Dear reader,

I want to call out and congratulate Justin Waite of Sharepickers on the successful publication of his 1st book, and publication of articles in both Moneyweek and the Investors Chronicle.

Several readers have asked me whether I am going to write a book. Thank you. Sadly I do not believe I have the time… one day perhaps. It would amazing to publish a book. Hence me congratulating Mr Waite.

I do recommend, meanwhile, you consider buying his book. Uncover shares with ten bagger potential.

Mr Waite speaks to achieving a colossal 9,036% return. Wow. My advice would be to stop wasting your time reading the Oak Bloke and go join Mr Waite at Sharepickers. I can’t make such a grand claim. I will continue to publish my success and failure. Both are how we learn.

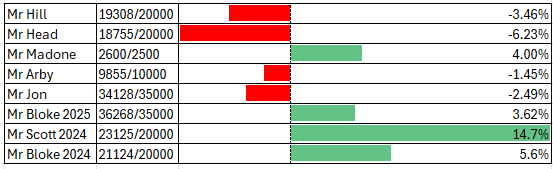

The Oak Bloke in 2025 in 13 days has achieved a 3.26% positive ITD performance and my 2024 ideas which are now in their 13th month are now at a net 5.35% return - and now only a 9% difference between my ideas and Mr Scott’s 2024 ideas. Puff puff, I’ll catch up, I’ll catch up.

Perhaps Mr Waite Sharepickers should be competing in the fun run in 2025 too. He would presumably effortlessly defeat us mere mortals, and even the mighty Mr Scott. Puff, puff, keep going, keep going, you can catch up.

Meanwhile I do have the satisfaction of being a close 2nd place in the 2025 race so far. I was 1st place till today. Mr Madone has fair play taken the lead today, because Touchstone has increased by 1p from 25p to 26p. With a target price of 100p this contender might prove to us all that placing all your bets on your single best idea can be more lucrative than a carefully balanced portfolio. But can you sleep at night? This run is just for fun, but betting the whole house on an O&G junior… that takes some guts (and glory). In any case, I know Mr Madone is a DEC investor, PTAL and probably other common shares, so well done Mr Madone on becoming the current 2025 fun run leader!

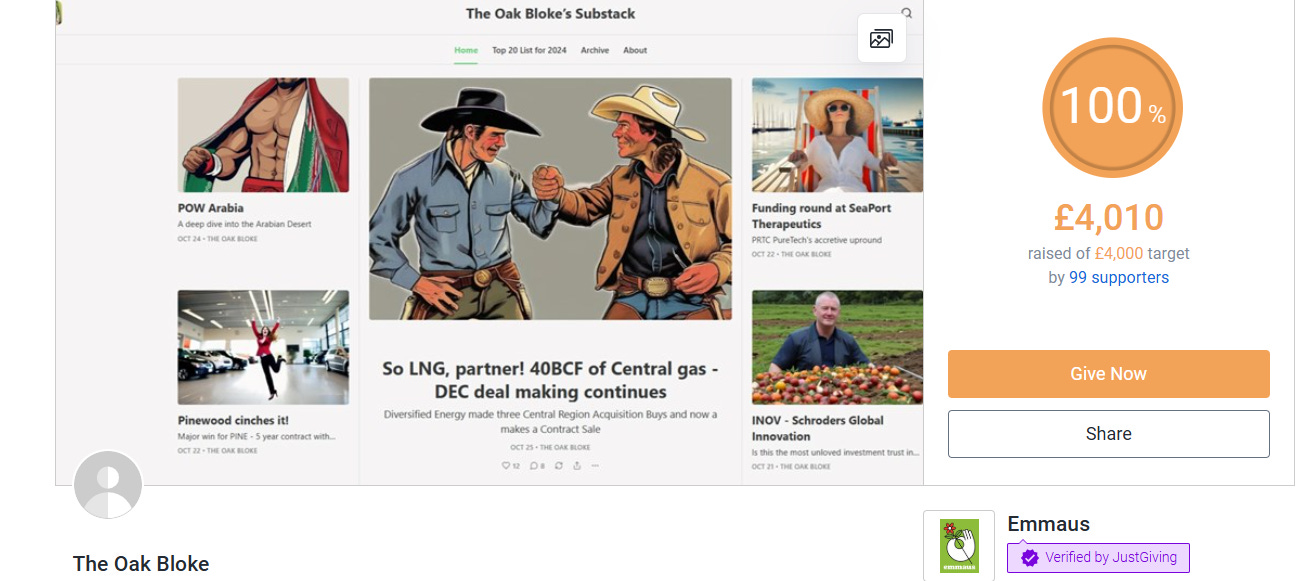

Over 50% of readers voted to say they thought I would win the 2025 fun run but I would be delighted to just achieve a decent positive performance. Having raised nearly £10,000 for Bowel Cancer and Emmaus (we hit 100% target today on Emmaus reader!!!!) my motivation is to give back to those donors for their kindness. Thank you! Thank you!

I still cannot believe I bested the mighty Mr Thompson of the Investors Chronicle and his 400,000 readers in 2024. How did that happen? He writes an article and the share shoots up many percent.

You will notice I have added Mr Head of Stocko to the 2025 race also. I want to race the best. Will Mr Head’s polished 90+ score portfolio thrash my sorry-looking band of misfits and (some) suckers? Not so far but 352 days left to go. In fact my ideas with “sucker” status have reduced from 3 to 2 - so it took 13 days for the 1st one to lose that title. My other 2 suckers are EMVC up 8.6% ITD and KAV up 30% ITD. How long will they remain “sucker” underdogs? Or will they be cast down and do I have another think coming?

