Dear reader

I last wrote about OB24 idea TMT Investments in “TMT-oh, tomato” and nearly fell off my chair today because that article was nearly 12 months old! Doesn’t time fly?

In that article I spoke of aggressive valuations in the Mag 7 vs an early stage technology angel investor that takes minority positions in businesses that are at the cutting edge of technology, software and mobility - but at an early stage.

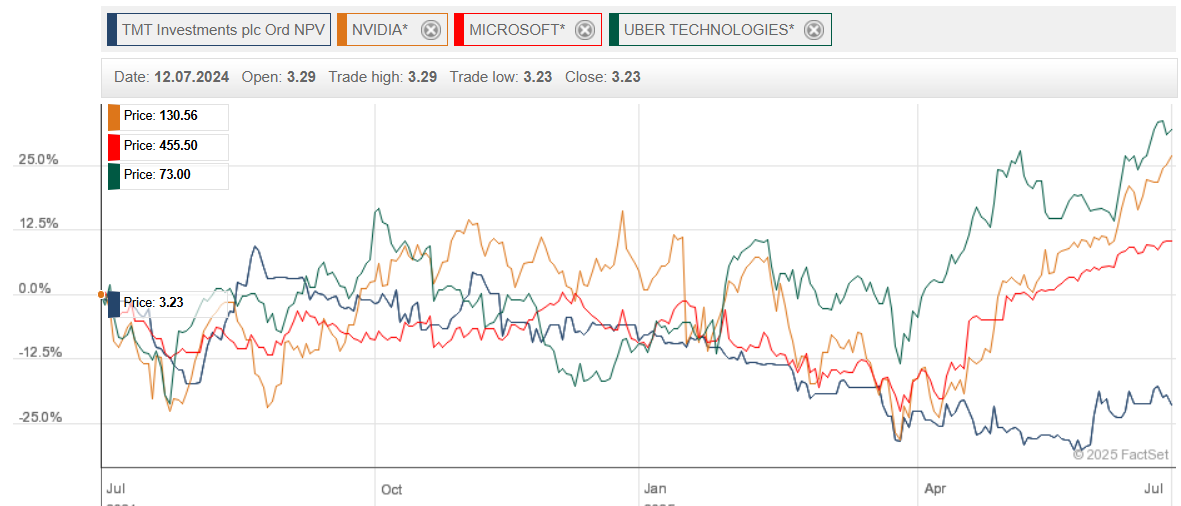

A 12 month view of TMT vs Uber, Nvidia, Microsoft reveals 12 months have not rewarded TMT.

A 5 year view and Uber has tripled and Nvidia is off to the races. What will the next year or 5 years look like? Will American exceptionalism defy expectations or will another share beat them?

TMT is no slouch. It achieved a 6.5X growth (650%) (factoring in dividends) in NAV terms since inception in 2012. Its share price since 2012 has only grown 2.5X meaning it is trading substantially below its NAV. Its IRR since inception is 14.5% and its holdings and exits include four unicorns.

Its NAV growth came quickly in 2013 and 2021. Growth spurts In fact look at the blue line on the above five year chart and for a time in 2020 and 2021 TMT outpaced the three US Tech giants - even NVidia.

Can that happen again in 2025 and beyond?

While TMT hasn’t grown during the AIM market drought of the past two years neither has it shrank and its NAV is 3.65% ahead over two years.

#1 Bolt.eu

Bolt’s mobility services covers all of Europe with key African markets, the Middle East and SE Asia. It has launched in North America. It has LEADERSHIP in 20 markets. 90% of its commercial activity is in Europe.

It is predicated on the idea that owning a car and use of a car will decline over time. That instead shared mobility is increasingly the future. That we shall “subscribe” to car clubs rather than own cars. Particularly for urban dwellers and urbanisation is growing. I know many Londoners (and folk in other cities) who own no car, but hire one when needed. Bolt see the key to successful shared mobility is integrated services. Deliveries, vehicle hire, taxi services, scooters and bikes all that integrate alongside public transport. That fill the gaps in that Public Transport… the so called last mile.

Bolt now has 4.5m drivers and couriers and that number has grown an incredible 50% in the past year. Sales grew 16.9% to nearly 2bn Euros ($2.16bn), and Bolt enjoys a strong 56.5% gross profit margin.

With overheads including R&D of -€107m, Marketing of -€795m and Admin of -€319m Bolt got to a -€102m loss, although even if the above three overheads had been kept at 2023 levels then Bolt would have made a maiden ~€100m net profit. In other words it invested it profits back into growth.

With €457m of current assets less liabilities of -€280m (ignoring lease liabilities and provisions) the business had nearly €200m of working capital plus a €220m line of credit.

