XLPE - excel Private Equity Idea #23

Xtrackers LPX Private Equity Swap - Idea #23 from the OB 25 for 25

Dear reader,

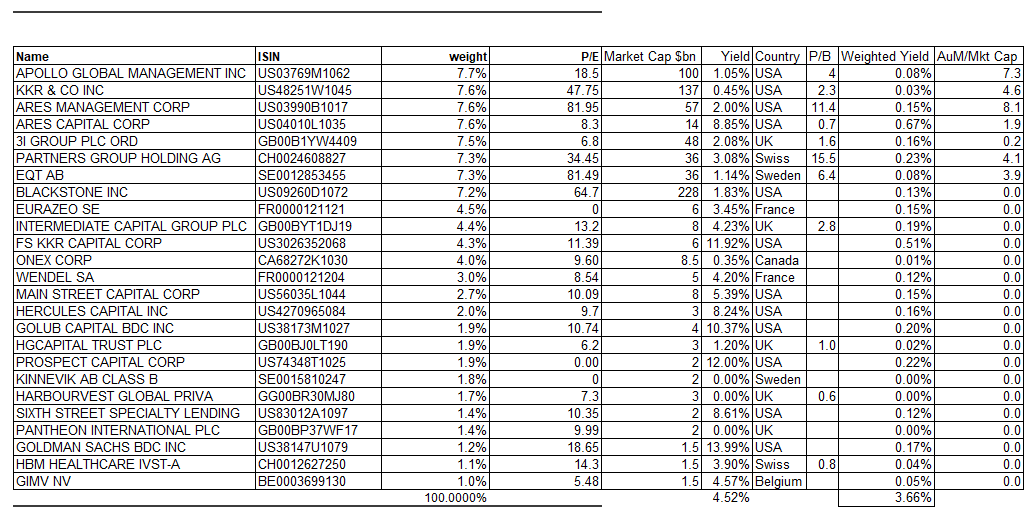

ETF Xtrackers LPX Private Equity Swap (ticker XLPE) is a fund of funds.

This is the second of the two OB 6X investments, an £1k imaginary investment into the 25 ideas for 2025, except for this and one other Serica I am leaning in 6X so a £35k portfolio to track performance.

-

So why choose XLPE? And why at 6X?

Because Trump intends to unite America through full prosperity.

Because the DOGE is going to make serious inroads into the US deficit offset by substantial tax cuts

Because peace is good for business and there are strong hopes for peace in Ukraine and the Middle East. (it’ll happen within 24 hours I think is the boast)

Because XLPE has only to continue the same trajectory in 2025 as it has done for numerous years - or better.

Because past wealth creation needs managing - as more wealth is being passed on - if you watched last weekend’s Wall St Week, on Bloomberg, the $105tn age of inheritance…. and if you didn’t it’s included below:

Larry Summers spoke to the fact that inherited wealth is reinvested and not distributed widely. So 25% understates the degree that wealth is compounded. So who benefits - apart from American inheritors - from that phenomenon?

The answer are the folks managing that wealth. And XLPE is possibly the best vehicle to access those Private Equity houses. Read on to find out more.

