Dear reader

£100m Market Cap THOR EXPLORATIONS (ticker AIM:THX) ANNOUNCES 3Q24 RESULTS

But before we speak of the present, let’s think about THX’s recent past.

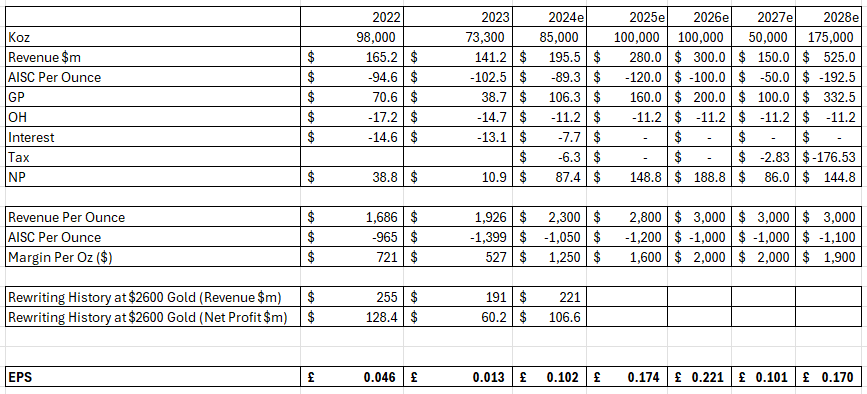

After all Thor has been mining gold in Nigera for just over 3 years. First gold pour was July 30th 2021. In 2022 and 2023 $165m and $141m of revenue was generated. Generated from the following volumes of gold: 2022 - 98koz, 2023 - 73.3koz

Meanwhile current 2024 guidance is 85koz. So about 250Koz mined so far.

So there are another 3 years (at 100Koz a year) of known (indicated) resources based on the 2021 MRE. Hmm.

But just like Jamiroquai THX has been going deeper underground. And guess what reader? At just 50m deeper than the current open pit shell THX report positive drill results of 3.22g/t to 11.24g/t. Salivating yet reader? 10 more results are to follow.

THX conclude the PoC is worth pursuing fully. In fact this is its top priority.

This is Segilola’s resource model and the green arrow are the above two drill results.

Let’s now consider the money. Money’s on the menu in my favourite restaurant (sang Jamiroquai). Will THX become your favourite reader? The aroma tantalises. Read on reader, read on!

What do you see reader?

I see a lot of debt (over half of the Operating profit is swallowed up by interest expense in 2023).

I see declining revenue. I see rising cost of sales. I see impairments. Oh dear, am I ruining that growing sense of anticipation. Patience reader.

But I also see declining overheads, I see zero income tax, I see EPS of 5p a share (in 2022) and 1.3p a share in 2023…. for a share you can buy for 15.5p.

That’s 3p of earnings per year, on a 15.5p share. So an average P/E of 5 averaged over 2 years, based on full prior years. A P/E of 5 is pretty good. Is it about to get better?

A bit of analysis shows it more clearly like this. A $965 per ounce AISC in 2022!

Oh ho, but what of the $434 jump in AISC for 2023? I oh ho’d too reader, and frustratingly the THX annual report contains zero commentary. But in a 2023 interview we learn this AISC is due to capex which has been expensed (and not capitalised). Capex which enhances efficiency and reduces cost. Salivating again reader? You should be!

FAST FORWARD TO TODAY

Segilola Q3 2024 Operational Highlights

· Gold poured of 20,110 ounces ("oz")

· Gold produced from 201,958 tonnes milled at an average grade of 3.22 grammes per tonne ("g/t") of gold ("Au")

· Mine production of 355,515 tonnes at an average grade of 2.01g/t of Au for 23,029 oz

· Ore stockpile increased by 2,094 oz to 39,934 oz of Au at an average grade of 0.94g/t of Au which includes a medium-grade stockpile of 52,947 tonnes at an average grade of 1.95g/t of Au for 3,316 oz

· Release of a further 1,614 oz of Au in circuit ("GIC")

· Payment of US$4.0 million towards the outstanding senior debt facility with Africa Finance Corporation ("AFC") leaving a balance of $3.9 million scheduled to be fully repaid by the end of 2024

So, wait, 40Koz, of ore stockpiled? That’s about 5 months worth of ore!