Bolt’s operating cash flow reached €53.1 million in 2024 — a year-on-year improvement of €79.5 million.

Mobility is a rapidly growing market in 2025 and beyond.

So we can see a substantial growth story at Bolt.eu.

A comparative of course is Uber. Its latest results also announced bumper results in its 1Q25 update in May.

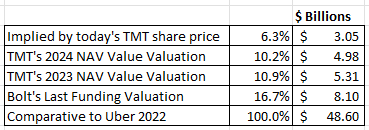

Comparatively Bolt remains substantially undervalued relative to Uber, in my opinion. While comparisons are difficult and it’s true that Uber is better established, the implied valuation of Bolt (based on its 2022 funding round) of $8.1bn vs $201bn valuation (24.8X higher) is rich. Bolt have succeeded in turning cash generative in 2024 and are also arguably EBITDA profitable. An IPO was planned for 2025. Could we see that in 2H25?

While revenue is clearly vastly different between the two (20.9X) the difference in scale is not so great. Based on number of countries, drivers or customers Bolt is about half the size of Uber.

Yes profits are very different but let’s not forget that profits at Uber are a recent phenomenon. Is Bolt not where Uber was back in late 2022? Losses at Bolt in 2024 were minimal and discretionary (to support growth). On the cusp of profitability. Cash Flow positive. What better time to IPO than as blossoming profits are revealed to a market hungry to buy in to the next Uber.

Bolt’s 2022 valuation round at $8.1bn is modest compared to Uber’s valuation when it was at the same point. Uber started 2022 at $43/share and fell to $24.90/share by end of 2022. Even taking the $24.90 low point the market cap at that point was $52bn. So 6X that of Bolt today based on its 2022 valuation.

For TMT shareholders the difference between an Uber 2022 comparative and buying TMT is even more extreme. At $2.54 per TMT share you are buying Bolt for 15X less than an Uber shareholder paid back in 2022 for Uber.

15X TMT’s Bolt valuation of $67.66m at 31/12/24 would be a $1bn uplift.

Think too for a moment that buying TMT for Bolt vs buying Uber today, is a 67X difference. A $3.05bn implied valuation vs $201bn market cap.

#2 Backblaze

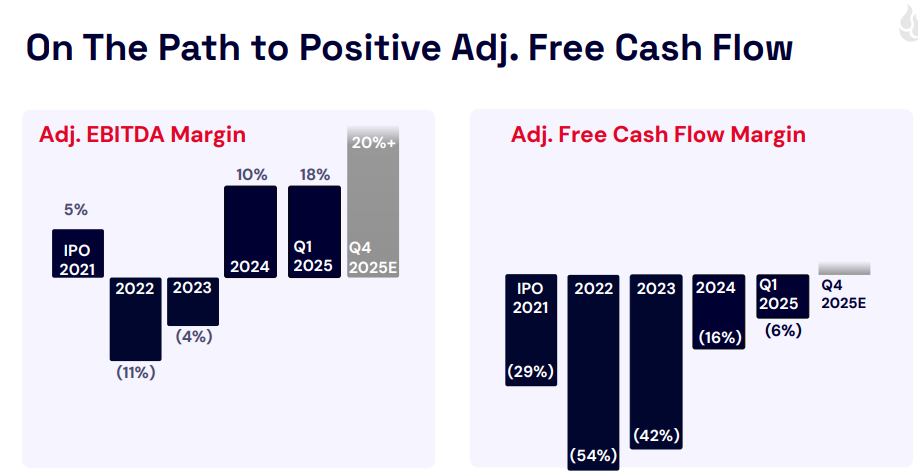

Backblaze has halved in share price follow a spike last year above $10/share (when TMT sold about a quarter of its holding - $4.2m). Today it is $5.16/share down 18% since 31/12/24. Can its price recover? Revenue, earnings and cash flow continue to improve and it is expected to turn cash positive this year.

