Oh Battery Store, oh what a bore

Let's deep dive into Vanadium, Lithium and BESS

Dear reader,

Remember tingling your tongue on a rectangular 9V battery as a child? It fascinated me that a battery did this, and I wondered whether one day there’d be larger batteries for bigger tingles. Then I saw a lead-acid milk float go past and decided large batteries were rubbish.

Now I watch Teslas, Hyundais and others purr past, and narry a milk float to be seen, nor a tingly oblong nine volter…. more’s the pity.

Meanwhile life as a Battery miner has been jolly rotten of late. Lithium is cheap and getting cheaper. Lithium - at 86,500 CNY and forecast 85,000 at the end of 2024.

Vanadium is cheap and remains cheap for now.

But bad news for miners “should” be great news for battery manufacturers (fewer input costs) like for IES. Is that true? Nope.

…and battery buyers and purveyors like Gore Street with their BESS systems. Nope

Why not?

This article tries to explore why.

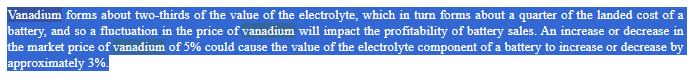

IES’ annual report explains:

So a 22% fall in the price of Vanadium in 1 year, is a 15% decrease to the electrolyte cost and about a 4% reduction in overall VRFB battery cost.

In my article BMN Bush Bushveld’s experts speak to a $27.70KgV price average in 2024 and $34.40KgV in 2025. So 5% higher in 2024 and 31% higher in 2025.

Which translates to a 0.8% increase in cost for IES in 2H25, and 5.1% in 2025.

Of course the above stats are true of IES’ 3rd generation “VS3” tech. Mistral, its 4th gen, has a substantial decrease from $111/MWh to $60/MWh or 46% reduction through improved efficiency but also less wiring, fewer tanks, pumps and controllers.

Wonderful news for Invinity and for its IES-sers as I set out the business case in my article “The Trajectory” back in May.

But it’s also fair to say that the ratio of the cost of raw materials change when other costs fall. So let’s consider that. 1/4 of $111/MWh is the electrolyte cost and 2/3 of that is Vanadium. So vanadium costs $18.30/MWh at current prices (the above chart is from May 2024)

$18.30/MWh as a proportion of $60 is 30.5%. So 31% higher prices in 2025 means a 10% increase in costs due to the vanadium electrolyte (assuming Bushveld’s forecast is correct).

In fact the argument made by IES for Vanadium Flow Batteries is that Mistral shall deliver a price equal to that of gas baseload.

Is this diagram accurate? Well 3.42mmbtu = 1MWh. Gas is 60% efficient. So 5.7mmbtu of energy is needed to generate 1MWh (assuming no transmission loss).

At today’s prices, yes. UK gas is 73.59p a therm so that equates to $65.35/MWh…. and that’s just the fuel cost and you’d need to add depreciation and other power plant costs, which are typically at least another $50/MWh.

But in the US? No. Not for now. Gas cost would be circa $15/MWh + $50/MWh+ opex. So US gas is competitive with a Mistral VFRB, but there’s room for both in the US since their power generation via natural gas lags behind that of the UK (as a proportion).

But moreover, the US don’t have a national grid, nor interconnectors like Europe, nor do they have many “peaker plants” so Wood Mackenzie report that BESS as a means to smooth fluctuations is growing very rapidly. Later on we see a lot of evidence of that from Gore Street too.

Is the section in green (the lithium price) acccurate? That Lithium adds $200/MWh of cost? Nearly - according to my article “you can’t HEIT me”. Harmony speak of a circa £130/MWh pricing which is $170/MWh which isn’t far away.

There’s a heck of a lot of misinformation or shall I say obsolete info out there. Take the Faraday Institute for example. A leading publication. Their Autumn 2023 report quotes numbers from 2020 and have a weird 1 hour to 12 hour diagram where all forms of power get cheaper as the duration get longer but it’s nearly impossible to say how. Can a Lithium Battery discharge for 10 hours? I do not believe this is physically possible. The article appears to dismiss VRFBs without any clear examination of the facts, or explanation of diagrams where costs are charted.

So how to profit?

1. Commodities

1a. Lithium

Well a rebound in commodity prices is one way. We are told Lithium demand in 2030 will far exceed that of today. Patience is certainly required, as lithium is substantially bombed out particularly in the junior sector.

