Dear reader,

Doesn’t time fly? We are 2-3 weeks from the full year results (to 30/06/24) for Frontier IP (ticker FIPP).

What might those results look like?

In my article “325 Musings” I wrote “(FIPP)’s market cap of £20m (NB £17.1m as of 11th Oct) today vs its last NAV of £47.3m, and a track record of 5 out of 6 years making a net profit and EPS of 44.42p over 6 years (2.25p 5.5p 18.41p 16.61p 7.5p -5.85p)! Have a think about that. A share you can buy for 32p and that generated 44.4p of earnings over the past 6 years.

I wrote FIPP is one of my least read articles so go on, surrender to your curiosity and give that hyperlink a click.”

Well guess what? The readership of that article doubled - but it remains 90% below the average 3k+ readers per article - so once again do give that hyperlink a click! :)

Let’s spend some time considering 1H24 FIPP newsflow and post period too.

1/ Exscientia FIPP now own 0%

We know that £0.24m profit, which is 0.4p per share, was booked as profit from Exscientia in 1H24. So ends the holding of what became a 7000x bagger.

2/ Diagen 4.26%

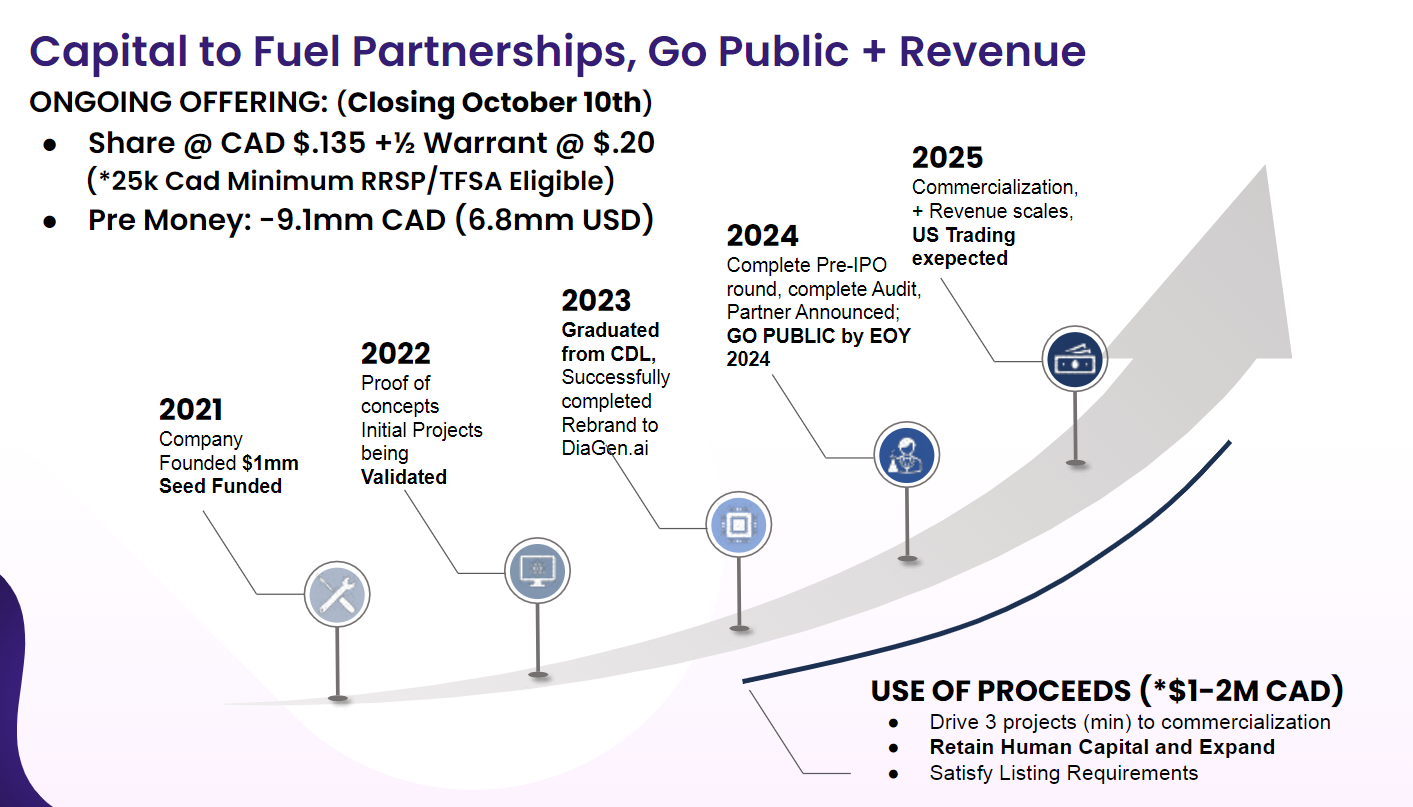

We further know that FIPP delivered advisory services to Diagen AI and in return earned a 4.26% stake. We know that Diagen is valued at £5.2m so this stake is worth £0.2m - more on that in a second.

We know that a wall of money is going into AI themed investment. How? Diagen tell us so. Not least from Big Pharma names but also Big Tech too. Diagen’s investment deck speaks to these. Names like Nvidia, Tencent, Johnson & Johnson, Gilead, Novartis:

And here:

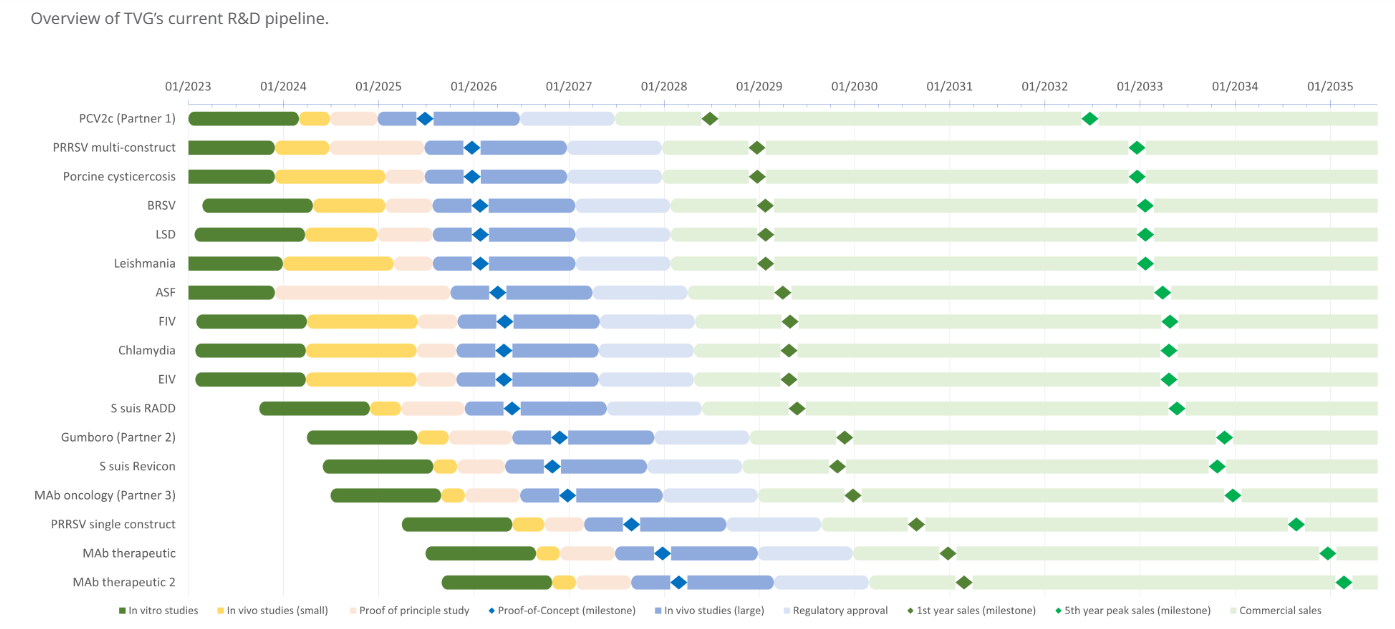

Diagen has an existing pipeline of work for its AI engine. One of these is another of FIPP’s portfolio companies, The Vaccine Group.

You may wonder where the £5.2m valuation came from? Well, Diagen have their IPO next week and the pre money is US $6.8m

3. TVG 17%

We know The Vaccine Group (FIPP have a 17% holding) have won a government contract from DEFRA to develop a novel vaccine candidate for African Swine Fever.