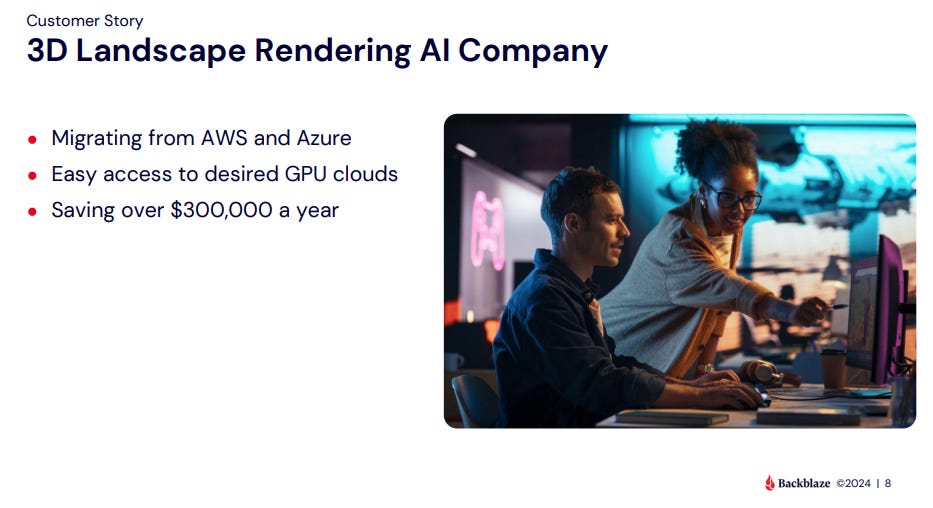

Backblaze is migrating customers from AWS and Azure saving them signifcant sums in total cost of ownership and with greater flexibility and reduced time and effort. Happy Landscapers and unhappy Mag 7s.

#3 - the 3S Money Club

3S Money Club. Their 2024 accounts show a growth in revenue from £17.4m to £17.9m as they navigated growth in Doha and Luxembourg, and an expansion of headcount from 157 to 201.

So what does a money club do anyway? Essentially the same as Wise Plc without the £13.5bn valuation. It offer near wholesale FX rates to businesses in exchange for a $100/month or $300/month membership. For many businesses this is a no-brainer. That’s because competitors like Wise charge “from 0.33%” and Equals Money say it “Varies”. (helpful).

TMT value their 12.2% holding (156055 of 1277696 shares) at £13.4m implying a modest £109.7m valuation of 3S.

Both 3s and Equals compare equally on Trustpilot.

The implication here is that 3S is at least comparative to a (ex-)listed peer; and arguably is growing faster and potentially is therefore worth more than the implied £109.7m valuation.

-

#4 Scentbird

Scentbird’s valuation doubled in 2024. It now boasts 500,000 active users. Its designer fragrance range of 900 fragrances is unrivalled and 100% genuine. Its operation has now expanded to the UK (from the US).

#5 Pandadoc

PandaDoc on the other hand, outstrips its competitor Docusign by a mile on Trustpilot by 4.3 vs 2.6. Lots of customer stories saving time and money. At its last funding round (in 2021) Pandadoc had a $1bn valuation. This was when Pandadoc had 30k customers compared to the 55k it has today. I strongly suspect this $1bn valuation is (highly) conservative. TMT holds 1.08% of Pandadoc after selling 11% of its stake for $2m in 2021. Implying that its remaining holding is 0.979% of PandaDoc. At a $1bn valuation TMT’s holding “should” be worth $10.8m not $8m suggesting that it is undervalued by at least $2.8m. Based on the 11% it sold for $2m, the remainder is worth $18m. ($2m/0.11)

In fact it was devalued by $2.8m in 2023 because someone made a silly offer to TMT! Never been revalued.

Pandadoc Customer Stories:

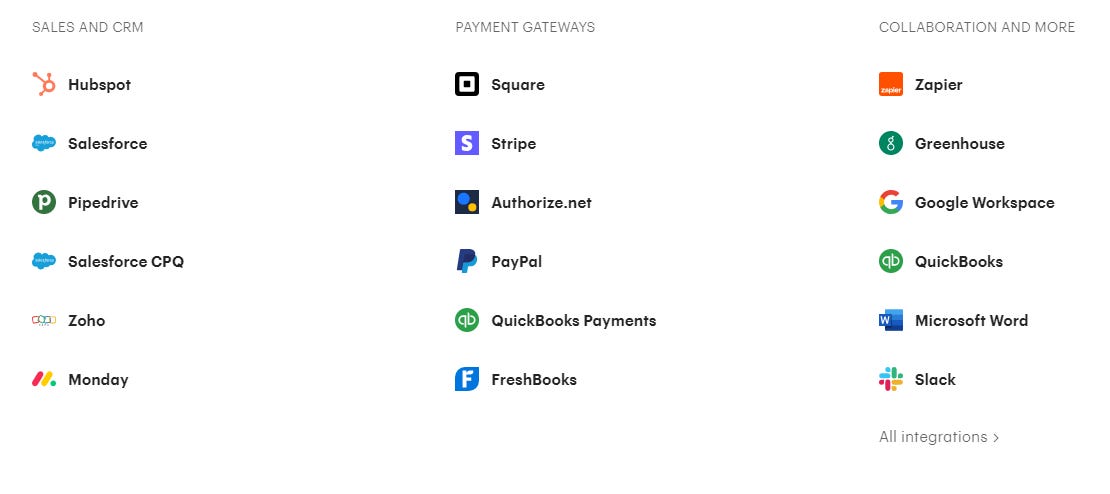

Pandadoc a wider set of integrations than docusign, including crucially (in my opinion) to all of the major CRMs rather than just Salesforce in Docusign’s case, and crucially with Salesforce CPQ which is where a complex proposal software would be most useful!