There are many lithium ideas but this morning encouraging news from two I’ve written about recently:

In my article "Cattle” I considered CleanTech Lithium (Ticker CTL) - lithium who announced this morning they’ve successfully extracted Li from brine in their pilot plant - at 15% above target. The economics of their approach (compared to hard rock mining) is compelling.

I’ve spoken several times to the bombed out value of EG1 and EMH held by KDNC.

Co-incidentally EG1 are also announcing a successful Lithium intercept in this morning’s RNS.

1b. Copper

Copper - is a prime idea for energy transition and various ideas are covered in “Copper!” and then in “Copper! Copper!”. These consider how copper will be a huge beneficiary to the macro. Copper is now back to $9,100 a tonne (from <$10k) so a lot of froth that accompanied the recent interest in copper has dissipated. But the need for copper for electrification hasn’t. Batteries are a play on electrification too.

1c. Vanadium

I read this week about Largo - another Vanadium primary miner. Largo is losing money in 2022, 2023 and forecast to do so again this year. But it’s forecast to return to profit in 2025. Bushveld (ticker BMN) according to my forecasts will also rebound to profit in 2025. The difference is Largo would cost you £100m and BMN £13m. There are of course risks, but potential for high rewards. BMN’s sale of its 2nd plant Vanchem and simplification should help it going forwards. The Chinese government with the forthcoming Third Plenum are going all out of fix the property problem. Buying property to turn into social housing is seen as one way out.

1d. Tin

Tin is used in electronics and to “glue” electrical things together.

ATM, 1SN (part of BSRT), EMH (part of KDNC) are all ways to back Tin.

1e. Uranium (and Rare Earths)

BSE is a great way to get investment in a Uranium producer. As I discussed in “I like the base base” the take over by Energy Fuels (Ticker TSE:UUUU) is insanely good deal for BSE (The market hasn’t understood). Today UUUU trades at $5.71 (so £4.40). You get 0.026 shares in UUUU for each BSE share. That’s 11.42p. You get a special dividend of 3.4p. That’s 14.82p, yet you can buy BSE at 14p today. I’ve been filling my boots.

The outlook for UUUU is positive, and their Rare Earth processing capability I think are very exciting. (Including processing the Monazite at BSE’s Toliara Project)

I also like POW as a great way to get early exposure to Uranium.

2. Electrolysers & Hydrogen

Battery is only one form of storage; hydrogen another. Regardless of the technical merits the fact is Germany and the EU more widely have hugely embraced hydrogen. The IRA has opened huge incentives for hydrogen too.

Invinity (Ticker IES) - Vanadium Flow Batteries

IP Group (Ticker IPO) - via its large Hysata holding

HGEN - with substantial (mainly) European Hydrogen holdings

CWR - covered in “CWR blimey” also with RNS news today and a major new (and as yet unnamed) partnership in APAC.

3. Energy Efficiency

SEIT is at a spectacular discount with a fully covered, tasty 10% dividend. I am positive for its prospects. It covers a wide range of holdings from CHP to EV Charging.

FIPP whose holding Pulsiv is currently commercialising its energy efficiency tech, could be a very interesting idea. They are commercialising it for Mobile Phone charger plugs. Just think how warm those get - and all that heat is wasted energy. Vast trillions of waste - we’d have a much smaller climate crisis if we actually reduced waste, and Pulsiv’s patented tech could be used for anything from grid-scale substations downwards.

Meanwhile other holdings like Alusid is reducing the energy inputs for Tiles and has a commercial partnership with Topps Tiles and will probably IPO in 2025.

4. BESS

Holdings like NESF are unlikely and hidden ways to play BESS theme. It’s all in the existing grid connections for NESF. Waits of 5-10 years for grid connections are a large issue for BESS providers.

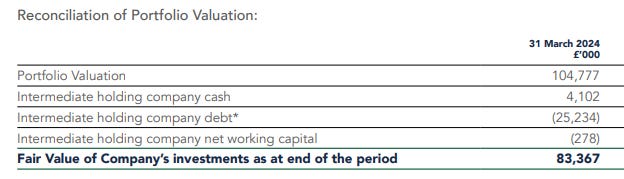

TENT

TENT looks good and it is in wind down and has just disposed its BESS portfolio but in a nod to its remaining hydroelectric and LED assets reported a NAV of 86.66p* vs a share price of 70p. Considering the y/e accounts 31/3/24 says £4m cash/receivables and post period there have been £54.5m of disposals paying off £25.4m of debt that’s £29.1m cash and now debt free.