I added Mr race leader “Mad One” Madone given his different style to other racers and who is backing Touchstone Exploration (TXP) as a single stock portfolio. The carefully constructed portfolios of other racers might get trounced in the face of single stock TXP executing its “Drill to Fill” strategy. I actually would not be surprised if Mr Madone won the 2025 race in his all or nothing approach. But there’s also a chance it could end with last place. TXP trades at 26p today but exceeded 150p in its recent past. We’ll see. It’s also true a concentrated approach didn’t work so well for Mr and Mr Roast in 2024 as their top 3 for 2H24 got roasted. But Warren Buffett Buffetology says don’t invest into your next best idea focus on your best one, and Berkshire Hathaway generally does make highly concentrated investments, doesn’t it?

I am incredibly grateful to the Cockney Rebel Richard Crow who has begun recommending the Oak Bloke substack to his 10,000 readers. Thank you Sir. And a warm welcome to new readers who are flowing in fast to the world of OB. If you scroll back you have hundreds of articles to enjoy (?) here. But I am a mere dwarf stood among mighty giants of the investment world. How did that happen exactly?

For those relatively new to this substack it might be worth me explaining that I do. Erm, aspire to do. You can be judge of the doing. I write a lot to validate my thinking. It helps me make better investment decisions - or at least that’s why this substack began. It later became focused on encouraging giving, and focusing on making a difference in this world. I like to analyse, analyse, analyse. Feel free to criticise but keep it polite.

I’m the only person (that I know of) who’s taken all their ideas and worked out whether they were right or wrong on a mass scale. I did so back in article 300 where I analysed every idea up to article 300 according to bullish or bearish and the performance but also the min→max price performance. This was due to some detractors making throw away comments like “The Oak Bloke is wrong most of the time”. Oh really? Let’s analyse that.

The analysis was (at that time) that in fact I was wrong 1/3rd of the time. So actually most of the time I am right. I’m not bragging that’s just stating facts. Being right meaning I was correct (at that point in time) about a stock’s positive or negative prospects. If you bought every stock I wrote about on the exact date I wrote that article would you have profited? No. The net return calculated was 0%. That included some 100% losses as well as some big risers. People will always remember the failures more than your successes in life.

But if you timed your buy and sell correctly then my ideas would have generated on average a 46% gain. (at that time)

Whose responsibility is it to get the timing to buy and sell correct? Mine or yours. I’ll give you a clue. It’s not mine. You make your own investment decisions and that includes timing.

If you got that timing exactly right then on 10 of the 83 ideas I wrote about you would have doubled your money if you could have timed them perfectly. Guardian Metals, for example, if you’d sold during 7th July and bought at 28th December you’d have made a 379% gain. Or TEK you could have picked up for 6.25p on 28th December and sold out on the 16th Feb at 17p pocketing a 172% gain. 66 of 83 ideas could have given you double digit returns.

These are not 9,036% gains it’s true. I can only dream to achieve such a lofty return. The sort of triumph they would speak of thousands of years from now. The sort of return where I’d go any buy a tropical island, retire and never return. The Oak who?

The other reason I mention “300” is that I plan to release an update on this soon. For article “500” actually (this is article #462 today).

I am curious what my revised hit rate will be and what my revised return will be. I sense that it is now above 0% (or 46%). Of course I’ve written about other further ideas since article 300. But I sense (and it is only my sense) that writing about stuff has improved my skills. That OB 25 for 25 is better than OB24 (shh don’t tell OB24 that)

I’m also planning to complete the 25 for 25 videos. I’m now 2/3rds of the way through those. I began quite nervously but now feel I’m getting into my stride. Feel as though I can make them more succinct and snappy too. Other videos I’ve watched seem to dwell on technical charts or just flash up the share price. Perhaps it’s very ponderous for me to approach them differently, but I like talking through the balance sheet, the cash flow, the foot notes, the auditor’s report. Walking through the company’s presentation deck. Their web site. I don’t see that others do do that. Even company directors don’t do that and they strictly stick to their powerpoint slides.

Perhaps they don’t do it because it’s a daft idea.

What do you think? Should I?

I will be doing another “vote for your ideas” article where people can suggest stocks they’d like me to analyse and then other readers vote and pick. I do need to complete my 25 for 25 before I do that but it’s on my radar.

Finally thank you again to the 99 supporters for all your support with the fund raise for Emmaus.

If you work for an organisation that wants to support an amazing cause in 2025 could I suggest to consider becoming an Emmaus Corporate Partner. One such Corporate Sponsor to Emmaus is brick, and international roofing supplier Wienerberger. As well contributing to Emmaus’ Companion Training Fund to help companions pursue training and education in the Construction sector, Wienerberger gets involved in renovating Emmaus’ buildings too.

I’m a sucker for a nice facade so I’ll share this Wienerberger project case study I particularly like at Loughborough University.

Regards

The Oak Bloke

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I concur that Justin's book is an excellent read and I joined SharePickers as a result. He updates a Microcap league on a daily basis and has an excellent website containing up to date analysis across a range of Microcap s. He also runs a weekly webinar each Wednesday to share his knowledge and his own picks and watchlists. Highly recommended.

It seems to me that you've identified severe undervaluations in UK stocks but unfortunately they can only be addressed by takeovers and winding down the companies. As long as all the big money goes into US stocks there will never be a recovery in the UK.