Dear reader,

My antenna twitched. The topic area was Fund Managers “marking their own homework” and I was advised to watch out for battery storage.

As a BESS investor I got to work to ascertain the truth.

BESS or Battery Energy Storage Systems provide flexible capacity in a grid delivering value by providing frequency services, load shifting, grid balancing, energy arbitrage (buy it low and sell it high, innit?), and by ensuring reliability of supply during periods of stress caused by extreme temperatures and varying wind conditions.

In the case of the UK in summer 2024 that meant extremely disappointing temperatures and invariable wind and rain conditions. I jest. The sun did come out once.

How do you mark your own homework in the provison of those range of services? One way would be by publishing a NAV which overstates the value of the assets. The NAV is calculated by using a DCF or discounted cash flow, so if your true cash flow isn’t realistic or uses false assumptions then of course your asset would be over valued.

Let’s consider Gresham House (ticker GRID)

Let’s consider Gore St (ticker GSF)

Now Harmoy (ticker HEIT)

So all have third party forecasters and independent reviews. Not much chance of marking your own homework if an independent valuer is marking it too. Let’s think of another way to obfuscate and overstate.

Revenue Forecasts

Another way to cheat is to say you can sell something at a higher price than is actually the case. The NAV is based on a revenue forecast so this is another side of the same coin. Now the actual price you receive depends on many factors. The country (where supply and demand differs across geographies), the duration of the battery (2 hours are more lucrative) or the weather, the competition, and many factors so the forecasts are just guesses. But do these companies pick the highest guess? No, their approach is subject to audit.

GSF forecasts declining prices in Texas (ERCOT) and Northern Ireland (NI) due to special schemes coming to an end in 2026".

Noticeably these pricing forecasts exclude the long-term fixed price Resource Adequacy contract in California (CAISO), as well as GB capacity market contracts. There are no details of the specific pricing agreed but the average bid in 2023 was $202/MWh (£151/MWh) which is 10X the MWh rate for GB in 2023!

Given the long-term fixed price, and large 400MWH capacity of Big Rock, and expensive California prices, the mathematics are astonishing.

£151MWh x 8800 (conversion to MWh/Year) x 200MW = £133.2m revenue!

But that’s not all. There is then a Resource Adequacy (RA) bonus of ~40% of revenue so a further potential £50m per annum revenue!

Even if the actuals are lower than this, let’s use the Texas rates for example, the upside is still substantial. £100,200 Mwh/yr x 400 = £40.1m + 40%, £16m so £56.1m revenue.

Depending on the 2025 California rates, an additional £56.1m - £183.2m revenue and an additional £36m - £120m EBITDA.

150MWh Dogfish at an assumed £100,200 MWh/year is a further £15m and £10m EBITDA too.

Given the 2023 operational EBITDA was £28.4m these two assets represent an 2.5X increase of profit!

GRID explain how different types of batteries offer different levels of income. (2 hour BESS are worth more per hour).

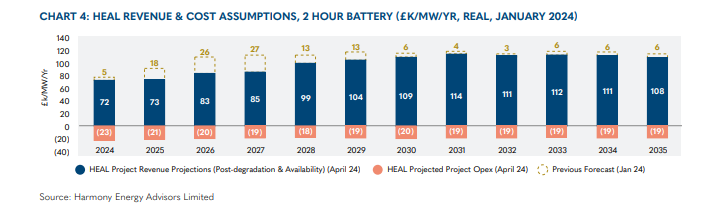

HEIT are one product and one country - 2 hour and UK but show a forward forecast of rates.

So no chance of marking your own homework here either. So what was the concern? This concern was based on some broker commentary about how GRID (specifically) was felt to be overvalued:

“The curves have been significantly reduced but, in our view, remain optimistic based on recent trends.”

The commentator was referring to power revenue curves. But consider that recent trends (for the UK) are upwards from a low point earlier in 2024, partly due to the NG ESO software debacle. I’d agree there are grounds to be optimistic.

In fact the 1H24 interims at GRID show increased £/MW/Yr pricing. Also increased pricing is seen at HEIT which is up an astonishing 48% from Q1 to Q2. Frustratingly GRID doesn’t show any Q1 to Q2 pricing just an overall 1H24 total. GSF’s last results are as at 1Q24 and showed £77/MW/Yr.

Quite why GRID has lower levels of revenue per hour than its two peers isn’t clear, although the age of batteries and need to modernise those is implied. The commentary goes on to say that the forecast should be £45k/MW/Yr regardless of the battery type (duration).

