Dear reader,

What do they say about buses? None come, then three at once. The weather can be like that too. Not enough rain and then too much. In fact doesn’t that now seem to be more and more the case? Grumble, grumble, climate change they mutter. Meteorologists tell us the weather gets “stuck”, or the jet stream is behaving a certain way to explain periods of dryness, wetness and everything else.

Investing into the management of too little (and too much) can be smart business. In fact eagle-eyed readers know I’m keen on Arqiva’s work in this area with its extensive roll out of smart water meters (alongside energy meters), and the monitoring of flows for the likes of customers like Thamas Water (Arqiva being one of DGI9’s holdings which you can buy at a 83% discount to NAV - and is one of the OB 20 for 2024)

As another company in this theme, WATR is a way to invest in the managing too little and too much. WATR owns several brands. Each is a product or service aimed at managing water and the consequences of when it goes wrong. i.e. when it leaks.

The WATR Corporate Entities:

1.ALD - American Leak Detection

ALD is a service and this has been going for over 40 years as evidenced by ye olde leake detection videography from days of olde (ald?):

Since then new technologies are now employed such as thermal imaging cameras, snake cameras and acoustic sensor technology to locate the problem, rather than bash everything till you find the leak approach. Also a clever little bit of kit called a leak frog which none other than Thames Water in the UK use, which monitors your meter over 48 hours because if there’s a leak you’ll have 48 hours of continuous flow rather than starts and stops. The taps or faucets as our US cousins call them never stop. Simple but effective. But fundamentally today’s leak detectors are doing the same job - detecting and fixing leaks.

It’s worth fixing such problems due to progressive billing which is common in the US. This is a typical bill where Tier 5 water costs over 4x more than Tier 1! Wasteful AND painful. You can just hear the ad can’t you - Call ALD toll free, and fix that leak!

A sobering statistic is that Americans lose roughly 4 trillion litres of water yearly due to leaks. A US gallon being about 4 litres that’s costing American somewhere between $840m-$3.76bn.

ALD operates in the US residential market with small operations in Canada and Australia but who knows maybe one day they will launch it into the UK. If they do, rather than having ticker WATR they might consider the fact that ticker BALD is also available. British & American Leak Detection servicing home owners both sides of the pond, and beyond on freephone 0800 or 1800 toll free.

1a. ALD/BALD Corporate vs Franchise

WATR delivers its ALD services throughout the US through a combination of direct delivery or “Corporate” and franchises.

There are currently 78 franchises operating in about 100 locations across 46 states of the US, with additional locations in Australia and Canada. Some franchisees operate multiple locations in their territory. Additionally Franchisees sell a limited number of WATR products into their customers as part of the service solution.

As you might expect, it earns a cut of franchisee’s income via a 6.75% of sales royalty agreement. This percentage is important. More on that later.

2.IntelliDitch™

Next, the web site describes this as a company and a brand, but the accounts don’t instead products get rolled into the revenue not reported separately. IntelliDitch™ is a patented product for 2024 which might look like a picturesque water slide but is actually, on closer inspection, a means to channel water without leaks, erosion or water loss. IntelliDitch™is a ditch lining. It qualifies for the National Resource Conservation Code 428 which basically means the Fed will match fund (50% off typically).

Its corrugated high density polyethylene competes with concrete which as all ditch-ficionados will know can spall and crack, even after a few years whereas ALD’s ditch tech is good for 20 years or (much) more. This saves between $7k-$23k per annum on water costs in the US, let alone the crop yield losses due to a lack of water!

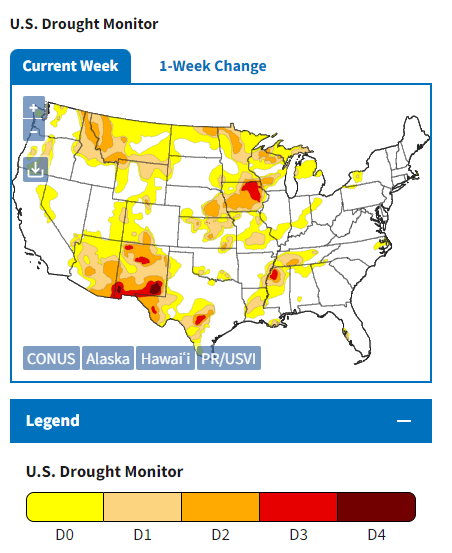

Significantly, look at today’s US Drought-o-meter. 19.46% of the lower 48 are in drought status, and much of that is in farmland.