It’s post period but also know DEFRA followed up with a 2nd contract award of just over £1m to replace antibiotics for Strep Suis (a serious bacterial disease in pigs) with a vaccine candidate. The aim to reduce the (over) use of antibiotics is one objective but transmission to humans is also a danger which would potentially leads to meningitis and septicaemia.

These multi million grants/funding are ways to the pipeline rather than being any kind of “profit” in and of themselves. But profit is coming. In the next two years studies will begin to complete, regulatory approvals will begin, and three years commercialisation where these vaccines are addressing £50m - £100bn size problems (per year). The Vaccine Group alone could be worth very many times the price of FIPP.

Essentially, these vaccines could be a “Covid prevention” strategy for governments as well as an antibiotic reduction strategy. Antibiotic-resistance is another potential world catastrophe. But also the simple costs to Pig Farmers of destroying Pigs have meant costs into the hundreds of billions - and continues even today. Imagine a world with no prosciutto! Che disastro!

TVG has numerous programs some self funded and other funded by DEFRA and others.

4/ Alusid 35.4%

Alusid’s tiles not only use 95%-98% recycled material but offer equivalent strength and have a much lower energy footprint.

Its distribution agreement with Topps Tiles is a major break through and an update on its continental Europe expansion is something to look forward to. The newsflow from Topps is that tile demand for the Residential/Home Owner market is very weak but that the Commercial arm is doing well and this is an area where Alusid has had a lot of success (busineses with net zero objectives). So could this success be the springboard to Alusid’s IPO?

5/ Cambridge Raman Imaging 26.9%

CRI reported accelerated growth in 1H24 FIPP provided extra working capital to support growth. Its fibre lasers are used for spectography in clinical diagnosis and biotech research. What that means in plain English is near real time ability to look at images of human cells and tissues with “messing around” with preparation of samples - as is currently the case. The laser approach itself is not new but the breakthrough technology - which is patented - means for the first time Lasers are able to be used without the assistance of a laser expert.

The implication of using such machines is enormous for diagnosis of disease -including cancer.

There’s been a post period funding round to further accelerate growth and begin manufacturing, so an uplift of valuation seems a distinct possibility.

6/ Graph Energy Tech 23.97%

A £1m funding round diluted FIPP from 32.1% ownership to 23.97% nevertheless meant (by my reckoning) a post money valuation increase from £6m to £7.5m therefore a £0.2m valuation increase for FIPP.

Replacing Silver electrodes in Solar Panels with cheaper graphene electrodes would save money but also reduce reliance on the vagaries of price (of silver). $4.5bn of silver were used in 2022 (at today’s $32/ounce).

The co-investor who contributed £1m is none other than Saudi’s Aramco. Graphene electrodes could also be used as a superior capacitor to an aluminium one but without the (extreme) cost of a Tantalum or Niobium.

So again a share in a technology which could be worth many times its value.

7/ Pulsiv 18.2%

The announcement of the world most efficient 65W USB-C design in August went largely unnoticed. But consider that a current smart phone charging cable is 18W - 30W and that “Fast Charging” is the most talked about feature in the iPhone 16 and that that requires an efficient cable (not just a smarter smartphone). So what if you have a patented and most efficient cable?

A broader point I’d not appreciated is could USB-C replace standard plugs and wall sockets? What I found very interesting is that we are used to plugging in adapters to existing wall sockets but as higher wattages are achieved through cables could they become the de facto wall sockets? Pulsiv is addressing a growing market and one where their patented design places it as a leader in efficiency but also device safety. Power surges can destroy delicate electronics and Pulsiv prevents power surges along with enhanced safety (from fire and overheating) as well as reduced electricity consumption - and faster charging.

Electrical efficiency is “green” but it’s also sensible economics. One reason that VW is struggling and losing money relative to Tesla and Hyundai is simple economics. Consider that the fuel efficiency of an Audi Q6 is 1/3 less than a Model 3. That translates to a >£1000 difference of fuel cost (assuming 79p/KWh fast charge rates) over 10,000 miles (i.e. over 10p a mile). But also the larger battery to provide enough range to compete, is a large expense at the outset too.

