Dear reader,

As sure as Eggs is Eggs drawled Forr-est Gummmmp. It might shock Gump to learn them eggs in the US have increased seven fold and are forecast to hit $8/dozen. Avian Flu has hit egg costs and a shortage has driven up prices. Coffee is also at record prices, so a number of products are expensive to produce. Let’s not even talk about the price of Blue Fin Tuna which runs into the millions of dollars per fish (if you ignore the moral cost akin to that of an 18th Century DoDo hunter - except perhaps the DoDo Hunter back then didn’t have a latter day extinction animal whereas the Blue Fin Tuna fisherman today does?).

This RNS from fellow ag tech listed holding BSFA (one of Mr Archer’s top ideas covered here) caught my eye. Did 3DBT have something special or unique?

3D Bio-Tissues (3DBT) subsidiary, is transforming the biotech landscape with innovative technologies that include scaffold-free tissue engineered materials and patented macromolecular crowders, used as media additives to optimize cell growth. These chemically defined, bio-inert additives, marketed as City-Mix™ for the alternative protein industry and CytoBoost™ for the biopharma industry, positively affect cell behaviour, reducing the need for expensive growth factors or animal serum in cell culture media. These products provide tailored solutions for advancing cell research and production efficiency, marking a step forward in sustainable biotechnology.

The answer is complex but appears to be no. Development of “engineered materials” and “media additives” is a common thread among numerous cultivated meat producers to reduce the cost of production.

But good to see they are heading the same path. Their high profile backers in the fashion and cosmetics industry are reasons to feel positive for the future too.

#1 Serum-free media for cultivated meat

Several cultivated meat companies, including Mosa Meat8,16,21, GOOD Meat22, Upside Foods23, Aleph Farms24, Believer Meat25,26, Vow27, and CellMeat28, have successfully developed SFM. Additionally, there are also a myriad of commercially available serum replacements for cultivated meat.

This bodes well for anyone concerned about how ANIC holdings can move to profitability…. the answer is costs are dramatically falling. This study found costs had declined dramatically and fallen from the thousands to hundreds…. SGD$454.26 is £270 GBP per litre. The point being also that if you can recycle and recover the £270 per litre media then we are not talking about a 1 Litre to 1Kg cost of production.

#2 The UK Food Safety Report on Alternative Proteins

It is very interesting to read the FSA sector report dated March 2022.

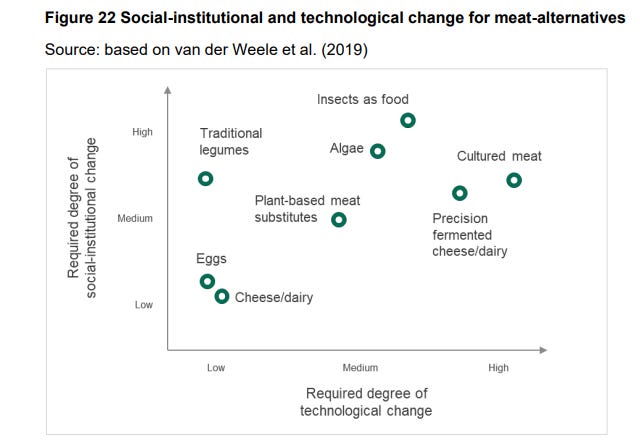

One of the conclusions reached and three years on appears to have been accurate was that eggs, cheese and dairy i.e. precision fermentation is the low hanging fruit.

It offers the “most significant potential for disruption”.

Interesting that ANIC has nearly £76m of Precision Fermentation holdings on its books - or £45m if you exclude the contract manufacturer Lib Labs (more on that later). So 100% of the market cap is backed by Precision Fermentation companies…..

Which between them have raised £520m of funds! They are highlighted in green below. Including Lib Labs adds a further $177m (£141m) of total funds raised to date.

#3 Meatly

Also consider the news from Friday that Chick Bites is on sale now at Pets At Home (consumer - demand it from your local Pets At Home, to transfer stock from Brentford please) at £69.80 per KG and considering PetsAtHome are probably taking 50% of that means cultivated meat is being produced for £34.90/Kg including as an yet amount of profit.

Can they make a profit at £34.90/Kg? When there is no £270/Litre serum used then you can produce a culture medium at £1/Litre as Meatly set out last year - with further reductions possible once you scale. Part of the reason that Cultivated Meat for Pets is “easier” and cheaper is that texture is of less importance to animals than humans, and secondly the safety protocols less arduous. If you have ever witnessed the making of pet food (as I have) you’ll know all of the meat used is labelled “unfit for human consumption” and not of a high standard, so please no bleeding heart complainers that pets are being victimised in this scenario.

So there are a number of positive aspects. First that the collective and combined progress via academia and industry is impressive - think of human ingenuity and the colossal progress made and still being made in semiconductor chips or computers - how easy is it to be a Thomas Watson on the subject.

