1H25 - JLP and its large waste project

Drought-ridden results leave Jubilee soggy, but what's next?

Dear reader,

Operational update for H1 2025 Jubilee

Can you imagine what Mr Hindsight was doing as Leon Coetzer delivered his 1Q25 update? Probably madly waving his arms crying Leon! Leon! Don’t say it, don’t say it, there’s more navigating to come. Just stop at the word executing, because mother nature’s gonna kill the power. Leonnnnnnnn….oooooooo

In his Q1 update Leon said: “Despite facing several hurdles along the way, including the country-wide power crisis, we have navigated these challenges and emerged stronger. Looking ahead to the remaining three quarters of FY2025, I am confident that we will continue with executing on our copper growth strategy, while maintaining the momentum of our successful South African operations."

Unfortunate drought conditions led to massive power problems across Zambia and Zimbabwe (who share a common power grid) and who heavily rely on hydroelectric energy - which quite literally dried up. Despite the further setback I think buying Jubilee or more Jubilee could be a very smart move. There’s a couple of reasons why I think so but first let’s consider the operational update.

Obviously the copper performance was >50% below expectations (5850-7500 tonnes at the half year would be 2925 tonnes - 3750 tonnes). Actually achieved 1,436 units, and that’s almost wholly from the unaffected but currently being upgraded Sable Refinery. Talk about bad timing!

That copper production underperformance is fairly irrelevant. What? “Irrelevant!” splutter the harrumphers, in rage and disgust. No, Mr Hindsight, nothing to see here, no need to wave your arms as the Oak Bloke has this covered. But the JLP share price is down over 50% exclaim the harrumphers - surely the two are connected?

I don’t believe so, or at least it’s at best a 2ndary factor. After all consider the news broke on the 17th December and the price went from 3.8p to 3.352p (and eagle-eyed readers swooped I dare say and saw what I saw) but now is back to 4.2p. Why is that?

What’s the primary reason for a 50% fall? II’s exiting the share - reducing by about 6% of shares being sold (based on notifiable shareholders so potentially more).

Why? Fund outflows from the UK continue Calastone tell us.

What’s the actual performance? And why am I bullish?

1. Massive Chrome Outperformance.

In my prior article “Is JLP on a P/E of 1?” I’d factored in the additional units to achieve 0.825MT. Actual performance? 0.975MT. An 18% outperformance beyond forecast. Pity my coccyx, reader, because yet again I fell off my chair when I realised what they’d achieved. I used the recent PGM basket price of $1380 from THS and $275 Chrome (at a circa 42% rate for the concentrate less a proportion on fixed tolls), to get a blended rate.

It doesn’t stop there. I ran the numbers through my profit model. An estimated £23.8m EBITDA, putting this on 5X EBITDA earnings (was at a £100m marcap - now £128m). And a P/E of about 12. That’s not half bad all things considered!

But the OB positivity doesn’t end there. The run rate appears to be higher in December (although we don’t know by how much) although even going by the 2Q25 number the run rate is 4 times 519,310 tonnes = ~2.1MT per annum. (vs a 1.65MT forecast)

2/ PGM prices

Eagle-eyed readers will know I’m generally positive about PGMs in 2025 and backed OB25 for 25 idea Tharisa, and reading the outlook for PGMs in 2025 is worth a look in my article “THS will turn around”. The short version is that there is no PGM surplus just a deficit (another coccyx pain-inducing chair event) while PGM producers are making no money (including JLP) and while PGM demand is continuing to grow and in fact I believe is accelerating. That’s a recipe for a spike as sure as eggs is eggs. No Mr Hindsight I still got this.

It is worth adding that JLP have the ability to expand their PGM production by 2.5X once the conditions are right. This would partly be through new agreements and strategic partners plus partly through prioritising feeds with a stronger PGM element. Currently chrome rich feeds are being selected instead. Some people believe they have PGMs “stockpiled” but a careful read through of the FY24 report doesn’t support this theory.

3/ Copper demand and supply.

Consider the reliance on recycling and reuse. I’m not as bullish on copper prices spiking but the demand is certainly there and will remain. Eagle-eyed readers will spot Copper offers the highest margin for JLP and so expansion of your most profitable activity if mother nature co-operates makes sense.