Deducting the cash from the market cap (£69m-29.1m = £39.9m) you’re paying a net £39.9m for hydroelectric assets valued at £76.1m and remaining an LED receivable of unknown value (although £2.5m previous LED valuation and £2.3m LED disposal suggests that this is negligible). A tasty 47.6% discount where TENT say they’ve a number of bids and offers (i.e. the whole thing should be wrapped up fairly soon). Difficult to see how you could lose money on this.

*the 86.66p or £83,367,000 includes £25,234,000 of remaining debt which was repaid to zero post period.

Gore Street - GSF:

I’ve not covered this before but it caught my eye in the II’s Discount Delver at a 42% discount. Further eye catching was a (now) tasty dividend (which has been cut to 7p a year) and international coverage (US 55% and UK 30% with Ireland/Germany the remainder). Digging a little further the 421.4MW capacity should grow to 750MW by March 2025 with three Californian assets coming on stream. What I believe the market has missed*** is once operational (in the next few months) these receive IRA tax credits of $60m - $80m (£45m - £60m) which equates to 15% to 20% of the market cap.

The balance sheet is bullet proof also with £50m of cash and while the dividend isn’t fully covered, there’s a clear path to achieve that.

QuotedData GSF Commentary

*** - a reader has picked up quite rightly on commentary made by Mr Carthew and Mr Hattie last week about GSF on their weekly podcasts. The pearls of wisdom they share are:

“The main thing was the change to the revenue curves of power prices”

The Oak Bloke says: If you follow any companies in this sector then you should already know that negative valuations due to power price curves are already well known and have been occurring for over 12 months. So I disagree that “it’s a change”…. No, it’s the status quo and fully expected.

As I’ve pointed out in other articles like “HEIT me” and “SEIT” this is a non-cash evaluation based on future power prices. Notably it’s SUBSTANTIALLY driven by Henry Hub and Natural Gas prices. Yes, gas is a form of power, and yes, some electricity is generated by gas powered generation. It is my belief that too much credence is being given to these prices which are broad brush and do not accurately predict the revenue (and profitability) potential of specific services like Grid Balancing, Peak Shifting and future Trading Ranges. Specifically on the latter, if power can be purchased at negative levels and sold at positive levels it is the future range that matters, not just the absolute price itself. In other words, I believe there is hidden value in the NAV and that future earnings (in my opinion) will surprise to the upside, or at least other factors like the level of competition and demand growth will determine prices not these guesstimate power curves produced by “experts” who forecast a normalisation of Revenue £80k/MW/Yr.

The other pearl is the £60m credit is in doubt apparently. But by his own admission, Mr Carthew on his slide says “may halt” and he has “no idea how fast”. and says he (Trump) is “negative about the whole Inflation reduction thing”.

The Oak Bloke says:

a/ The IRA took ONE YEAR to pass into Law. It required a cross party co-operation which was (unusually) achieved via an 11th hour deal between Schumer and Manchin. Biden had lost hope that he, **THE PRESIDENT**, could get it through.

b/ Therefore the assertion “he (i.e. Trump) may halt”. Nonsense! He can’t! It requires both Congressional And Senate approval, and as stated above that’s neither fast nor easy.

c/ While I agree on balance Trump stands a very good chance of winning it is far less clear that the Republicans stand to simultaneously win all three of the Senate, Congress AND the Presidency.

d/ Many Red States have been beneficiaries of the IRA. Texas is a great example. Even *IF* the Republicans had an outright majority it doesn’t follow that a majority would support abolition of the whole IRA. There would be a lot of horse trading.

e/ I don’t claim to have a detailed knowledge of American politics but I do know that the focus of Republican dislike of the IRA is the fact that money ends up going to China, and to EV manufacturers. So any attack on the IRA is almost certainly going to be against that.

f/ Not once have I seen or been able to find a Republican complaining about money going to BESS. Here’s a simple fact. Americans love their Air Conditioning. They do! Every time I go to America the indoors everywhere is icy cold. You return to Britain and think what neanderthals we are. Measures that protect the grid and prevent brown outs and black outs are POLITICAL HOT POTATOES. Going after IRA credits for a political hot potato? You’re kidding, right?