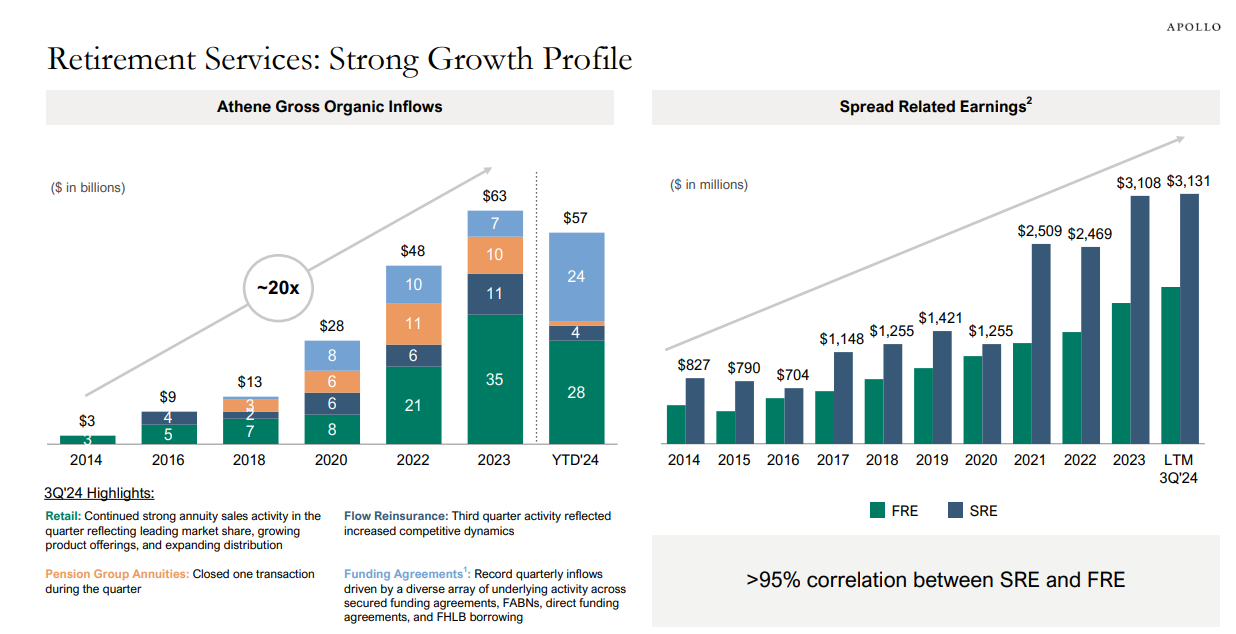

#1 Apollo Global Mgt 7.7%

A Retirement services and Asset Management with a balance sheet of $313bn of assets and -$288bn of liabilities, and managing $0.73tn of credit and equity assets.

Fees are up 12.5% year on year….

And the 10 year picture is even more impressive…

At a 18.5X P/E (trailing) it’s not cheap but is a good way to profit from positive US economic performance in 2025. And the “E” is growing fast.

#2 KKR & CO INC 7.6%

3Q24 Fee-Related Earnings (“FRE”) of $1.0 billion ($1.12/adj. share) in the quarter, up 79% year-over-year. $624bn AuM was up 18%.

Private Equity is only one component of KKR… 32% of AuM

Its growth is impressive and it intends to grow to $1tn AuM in the next 4 years.

Earnings are growing rapidly too.