Pulsiv is a means to improve the flow of electricity - it’s not limited to cables. An interesting insight was that Pulsiv’s technology could be used to improve everything even up to a 900KV National Grid substation too.

A nearer term objective is to target solar microcontrollers. Since Solar is all about driving efficiency Pulsiv’s patented technology could be an upgrade option to the estimated 2.2 Terrawatts capacity of solar energy.

8/ Fieldwork Robotics 22.1%

Dubbed “Robocrop” will protect (raspberries) and serve (farmers).

The expansion both in terms of numbers of robots on lease but also the number of countries is an interesting development. Beyond its Portuguese roots Robocrop is now in Australia and expanding to the USA. Micki Siebel is a Silicon Valley veteran product manager ex-Ebay, ex-Intel, ex-Ask.com (remember Jeeves?!) but who has worked in AgTech the past 20 years. She joins as a non-Exec and will be instrumental in expanding sales but also in raising capital.

You see Micki is a Partner in Farmhand Ventures, who recently led a $500k investment round in a similar organisation called L5 Automation. L5 have a Strawberry Robot. Strawberry Robot meet Raspberry Robot. Will they have a fruity relationship or be blowing raspberries? Some sort of synergy or deal or something must surely be under discussion since both companies bring different aspects to the table.

Here’s other investors in L5.

Farmhand Ventures: An AgTech innovation venture capital firm led by Connie Bowen

GoodFarms, LLC: A strawberry farm operator with experience in robotic farming

GTT Group's Ideaship: An investor in L5 Automation

National Science Foundation: An investor in L5 Automation

Wayne Chan: A board member and investor who previously co-founded Kabam

Edward Lopez: A board member, advisor, and investor with over 30 years of experience in Silicon Valley

Derek Parham: An advisor and investor who was the original founder of Google Apps

Boris Sofman: An advisor and investor who co-founded Anki and is currently the Senior Director of Engineering at Waymo

This is an interview of L5 Automation and its funding round.

9/ Nandi Proteins FIPP owns 19.7%

Finally let’s consider the post period convertible loan of £0.5m and £1m further funding.

This funding follows Nandi Proteins signed a commercial license with a leading global food ingredients business who will take Nandi's meat/fat replacer to market worldwide

“In some cases we can halve the fat content of burgers and sausages”. As you can imagine the halving of fat in junk food could be worth a colossal amount.

Conclusion

So £0.5m million of gains appears nailed on, but potential for other “fair value” gains too.

What’s more exciting is the level of commercialisation at the above holdings. Tiles you can actually buy at Topps Tiles, hyper-efficient fast charge USB cables you can buy, and Robots earning lease income from grateful Farmers.

Then there’s other holdings building readiness for commercialisation: Vaccines heading towards regulatory approval solving million and billion pound problems, eggwhite replacement agreement with a Commercial Partner, a factory being built to offer Spectroscopy lasers for near real time analysis of samples.

The first point to make is that many of these are not wacky ideas but real needs with real benefits. Fewer human crop pickers but growing demand for fruit (without getting into the reasons for that like post-Brexit and various US crackdowns on immigration). Faster charging but inefficient cables which can slow charging down. Damage the precious device. Woeful levels of cancer diagnosis due to the speed and complexity of mass testing via Spectroscopes. Unhealthy junk food filled with unhealthy fats. Zoonotic diseases which could wipe out farmers incomes - or indeed the world.

The second is that the FIPP ownership percentages of around 20%-30% are chunky holds and we are not talking a 1% stake with tiny upside.

The third is that the total addressable markets appear to be enormous.

The fourth is that FIPP have a track record of results. 7000 bagger is an impressive record.

So for the patient and shrewd, FIPP at 32p is at an astonishing 62% discount to its last 84.2p NAV. Despite its 44p+ over 6 years earnings and the fact that it holds a number of potential multi baggers, some which are either at a point of commercialisation or are close. Will this multi bag in the near term? Refer back to the bit about being patient. But the Full Year results should give a flavour of progress and so at the very, very least I would suggest to readers to give that a once over later in October.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks for the write up. I'm an investor in FIPP and hope for big things. Although concerning about delay in Full Year Results. I also note no mentioned of CamGraphIC, which I think can deliver big

Thx.

Am I correct in seeing, based on the latest six-monthly report, that annual admin expenses equate to 20% of mkt cap ?

Scott