group’s research and development arm. It also conducts research and development into technologies and beneficiation opportunities. Out of its testing site (AMBS) it operates a 1MW DC furnace to produce PGM-rich metal alloys with the aim to further beneficiate the PGM concentrate from the Tharisa Mine. This means THS can concentrate the PGMs to sell to smelters with a 97% payability rather than the standard 85%.

ARXO Logistics owned 100% by THS - manages the rail and road distribution of PGM concentrate and chrome concentrates produced by the Tharisa Mine, and chrome concentrates from Sibanye-Stillwater’s K3 UG2 chrome plant. These products are transported to customers in South Africa and international customers via port facilities in Richards Bay, Durban and Maputo, Mozambique.

MetQ (South Africa) owned 100% by THS - MetQ manufactures equipment used in the mining industry, with a particular focus on beneficiation.

Salene Manganese (South Africa) is an option THS has for 70% Salene Manganese’s principal activity is a manganese exploration and mining company. The Mining Right is for the mining of iron ore and manganese ore. Manganese recently shot up by around a third, and Iron Ore at around $120/tonne is not doing badly either.

Salene Chrome (Zimbabwe) is owned 100% and is an early stage open pit chrome project adjacent to the Great Dyke of Zimbabwe. Chrome prices are on a tear too. After hitting $319/t in the summer they have settled to $255/t today.

Redox One – the final part of THS’ “Mine-to-Megawatt” launched their product at the Africa Energy Indaba. This is an energy storage not dissimilar to a VRFB but uses different chemistry i.e. an iron-chromium flow battery technology (ICRFB). It was “well received”, reports Tamesis. Demonstration units are being produced and tested in real world conditions. Eagle-eyed readers will know of the opportunity of Energy Storage which is worth around £0.4m/MWh of storage capacity or £0.04m/MWh under licence (these are my assessments based on available info - see my Trajectory of Invinity article). Assuming a capital light model and even just 200MWh being built under licence per year that’s £1m additional future profit with little or no marginal cost. 200MWh may sound a lot but IES have a 6TWh pipeline by comparison which would equate to £30m under a licence model (which was THS entire 1H24 profit). Of course this assumes THS’ technology is as good as IES which we simply do not know and is unlikely to be the case. In general, an ICRFB vs a VRFB is 4X cheaper but inferior in terms of longevity.

The FY2024 Update

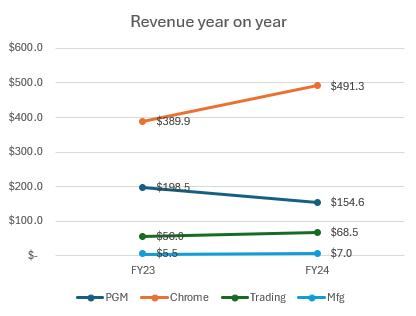

The 2024 accounts show a strong showing for Chrome and a not as bad as you might imagine for PGMs. THS’ other businesses are marginal but growing.

Assets such as its LDES BESS business Redox One might come to nothing but just might be the next “thing”. An Iron Chrome battery would be as cheap as chips even if it’s not as snazzy as a lithium or vanadium battery. I’m interested to watch it but you get that in the money for free.

Meanwhile the “Agency and Trading” segment comprising Arxo logistics, Arxo Metals, Arxo Resources is small but offers a way to “upcycle” production. So far it’s a low-margin activity (8.8% gross margin) but in its defence it offers control and eagle-eyed readers will know that fellow firm Jubilee Metals has suffered through a lack of control of power and water. Vertical integration and control of your process helps you sleep at night. Pleasing to see the manufacturing segment has doubled profits at MetQ. Although we are talking $1.1m to $2.4m gross profit. Still it’s a further, slightly more oblique form of vertical integration.

Revenue shown graphically we see Chrome has really helped sustain and grow revenues (up 11% y-o-y)

It’s true that profits are down slightly although up on a PBT basis.

Translated into Sterling a P/E of 3.1X and 3.2X this year is incredibly cheap! And stripping out the FV adjustments we see underlying profits have grown in 2024. EBITDA profit is up over 20%.