In conclusion has this “risk” been actually thought through? Where’s the evidence?

Andrew McHattie “The dividend is in doubt”. This is evidenced that the dividend is structured “1p,1p,1p,4p” (and they might pull or reduce the 4p)

The Oak Bloke says:

Is it in doubt though? Let’s look at the numbers:

2023 Revenue is £42m; Op. costs are £14m. EBIT £28.4m. Other income £3.1m. Overheads are £11.3m.

Cash/receivables is £61.2m. Dividend (at 7p) costs £36.4m.

By my reckoning Average MW/Years grows ~20% from 421.4MW to ~500MW during FY25 (ending March 2025) (Enderby energises in mid year and Big Rock at 9 months)

FY25 pro-rata would be circa ~£34m EBIT. Assume other income falls to £2m. Assume Overheads grow 5% £12m = £24m NET (so a circa £12.4m shortfall to covering the dividend or 0.67X).

I’m assuming a steady state to the MWh revenue - which I think is highly conservative for the UK given that ESO National Grid have sorted out the software issue which froze BESS out of the grid management services market.

Plus there’s a £48.8m worth of cash “margin of error” (£24+£61.2-£36.4m) to the above calculations.

Plus the FY25 exit rate is 755MW which is ***80%*** above the FY24 operational portfolio. I calculate that the FY26 run rate would be circa EBIT of £51.1m - overheads of £12m = £39.1m or 1.1X the dividend in 9 months time…. and I’m assuming zero “other income” plus the majority of that 80% would be at the higher (at least in FY2025/FY2026) US prices - which isn’t included in my calculation.

In other words, the “doubt” isn’t borne out in the numbers. Where is the evidence of this unsustainability exactly?

Other pearls from Andrew McHattie in the podcast are:

“The revenue includes investment tax credits”

OB says - err no, nowhere does GSF assume the ~£60m windfall in its forecasts (for example under the APM). Nor do I, in the numbers above, you’ll notice.

“It depends on the build out of the portfolio”

OB says - well, that affect the growth in earnings but not the current earnings themselves. These BESS projects are multi-year and while yes delays can and do occur we would be talking months of delay - and usually there are claw backs/liabilities on the constructors (as is currently the case with HEIT) which compensate for delays.

“There’s the likely path of power revenues which are slightly uncertain, and we do not know if the US revenues will be as strong”

OB says - we know the MW price was at record low levels in mainland Great Britain in FY24 and I do not model for any increases to that in the numbers above for FY25. The share of energised US assets are currently 29.85MW of 421.4 MW, that’s 7%, so I do not model for any drop, we are talking 7% of assets delivering 14.5% of revenue so how much of a fall in the US does McHattie expect for this to be a relevant reason affecting the overall EBIT? If somehow the US in FY25 fell (inconceivably) to GB FY2024 levels that would be a 61% drop in prices there and mean a 8.8% reduction overall. Conceivably a more realistic reduction in EBIT could be 2%-3%, which equates to just £1m of my £34m forecast EBIT vs my £48.8m margin of safety.

The inconceivable 8.8% is £3m of the £48.8m by the way.

GSF Highlights:

A GSF diagram provides an important clue that falls in the price of Lithium as well as improvements to technology mean LiO batteries cost around $130/KWh compared to $210/KWh 5 years ago.

If I compare the LiO and VRFB then $130/KWh is $130k/MWh. Assuming LiO have a ~10 year life. Assuming 365 day use then 130000/(12X365) = $35.62 per day.

Invinity sell their VRFB at $400,000/MWh. On a ~30 year life, again 365 day use then 40000/(30x365) = $36.53 per day.

Of note the $35.62 per day (per MW) is just 30% of total equipment costs. Total costs per day $118.73

Or put another way £41.4m - £28.4m are operating costs, right? £13m. 13m/311.5 MW = £41,733 per MW per year. 30% of £41,733 is £12,520 and divide by 365 is £34.40 per day. Notice this is GBP not Dollars, so $44.72 per day is 30% higher than the $130 per MWH GSF speak of.

But then it twigged.

The $130/MW is the marginal or NEW cost of LiO batteries. The legacy costs are between $130 - $210 per MW so about $170 per MW per year for LiO batteries and $567 per MW per year for all costs (remember batteries are 30% of system costs).

It reconciles!