Then it struck me. There’s 1.21MT of ROM which at a 0.7% grade is 8,466 tonnes equivalent. But, but, but, that’s over 1 year’s worth of the FY25 production target ready to process. (copper target 5,850-7,500 tonnes for FY25)

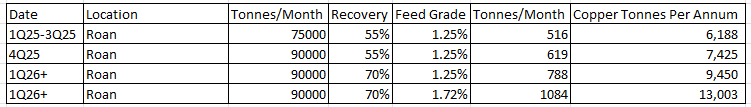

Capacity of 25,000 tonnes is “targeted” but we know Sable is being upgraded currently (so we could assume just another 1,400 tonnes from Sable perhaps in 2H25 to June 2025) although some work continues until December 2025 sadly. Assuming Roan is operational from February 2025 conservatively 350 tonnes a month for 5 months delivers 1,750 tonnes more. So 3,150 tonnes in 2H25 from Roan perhaps? That gets Copper production to 6Kt for FY25 and seems reasonable - and hits target. But there’s defninite upside to that number once you consider Project G and the Waste Rock project as I continue below.

In any case what investors should focus on is the FY26 outlook and forecast. What price will JLP be once the market prices that in?

4/ Speed of response.

I liked that JLP reported a problem 17th December and say in the next days so this month (assuming regulatory approval - more on that later). I think you do have to give some credit for that, although it’s a pity a plan B wasn’t already in place especially as there is no penalty cost for the 2nd source. Mr Hindsight always knows best.

5/ The Leach Trials

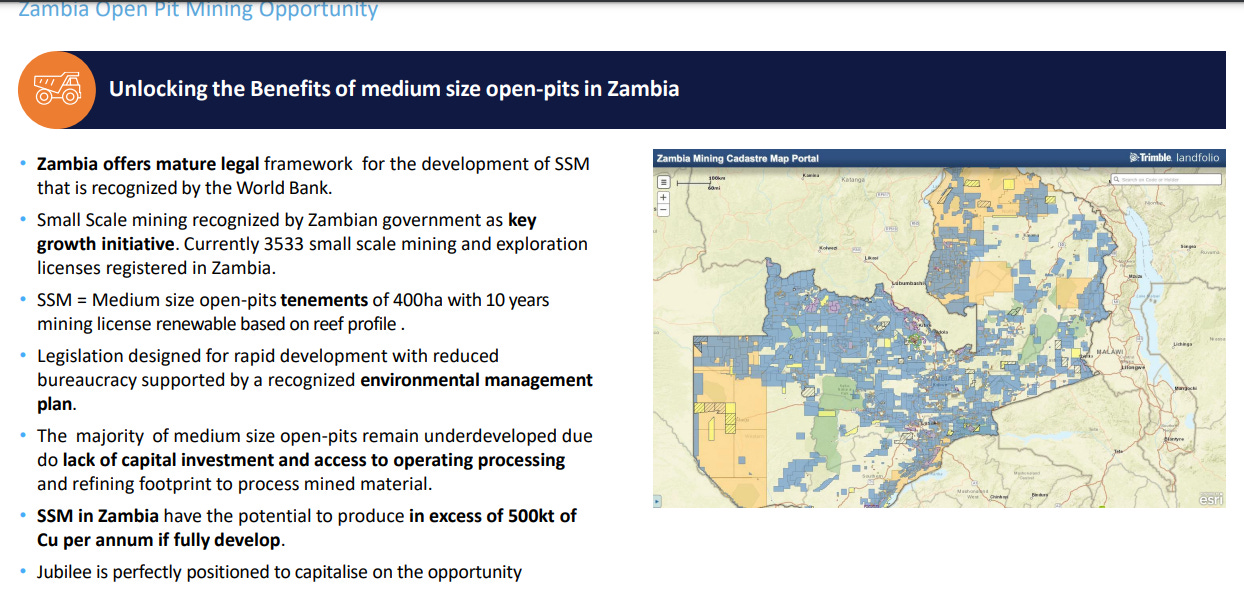

Is that a Hollywood film? A Celebrity Get Me Outta Here Bucktucker? MMMMM yummy. Or perhaps amazing news that the market hasn’t appreciated yet? Munkoyo is a footprint for a methodology which will repeat across numerous locations in Zambia. A rinse and repeat. Potentially 3,533 times.

So the confirmation of the recoverability of copper and strong economic returns with modest capex is a hugely positive piece of news.

But the modest capex is only part of the story, reduced opex (acid consumption) too.

I said potentially 3,533 times. Yes SSMs - small size miners like Munkoyo need “The Jubilee way”. Munkoyo was going nowhere prior to JLP’s involvement. Now the mine owner is a happy JLP shareholder and a future “regional hub” - just look at the number of copper tenements on the map. The pilot plant has proved the means to concentrate the copper ore (ROM) so that a 7% concentrate is produced to be passed for smelting and processing.

Cough. Zambia isn’t the only country in the world with copper wastes and run of mine either.

6/ Project G

At least 300 units a month from March delivers 1,200 tonnes of copper equivalent too by year end. That would take my 6,000 tonnes estimate to over 7,000.