And debt balance just $3.9m - and fully repaid by the end of 2024? Hmm, in 2023 that would have more than doubled profits, wouldn’t it reader?

And 355Kt mined on 3647Kt indicated is about 10% of the MRE - so with ~50% left that is another 15 months of production + 5 months Stockpile takes you to mid 2026.

Let’s carry on with the RNS:

Exploration Q3 2024 Highlights

Nigeria

· Initial positive drill results received from the first two holes drilled out of an ongoing 12 hole drilling programme from the Segilola Underground Exploration programme including 3.0 metres grading 11.24g/t Au from 294m and 1.5m grading 3.22g/t Au from 269m

· Additional drilling was carried out two kilometers ("km") north of the Segilola Mine. This was carried out as a follow up for targets generated from stream sediments sampling and geophysical surveying. A total of two holes were drilled. No significant results were reported.

· Geochemical sampling programmes continued over the Quarter, focusing on the area to the South of the Segilola mine. A total of 2,525 geochemical samples were collected, with the objective of generating drilling targets. Regional stream sediment sampling returned a total of 31 samples that returned assays of >1g/tAu including nine samples that assayed >3.0g/tAu.

So, as well as below the current opencast mine, exploration north and south of Segilola is ongoing too. There’s a further Nigerian surprise coming later too. Nigeria is an interesting country for a gold miner. There is virtually no mining activity and simply hasn’t been for the past 60 years. Nigeria has been focused on Oil & Gas. But today, like fellow OPEC member Saudi Arabia, Nigeria is looking to expand its horizons and with its industrial base, skilled workforce and infrastructure it is an easier proposition than some of its less developed neighbours. To encourage mining Nigeria introduced a 5 year tax-free incentive. So THX is living a tax-free life until late 2026. There are a number of prospective satellite discoveries which are proximate to Segilola mine for trucking ore.

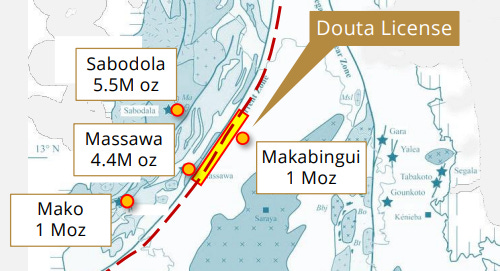

But Nigeria isn’t the only holding for THX.

Senegal

· Geochemical exploration activities during the quarter were focused on generating drill targets at the Douta West and Sofita projects.

· Reverse circulation ("RC") drilling has focussed on increasing the percentage of oxide resources at the Makosa East Prospect which runs parallel to the main Makosa mineralisation and which is additional to the current mineral resource. Additional infill drilling was also completed at the Makosa North, Mansa and Maka prospects

· Pre Feasibility Study ("PFS") workstreams are continuing, with a target completion in Q4 2024.

So the PFS for Douta is imminent. 1.78Moz is $5bn revenue ($3.5bn to THX). At 1.2g/t-1.3g/t perhaps not with a AISC sub $1400 but at $2600+ gold and a $1200/oz margin 70% of that is $1.5bn (£1.2bn). Potentially. Very hard to disbelieve in the existence of 1.8Moz when you’re surrounded by neighbours with MREs of nearly 12Moz of gold.

Cote D'Ivoire

· During the Quarter, the Company expanded its operations into Cote d'Ivoire, a country that hosts over 30% of West Africa's greenstone belts and is proving to be an emerging region for world class gold discoveries.

o Signing of binding agreements to acquire the Guitry gold exploration project from Endeavour Mining Corporation. The project is characterised by numerous gold-in-soil geochemical anomalies that have only been partially drill tested by the previous explorers. Some of the drill results include 12m grading at 10.4g/tAu, 16m grading at 7.90g/tAu, 24m grading at 2.02g/tAu and 16m grading at 2.25g/tAu. The two major prospects, Krakouadiokro and Gbaloukro, are yet to be fully tested with several additional targets yet to be drilled.

o The Company has entered into an earn-in agreement to earn up to an 80% interest in the Boundiali Exploration Permit, an early-stage gold exploration permit located in northwest Côte d'Ivoire. In the Quarter, the Company undertook an initial geochemical exploration programme which identified several continuous soil geochemical anomalies.