2a. Pulse

Pulse is another new product for 2024 and uses an acoustic excitation fired through a pipe to work out either blockages or damage in a pipe’s interior. Compared to CCTV on a little robot trying to see damage where the surfaces are smeared with detritus it’s a much faster and more thorough way to detect damage. Prevention is better than cure, so tackling damage before it becomes a blockage is a major usp. The device has been designed to minimise the cost of skilled labour for infrastructure surveys and is already used at three different UK water utilities.

2b.CreatorSuite 2.0:

Starting in 2024 CreatorSuite is an AI video ecommerce tool that enables the Group to make video moments of its products and services with “end-cards” that more efficiently convert leads into purchases. The product has been tested in various business-to-business channels with significant improvement in lead conversion. Water Intelligence has an exclusive licence to the tool for the field of water and wastewater.

2c. LeakVue™

The LeakVue™ system uses a laser sensor to detect changes in a water’s surface of a swimming pool. It sends its findings to a screen that displays a graph of rises and falls and determines whether changes in the water come from a leak or natural environmental factors.

3.International

It’s not something you’d hear from wikileaks but leaks also happen outside the US and Water Intelligence International (imagine answering the phone saying that 50 times a day) focuses on municipal water - so aimed at water companies - leakage services across the world, with teams frequently operating in the UK, Ireland, Continental Europe and Australia.

These services are (unsurprisingly) leak detection, water asset surveys (including sewers) as well as sewerage flood monitoring.

4.Wat-er-Save

Again a separate company on the web site but part of “International” in the accounts this is a UK business established in 1979, and acquired by WATR in 2021. Wat-er-Save Services Limited provides specialist Water Management services to the major names in the Leisure Industry, Government, Commerce, Local and Public Authorities, Industry and Private Organisations throughout the UK.

On to the accounts…

2023 vs 2022 P&L

The first comment is we see a sea of green, positive increases in 2023’s trading update - I dislike using the adjusted EBITDA rather than EBITDA because the share-based compensation is still a cost but that was green actually too.

WATR’s latest update shows continued delivery of double-digit profit growth PBT up 12.7%. What I was particularly interested in was the extent that “up sells” of product are occurring. This is based on my assumption that products are higher margin than services. My calculations are we see a growing percentage of products sold by franchisees so using the same product/service mix (12%) we can assume growth in Direct product sales too (these are not separately reported). The results are despite rampant inflation, and the challenges of 2023, exhibiting the defensiveness of their offering, and the continued momentum.

Balance sheet - the trading update doesn’t give us a full balance sheet but the market cap at £64m, prior year at £56m it wouldn’t surprise me to see net assets at £64m in 2023. So on a net assets basis you are paying £3.75 a share for £3.75 of assets which are profit making.

Hidden Value

It is also of note that there is investment hidden in these numbers in a number of aspects:

a. The value of efficient systems

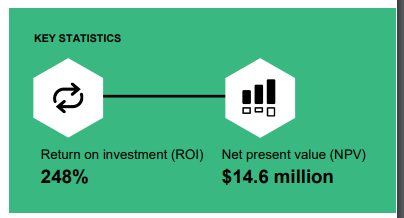

$3m investment in Salesforce. The Capex vs Opex of this I’m assuming at 50%/50% which means profits are $1.5m lower due to the one-off implementation cost (PBT grows 40% if underlying profit was therefore $7.7m). Typically for a CRM/ERP project the payback on this in terms of efficiency is usually positive. More capital means more efficient and less labour. So arguably the +$1.3m cost (franchisees contribute $0.2m) should be offset by reduced labour and administrative costs. This is a link to Salesforce's Total Economic Impact study.

The other impact is better ability to manage recurring revenues (contracts) and to handle renewals, cancellations, additions and reductions. To auto calculate revenue recognition. To apply AI into aspects like coding of transactions, scheduling and providing a seamless back office/front office comms link between the people on the coal face and the people co-ordinating them.