Now this isn’t how the industry behaves where longer batteries are more valuable becauase you can discharge 70%-80% without damaging the battery (known as deep discharge), so a 1 hour battery has 42 minutes run time while a 1.5 hour battery increases that to 63 minutes.

It’s the same principle as buying a Duracell battery which is more expensive than an Ever Ready one. If you need your drum banging bunny to go on and on much longer then you pay a higher price for higher performance. Not that difficult a concept.

These two elements appear contradictory to us.

Quite why different duration batteries with different revenue rates are “contradictory” isn’t explained, but at this point the wider concern about BESS as a sector does not appear to be a broader issue and the commentator’s concerns are very specific to GRID.

It’s good to see a consistent average at GSF over 6 years, GRID’s £45k/MW/Yr equates to £5.14/MW/Hr which is dramatically below what GSF has regularly achieved as can be seen in the chart below (albeit across multiple countries). Revenue has never fallen to such low levels (overall).

Heit also over an extended period hasn’t dropped as low as £45k/MW/Hr either.

Unwarranted Discount?

Considering HEIT it provides interesting commentary to say its assets are valued at £616k/MW whereas the build cost is £842k/MW suggesting a 30% premium even before considering the (substantial) value of the connection to the grid which can take 5-10 years.

GSF also explains how the cost of capex upgrades is reducing, and is down by 1/3 over 5 years. This improves profitability on the economics of upgrades to battery duration for example. But there are also substantial incentives through the Inflation Reduction Act in the USA too. The USA doesn’t have a national grid so there are opportunities across a myriad of regions to offer balancing services because there are no interconnectors as we have within the UK, by comparison.

COP a good one

It’s interesting to see there is a focus on energy storage as a large part of the upcoming COP29. Will we see our new government embracing COP29 in a way the last government didn’t (following COP26 in Glasgow, that is)?

Meanwhile we know Mr Milliband, Energy Secretary (that there’s plenty of energy in a rapidly eaten Bacon sandwich) is signing off numerous UK renewable projects far left, right and centre. Nimby’s up and round the green and pleasant land are choking in horror at the thought of their back yards changing. The government’s determination to make the UK a “power house” can only be positive for BESS in the UK. The National Grid ESO software issues and glitches are being addressed although no one knows when, it seems.

Conclusion

While I’ve not found any compelling reason to further consider Gresham House’s Energy Storage Trust (GRID), and some reasons not to, there appears not to be a broader and general concern around UK BESS Investment Trusts, just a specific trust which appears to hold inferior assets in inferior locations compared to its two peers and who wants to restart dividends but probably shouldn’t, to paraphrase the commentator.

All three trusts already trade at substantial discounts and in the case of HEIT the dividend is suspended but could recommence in 2025, or the whole trust could be wound up, and its assets sold (at a profit). I considered this in my article “You can’t HEIT me”

GSF meanwhile actually appears in rude health as I considered in “Money to be Made”, but it’s down another 5% since I wrote about it. It’s true that the ultra high US and NI rates are forecast to normalise after 2025. But GSF are well able to find new source of high revenue, I reckon. Comparatively there’s done a great job of finding those over time. Moreover in my article I examined the concern that Trump will cancel the IRA on day one (if he wins), removing a tax bounty for GSF. I found the whole “risk” fanciful and extremely unlikely to occur any time soon, if ever.

GSF offers a colossal yield for what is a fairly boring and defensive area (energy trading and services). If Custer were still alive, had some dollars, and was offered the opportunity to charge a battery, I suspect he would give the order without hesitation. Chaaaaaaarge!

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

👍CAISO = California https://www.caiso.com/

The skip rates for batteries in the UK is decreasing but still high 90%=>75%

because it’s easier for an essentially manual process to fire up a gas plant than manage several short duration batteries even though they are cheaper.

The (N)ESO software upgrade to resolve this is looking more like 2026 to resolve this problem.

I think there is deep long term value here. In the shorter term we can expect the growth in generation to outpace the delivery of transmission leading to greater curtailment expense and hence further driver for storage. ⚡️🔋

Dogfish is on track to be energised in Feb 2025. It will be 75MW. Full operation seems to be three months after energisation so that will be May 2025. Average ERCOT rates from May 2025 to May 2026 will be about £125K/MW/year so that makes Dogfish revenue in its first year of full operation £9.4M.