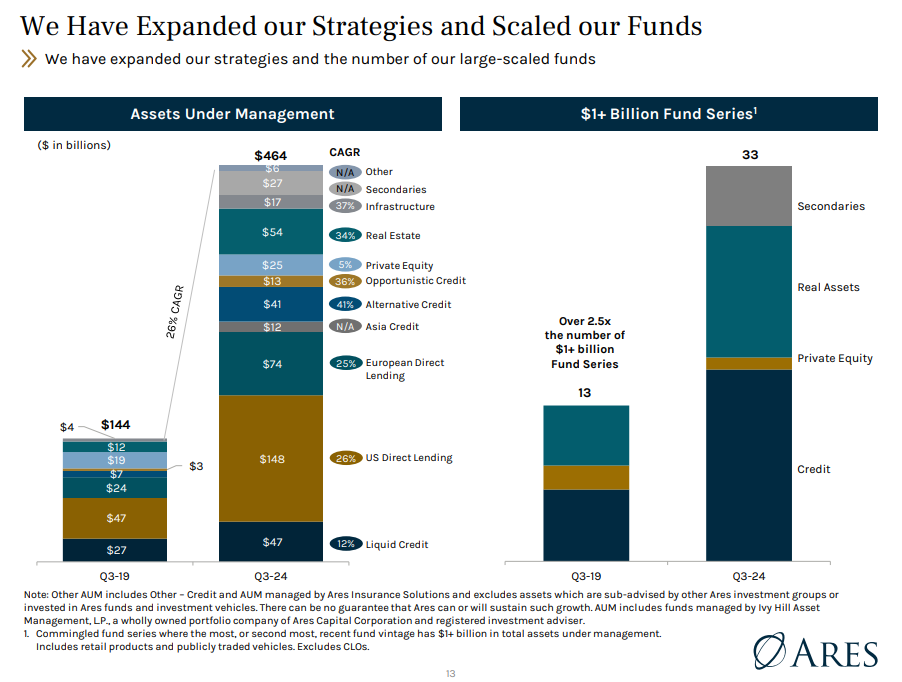

#3 ARES MANAGEMENT CORP 7.6% OF ASSETS

Once again strong growth:

Once again only a small component of AuM is Private Equity.

Ares see further growth opportunities.

#4 Ares Capital Corp 7.6%

Again predominantly not private equity and predominantly loans. Yields of around 11% with the majority senior secured, or 2nd lien senior secured. Ares creditors meanwhile charge a weighted 5.228% rate so a 6% interest margin is pretty tasty, and explains the 8.85% yield income.

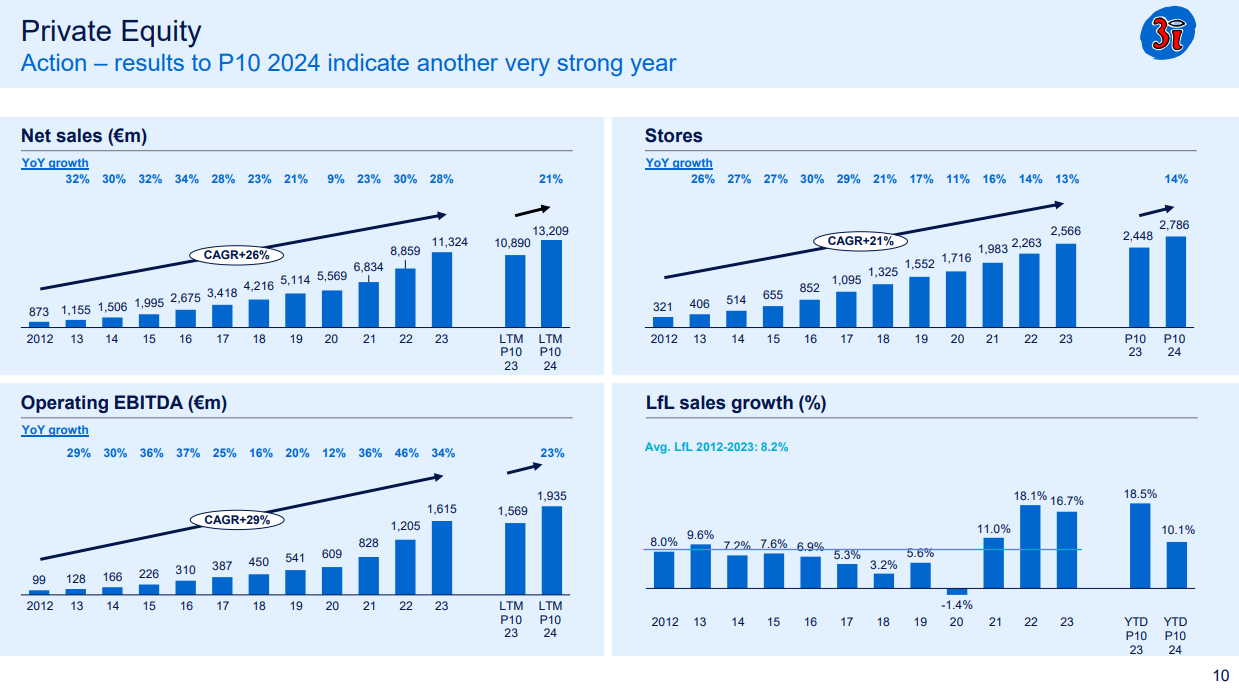

#5 3I GROUP PLC ORD 7.5%

We have now covered 38% of the fund and haven’t really found much private equity yet.