The corollory of this is the time it takes to train Leak Engineers. 18 months. That’s a substantial cost and making these “expensive” people more productive is usually where software systems help. If they spend more time mining coal and less time standing in mine shafts you get a sharp economic benefit. Sharp meaning 10%-20% productivity potentially more. It’s also the case that upsells are easier once you’ve established trust, and given the US Water Industry is worth $20bn alone, there’s plenty of coal out there to be mined!

b. Insurance and playing the Claim game

Rather than just marketing to home owners, and coming at this from the perspective of the individual, gaining agreeents with two insurers are enormous wins. These wins have been supported by national coverage, but also better systems and processes, security and “Professionalism” delivered via Salesforce which will better meet levels of service while providing data security and customer analytics to support customer claims. Huge value adds for the insurer and a huge value add for WATR.

I read both WHI’s and Dowgate’s analysis and there is zero consideration given to the increase to sales this will bring. Past network sales growth were 3% so that’s the target for 2024 more or less.

The significance of the news of the two contracts with national insurance companies, also could mean further product sales too. For example customers buying leak detection services, get a discount on their home insurance. It’s pretty much a win-win-win for home owner, insurer and WATR to offer something like this.

The value of these contracts is not disclosed and perhaps they are a schedule of rates rather than any of fixed volume but water-related claims was one of the largest sources of home insurance claims, with average claims in 2023 being $11,605 and restoration costing between $1,322 - $5,954 and that 1 in 60 home owners made a claim for water or freezing damage.

Thinking WATR will only achieve 3% revenue growth in 2024 seems far too low.

c. The UK Water Pollution Cover Up

I imagine more people than just the Oak Bloke wrote to their MP following this episode of Panorama. I was fuming to learn a 2m gallon of raw sewage is classified as no impact.

If you didn’t bother, you will nevertheless, be pleased to hear the government reacted to the Panorama programme and are ratcheting up pressure on Water Utilities and that’s good news for WATR. £60bn investments are planned. Will WATR get a slice of that action with products like Pulse, Intelliditch and LeakVue? Will they provide services like sewage flood monitoring? I think the answer is fairly obvious. 3%? Give me a break.

Similar problems and challenges exist throughout the world. The UK isn’t alone in being challenged by sewage.

d. Penultimate Thought: Franchises and the strategy of buying them up.

There is a fixed and various cost and therefore margin trade-off between franchise royalty growth and corporate-operated growth. The margin on services is 29% and therefore higher than the 6.75% royalty margin. The other difference is the extent of additional fixed management costs and reduction of contribution to shared costs (e.g. Salesforce) for franchisees.

In the trading update acquisition of the Pittsburgh franchise is announced at a cost of $0.5 million, based on pro forma sales of $0.5 million and net income of $0.12 million which WATR believe they can grow. Royalty of $33,750 would grow to $120,000 which puts the buy on a “P/E” of 6 ($86k/$500k) but a PE of 3 (so profits double) if sales increase by just 60% (60% of $500k at 29% margin is a further $86k). In other franchises a 3% improvement is noted.

So a WATR guide to swallowing up your Franchisees would look like this:

What marginal management fixed cost? -A

What current sales? 22.25% of B

What upside service performance? 29% of C

What upside product performance? D

Cost of acquisition: -E

Cost of Debt, if relevant: F = 8% of E

B+C+D-A-E-F

To me especially as they can pick between dozens of franchises generating $94m of sales to choose which franchises to reacquire it provides a growth engine both to widen the network and buy up growth at a low PE. Compared to establishing a brand new office taking on a going concern with a bank of customers and who already are loyal to your brand is a dream. Remember you’ve got 100% visibility over every metric via Salesforce to see exactly how well each franchisee is performing. When they say Pittsburgh offers upside they know exactly how and why.

Conclusion

Having heard from analysts and pundits saying this was a steady eddie stock that won’t shoot out the lights I think there are reasons to think it will do much better than forecast, has dry powder to pursue growth opportunities in 2024, so is an interesting stock especially when you consider it’s defensive, has growth tailwinds yet trades at around its net assets.

This is not advice.

Oak