Article 325 - Musings from The Oak Bloke

Last Bank Hols till Chrimbo

Dear reader,

My article “300” feels a long time ago. And 25 articles since then. Just wanted to take stock (ha ha) on where the market is.

DEC

Four of those articles were on DEC. I decided to average down at 921p today. As I write the price is £9.44 (at a $1.32 FX) or £9.82 at the average $1.27 FX rate. If US rates are reducing then this is a more realistic FX rate going forwards.

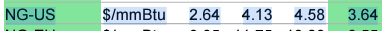

Interesting to see Panmure Liberum today say Henry Hub at prices unrecognisable to hard-pressed DEC hands who’ve withstood harsh falls in the share price twice. $2.64/mmtbu for 2024 rising to $4.13 in 2025 and $4.58 in 2026. Long term $3.64. Ex-dividend next Friday.

Panmure’s perspective on NG prices echoes my belief that US NG prices are unrealistically low but this has been a headwind for DEC.

This has also a headwind for peers like i3e, EQT, and WDS too (which haven’t had the misfortune of an unwarranted short attack and the attentions of Honorable Pallome. This is a 3 year view of all four stocks, where i3 Energy (in red) had a bid offer this week.

Jackson Hole brings good news. J Powell tells us: “The time has come for policy to adjust”.

KZG

I hope some of my readers were inspired to look at the opportunity in “Diamond in the Rough” and “Bigger Slices for KZG-stanies” because Kazera has more than double bagged since those articles. I’ve enjoyed my bigger slice of the bligger slice and done a top slice today. There’s more to come at KZG because 49.9% densities of heavy mineral sands exceeds other producers concentrations by a country mile, plus marine diamonds on top through their Deep Blue business.

IPO

I’ve top sliced Molten Ventures (GROW) too. Back on May 4th I wrote a comparison article “May the Fourth of Discounts” I remain really positive about it and its further prospects but its recovery from £2.20 lows to £4.25 meant it went from my #10th to #3rd largest holding, so I make a decision to rebalance. Its realisations aren’t vastly different to those achieved at IP Group so have cycled more funds into IPO. Much of IP Group’s fall is due to IPO’s largest holding Oxford Nanopore (ONT) which has been reporting progress, growth and contract wins. We are 3 weeks away from IP Group’s 1H results and the news flow has only been positive. Over 25% down in 12 months vs GROW’s growth of 80% makes this unloved FTSE250 company a hot prospect. The sheer scale of buy backs make IPO a no brainer too.

Featurespace:

In a matters of hours after writing this article news hits that benefits both IP Group and Chrysalis, potentially.

I pointed out in the Y/end update that CHRY was valuing Featurespace differently to IP Group. It seems the uplift in CHRY’s March 2024 update was spot on to the potential sale price of Featurespace to Visa.

As a 20.1% owner £700m valuation means a £67.7m upside for IP Group - and cash for CHRY which of course can be used for buy backs.

FIPP

I also added to FIPP and this has been rising this week (up 4.3% today). Is that because of excitement of its holding in Pulsiv? Power generation is growing and the price of power too (Gas and Electricity bills are going up 9.5% in October). Pulsiv offers an intriguing way to reduce waste. Other holdings like Alusid Tiles are heading towards an IPO so lots to like at a bargain price which briefly fell below 30p this week (vs a NAV of 84.2p). Its market cap of £20m today vs its last NAV of £47.3m, and a track record of 5 out of 6 years making a net profit and EPS of 44.42p over 6 years (2.25p 5.5p 18.41p 16.61p 7.5p -5.85p)! Have a think about that. I added FIPP at a price equal to 4 years of its average past profits.

FIPP is one of my least read articles so go on, surrender to your curiosity and give that hyperlink a click.

Update 27th August: “In some cases halve the fat content of burgers and sausages”. As you can imagine I read this this morning and feel extremely positive about the prospects for Nandi, which FIPP own 19.7% of:

I also added more to CHRY, TMT and NSCI.

CHRY

See my addition above about CHRY’s holding Featurespace.

CHRY is down 20% from recent highs possibly due to fears around WeFox. £452m to buy CHRY when £61.3m Cash + Starling’s book value + Smart Pension + Wise = £447m.

£5m gets you £100m Klarna, £82.2m of Brandtech, £74.2m of Featurespace, £60.5m of Wefox, £45.2m of Deep Instinct, £26.2m of Secret Escapes (that’s a lot of Luxury holidays!), and £28.3m for InfoSum.

Bearing in mind that CHRY owns 1.11% of Klarna so if a $20bn/£16bn price is achieved at its IPO, the result for CHRY is a substantial £74.80m uplift and a £174.80m realisation. CHRY intend to recycle a large proportion of cash proceeds into buybacks. £145m at 75.9p would be 191m shares (of 595.15m) leaving about 404m shares.

Those remaining shareholders would have £50m cash, £45m other assets and £700m of holdings. That’s a NAV of 225p per share (up from 143p). Of course all this assumes a steady share price which is probably unlikely on such good news but I doubt shareholders will be complaining too loudly if the buybacks are at higher prices (but below NAV).