That’s about to change. 3i is probably known to most folks. Up 50% in 2024 - not bad for a £36bn market cap!!

Dutch supermarket Action added £2.2bn to the portfolio with other holdings adding 10%-20% in a year. Good to see that iii are achieving successes outside Action - this is a past criticism made of iii - that it’s a one trick pony. One detractor, WilsonHCG looked sorry.

Zoom out and you see a long term growth story at its holding Action.

Debt is used where debt to earnings is at about 3X while cost of debt at 4.8% is modest. A P/E of 6.8X seems ludicrously good value.

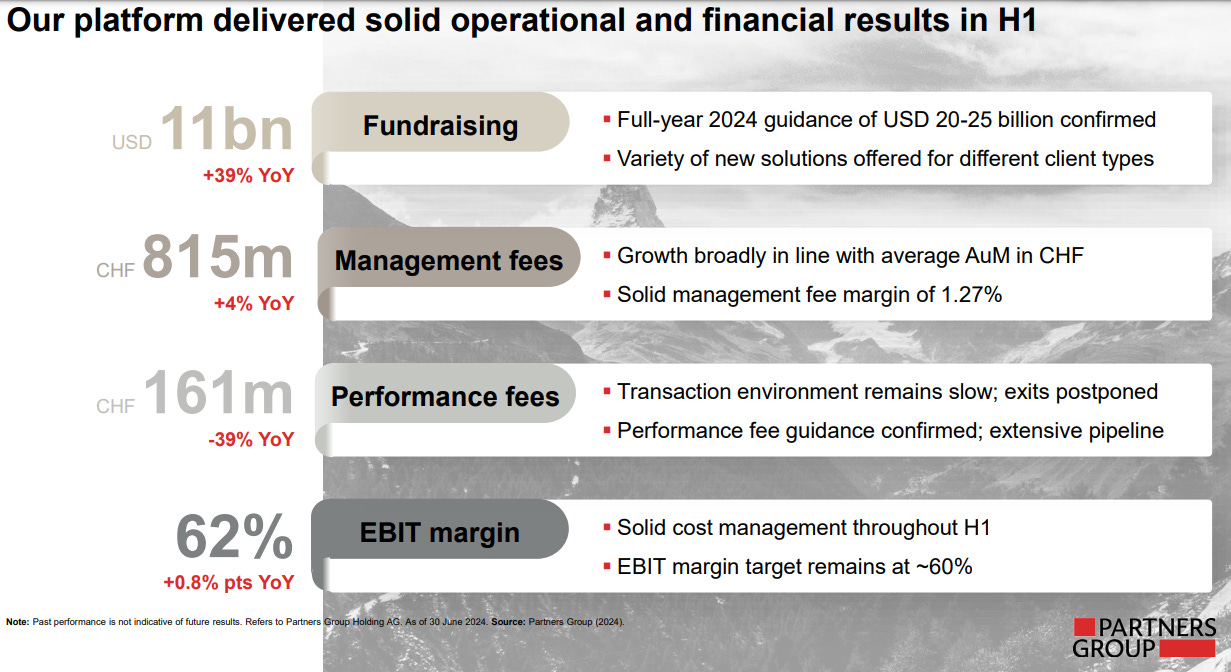

#6 PARTNERS GROUP HOLDING AG 7.3%

Now we arrive to 45.3% of the portfolio - nearly half. Partners group’s EBIT margin straight away catches my eye 62%. Next I see management fees up and performance fees down - a lot.

Well 1H24 was not a good vintage for Private Equity exits, was it?

$76bn of $149bn (so about 50%) is private equity with the remainder across Private Credit $31bn (25%), Infrastructure $26bn (15%) and Real Estate $16bn (10%). With a nascent royalty business.