7/ Large Waste

Amidst the harrumphing of power concerns in December 40% off the cost to buy the Large Waste Project is not to be sniffed at. Assuming this to be because the (as yet unreleased) test results show 0.8% grades that equates to over 2 million tonnes of copper units.

Paying just $9 per tonne of copper (plus processing costs) seems a bargain to me.

To illustrate that consider that its partner in the Large Waste Project IRH recently paid $700m+$400m loan to acquire 51% of nearby Mopani Copper Mines with its 170MT measured resource which is $8.07 per tonne…. for copper which needs to be mined underground. That isn’t at surface. I know which I’d pick as the better deal. Of course if the grade is higher than 0.8% then JLP have struck a better deal than a vastly larger business with $billions to spend could obtain. Again credit where credit’s due.

There is near term newsflow to look forward to on the trial and a go-no go by end of this month.

Conclusion

I saw a Zeus broker note saying their valuation is dependent upon a quick resolution to the issues in Zambia. Issues? There is only 1 issue I’m aware of: Availability of electrical power.

Am I ignoring Mr Hindsight at my peril? No, because I don’t see that quick resolution of the 2nd Zambian power source is the basis for fair value.

What does quick resolution require? Regulatory approval. Will JLP get regulatory approval? What, for the Zambian President’s Pet Project to grow production to 3 million tonnes of copper per year by 2030? Come on!

In any case and even if the (unlikely) answer is no, it is raining again in Zambia. Raining a lot actually. Has been for a few weeks. So even if power source #B doesn’t work out or get given approval, there’s potential reversion to Plan A as the er Plan B to Plan B. At least until the summer.

Besides there are too many other positive factors to consider. A storming result for the South African business, it is thought future chrome prices are well supported even if there’s been a dip recently based on Chinese sentiment.

There are reasons to think the PGM prices will move higher in 2025 - perhaps a lot higher. At $1,700/oz (and $72/tonne chrome) if you consider the Zambia business is worth zero the SA business still generates ~£30m net. So a future P/E of 4 roughly. So you can get to 6.6p on a sotp basis of SA alone.

The sheer scale of ambition in Zambia is enormous. There are numerous projects and further news flow to come. The “proof” of Munkoyo and the proof of the trial there, and of reduced capex and opex well that appears to be the “game changer” news. But this the 2nd game changer news. JLP have demonstrated a capability to extract metals cheaply and effectively with chrome and now copper. In my book that is a core competency - and where in a 11p or 22p valuation is the value of that know how? The answer is nowhere. If you valued JLP as a technology company you would not arrive to either 11p or 22p. Consider their claimed expertise spans cobalt, lead, zinc and vanadium, partly through acquisition and partly through R&D investment.

Consider too a cheeky 6.5 million tonnes of high-grade (3.88%-10.45%) Zinc material JLP owns and is hidden in the accounts. Even at a (very) lowly 10% net margin and 3.88% at $2840/tonne that would be $71.6m profit (£60m so about 50% the market cap).

Where in the price is the value of the know how?

Returning to the here and now, JLP’s stockpile of copper ore at Munkoyo is vast - over 1 year’s worth of JLP’s target production.

JLP is like a car spinning its wheels with its handbrake jammed. The market is focused on the jammed handbrake. But once that hand brake comes off and the nitro button is pushed, and the batmobile anti gravity gizmo…. well you get the idea.

Could Mr Hindsight do his thang? Delay and frustrate a bit more - yes - that is a risk. Do you see him waving? Is the waving to not buy or not miss out? Only you can be the judge of that reader.

With reasonably supportive prices ($1700/oz PGM basket, $285/t chrome, and $11,000 copper) and projected copper production, alongside current chrome and running PGM rich material, you can see a point where profit goes into 9 numbers (GBP) for JLP.

The other thing is a £100m prospective net profit on a £128m market cap is a P/E of 1.2. So when the broker says 11p fair value (on an undisclosed valuation basis) that’s 2.5X today’s 4.4p ask. If I’m right is a P/E of 1.2X x 2.5 = 3 times not a tad too low? Is 22p a fairer fair value based on a projected 6X P/E?

Are those supportive prices realistic? Only you can be the judge of that reader. Copper recently was at $11,464, Chrome concentrate was at $310 in 2024, and PGMs baskets were at ~$4,500, higher than $1700 in 2021. Of course there are risks, and misfortunes too. More misfortunes than is comfortable. Oscar might comment: “To lose one power source is unfortunate, but to lose two seems like carelessness.”

Yet there are minerals in them there hills of mined material, and further proof points too to “the Jubilee Way”.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

1800 copper unit tonnes was the original target for H1 FY25.Not as bad a production miss as indicated. The estimated impact on copper production for FY25 will not be known until revised target figures are announced sometime in February, assuming Roan is now fully up and running.