How much more important is food, than communications? Maslow would place it ahead in the hierarchy of needs - most humans would too, including all who were hungry.

When it comes to making choices between slaughtered meat, cultivated meat and plant-based meat many consumers will generally be driven by price, it’s true. But not all. Price is not the only factor behind people’s choices.

Because if that were true Waitrose could never exist.

If that were true no one would ever buy food in an Airport, or at a Sports venue.

NAV as at 31/12/24

The NAV update was a further fall after a long series of rises. Solar Foods is a large reason and which IPO’d in 2024. Post period (in 2025) it has fallen 15% further to EUR4.11. ANIC holds 5.8% of shares. More on Solar Foods a little later.

A write off of Geltor is an example of a “no news being bad news”. Zero social media posts in the whole of 2024 possibly speaks volumes?

The reversal of CellX looks to be an auditor’s amendment disallowing a prior gain. So all in all there’s not really much to speak of other than Solar Foods and Lib Labs. This is my best estimate of holdings and values - there is a correcting reduction since specific movements are not always disclosed or not consistently.

#4 Solar Foods

If there were ever a new stock to pique Elon Musk’s interest it would be Solar Foods. Musk whose life goal let’s remember is to populate Mars. Not to be the best car manufacturer, not to create the world’s first global broadband service, not to create a huge solar energy and energy storage business, not to bore tunnels and create public transport on a scale unseen since the Victorians built today’s underground network - even though Musk has achieved all those things.

Solein can be made without land, without crops and without sunshine. It is true space traveller’s fayre.

Many space agencies are in talks with Solar Foods and its endorsement from winning NASA’s deep space challenge speaks volumes. It would be no surprise if SpaceX were already in talks, although we do not know that.

They ain’t making land no more is the famous quote often used about investing in land. So protein with less land used? Makes sense.

But questions like how do we feed the world? How do we achieve net zero at a reasonable cost? How do we use scarce fresh water efficiently? Solein provides a compelling answer to these questions. The yellow dot is how much less land, water are required and how much less CO2 is produced in its production.

Solein debuted in Singapore in 2024 backed by Japanese food giant Ajinomoto.

But also debuted in the US in November 2024 where it has GRAS (generally recognised as safe) status. NY finest Greg Baxtrom showcased Solein in his four-course taster. A Spätzle is a Germano-Hungarian egg pasta.

Solar Foods has new leadership and an impressive CEO who previously delivered strong growth and profitability at the ABB Group, Rolls Royce and Körber.

EU approval is four years in, and is anticipated next year.

So despite the price falls there are reasons to feel positive about Solar Foods even if profitability is several years out and relies on the build of Factory 02 (with its larger scale and stronger economics while live Factory 01 is the test bed for prototyping) although even F01 is expanding by over 50% from 160t to 230t by next year.

A 15X productivity increase has been achieved over the past five years. More to come and is targeted - even before Factory02 is built - with its superior economics.

#5 Liberation Labs

I will try to be brief here.

Lib Labs is a US production facility so a picks and shovels on precision fermentation.

The fact that there are (albeit uncontracted) five year commitments over double the capacity and several large companies tells you much of what you need to know about the future success of this ANIC holding.

19th February 2025 update - I fell off my chair to see the “over double” is now “nearly triple”. Does that tell you what you need to know about burgeoning demand for Liberation Labs?

Lib Labs is 20% of the ANIC NAV but 71% of the share price (at today’s 4.2p), with forecast EBITDA of $30m from mid 2025, means a pro-rata for ANIC of $11.3m (or £9m)

Lib Labs alone puts the whole of ANIC on a forecast EBITDA to Market Cap of 5 times.

#6 UK Food Standards Agency

The Sandbox programme. This was extremely positive news, I thought, and a real win for the UK that we could become a world leader in the area of cell-cultivated products “CCP”. The government have funded a programme to research the area of CCPs and how best to support and fast track applications while ensuring rigourous safety. These are to be classified as “products of animal origin” but not classified as “meat”

In other words the UK is open for CCP business!

#7 Conclusion

Lib Labs 0.6m 1st facility is fully funded. It alone underpins the value here with its relatively near term commercialisation. But a number of holdings are on the cusp of commercialisation and appear to have pathways to profitability too.

Solar Foods, Meatly, All G, Onego and Formo are all large holdings with those pathways with active social media newsflows and evidence of progress.

The potential pay off here is vast although risks remain and further funding and dilution at some holdings likely if not an inevitability.

This 2024 idea remains one I believe to be sound despite the fall in share price.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I am about 75% down on a very heavy bet in Anic since I started buying in late 21. And despite that it’s the investment that I follow with the most interest and fondness. I am sure this is the future and will turn out good at the end. This is not investment advice! Just irrational conviction!

Think it's worth calling out a new interview with Mark Warner who is now reporting that Letters of Intent are now not "over double" but "nearly triple".

Does that tell you what you need to know? I've linked to it and update the article here:

https://theoakbloke.substack.com/i/154456597/liberation-labs