Its North American business has 5X in 10 years to $35bn and expects “disproportional growth ahead”

What we can see below is if you catch a vintage year then the performance fee returns from private equity are worth at least $1bn of profit. Will 2025 return stronger performance fees? There are strong grounds to at least think that $161m was the nadir and the fees increase in 2025.

EQT SE 7.3%

Now we go to Sweden and arrive to 52.6% of the portfolio. EQT have enjoyed meteoric growth since its IPO in 2019. If these guys are the newcomers, they certainly appear to know what they are doing rapidly losing their underdog title in the PE world. $140bn of AuM comprises $42bn of infrastructure and $23bn real estate and an assumed $75bn of Private Equity.

Their focus is on five themes….

And became the third largest PE house in terms of new funds raised. Comparing the top 8 in 2019 to 2024 shows the growth in funds flow.

A chunk of that growth has been the USA with a 5.4X growth in investments in 5 years. $8bn is only about 5% of its AuM.

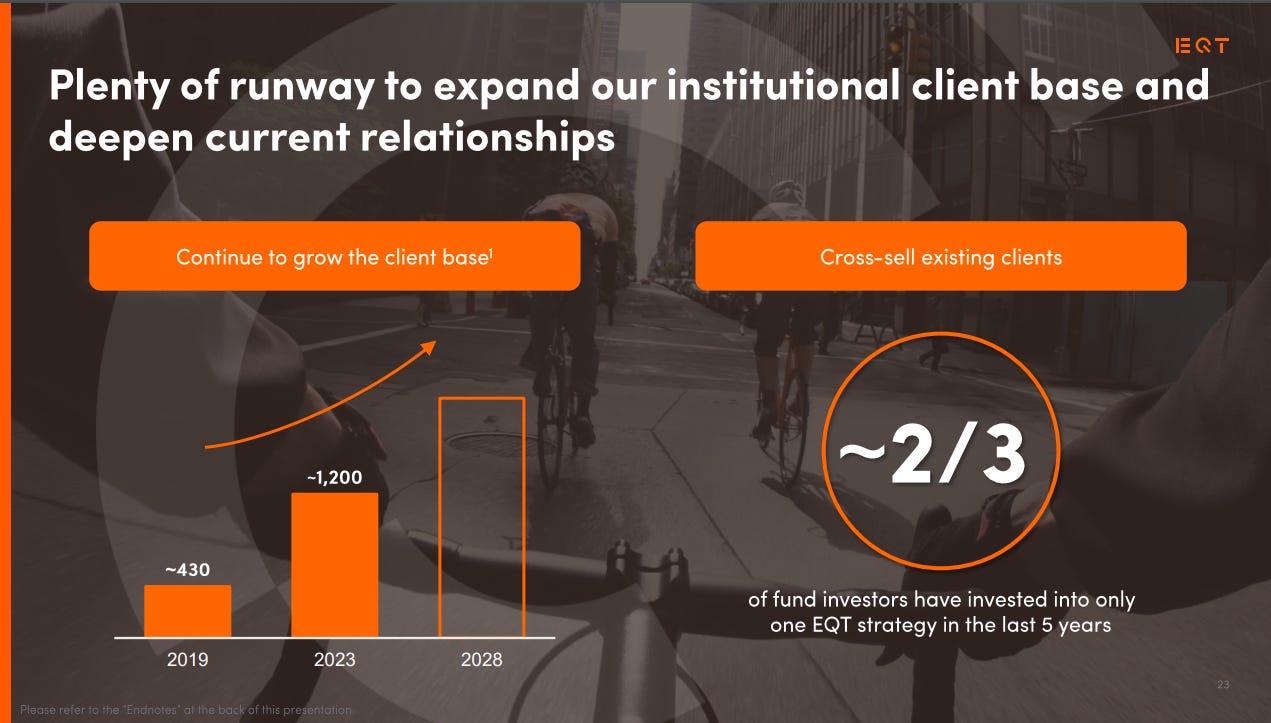

The strategy is to continue to grow clients but also to cross sell into the 2/3rds of clients who only invest in one EQT strategy and it is growing its products in 2025 in different geographies to address this.