By the way, “EBITDA” is not what most people would consider “EBITDA” but should be read as “EBIT Pre-Overheads” at portfolio level, i.e. it excludes all the fund costs at top co which total £11.31m costs.

GSF’s P&L records income from all its assets as “Loan Interest Income” (£29.15m)

There are other similar holdings to GSF like GRID and SAE. I might do a compare of these plus NESF one day.

Conclusion

Deep diving into these numbers makes me realise a few things:

First, that miners are at record low valuations. Yet the outlook is far brighter than the prices would show.

Second that if prices for lithium and vanadium do go shooting up that this won’t necessarily destroy the market. The proportion of “metal” cost in a Battery is actually fairly low. Also technology is rapidly improving both VFRBs and LiO battery technology (which potentially drives down the proportion required per unit of power).

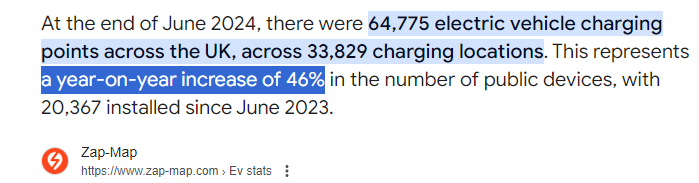

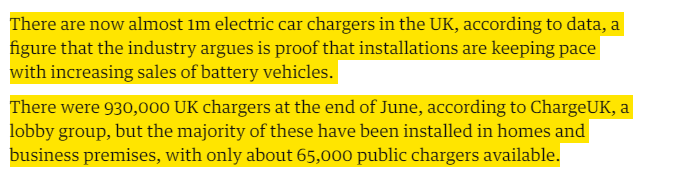

Third that investors are in danger of falling into the trap of the “EVs are now dead narrative”. It’s not hard to find negative headlines, is it reader?

The rapid growth of charging points and rapid improvements in technology will mean EV growth will continue.

65,000 may seem a small number but that’s just PUBLIC chargers. There’s another 1m private chargers in the UK.

Fourth that other Energy Transition metals and minerals also represent opportunity. Particularly Uranium. BSE which in the future means selling UUUU a Canadian holding so SIPPs or Trading Account - not an ISA.

Fifth, that Invinity’s new Mistral VFRBs are very competitive, and competitively priced - which is why the IES pipeline is growing as fast as it is.

Sixth that quite a lot of my article is just musing a load of numbers and ratios which readers might find a bit random and strange. But eagle-eyed readers will know that I’m pulling stats from various other articles to cross check and compare data from multiple sources to try to determine whether Vanadium and Lithium battery costs “add up”…. It was gratifying that they did.

Seventh that BESS are able to make tasty profits, and so long as they are well capitalised (like GSF) should be able to prosper in today’s brave new world. The current discounts are a gift.

Eighth that energy efficiency is the overlooked part of this equation. Whether through technology or simply the ROI of reducing waste, there’s money to be made.

Ninth and finally, Hydrogen and Electrolysers offer a further form of power to BESS and there’s no clear winning technology, at least not for now. And even if ultimately you feel there will be (I have had readers proclaim hydrogen will never succeed), the fact is that there’s plenty of money going into both BESS and Hydrogen, and almost regardless of the truth of that statement, there are ways investors can profit today, I believe.

The proof of that pudding is seen in the NAVs, the sales growth numbers, the P&Ls and the balance sheets that I’m reading in these sectors.

(PS this is article 299 and I’m planning something special for article 300, so bear with me reader)

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Regarding GSF, I don't think the market has missed the IRA tax credits, rather they are concerned that there is a possibility that GSF might not get them if Trump is elected?

GSF was discussed on the weekly Money Makers investment trust podcast (Jonathan Davis) this weekend and on the Quoted Data weekly investment trusts weekly investment trusts news roundup last Friday - they discussed the dividend cut and rearrangement and the IRA credits.

Money Makers is here:

https://youtu.be/FTVRxeDAupk?si=pkITJIEFxacaDdbw

(GSF at 36 minutes in)

Quoted data is here:

https://youtu.be/8EL_wu-4BG0?si=a6FCY8Gmtv35MNUU

(GSF at 3:36 minutes)

please, regarding your sixth point "quite a lot of my article is just musing a load of numbers and ratios" -> for me, this is an absolute strong point!!! some of those numbers/ratios/evaluations might be more *obvious*/in plain sight - many are not and very insightfull for the interested reader! thank you