If we next consider production we see there is steady PGM production with a downside and upside FY25 forecast in orange.

We also see 1.58MT grow to 1.7MT and a forecast which will be 1.65MT-1.8MT in FY25.

Seen graphically we see increasing output - and this does not factor in the Karo mine whatsoever! There is 11 years of open pit mining left in FY2024.

Next I take the historic rates per ounce and per Ten Tonnes of Chrome (I did this odd unit of measure to show comparables in the graphs reader)

We see a decline in PGM prices in 2024 but the price is $1405 as at 26/11/24 which I use as the lower assumed price for FY25, and I speculate that a $1600 basket average is possible in the year to Sep 2025. Considering that includes Rhodium the 15% increase doesn’t seem overly greedy or unrealistic.

Plugging these in and using a 14.6% EBITDA margin for the lower and 16.6% for the upper (the previous FY23 and FY24 margins) I arrive to a $101.2 - $146.7m EBITDA.

So THS should achieve somewhere between the equivalent of a Price Earnings of 3.5X and 2.5X in the coming financial year.

Conclusion

The bull and bear case give an outlook which offers upside to THS from here. If PGMs explode (and this article sets out plenty of reasons why they could) in 2025 then THS could offer VAST upside.

So this is the idea. Limited downside and plenty of upside. Fundamentally undervalued by the market. Cash generative.

It has fingers in a number of pies. Its 2nd mine (Karo) is nowhere in the price, its ability to convert the 11 year life of its open pit into two underground mines for the long term.

If/when PGM prices recover - and there appears to be strong evidence they shall - THS is incredibly well-leveraged for growth but also to take advantage. A 4X share price is conceivable (and the opinion of Brokers too).

(In the “upside” scenario 4X today’s price is only putting THS on a future P/E of 10 based on a PGM basket of $1,600 and Chrome above $250/tonne).

THS aren’t shy at giving dividends, and buying back shares either.

The fact that PHEVs have improved, makes their popularity no surprise. No range anxiety combined with cheap electrical power bragging rights in a gorgeous car - what’s not to like? Rather than backing a car manufacturer, or backing a shortage of PGMs, backing THS is a picks and shovels play to a PHEV’s popularity.

A popularity, smashing into a PGM shortage the market hasn’t woken up to - yet.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Nice write up. Went through the numbers and I just wanted to ask you a clarification. EBITDA for FY24 is USD 177 mio, and FY23 is USD136 mio, this makes your valuation more attractive or am I getting numbers wrong?

Second, I see just like you (or close) that they realized 1089$/oz in FY 2024 (I refer to $1065 for FY24 in your table). However they say that basket price is 1405$/oz according to the slide you posted. Is it correct to just slap $1400/oz on 140koz for 2025(low)? Quite a jump from FY2024. If the realized basket price is lower than reported in the slides shouldn't we decrease the figure when forecasting? Using again the breakdown they provide in the slide to calculate current spot basket price I get 1386 ... I'm quite confused wheter this is a good price basket. For your reference:

Platinum (Pt) 56.20% 936

Palladium (Pd) 16.10% 967

Rhodium (Rh) 9.50% 4575

Gold (Au) 0.20% 2945.83

Ruthenium 13.60% 470

Iridium (Ir) 4.40% 4550

Total 100.00% Basket Price: 1386.35566

A little surprised Tharisa was chosen over Jubilee. Certainly on a 12 to 24 month view. On the PGM side Jubilee can quickly at least double their PGM production from their large stockpile and existing 3rd party agreement with Northern. Admittedly they will only get about 60% of the margin, but will have no CAPEX issue to achieve it. In addition they should start to see significant copper operational progress in Zambia once the power issue is resolved after the drought. It is likely they will also produce far more chrome concentrate in the next 12 months, but probably at a smaller margin as they do not own their own chrome mines. On top of that their share price has been trashed by what appears to be forced institutional selling, which once finished should also provide a significant upside catalyst.