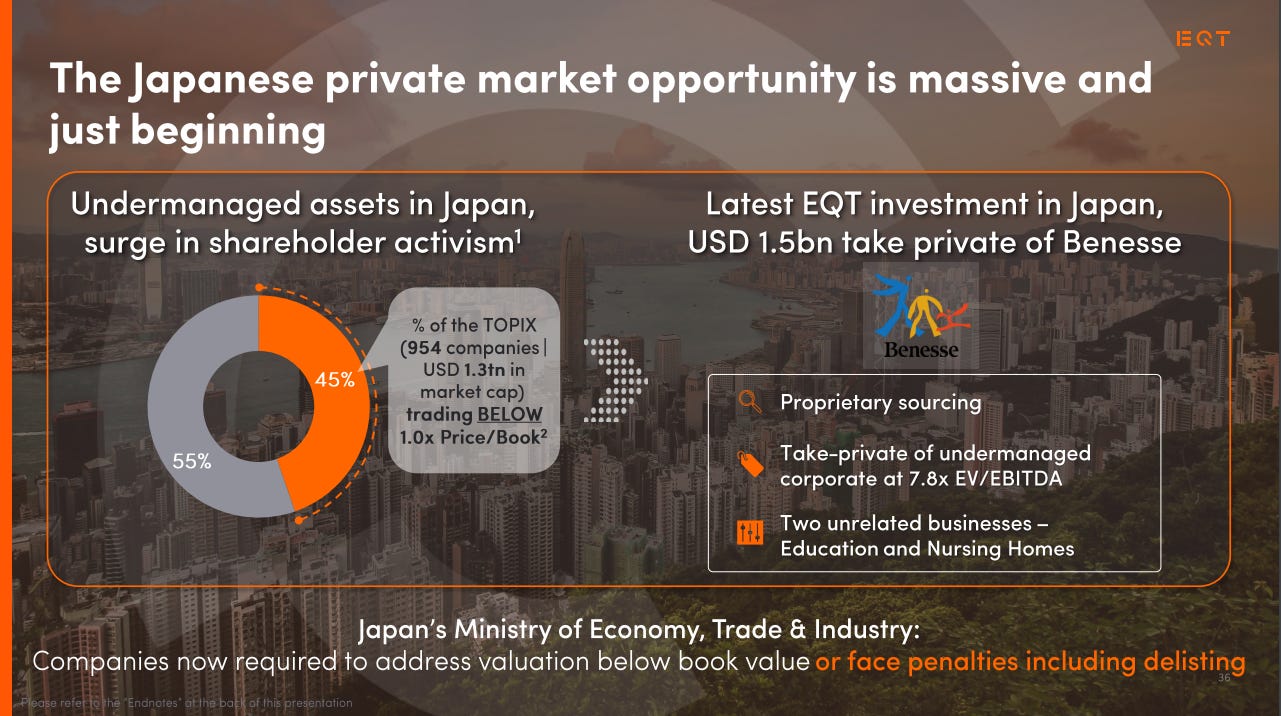

EQT is the first PE house to speak of the opportunity in Japan. The statistic below that they share that 45% of the Topix (954 companies and $1.3tn market cap) trade BELOW 1X Price/Book. In other words their net assets exceed their share price.

One obvious way to tackle this is for Private Equity to get involved. The opportunity is massive and just beginning.

EQT is also the first to speak specifically of the opportunity in India and their net IRR of 35% is impressive (and 3.9X gross MOIC which means multiple of invested capital).