Of course this is earlier stage but drill results of 2g-10.4g per tonne are very interesting. News is pending.

FY 2024 Outlook and Catalysts

· FY 2024 production guidance reduced to 85,000 oz of Au as a result of extreme rainfall, delays in mining certain high grade areas in the pit and the late installation of the new SAG Mill liner

· FY 2024 All-in Sustaining Cost ("AISC") guidance range reduced to $800 to $900 as a result of the implementation of cost reductions and lower mining volumes year-to-date and forecast to year-end

Wait, stop. An AISC reduced to $800-$900 an ounce due to cost reductions? That’s incredibly good. Ok, as mining volumes increase in 2025 we will see this move back up but to perhaps $1000/Oz?

So THX a producing mine at Segilola, plus 4 exploration programmes with imminent results.

Segun Lawson, President & CEO, stated:

"This has been a challenging Quarter for the Company. Operationally at Segilola, we have been impacted by extreme weather conditions with a heavy and prolonged rainy season and have also been disrupted by a fly-rock incident and logistics delays early in the period.

So $800-$900 AISC was achieved despite 12 days of heavy rain (nearly half a metre of rain brings a new meaning to heavy) so an AISC of perhaps $700-$800 if it hadn’t rained is the implication?? More powerful pumps were introduced to cope with heavy rains in the future, we are told. A rethink of the blasting strategy and a delay in the SAG mill liner replacement delayed things too.

"Corporately, we are continuing our engagement with the relevant Federal Ministries, including the Ministry of Solid Minerals Development (the "Federal Ministry of Mines") to resolve the unfounded accusations, demands and disruptive actions instigated against us by the Osun State government and look forward to a full resolution by the end of the year.

Oh ho. Here we might have found why this is a £100m market cap and not much more. It seems THX is in a spat with the state government. THX has won an injunction against the state government and a cease and desist order. The question here is who is more powerful - the Federal Ministry or the State Government? It appears to be the former and remember Nigeria are keen to promote a mining-friendly jurisdiction so what do you think El Presidente will say to the State Governor reader? Wind your neck in is the answer, I believe.

Moving into Q4

So 3Q24 had a $2,326/oz gold price. Today we are looking at ~$2,650. If Q4 is merely a repitition of Q3, what does that look like? Well on the assumption that a 30% corporation tax now applies (it’s been >3 years and THX speak to a 3 year tax free period from date of operation) THX’s profit is about the same as Q3.

But when we zoom out to a full year result the increase in profit should take your breath away. $87.4m is a P/E of 1.5. Assuming a $1050 AISC is correct. I’m probably being too pessimistic given THX guide to a $800-$900 AISC for 2024!

At an AISC of $900 that’s a further $10m net profit in 2024! £70m net profit in one year on a £100m market cap!

Moving to 2025?

Again possibly being too pessimistic but on a $1,200 AISC (based on a possible declining grade) then we still arrive at $148.8m net profit which is 17.4p after (no) tax, earnings per share. A P/E of 0.85, also assuming the AISC rises far above where it is following those cost saving measures, assuming no further rise in the price of gold. In other words the actual profit could be far higher than this.

It’s interesting to consider that at today’s price of gold, earnings for the period 2022-2025 would have been $403.8m which equates to 48p per share of earnings…. for a share costing 15.5p. That incidentally also cost 15p back at 31/12/2021.

So how is it 15.5p today? I can only explain it that people see Nigeria as too high a risk, although history would tell us otherwise.

MOVING TO 2026

One question mark is whether THX can extend the life of its Segilola Mine either through satellites or going deeper underground. Or indeed both. Work is ongoing, it still has plenty of time and it’s not resting on its laurels. THX has first mover advantage in Nigeria and it seems is cleaning up.