But will Klarna or Starling be the first to list? Starling are recruiting in what appears to be readiness for a listing.

In my article “a more interesting world” my deep dive on Starling arrived at a £2.6bn valuation and therefore a £46.1m upside to the £258.9m valuation as at 31/3/24. That’s a 9p per share upside for CHRY-tons. £305m of proceeds would equate to 2/3 of CHRY’s market cap.

TMT

I was gobsmacked I could top up on TMT at $2.80 in the past fortnight.

TMT announced its 1H results which I covered in my article “TMT-h tomato”. A Bolt IPO is a potential 2025 event and comparisons to Uber make this an intriguing holding. Uber is profitable in 2024 but wasn’t in 2022 so the growth and trajectory of Bolt appears similar albeit smaller. Interesting to note that Uber owns 29% of Lime. Lime which I’ve spotted in various UK cities operates 200k (Boris) bikes and escooters. Interesting that Lime is enjoying a 32% growth in bookings in 2024 and sales of $616m and adj.EBITDA up 500% at $90m. Bolt is #1 in various African, Asian and Eastern European countries with competitive positions in Germany and the UK. A trade sale to either Uber ($156bn), Lyft ($5bn) or Grab ($12.8bn) are another potential future.

Grab’s Mobility revenue is around $1bn vs $1.7bn for Bolt and has a $12.8bn market cap vs a $8.8bn inferred valuation based on TMT’s valuation of its Bolt holding. Grab is growing (like Bolt) both revenue and profit.

But we can be blinded by our “Western” thinking. Other candidates eager to buy Bolt could be Gojek in Indonesia worth $10bn and 170m users. Or Ola Cabs $2bn possibly whose sister company Ola Electric of Bangalore India, IPO’d 8 days ago at $4bn and soared 75% to $7bn.

Or Didi of China $19bn marcap.

NSCI

There has been continued positive newsflow from Netscientific (Ticker NSCI) as its PDS holding embarks on the Phase 3 trial of its HPV cancer trial (working with Merck’s blockbuster Keytruda drug as a conjugate).

Its FY23 results disappointed in June when it announced a 15% reduction of NAV. But PDS accounted for that loss and in my article “YEFY23” I further explained that the £17.1m NAV didn’t include any fair value of holdings (+£19.2m), nor did it value the upside from capital under advisory, nor the VCT/EIS growth potential of its Martlet and EMV businesses (and its current earning potential), nor the fact that the share price of PDS has recovered 10% compared to June 30th. I covered the exciting potential of its Martlet holdings in Part 1 and Part 2 (and I realise Part 3 is yet to be written - oops)

I was excited when NSCI was £17.1m (the black horizontal line in the above chart), but at today’s £13.4m market cap it’s a screaming buy in my opinion. Just to be clear on the above chart, the red contains both the “official” NAV excluding PDS, and the “fair value” of holdings (excluding EMV and Martlet), the Blue and Grey are the value of assets under advisory (being managed) and the yellow is the planned VCT/EIS funds based on my best assessment of likely capital raises from existing portfolio plus assuming some new holdings in 2024. The green, finally, is the value of PDS (which is Nasdaq listed). The reason I separated this was to visualise that NSCI had actually grown its assets. Under “future” I’ve made zero assumptions of further growth by the way and simply model their planned CuA expansion and the recovery of PDS based on the average target price of analysts.

Gold

I’m also very excited by progress in gold holdings and I hope readers considered the various ideas in Mano De Oro. If you did you’re probably well into profit today. Hats off to readers who suggested Condor, Pan African, Thor and Panthera. My own ideas of Power Metals, Caledonia and Metals Exploration were other ideas all up on good news.

I backed up the truck on Thor and top sliced that yesterday after it announced its update. But also Caledonia which was up over 20% since I added at 760p I sold on the basis that I have a large Baker Steel holding and hold CMCL indirectly via that.

I noticed a large SP Angel report yesterday on Condor puts the valuation at 97p whilst it was for sale at 21p in the past few weeks so I added that.

Power Metals is up but I don’t think a cent of that is due to either Gold or Uranium. It’s due to Guardian Metals and the share price hitting 36p a share (£42.85m) and an increase of GMET shares to 119m shares meant POW’s holding is now 45.36%.

POW’s Fair Value NAV based on its official NAV and on listed holdings is now £30.7m putting it on a 38% discount to NAV, before even considering whether anything unlisted is worth above its listed value, or indeed whether the listed holdings are at reasonable prices given news flow. (See Uranium later on)

GMET has delivered a £14.3m gain so far (70% of POW’s market cap), while FCM is on a loss but there is pending newsflow on gold prospects which will turn this from red to green. Meanwhile Red Rock and Aruma have delivered a £0.9m gain to NAV (5% of market cap).

Uranium

Rozencwajg forecast a cut at Kazatomprom from 80m/lbs (32.3KtU). To a lower figure. Yesterday that materialised with a 2025 production target reduced to 25KtU-26.5KtU. He was spot on. (He also speaks to Natural Gas prices increasing).