Of various examples they share this EQT holding is very encouraging for eagle-eyed holders of DGI9… the read across to the earn-in at Verne Global is obvious, but while some might disclaim that the “pipework” of the internet is worth less than data centres - the common sense point that if a data centre is like a waterworks then a company like Aqua Comms is the pipework…. and the pipes are getting used many times more than just 4 years ago based on the numbers coming out of data centres. More demand in basic econonics does not equal lower prices - although if some undefined technology is increasing the supply of data through the pipework then the supply curve does point downwards. I suspect demand is stronger than supply however.

Conclusion

Alongside an average 4.5% yield, the top half of these holdings tell me a couple of things.

The growth in asset management is spectacular, there’s no other way to describe this. The average 20% funds growth and average 10%-20% profits growth means paying a higher multiple is justified.

The average market cap to assets under management is 4.3X. If you assume 2% fees then you are getting an approximate 8.6% return on each £1 invested (and 4.5% of that paid in dividends). Consider 20% growth and that 8.6% compounds to ~20%+ returns in about 5 years.

You might point out to me (and I philosophically considered) that Warren Buffett is quoted as saying Private Equity is a fraud. He was referring to the fees and charges they charge and the returns they actually achieve for their clients. But this investment is not where you are their client. You are the recipient and not payee of said fees so are on the side of the Fund Manager with this ETF and these companies are essentially doing what Mr Buffett does - buying great companies and earning a share of the returns for their trouble.

Rather than invest in something like the S&P500 this ETF is a leveraged bet on the skills of 25 obviously highly talented businesses chasing returns globally - and the clear evidence is that they’re consistently finding them.

The fact that these funds are spread over real estate infrastructure as well as Private Equity is also very encouraging. You’d imagine this to be a much higher risk ETF than it actually is based on the holdings.

There’s quite a lot of evidence that 2024 performance fees achieved were lack lustre but 2024 was a terrible vintage and there are grounds for optimism that 2025 and beyond will be stronger.

Risk? Sure there’s risk but if you believe that global economic growth will continue, if you believe that clever people can sniff out opportunity even if it somehow won’t be, if you believe putting your eggs in 25 baskets (I’ve only considered the top 7 of the 25 which make up just over half the basket) where the long-term trajectory appears to load the odds in your favour then this ETF is an exciting way to “bet” on growth.

Are these holdings overpriced? I considered this but not found evidence to that effect. In fact if you are happy to strip away number #3 Ares and number #7 EQT which trade on very high P/E multiples (and clearly are chasing growth, and profess to be) the remaining 23 P/E houses trade on a (frankly astonishing) 14.2X multiple! Where PEG (Price Earnings Growth) is reducing that number year by year.

Apart from two holdings chasing growth the remainder trade on an astonishing 14.2X P/E multiple!

9. Finally apart from III (and there are some other UK holdings in the remaining 18), the chances of you directly investing in Swedish and Swiss and perhaps even US holdings is slim and inconvenient and carries some level of FX trading cost. Via this ETF at a 0.5% charge (OCF 0.7%) I think is extremely reasonable.

What do you think?

Regards

The Oak Bloke.

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings including those held in a Fund might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Hi OB.

The first thing I noticed is that Brookfield Corporation doesn't get a mention in the holdings list (it is number 2 in the ishares version). Seems a bit strange.

Worth mentioning that since it is based on swaps they won't have to pay withholding tax within the fund, compared to the ishares which will.

I think it is worthwhile holding a slug of PE within a portfolio and this looks a decent way to do it. The industry has had a good run over the last few years, but some (Jared Dillon) are calling it a bubble as it has to continue to deploy capital into a diminishing opportunity set.

I find this a strange choice for your 6X as you have massive expertise for explaining when something is underappreciated whereas this is more of a performance call.

Finally, I am finding the OB25 to be fascinating. Well done - and thank you - for an outstanding body of work.

I much prefer to get my exposure to fund managers by owning Petershill with its 25% discount. There are many ways to gain exposure to PE assets - I can think of many investment trusts - but the interesting part is owning some of that fee income.