Does the State Government political issues matter for THX? My instinct is no, the Federal Government are what matter and the State Government’s activities have simply been vexatious, perhaps seeking to squeeze THX for some cash - who knows.

Can Senegal come online by mid 2026? Possibly but it would be a stretch. 2027 maybe. But it seems to me with potentially circa $200m FCF by mid 2026 THX hasn’t got to be overly concerned about solvency.

Ivory Coast is earlier stage but could follow in 2027 or 2028.

Based on a 2028 go live of Senegal, a 5 year tax holiday until late 2026, followed by 95% capital allowances meaning an effective 1.5% tax rate in 2027 and 27% in 2028 we see profits are very robust indeed.

BONUS HOLDING

The prospect of gold across three territories and we’ve not even spoken of Lithium. The green is THX’s Lithium subsidiary, while the red is the Segilola mine and satellite gold prospects. 1.3%-9.3% Li20 is preumably commercially viable even at today’s low prices. What about when Lithium recovers in price? Drill targets are generated and tested but this is earlier stage.

STOP PRESS! The outlook brightened (much) further.

A reader helpfully pointed out that Zero Corporation Tax applies for 5 years plus after this 95% capital allowances apply meaning (presumably) the Segilola build, all Nigerian exploration costs can be largely offset against future earnings - suggesting an effective 1.5% tax rate for perhaps two years following 2026.

Fiscal Incentive Regime

Corporate Income Tax

Under the key incentive provisions of the Industrial Development (Income Tax Relief) Act (IDITRA”) and the Mining Act, the Project would benefit from a 5 year tax holiday followed by an accelerated capital allowance of 95% of mining expenditure. Following this period, the Project would be subject to standard Corporate Income tax of 30% on total profit.

Pioneer Status

The Mining Industry in Nigeria has been granted “Pioneer Status” which in accordance with the provisions of the IDITRA, provides for the grant of a tax holiday for a period of 3 years which may be extended at the end of the initial 3 years for a period of 1 year and thereafter for another period of 1 year or for one period of 2 years upon satisfactory compliance with certain conditions.

Other Key Incentives

Free transferability of currency, remittance of foreign capital and an exemption from import duties.

Minerals exported from Nigeria are zero rated based on the provisions of the VAT Act.

Royalty

Royalties are payable by companies engaged in mining activities in Nigeria. Royalties are calculated on an ad valorem basis. The applicable royalty rates range from 3%-5% depending on the type of mineral (Gold is 3%). The Minister may grant a concession to a mineral titleholder to defer payment of royalty on any mineral for a specific period, subject to the approval of the Federal Executive Council.

For the PFS, including the formulation of the Mineral Resources and Mineral Reserves it has been assumed that the project will qualify for a government royalty concession.

Other Taxes

Nigerian companies engaged in mining activities are liable to education tax at the rate of 2% of their assessable profit. The educational tax is not applicable during the Pioneer tax holiday.

An impost in terms of the Industrial Training Fund Levy has been included which has been levied at the rate of 1% of the amount of the annual pay roll levy

Conclusion

A reader spoke of THX some months ago and when I looked at the numbers I couldn’t believe it was as cheap as 15p.

Looking at THX again today in some more detail, and following the drop of the AISC, the rising gold price and strong cash generation I had some inkling that it would be attractive but even applying some fairly pessimistic assumptions it offers huge upside from its current price, barring some catastrophic drop in the price of gold.

At what point do we see buy backs? If people “don’t believe” in this share give them 15p for goodness sake and take their share from them - because THX will soon have more 15p’s than it knows what to do with!

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Great write up. THX has been undervalued for some time. The State issues have been a nuisance that will hopefully be resolved shortly.

I can't personally see Buy Backs. I think there's too much Capital required for Douta. Just my opinion of course. Lots of near term catalysts news though - Segilola Drilling, Douta PFS and get this State nonsense out the way and we could be off to the races!

May I check their eps sensitivity to $100 increase in gold price? Thanks.