Of course Kazatomprom enjoyed higher prices and increases to profit so shares rose yesterday, despite the political risk (from Russia but also the Kazakh government themselvs), the increased Kazakhstani taxes on Uranium, and reduced forward prospects.

But this diagram shows demand (black line) and production (all the colours) and the colours just dropped by 5,000. Think about that.

My favoured play which stands to benefit from the likely Uranium price spike is a US miner and miller of Uranium, of Rare Earths and Vanadium.

Energy Fuels increased 6.5% too yesterday but is 1/3 less than recent prices.

My entry route into this US listing is via a UK stock, Base Resources. Each person will get 3.25p special dividend. So 9.75p net. Each share converts to 0.026 UUUU share so implies a valuation of $4.90 at an FX of 1.32:1.

UUUU plan to expand Uranium production from 1m Lbs to 6m Lbs by 2026. Given KAP’s troubles this expansion appears to be coming at a perfect time.

POW

POW is another holding which stands to benefit from Uranium’s prospective rise. It announced on 3rd June 2024 that it had entered into a non-binding term sheet with UCAM and that the Parties had entered into an eight-week exclusivity period. Whilst significant progress has been made towards completion of the Joint Venture, certain legal due diligence processes remain outstanding. Consequently, the Parties have agreed to extend the due diligence period until 23 August 2024.

Come Tuesday morning there will be an RNS with what I expect will be a positive outcome. How did POW’s share price react to the news from Kazatomprom? No change. What about Gold’s $2,515/oz record price? Nope no change there either. POW is sitting on a gold mine (or two) and a future Uranium mine (or 14) via its Athabascan Canada holdings.

Failures

Before ending this article I wanted to reflect on things which haven’t gone well.

I’m becoming increasingly negative about Lithium. I considered Lithium in articles like “Cattle? CTL” and “Lemme ATM” both are on losses. And of course in Battery Store where winners include Gore Street and HEIT, and losers potentially include Invinity (competing against cheaper and cheaper Lithium Batteries). Of course it’s a nuanced picture where Tin is at $33k/tonne so ATM is benefitting from that while IES enjoys benefits beyond mere price/performance (safety, duration and TCO for example).

Holdings like Cadence KDNC remain at ultra depressed levels. Part of its holdings are Lithium.

I(X) Net Zero is now unlisted and the first auction on AssetMatch is a month away. What will the result be? After being told by my broker Interactive Investor trades would be £3.99 but they’ve now reneged and said £49 telephone orders and 3% of proceeds. I have raised a complaint and am really disappointed because II have generally been a good broker. Will I be able to achieve a profit on this? At 9p the assets remain at a 94% discount to NAV so I suspect I shall, but costs in the world outside of the London Stock Exchange are ugly. I’m surprised to find dozens upon dozens of companies listed at AssetMatch and JPJenkins. As much as people moan about AIM the world outside AIM is expensive. £3.99 vs £49 + 3%.

TEK remains in the doldrums, as do DGI9, BELL, so several OB19 ideas are “failures”. Agronomics too (although Canaccord Genuity wrote a long piece and speak to the mispricing I noticed).

But it’s interesting to see KZG was at a 36% loss when I wrote “300” and is now on a 36% gain YTD. BMN is up 30% from 0.5p back then. MKA up 40% from the 4p back then.

So I shall go and enjoy my Bank Holiday and hope you do the same. It’s the last Bank Holiday until Christmas (for Non-Scots) so make the most of it. Even if it’s distinctly Autumnal outside as I write this, just like in the world of investments, the picture can brighten considerably and sunshine emerge.

“Outstanding Articles”

Even if I do say so myself, ha ha.

I do enjoy listening to my own articles (Substack enables you to play these)

2,500 articles are read each day (and growing) so it appears people enjoy my writing and find them useful. Hopefully you are profiting from ideas after doing your own research and due diligence.

That’s 912,000 article reads a year. Readers kindly contributed £3,300 to my BowelCancerUK campaign that means I’ve raised 0.3p per article read and £10.15 for each article I’ve written. Given each article takes around 6 hours, that’s £1.65 per hour spent I’ve raised.

During 2024 I am asking for NO subscriptions. I am considering whether in 2025 to switch subscriptions on. 100% of proceeds will continue to go to charity but I’ll admit it slightly irritates me that only about 1.3% have contributed and 98.7% have not. If you’ve made some money following an idea why not give some of those gains to support Bowel Cancer’s work to say thank you. In advance I say thank you.

Outstanding Articles

What I meant to list was a list of articles people have asked for and that I’ve forgotten to write or not yet felt sufficient inspiration (choose your excuse).

AVAP - Avation

SOHO - Triple Point Social Housing

COR - Cora Gold

JLEN - JLEN Env’ Assets

ORIT - Octopus Renewables

ITH - Ithaca

SEIT - SDCL Energy Efficiency Trust - 1H24 update

Serica

Empire Metals

Petrofac

Any more for any more? (no promises mind).

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

WIDOWMAKERS Empire Metals, Petrofac

One of the big problems with DGI9 is the lack of communication about what it is doing!