Users that rate software on G2.com also rates Panda the best

In the latest G2 Grid for proposal software, it’s the clear leader for both market presence and performance.

When you look at how it can help sales people build quotes and proposals more quickly, but also provide oversight and sign off to the sales process it is impressive.

Features like its Smart Content make me think even those paying for a CRM system would pay for the benefits of this platform - especially those in Professional Services. Its full features are here:

https://www.pandadoc.com/features/

PandaDoc in action:

#not top 10 - Scale = If you can’t beat ‘em…. join ‘em.

On 12 June 2025, Scale AI, Inc. (https://scale.com), announced a significant new investment from Meta Platforms, Inc. (Nasdaq: META) that values Scale at over US$29bn.

The transaction represents a revaluation uplift of 138% (US$0.7 million) in the fair value of TMT’s holding in Scale, compared to the previous reported amount as of 31 December 2024. As part of the transaction, TMT also expects to receive a US$0.6 million cash dividend. This positive revaluation of 2.38X in only 8 months represents another example of how notable returns can be generated from risky, but carefully selected, AI opportunities.

#not top 10 - Praktika.AI

Praktika is an automated 1-1 tutorship powered by gen-AI avatars. In contrast to most language learning apps that focus on human interaction, with a human tutor or ‘machine-to-human’ interaction involving clicks and drag and drops, Prakitika is the only app focused on tone of voice, where the user mimics human-to-human interaction. Praktika was the first to master this AI avatar approach, which is very natural to language learning.

It is also TMT’s 12.5X bagger having turned a $0.4m investment into a $5m valuation. Having sampled the service I can confirm it is extremely compelling. I am a fan!

Valuation of TMT

The 2H24 update leaves us with a discount to NAV of 60.3% but considering the read across from fair value the discount rises to 69.3%. If we strip out cash the discount is 68.1%. Strip both and you get to a 71.9% discount.

If Bolt IPO’d and was turned to cash, and BLZE was also turned to cash and that cash was used to buy back shares you’ll get to a 110.8% discount (i.e. you’d buy back every share and give shareholders $8m left over cash and still have the remaining 51 holdings for free.

If you could IPO the holding Bolt for more than the $8.1bn valuation i.e. the read across value and turn that to cash and buy back TMT share then the implied discount is 160.1%!

The question would then turn to well what are those “free” 51 companies actually worth? More than $105.1m I would argue.

Conclusion

The discount to the holdings makes no sense whatsoever. It is a very large fish in a very small barrel. The problem is when will the gun arrive?

The US IPO market in the first half of 2025 showed significant growth, with proceeds increasing by 56% from $17.6 billion in H1 2024 to $27.5 billion in H1 2025. This surge was largely driven by a resurgence in Special Purpose Acquisition Company (SPAC) IPOs, which accounted for over 40% of US IPO issuance. The NASDAQ and NYSE were the primary exchanges, raising $19.4 billion and $8.1 billion, respectively. The financials sector led in performance, reflecting the SPAC rebound.

Growing IPOs, realisations and continuing growth in performance all bode well for TMT and its holdings. Could we see an IPO thaw in Europe also? With Revolut announcing this week a potential secondary at a $65bn valuation (vs the current $45bn valuation) then that could be the start of the thaw.

Will the Mag 7 see off competition from start ups and upstarts like some of those backed by TMT? Seems to me TMT’s ragtag 53 are making inroads on their entrenched positions. Meanwhile, the Mag 7 are priced to perfection - while the ragtag 53 of TMT are priced on an assumed deep imperfection. Why does the market overlook an opportunity like TMT? How is it so mispriced? I believe many people are out there simply buying the index and they are ignorant of the implication of that. So when Bolt “becomes the index” then the rerate could be colossal.

Regards

The Oak Bloke

Disclaimers:

This is not advice; you make your own investment decisions

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

I'm sure we'll do fine out of a Bolt IPO. But I don't think that the Uber comparison is actually that relevant. Uber - and Tesla for that matter - is expected to dominate the driverless taxi market, which will arrive to the US (and China) substantially earlier than Europe. Medium term, the case for investing in a Bolt IPO might be about being bought out by Uber, Lyft, Grab, etc.

Hi Oak. Yes I like this trust. Looks great value. What do you think of Eagle Eye Solutions plc? I'm thinking that a small UK based, high growth company that's not so highly valued might be right up your street.